However extra are taking over a facet job or gig to save cash

A latest survey by Evaluate the Market Australia has discovered that whereas many Australians aspire to personal property, their methods for saving differ considerably, with solely half prepared to chop non-essential spending and a notable quantity contemplating extra jobs.

Evaluate the Market survey findings

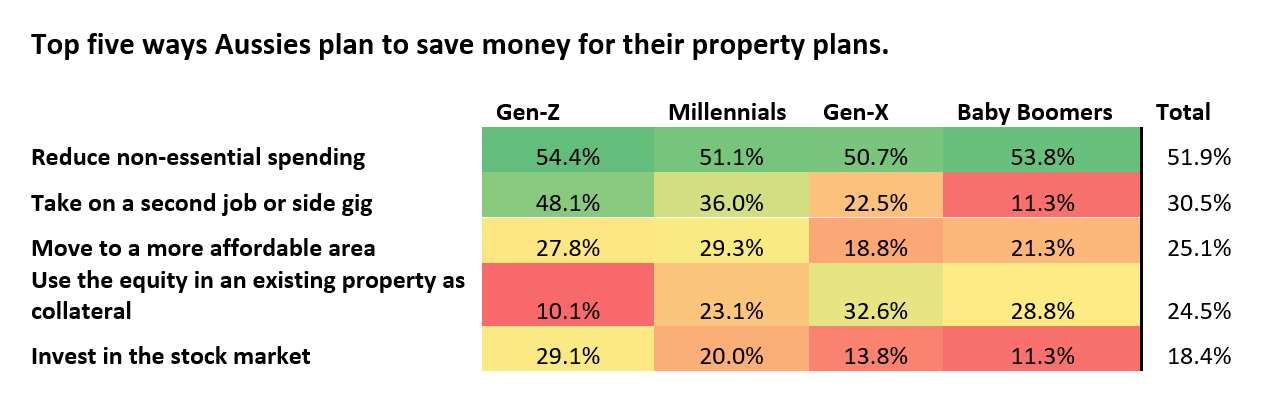

The Evaluate the Market survey, which garnered greater than 3,000 responses, indicated that solely about half of Australians are prepared to scale back non-essential spending to save lots of for property. This was constant throughout all age teams

In distinction, nearly a 3rd of respondents are contemplating taking over a second job or facet hustle to spice up their financial savings. This development is especially outstanding amongst youthful Australians, with practically 48.1% of Gen Z respondents anticipating the necessity for extra work, a stark distinction to only over one in 10 Child Boomers.

Curiously, the survey revealed a notable lack of property ambitions amongst Australian Gen-Z, with over one-third aged 18-25 having no property plans inside the subsequent decade.

Australian Gen-Z’s property aspirations lag behind their worldwide friends, being 10% much less probably than People and nearly 20% much less probably than Canadians to have property buying or enchancment plans inside the subsequent 10 years.

Professional recommendation on saving for a property

Stephen Zeller (pictured above), common Supervisor of Cash at Evaluate the Market, underscored the significance of life like saving methods.

“There isn’t a denying that proudly owning or bettering a house might be extraordinarily costly…,” Zeller stated. “Saving for a property will in all probability take a variety of time, persistence, and aware cash administration.”

Zeller inspired potential property consumers to plan, funds successfully, and set life like expectations to realize their objectives.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day e-newsletter.

Sustain with the most recent information and occasions

Be part of our mailing listing, it’s free!