Now that it appears to be like just like the coronavirus is beginning to come beneath management (and I’ll do one other replace right here tomorrow), it’s time to take into consideration what’s coming subsequent for the markets. We now have had the quickest onset of a bear market in historical past, adopted by the quickest restoration right into a bull market in historical past. This type of volatility is, nicely, historic. However since it’s unprecedented, we will’t actually look again at historical past for steerage as to what occurs subsequent.

The Technical Indicators

Nonetheless, analysts have tried to just do that. There was appreciable dialogue from market technicians, those that take a look at charts and monitor value actions, attempting to suit current market motion into their fashions. Most of this dialogue has been across the “truth” that what we’re seeing is a standard bounce off the lows, to be adopted by a renewed drawdown. Lacking from the dialogue, nevertheless, are the technical causes for the preliminary drop, so I’m skeptical about their pronouncements. From what I see, the technical indicators are bouncing round as wildly because the market itself. Technicals are most helpful within the context of longer-term tendencies, moderately than in short-term volatility, which is what we now have proper now. When you think about the truth that the volatility has been pushed by one thing exterior the market itself, technicals turn into even much less helpful.

Future Expectations: Company Earnings

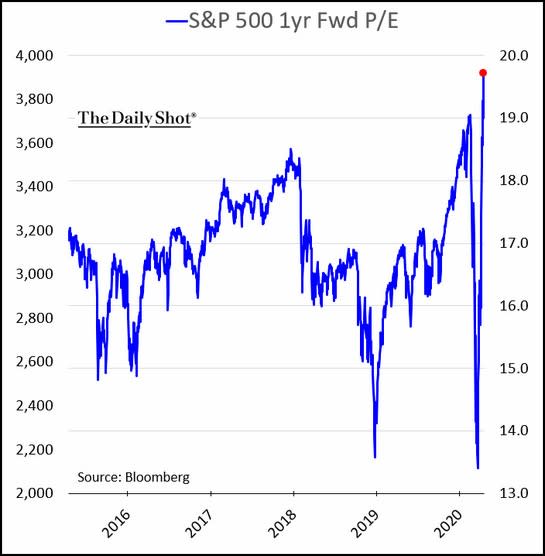

Extra helpful, to my thoughts, is to take a look at what the market itself is telling us by evaluating the current volatility in inventory costs with the anticipated modifications within the underlying fundamentals: company earnings. Right here, once more, we now have an issue. That’s, we don’t know what earnings will probably be over the subsequent 12 months or two. However we do have estimates, and we will at the least use these as a foundation to determine simply how low-cost—or costly—shares are primarily based on these expectations. That calculation may give us a historic baseline.

Utilizing that baseline, we will see that when the markets dropped, primarily based on the earnings expectations then, they grew to become the most cost effective since 2015. Since then, nevertheless, a mix of a market restoration and declining earnings expectations has introduced the market to be much more costly—primarily based on subsequent 12 months’s anticipated earnings—than it was on the peak earlier this 12 months and dearer that at any level previously 5 years.

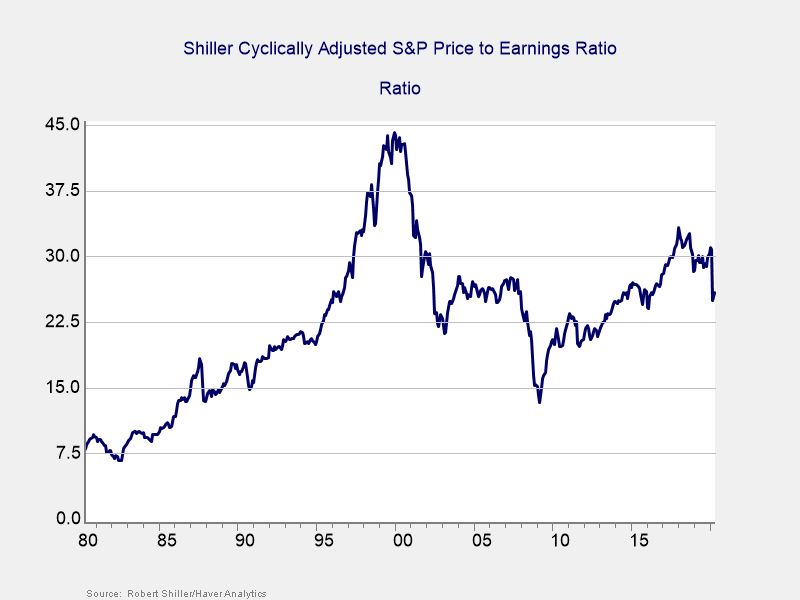

Historic Information: The Shiller Ratio

Whereas regarding, the issue right here is that this evaluation depends on earnings estimates, which might change and are sure to be fallacious. To steadiness that shortcoming, we will additionally use a unique metric that depends solely on historic information: the common earnings over the previous 10 years moderately than estimates of the long run. As a result of it makes use of averages over a 10-year interval, this metric is much less influenced by the enterprise cycle or the abnormalities of anyone 12 months. It was popularized by economist Robert Shiller and is named the Shiller ratio.

The chart under (as of the top of March 2020) reveals that regardless of the sharp drop, valuations closed March at concerning the degree of the height earlier than the monetary disaster. As costs have recovered via April, that ratio has moved even greater. Simply because the chart on ahead earnings confirmed the market to be very costly, this one reveals the identical primarily based on historic information.

So, What Did We Study?

Between them, these charts inform us two issues primarily based on the basics. From the primary chart, even when earnings get well as analysts count on, the market is presently very costly primarily based on these expectations. For the market to outperform, earnings should get well even sooner. From the second chart, even when that restoration occurs, the market nonetheless stays very richly priced primarily based on historical past. In different phrases, whether or not you take a look at the previous or the long run, proper now shares aren’t low-cost.

Keep in mind, these conclusions assume that the earnings will meet expectations. Proper now, earnings development is predicted to renew within the first quarter of subsequent 12 months. For that to occur, the virus might want to have been introduced beneath management; the U.S. and world financial system might want to have opened up once more; and, that is essential, American customers (greater than every other) will have to be comfy going out and spending cash like they did in 2019.

All of this might occur, in fact, and the primary two caveats look moderately more likely to me. The third—client willingness to go spend—is the massive wild card. Present inventory costs rely upon all three, however that’s the weakest hyperlink. Simply ask your self this: in 6 to 12 months, will you be over this?

Volatility Forward?

That’s the context we’d like to consider after we take into account what’s subsequent. A slower restoration appears extra seemingly, which implies we ought to be cautious about inventory costs. There are numerous assumptions baked into the optimistic analyses, in addition to many factor that should occur between right here and there. There are additionally many potential scary headlines that would knock investor confidence. In the very best of all attainable worlds, present costs make sense. In a extra regular world, we must always count on extra volatility.

Be cautious. The progress is actual, each medical and financial, however markets are saying all the pieces is all proper. And whereas it will likely be, it isn’t—but. Maintain that in thoughts.

Editor’s Notice: The authentic model of this text appeared on the Unbiased

Market Observer.