Over the previous week, the information associated to the coronavirus pandemic has usually been good. The virus continues to return underneath management, with the expansion fee slowing (though the case depend has not declined as a lot). Some states are reopening their economies, which can give us useful information and will assist with employment. Lastly, the markets have continued to rally however could have gotten a bit forward of themselves. Let’s take a more in-depth look.

The Virus: Continued Progress

Development fee. As of this writing (April 30, 2020), the every day case development fee has been beneath 3 % per day for 4 days in a row. This result’s down from between 3 % and 4 % final week, so it represents continued progress. In actual fact, we’ve seen the bottom development fee because the finish of February. We proceed to be about two weeks behind Italy, which suggests the expansion fee will proceed to say no within the coming weeks.

New instances. The brand new instances have additionally declined, though in a much less regular vogue. Case counts briefly broke beneath the 25,000 per day stage, however they’ve since bounced again to between 25,000 and 30,000 per day, as a bigger base case stage has outweighed the slower development fee. A sustained drop beneath 25,000 per day is the following milestone. Nonetheless, the downward pattern appears fairly constant over the previous month, suggesting we should always see the variety of new instances per day proceed to inch down.

Economic system: States Beginning to Reopen

Easing of social distancing restrictions. The actual progress in controlling the virus has led to speak of easing social distancing restrictions and reopening the financial system—and a number of other states have began doing simply that. Whereas there are issues that this shift may result in sooner unfold of the virus, that won’t be obvious for a couple of weeks when new infections truly present up within the information. So, a continued decline within the unfold of the virus over the following couple of weeks won’t be an argument for (or towards) any such opening.

Enhance in testing. One other concern is that when states do open up, extra complete testing shall be wanted to trace and isolate contaminated and uncovered folks. Opening up basically means switching from isolating everybody to isolating solely those that are sick or in danger. To take action, we have to know who these people are. The one approach to make this identification is thru widespread testing. Prior to now week, encouragingly, we now have seen testing enhance considerably, to round or above 200,000 per day (up from 150,000 per day final week). This enhance is actual progress, and it appears to be like more likely to proceed.

We aren’t but sure about what number of exams per day we are going to want, however preliminary estimates have been within the 1 million per day vary. That quantity now appears to be like too low. In any occasion, the present take a look at run fee stays too low to assist any form of significant surveillance operation to assist reopening economies, however it’s a minimum of shifting in the appropriate route.

Optimistic take a look at outcomes nonetheless excessive. One other approach to take a look at the place we at the moment are is to look at the proportion of exams which can be coming again optimistic. Ideally, if everybody have been being examined, this quantity must be fairly low. In actual fact, between 10 % and 15 % of all exams are coming again optimistic, which suggests two issues. First, the exams are primarily being given to people who find themselves possible sick with the virus. Second, given the restricted availability, most individuals who might need the virus aren’t being examined. The extent of optimistic outcomes ought to possible be 5 % or beneath. Till we get right down to that stage, we won’t have sufficient information to reopen economies with out risking one other wave of the virus. Once more, whereas we’re not there but, we proceed to make materials progress.

Headed in proper route. We’ve made actual progress, however we don’t but have the virus underneath management. Whereas the every day case development fee is right down to lower than 3 %, that also signifies that—absent additional reductions—the overall variety of instances will double within the subsequent 4 weeks or so. It also needs to be stated that the present beneficial properties aren’t locked in stone. Untimely coverage adjustments or a failure of individuals to look at prudent habits may unleash the virus once more, which is an actual danger of the present partial reopening of many states. We’re headed in the appropriate route, however we’re not there but. We should maintain that in thoughts as we have a look at the markets.

The Markets: What Occurs Subsequent?

Over the previous a number of weeks, markets had the quickest onset of a bear market in historical past, adopted by the quickest restoration right into a bull market in historical past. Prior to now week alone, the S&P 500 is up about 4 %. This type of volatility is historic. However since it’s unprecedented, we will’t actually look again at historical past for steerage as to what occurs subsequent. We will, nevertheless, look at the moment to see what that tells us in regards to the market immediately.

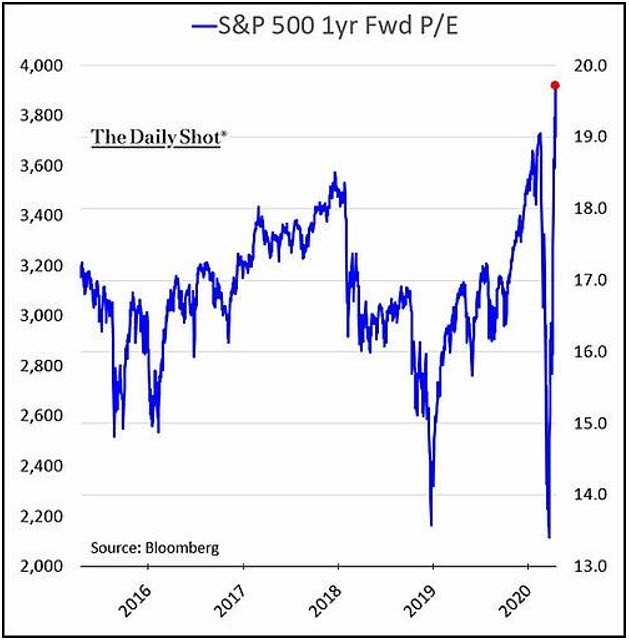

Company earnings. The easiest way to take action is to take a look at what the market itself is telling us by evaluating the current volatility in inventory costs with the anticipated adjustments within the underlying fundamentals: company earnings. The issue right here is that we don’t know what earnings shall be over the following 12 months or two. However we do have estimates, and we will a minimum of use these as a foundation to determine simply how low-cost—or costly—shares are based mostly on these expectations. That calculation can present a historic baseline.

Utilizing that baseline, we will see that when the markets dropped, based mostly on the earnings expectations then, they grew to become the most cost effective since 2015. Since then, nevertheless, a mix of a market restoration and declining earnings expectations has resulted available in the market being much more costly—based mostly on subsequent 12 months’s anticipated earnings—than it was on the peak earlier this 12 months and costlier than at any level up to now 5 years.

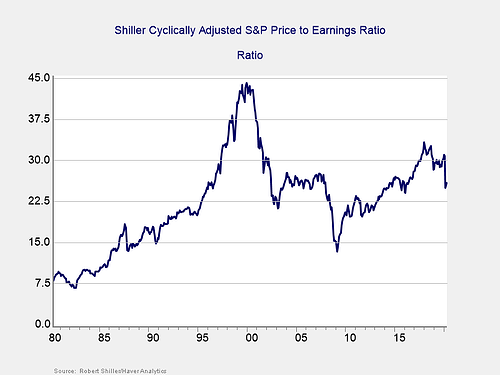

The Shiller ratio. Whereas regarding, the issue right here is that this evaluation depends on earnings estimates, which might change and are sure to be flawed. To steadiness that shortcoming, we will additionally use a distinct metric that depends solely on historic information: the common earnings over the previous 10 years moderately than estimates of the longer term. As a result of it makes use of averages over a 10-year interval, this metric is much less influenced by the enterprise cycle or the abnormalities of anyone 12 months. It was popularized by economist Robert Shiller and is named the Shiller ratio.

The chart beneath (as of the tip of March 2020) exhibits that regardless of the sharp drop, valuations closed March at in regards to the stage of the height earlier than the monetary disaster. As costs have recovered via April, that ratio has moved even increased. Simply because the chart on ahead earnings confirmed the market to be very costly, this one exhibits the identical based mostly on historic information.

Shares aren’t low-cost. Between them, these charts inform us two issues based mostly on the basics. From the primary chart, even when earnings get better as analysts anticipate, the market is at the moment very costly based mostly on these expectations. For the market to outperform, earnings need to get better even sooner. From the second chart, even when that restoration occurs, the market nonetheless stays very richly priced based mostly on historical past. In different phrases, whether or not you have a look at the previous or the longer term, proper now shares aren’t low-cost.

When Will We Return to “Regular”?

That’s the context we’d like to consider after we contemplate what’s subsequent. We are going to maintain making progress on controlling the virus, however setbacks are possible at instances. The financial system will open and get better, however it may be slower than markets anticipate. That is the muse of the place we’re proper now.

The market, nevertheless, expects sooner progress. Earnings development is predicted to renew within the first quarter of subsequent 12 months, which would require that the virus be underneath management, that the financial system be open, and that buyers exit and spend cash like they did in 2019. That expectation could also be optimistic. In one of the best of all doable worlds, present costs make sense. In this world, we should always anticipate extra volatility.

Actual and substantial progress has been made in each controlling the virus and supporting the financial system till it opens once more. We all know what to do, we’re doing it, and it’s working. We are going to get again to one thing like regular—and certain in a shorter time than some concern. Nonetheless, we’re not executed but, and there may be nonetheless substantial progress that must be made earlier than we will declare victory. The markets are very assured, and I hope they’re proper—however let’s not get forward of ourselves.

Editor’s Notice: The unique model of this text appeared on the Impartial

Market Observer.