Over the weekend, I wrote concerning the explosion of {dollars} into index funds and the way they could be impacting the market. As we speak, I need to focus on what else is transferring shares, and it has nothing to do with Jack Bogle.

Earlier than we get into among the insane shit taking place round Nvidia, I need to level out one thing apparent but additionally true. Nvidia’s enterprise has earned the run its inventory is on. We will argue about how a lot is warranted and the way a lot is froth, however its shares are up 275% during the last 12 months for good motive.

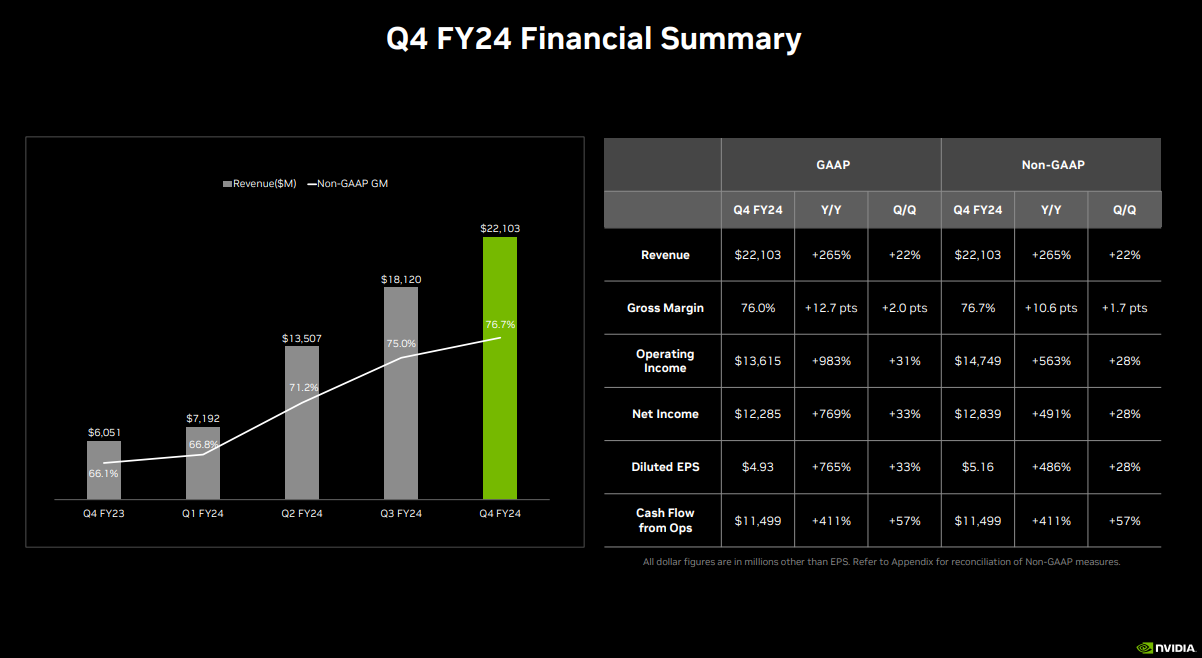

Of their most up-to-date earnings report, they shared that their income is up 265% 12 months over 12 months, and their internet revenue is up 769% over the identical time interval. The enterprise is on hearth.

On TCAF, we mentioned NVDL, a levered single-stock ETF that gives twice the day by day returns of Nvidia. To begin the 12 months, it had $220 million in property; now, it’s at $1.4 billion.

I don’t know sufficient concerning the intricacies of this product, the gammas, the deltas, and whatnot, however this must be impacting the underlying.

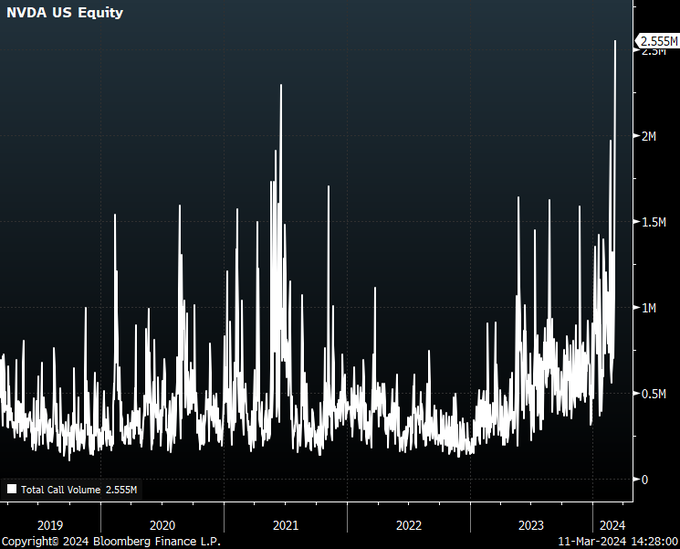

However why get solely two instances the day by day return when you need to use choices and actually have some enjoyable? In line with Danny Kirsch, Nvidia name quantity reached 2.55 million on Friday, which is over $200 billion in notional {dollars}. That is undoubtedly, undoubtedly transferring the inventory.

After which there are the analyst upgrades that appear to occur every single day. As we speak, Cantor Fitzgerald raised its worth goal from $900 to $1,200. The inventory has 39 buys, 11 outperforms, 5 holds, 0 underperforms, and 0 sells.

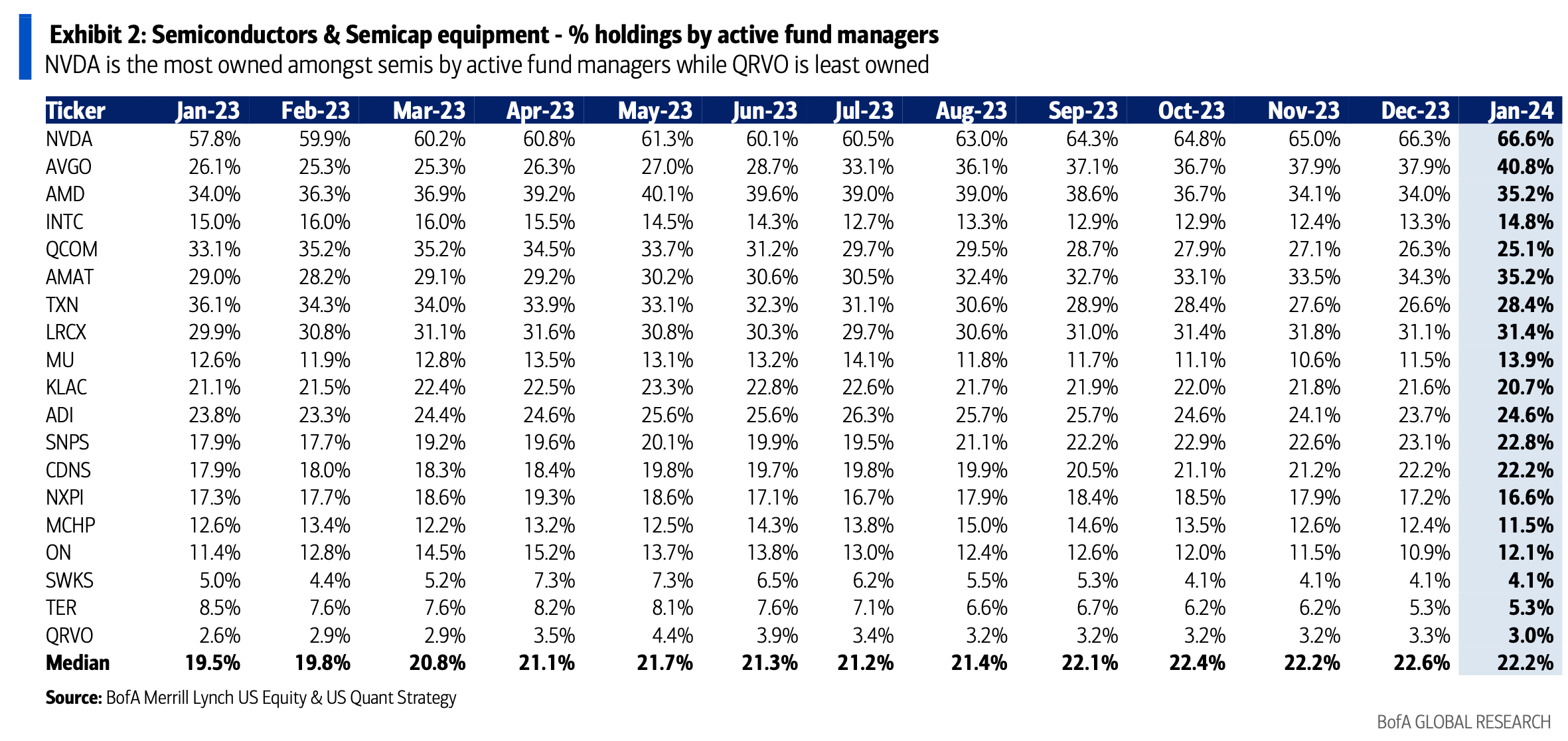

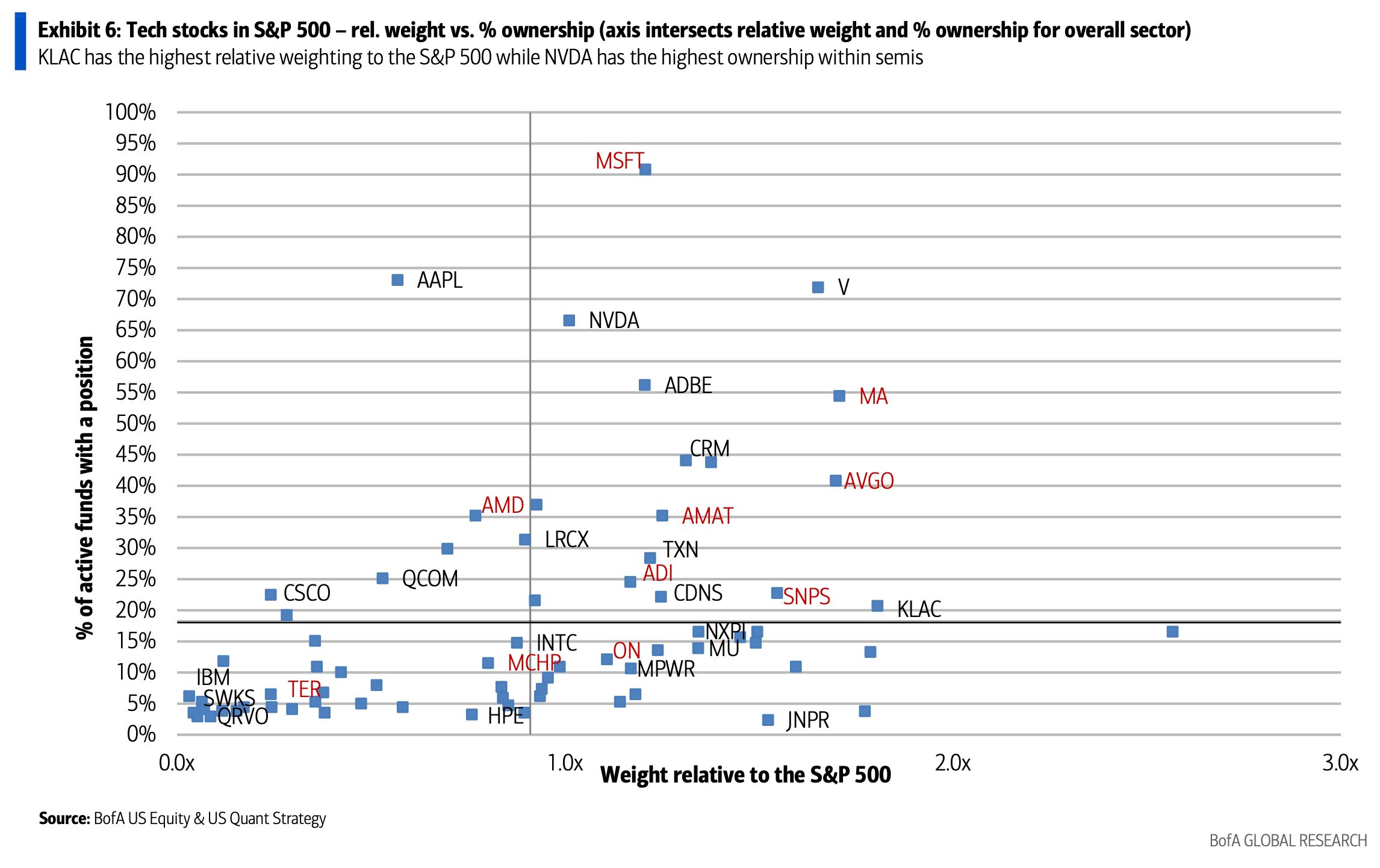

And let’s not neglect concerning the lively managers who’re largely setting costs for the remainder of us. Each day Chartbook was form sufficient to ship me these charts. To no person’s shock, Nvidia is probably the most owned semiconductor inventory by lively fund managers.

I used to be shocked to be taught, nonetheless, that lively managers are solely barely chubby the inventory.

In equity, it’s now the third largest inventory within the index, at a 5% weight, so I assume it wouldn’t make sense for a monster chubby.

A number of components are pushing the inventory greater; retail traders, possibility YOLOers, mutual fund managers, analysts worth targets, and sure, in all probability index funds too.

This content material, which incorporates security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here can be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the chance of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.