Everyone knows that payments generally is a actual ache. However simply how a lot do they value every month on common? On this weblog submit, we’ll check out the common UK family payments per thirty days.

We’ll break down the prices of your common payments, comparable to cell phone payments, utility payments, transportation, meals, power payments and extra. After studying this submit, you’ll higher perceive the place your cash goes every month and perhaps even discover some methods to avoid wasting.

£10 BONUS OFFER: Earn straightforward money by watching movies, enjoying video games, and getting into surveys.

Get a £10 join bonus once you be a part of at the moment.

The common family payments per thirty days UK

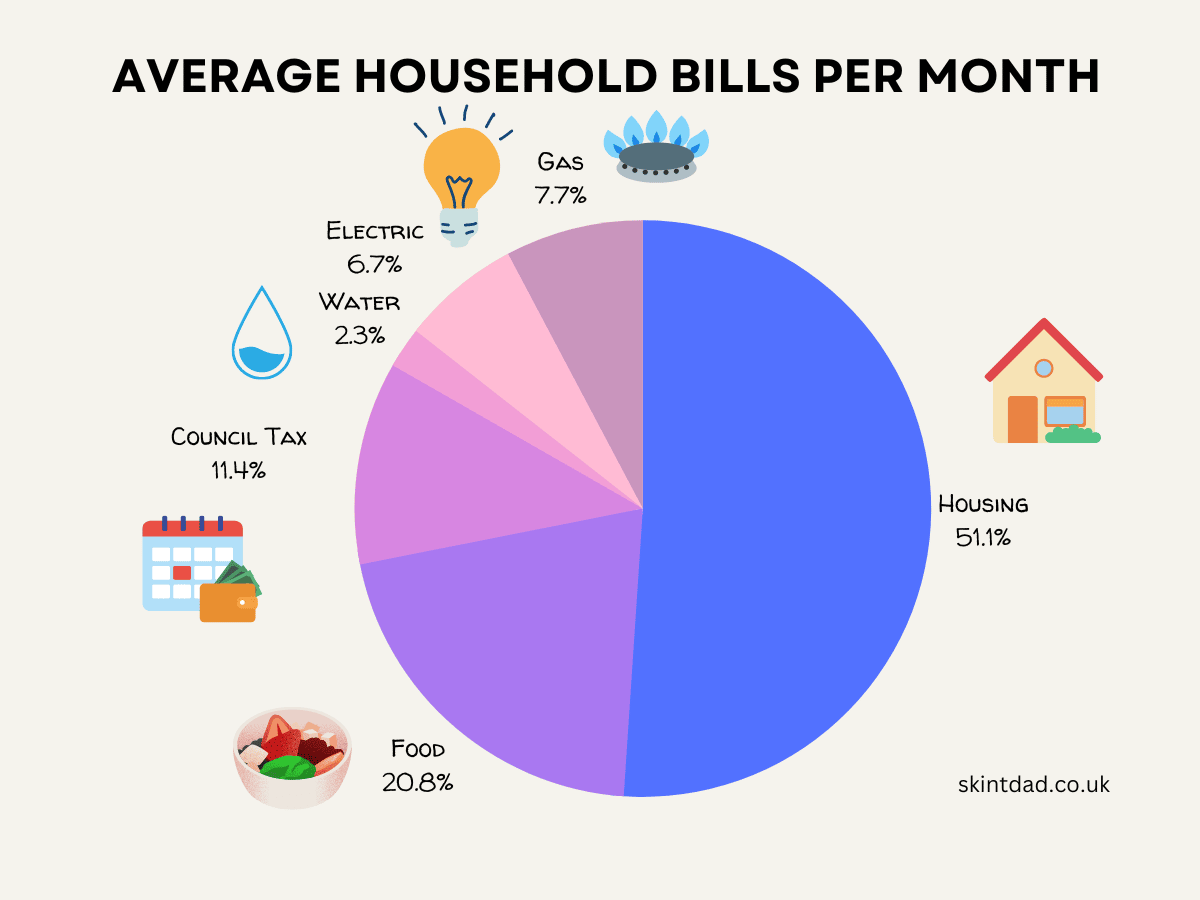

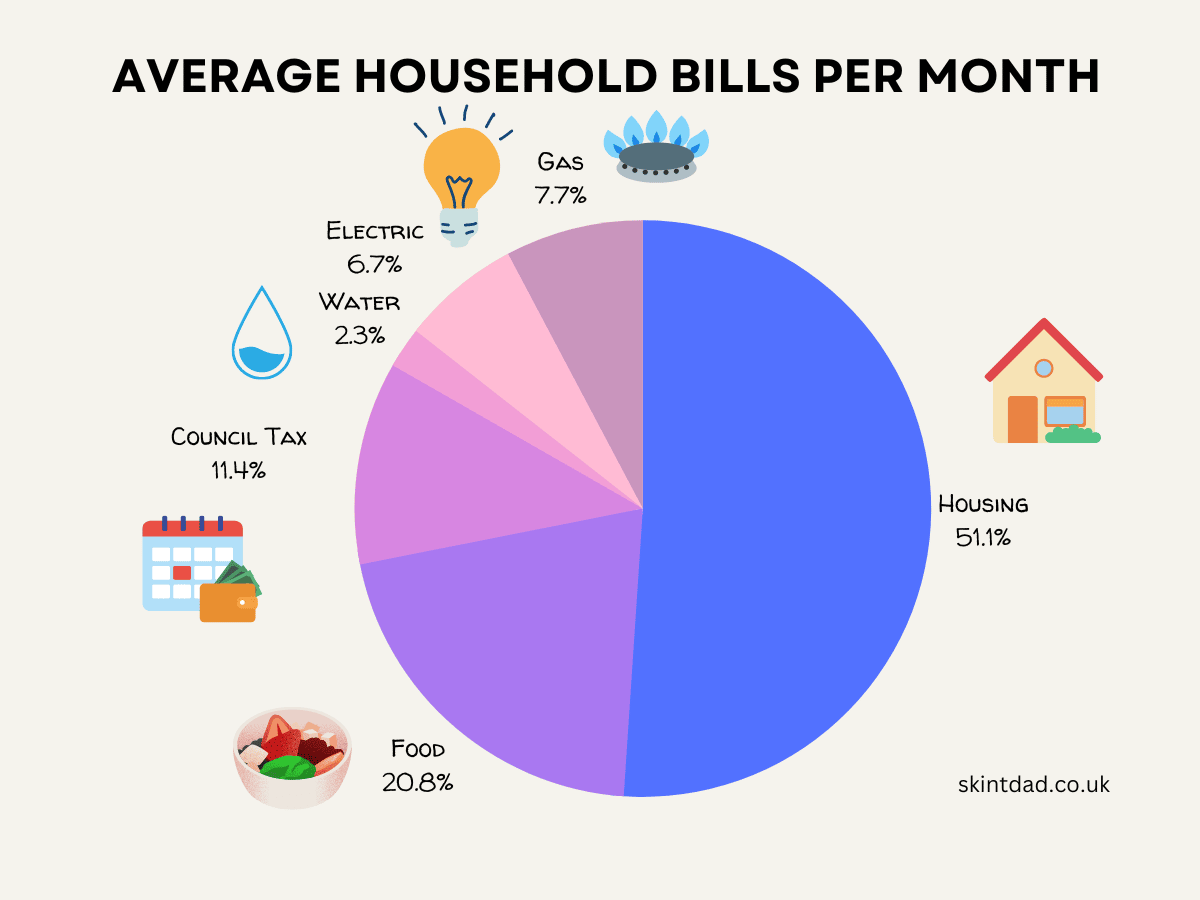

- The common month-to-month family invoice within the UK is £1,500. This contains hire, mortgage, utilities, council tax, and TV licence.

- The common month-to-month mortgage fee within the UK is £658.

- The common month-to-month hire fee within the UK is £1,113.

- The common month-to-month council tax invoice within the UK is £172.08.

- The common month-to-month water invoice within the UK is £39.

- The common month-to-month fuel and electrical energy invoice within the UK is £140.

- The common month-to-month TV licence charge within the UK is £13.25.

- The common month-to-month meals invoice is round £300.

Family payments to pay when proudly owning or renting

- Mortgage or hire – Your mortgage or hire is more likely to be your largest invoice and can fluctuate relying on the scale and site of your property.

- Insurance coverage – Insurance coverage can be a excessive value, and you will want to insure your house in opposition to hearth, theft and different dangers. For renters, you’d want contents cowl, however as a home-owner, you want buildings and contents insurance coverage.

- Council tax – It’s a native tax that’s levied on all households within the UK. The quantity you pay will depend upon the banding worth of your property and the realm you reside in.

- Utilities (comparable to fuel, electrical energy, water and sewage) – Utilities can be costly, notably you probably have a big household. Fuel and electrical energy costs have been rising not too long ago, so purchasing round for the most effective offers is vital. You might save extra when you swap to a water meter.

- TV licence – TV licence charges are at the moment £159 per 12 months and are used to fund public service broadcasting within the UK. You want a TV Licence when you watch any dwell TV.

- Broadband and cellphone – though it’s possible you’ll not use a house cellphone, most broadband suppliers require you to have a line. You will get some good offers when you store round, however be aware in regards to the add and obtain broadband velocity you want, notably you probably have a number of folks in the home who stream or play on-line video games.

- Service prices/floor hire – when you dwell in a leasehold flat, you will have communal areas you should pay for every month/12 months. This pays in the direction of the maintenance of administration and upkeep of the within and outdoors of the property.

- Residence upkeep – whereas it’s not an ongoing invoice, you will want to issue within the one-off prices of the maintenance and restore of your house. This might be put on and tear not coated by insurance coverage (roof repairs, plumbing, breakages) and backyard bushes and fences upkeep.

- Parking prices – relying on the place you reside, it’s possible you’ll must pay for an area allow. Your native council normally manages this.

Common UK meals prices over time

In 2022, the common weekly meals store was £62.20 per week on meals and non-alcoholic drinks.

That’s round £300 per thirty days, or £325 per thirty days when you embrace alcohol, or £440 when you embrace consuming out as nicely.

Information sourced from the ONS Residing Prices and Meals Survey within the UK report.

On account of inflation, this rose in 2022, however there aren’t any official statistics for the time being. The common rise since 2021 now sits round 8%, however was as excessive as 15%.

The most important proportion of family expenditure on meals went to meat (£6.80/week), adopted by bread, cereals, and different bakery merchandise (£5.40) and recent greens (£4.20).

When analyzing developments over time, it’s obvious that there was a basic upward pattern in spending on meals for the reason that early Nineteen Nineties.

Households in the UK spent a median of £276 per thirty days on meals and non-alcoholic drinks in 2019-20. This was a rise of £3 from 2018-19, when households spent £448 per thirty days on common.

You possibly can save prices by cooking at dwelling, not consuming out as a lot and shopping for in bulk.

For no-frills purchasing, take a listing with you, then resist shopping for further stuff you don’t want.

There are apps to assist monitor your receipts, and retaining observe of what you spend on the retailer will can help you earn cashback or get cash free of charge objects.

The common value of UK housing

The common value of housing within the UK is £735 per thirty days, based on the Workplace for Nationwide Statistics (ONS). This contains mortgage repayments, hire, council tax and upkeep prices.

The common month-to-month mortgage compensation within the UK is £658, whereas the common month-to-month hire can fluctuate relying on the place you might be within the nation, however it has a median of £1,113 throughout the nation.

In Better London, the common month-to-month hire is £1,846; within the South East, it prices £1,190; and on the opposite finish of the dimensions, in Wales, it prices £752, and it’s £588 on common for hire within the North East.

The full quantity you’ll be able to afford to hire relies on your earnings, and having the next than common wage can imply you would get an even bigger property or one in a extra sought-after space (nearer to facilities, faculties and many others).

In the event you’re renting, your landlord is answerable for most upkeep prices. Nevertheless, you will have to pay for some repairs your self, comparable to regular put on and tear, blockages or accidents which can be your fault.

You possibly can all the time negotiate along with your landlord or letting agent for a greater rental worth.

Constructing insurance coverage/dwelling insurance coverage

Property insurance coverage is made up of two totally different elements, buildings and contents.

Constructing insurance coverage is vital to guard your house from injury comparable to fires, storms and floods.

In the event you hire your house, you don’t have to fret about this. In the event you personal the home, then it might be a requirement of the mortgage firm so that you can get this protection. Even when it’s not required, it’s one thing that’s positively price your whereas to have.

There are such a lot of variables that have an effect on insurance coverage prices. For instance, the insurance coverage firm you select and the way a lot different work you’ve performed with them earlier than. The place you reside can be a significant factor in worth.

The common constructing insurance coverage value is £15 for month-to-month funds and £120 for yearly funds.

Go searching first earlier than selecting your insurance coverage, so that you get the most effective deal.

Reducing prices might be performed in several methods. For instance, you would take away unintended protection (i.e., when you put your foot by means of the TV or drill by means of a pipe). With out this safety, if you end up needing to file a declare, you received’t be capable to do it.

With the next extra, you’ll pay a sure greenback quantity each time you file a declare reasonably than throwing a share into it. This fashion, insurance coverage corporations have much less of a danger that you just’re going to file a number of claims, they usually’ll have smaller prices as nicely.

Council tax invoice

Council tax is an area authorities tax on home property. It’s a cost set by the native authority wherein the property is positioned.

The quantity of council tax you pay relies on the worth of your property, how huge your property is and the place you reside.

Based on the Division for Levelling Up, Housing and Communities, in 2023 – 2024, the common council tax for a Band D property is £2,065, or £172.08 a month. It is a £99 or 5.1% improve on the earlier 12 months.

You’ll find out roughly how a lot council tax you will want to pay utilizing Cash Helper’s information. Additionally, these hyperlinks will enable you to discover out extra in regards to the totally different UK households.

The common council tax invoice in England for 2022/2023 was £1,966. This was elevated 3.5% from the earlier 12 months.

There are a selection of the way to cut back your council tax invoice, comparable to making use of for reductions or exemptions.

You may additionally be capable to attraction when you assume your property has been incorrectly valued.

Residing alone can scale back your invoice by round 25%. All it’s important to do is apply for a Single Particular person Low cost.

Water

In the UK, the common water invoice yearly is £473 for 2024 – 2025, based on Uncover Water. You possibly can pay round £39 month-to-month.

Water payments have risen 1.9% since final 12 months.

Prices embrace each the price of the water itself and the price of sewage and drainage.

The water value relies on what space you reside in, and a number of the highest water payments are within the southwest of England.

The water value might be divided into two most important classes: standing prices and utilization prices.

Standing prices are mounted prices that you should pay no matter how a lot water you utilize. This cost covers the price of sustaining the water provide infrastructure and is normally billed quarterly or yearly.

Utilization prices are based mostly on the quantity of water you really use and are normally billed month-to-month.

There are a selection of the way to save cash in your water invoice, comparable to:

- Utilizing a water meter to solely pay for the water you really use

- Putting in a rainwater harvesting system

- Getting a roommate

- Utilizing much less water

Fuel and electrical energy payments – power payments

The common fuel and electrical energy invoice within the UK is £140, based mostly on the April to June 2024 worth cap.

This places the common yearly power expenditure for a household at about £1,690. It’s vital to grasp how to save cash on this.

It’s based mostly on what Ofgem considers a medium-use, average-size home, with 11,500kWh of fuel and a pair of,700kWh of electrical energy utilized in a 12 months, and may also fluctuate relying on the place you reside.

scale back your power payments

Change to LED lighting – After the stunning rise in electrical payments, we have to have a look at choices like LED lighting.

We discovered that you just’ll be capable to save some huge cash in your power payments by changing your previous 60-watt incandescent bulbs with LED bulbs.

The LED prices round £1.50, whereas the incandescent bulb is round £25 and takes 10 hours of use per day, which makes it round £256 a 12 months.

Examine this to the LED, which is simply round £1.52 per 12 months, and you’ll see how a lot cash you’ll save simply by altering all the sunshine bulbs in your house.

Change suppliers – when you don’t really feel like your present provider is offering good service, store round. There are various choices out there, and your house would possibly profit from a distinct strategy. Though, this isn’t an possibility that works for the time being as a result of ongoing provide challenge.

Get a meter that’s sensible – this tracks your power utilization in real-time and may also help you establish the place you’re utilizing probably the most energy so you may make adjustments accordingly. A wise meter is an enormous funding, however it pays off in the long term.

Get photo voltaic panels – Get your power from the solar and begin saving.

Insulate – insulation will result in decrease payments in addition to assist to maintain your house comfy relying on the temperature exterior. Verify along with your native authority if they’ve any grants out there it may be price investigating.

TV License

Some of the frequent sudden bills is the TV license.

You probably have a tv in your house for dwell programmes or iPlayer, you might be required by legislation to pay for a TV license.

The price of a TV license is at the moment round £159 per 12 months, and it covers all households within the UK no matter what number of TVs they’ve.

You possibly can pay the associated fee month-to-month with direct debit instalments of round £13.25.

Whereas the price of a TV license might not appear to be a lot, it might probably add up over time. Additionally, in case you are paying for a TV licence for the primary time, you might be made to pay 6 months upfront, which makes it dearer at first.

In the event you’re wanting to save cash in your month-to-month funds, slicing out the price of a TV license is one approach to do it.

TV Subscription

The common UK family spends roughly £47 per thirty days on their TV subscription, based on new analysis.

Which means that the common household is spending over £550 a 12 months on TV, which is greater than the price of a fundamental Sky TV package deal.

The analysis carried out by uSwitch discovered that the common month-to-month TV invoice has elevated by £5 within the final 12 months. That is even if many individuals at the moment are watching extra TV than ever earlier than, due to streaming providers comparable to Netflix, Disney + and Amazon Prime.

Whereas the price of a TV subscription might appear to be a small expense, it might probably actually add up over time.

In the event you’re wanting to save cash in your month-to-month payments, you would begin by cancelling your TV subscription or looking for a greater package deal deal like paying yearly, which works out cheaper than a month-to-month.

Broadband and Telephone

Broadband and cellphone providers are a necessity for many households within the UK.

The common month-to-month broadband payments and cellphone providers payments are between £30 and £50.

The key suppliers of broadband and cellphone providers within the UK are BT, Sky, TalkTalk, and Virgin Media.

BT is the biggest supplier of broadband and cellphone providers within the UK. They provide a variety of providers, together with ADSL, fibre, and cable broadband. BT additionally provides quite a lot of cellphone providers comparable to landline, cell, and VoIP.

The common month-to-month invoice for BT broadband and cellphone providers is £39.

Sky is the second largest supplier of broadband and cellphone providers within the UK. They provide a variety of providers, together with ADSL, fibre, and satellite tv for pc broadband. Sky additionally provides quite a lot of cellphone providers, comparable to landline, cell, and VoIP.

The common month-to-month invoice for Sky broadband and cellphone providers is £26 for the fundamental package deal. Try some Sky options so yow will discover out about different streaming providers and decide the most effective one for you.

TalkTalk is the third largest supplier of broadband and cellphone providers within the UK. They provide a spread of ADSL, fibre, and cable broadband plans. TalkTalk additionally provides quite a lot of cellphone providers, comparable to landline, cell, and VoIP.

The common month-to-month invoice for TalkTalk broadband and cellphone providers is £35.

Virgin Media is the fourth largest supplier of broadband and cellphone providers within the UK. They provide a spread of ADSL, fibre, and cable broadband plans.

Cell Telephone

The common family within the UK spends round £37 per thirty days on their cell phone invoice.

This contains the price of the cellphone itself, the month-to-month service cost, and every other related prices, comparable to textual content messaging or knowledge utilization.

There are a selection of the way to scale back the quantity you spend in your cell phone invoice every month:

- Discover a cheaper cell phone plan that also meets your wants.

- Be aware of your utilization and solely use your cellphone when you really want to.

- You possibly can look into various choices, comparable to pay-as-you-go plans, that may enable you to lower your expenses in the long term.

- Get a SIM-only deal.

- You possibly can flip off knowledge roaming when you’re travelling however don’t want it.

- An excellent rule is to attempt utilizing WiFi as a lot as potential.

5 steps on how you can minimize the associated fee

- Evaluation your bills: Step one to slicing prices is to take an in depth have a look at your spending. Observe the place you might be spending your cash and see the place you’ll be able to in the reduction of.

- Make a funds: As soon as you recognize the place your cash goes, you may make a funds that may enable you to curb your spending.

- Lower pointless bills: Take an in depth have a look at your funds and discover areas the place you’ll be able to in the reduction of on pointless bills.

- Lower your expenses on groceries: One of many largest family bills is groceries. There are various methods to save cash on groceries, together with coupon clipping, shopping for in bulk, and cooking at dwelling extra typically.

- Save on utilities: One other huge expense for households is utilities. There are a number of methods to avoid wasting on this expense, together with energy-efficient home equipment and weatherproofing your house.

4 tricks to observe your spending

- Having a family funds is essential.

- You need to use a easy spreadsheet, budgeting apps, or budgeting software program like YNAB, or you’ll be able to go old-school and use a pen and paper.

- Whichever methodology you select, make sure you’re monitoring each penny that goes out the door. That features huge bills like groceries and fuel, small issues like espresso runs, and impulse purchases.

- When you’ve been monitoring your spending for a month or two, you’ll begin to see patterns emerge. Perhaps you spend extra on weekends than throughout the week, or perhaps there’s one class (like garments purchasing) that appears to suck up a lot of your money.

Then, when you may have spare cash in your funds, guarantee to start out placing some apart – check out the common financial savings UK.