Years in the past, retirement plan specialists constructed their companies focusing on plans utilizing dabblers and blind squirrels, underscoring the hazards whereas highlighting the advantages of utilizing a specialist. That very same philosophy is driving adjustments for CPA plan auditors together with revised necessities and PEPs, which restrict auditing prices for his or her members.

And although fewer DC plans use inexperienced CPAs to audit their plan, in accordance with a 2023 DOL report, “70 p.c of the audits totally complied with skilled auditing requirements or had solely minor deficiencies below skilled requirements.” The consequence, in accordance with the DOL is, “30 p.c of the audits (3 out of 10) contained main deficiencies … [which] places $927 billion and 11.7 million plan contributors and beneficiaries in danger.”

That compares to 39%, $653 billion and 22.5 million contributors of their 2015 examine. Not surprisingly, the DOL discovered a correlation between, “the variety of worker profit plan audits a CPA carried out and the standard of the audit work.”

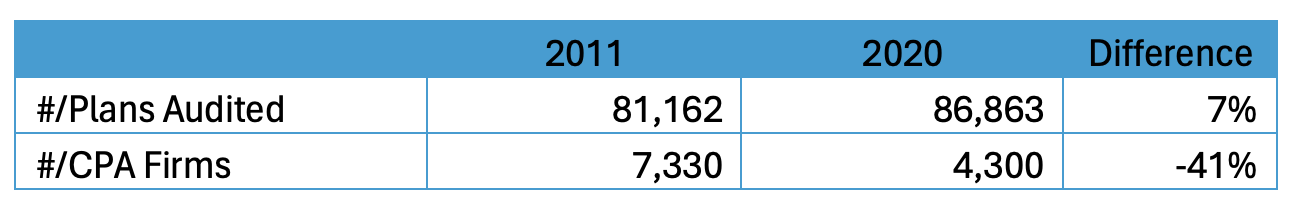

The 2023 DOL report indicated a 7% enhance within the variety of plans audited from 2011-2020 and a 41% lower within the variety of CPA companies conducting the audit:

Adjustments within the DOL’s definition of “bigger” plans requiring an audit final yr are anticipated to eradicate audit necessities for about 20,000 plans. The massive change is the 100-participant depend now contains solely these with a steadiness somewhat than eligible to take part. Moreover, in the event that they have been a “small plan” filer within the earlier yr, the plan can stay a small plan filer till the plan participant depend reaches 121. All of which makes pressure outs now at $7,000 or much less that rather more essential.

The variety of plans might drop precipitously on account of new standards of “massive” plans and PEPs.

PEPs suppliers lure plans promising to tremendously scale back and even eradicate the audit price because the pooled plan should solely file one audit. However in accordance with Karen Sanchez, Accomplice at Sikich, “The fee discount is dependent upon the make-up of the PEP and what number of must be sampled.”

Sanchez famous that the hazards of utilizing an inexperienced ERISA auditor embody protracted interplay with the DOL throughout an investigation in addition to the shortcoming of the inexperienced auditor to detect points early. Although she doesn’t construct techniques that combine payroll and report protecting, a key part of a profitable ultimate plan, she will overview the processes and make options simply as she does for working a plan total.

Russ Kanner, Senior Supervisor at Smith + Howard, notes that the highest points he finds with plans embody:

- Definition of compensation

- Well timed remittance of deferrals

- Well timed submitting of the plan audit with the 5500 Type

Brad Bartells, Accomplice at MUN CPAs, mentioned many plans don’t comply with plan paperwork particularly associated to the definition of compensation. It’s like having an IPS however not following the foundations. Mortgage distributions could be one other problem, in accordance with Todd Hallowell, founding father of 401(ok) Assurance, in addition to asking for issues not wanted that could possibly be crimson flags for the DOL.

All of which could trigger RPAs to surprise, “Why ought to I care?”

Plans wish to their advisor to be their quarterback overseeing all the plan and all of the distributors. If one thing goes unsuitable with the audit, plans is not going to be blissful to listen to their advisor declare, “It’s not my drawback.” It will not be their fault, however it’s their drawback.

It is also amusing to me when advisors use litigation as a scare tactic for smaller and mid-size plans. The possibilities of plans below $100 million and even $250 million to be sued is low and the copycat lawsuits with out advantage are getting tossed extra rapidly. However DOL audits and investigations are more likely which is a type of litigation for smaller plans. Advisors that proactively recommend to the 11.7 million plans utilizing a “blind squirrel” auditor {that a} change is required might be valued even when there’s a threat of offending the consumer’s CPA performing the audit. Simply as they did when lots of them have been employed.

The American Institute of Licensed Public Accountants’ (AICPA) Worker Profit Plan Audit High quality Heart lists virtually 2,000 certified CPAs on its web site.

So whereas not attractive, serving to with audits and recommending certified CPAs is an RPA to not simply distinguish themselves but additionally assist the plan keep away from expensive errors and establish issues earlier than they metastasize. And serving to shoppers keep away from audits because of the new DOL definition of “massive” plans in addition to becoming a member of a PEP would additional elevate the plan advisor.

Fred Barstein is founder and CEO of TRAU, TPSU and 401kTV.