Finances studies! Finances studies! Lengthy reside, finances studies!

You need to slice and cube your monetary knowledge each which method? Examine.

You need a high-level view of the way you’re doing? Carried out.

You need to get all the way down to the nitty gritty particulars of a specific class? Woot!

You need colourful graphs and pie charts? Bam. We’ve acquired you, fam.

Knowledge is a crucial a part of private finance, which is why the YNAB report performance is a useful budgeting software. You may monitor traits, examine checking account balances, determine areas of overspending, and visualize your progress.

So, with out additional ado, right here’s tips on how to do all of that and extra:

See Your Finances Stories in YNAB

With finances studies, you’ll be capable of isolate and give attention to the info that’s most necessary to you—and analyze your funds from a number of totally different vantage factors.

In all three studies, you possibly can filter by class teams, timeframe, and accounts. Simply use the filters discovered on the high of every report display:

See How A lot You Spend on Quick Obligations

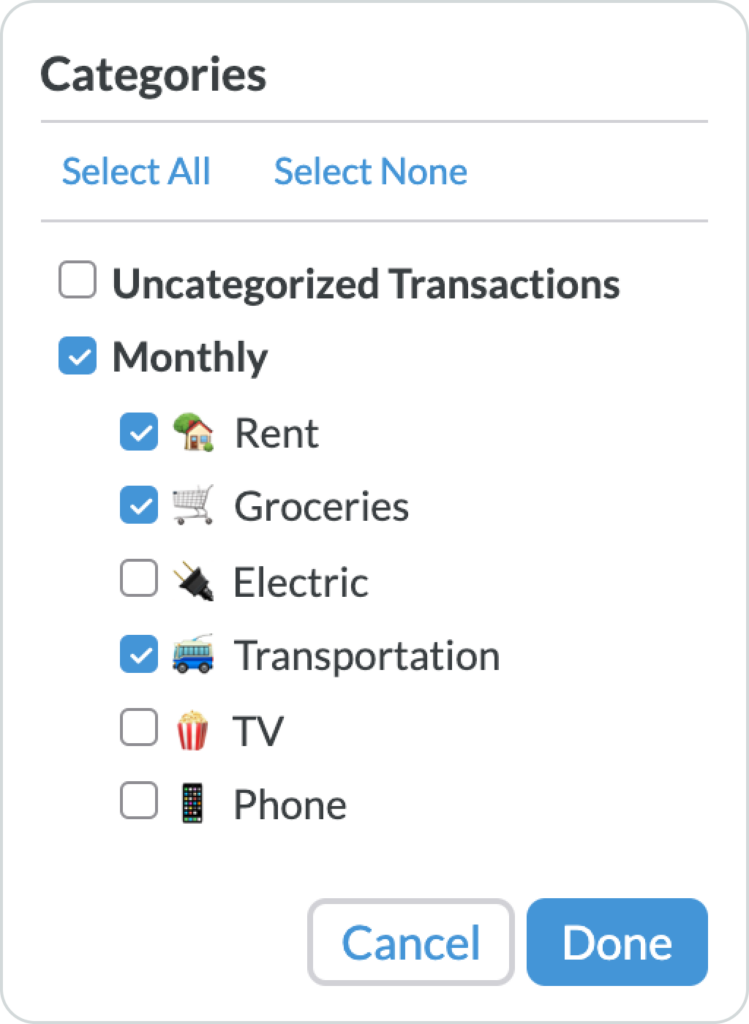

The default view exhibits your entire finances classes, however if you wish to examine particular grasp classes and even particular subcategories, you possibly can toggle these classes on and off.

You may “Choose All” to simply return to the default view of all classes, or you possibly can “Choose None” to begin with a clean slate and select the classes you need to consider.

Splice and Cube Knowledge by Dates

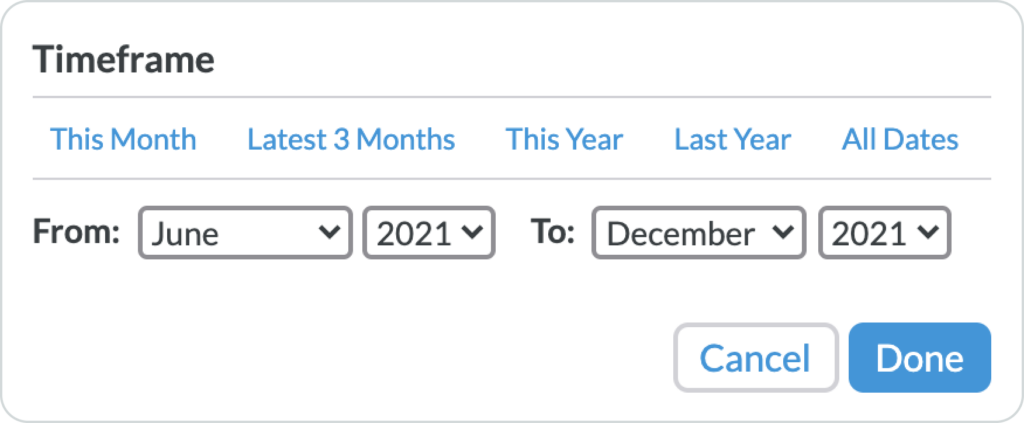

Utilizing the preset filters on the high of the timeframe dropdown, you possibly can toggle between “This Month,” the “Newest 3 Months,” “This Yr,” “Final Yr,” or “All Dates.” If these presets are too generic, you possibly can enter customized begin and finish dates within the “From” and “To” fields, to question a selected timeframe.

See the Development of a Particular Account

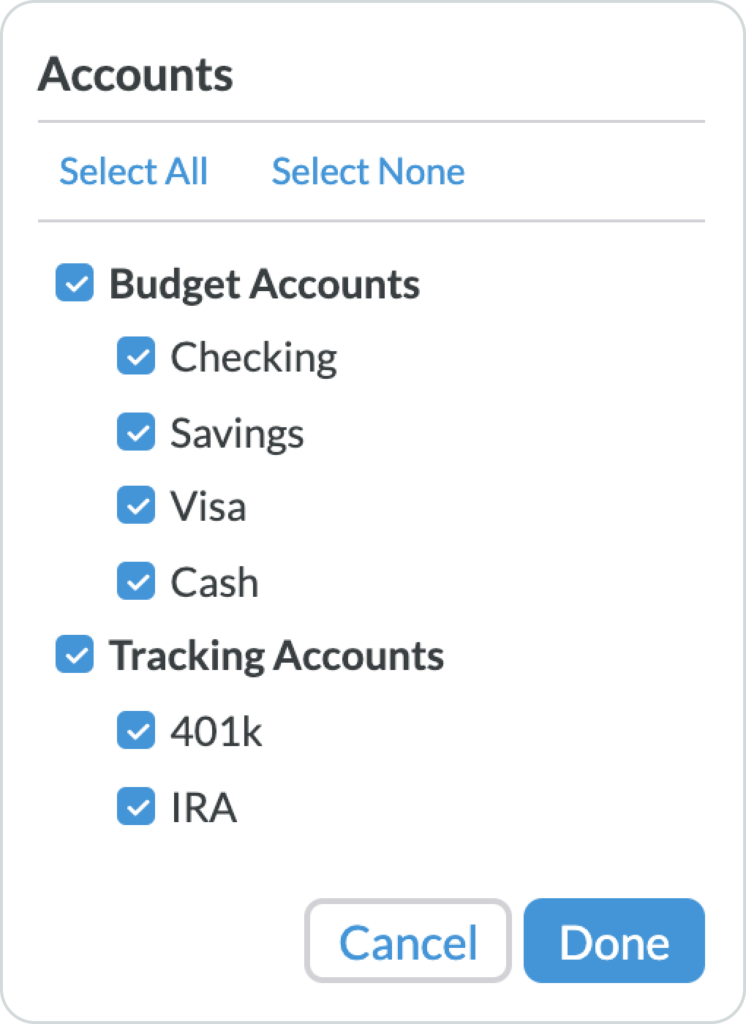

Most individuals deal with distinctive accounts in another way. Perhaps you simply need to take a look at your checking account, otherwise you need to see the expansion of an funding account that you just’ve been monitoring.

Within the accounts choice dropdown, you possibly can toggle particular person accounts on and off or choose “Finances Accounts” or “Monitoring Accounts.” Simply view all accounts by checking “Choose All,” or begin with a clean slate by checking “Choose None,” after which merely examine the accounts that you just need to see.

The Spending Report

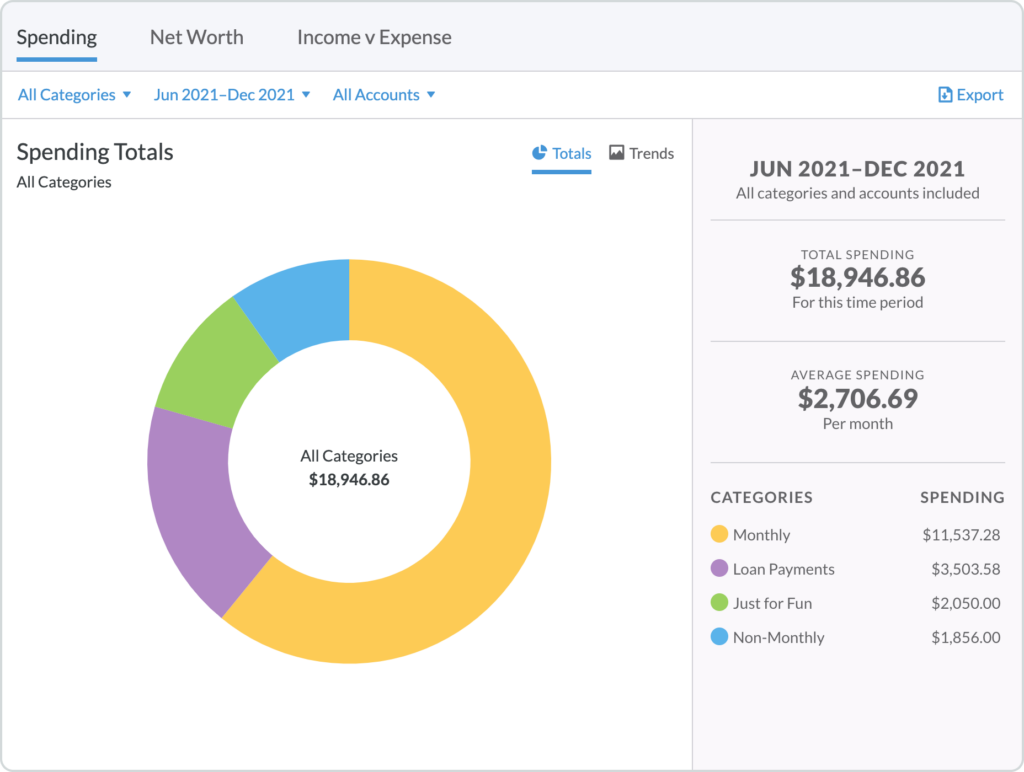

The Spending Report brings all of your spending to life! You may view your spending totals in a pie chart or your spending traits in a bar graph with a easy trendline that exhibits the info by month.

See Your Spending Damaged Down by Class

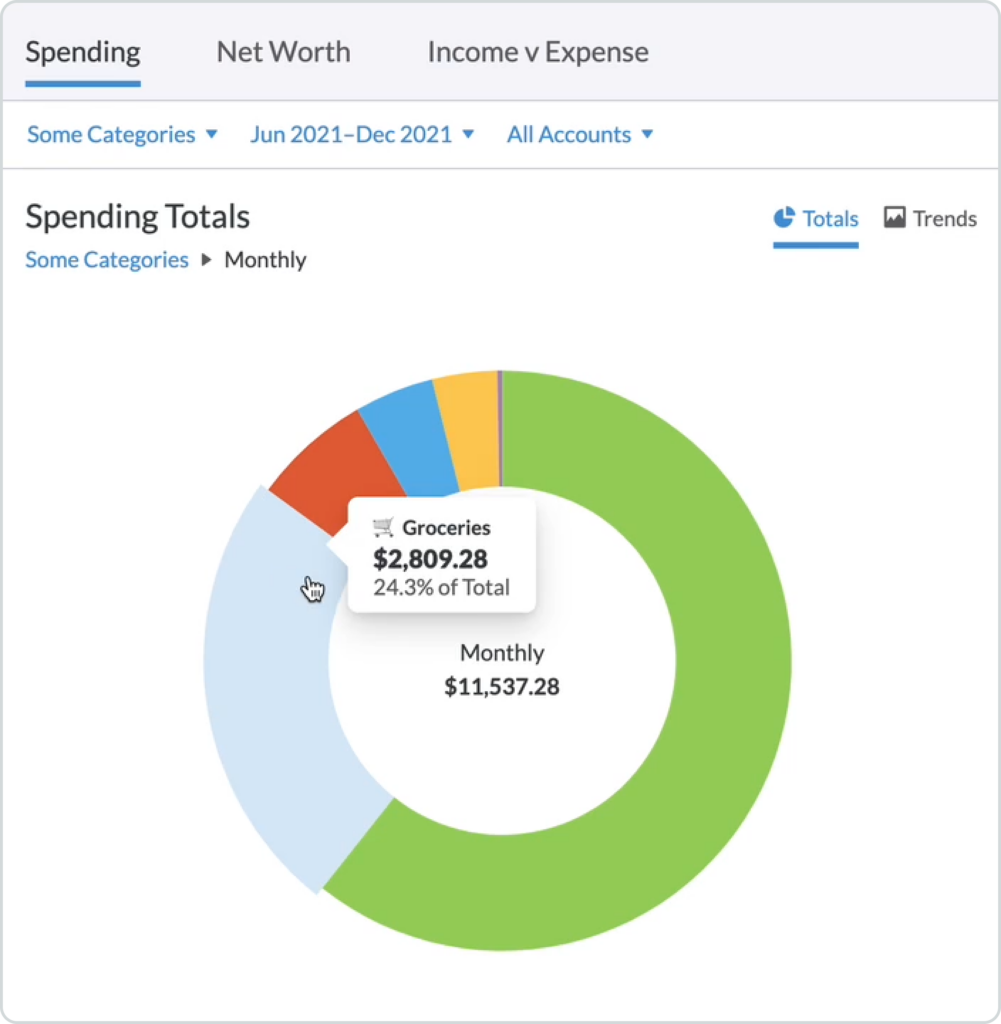

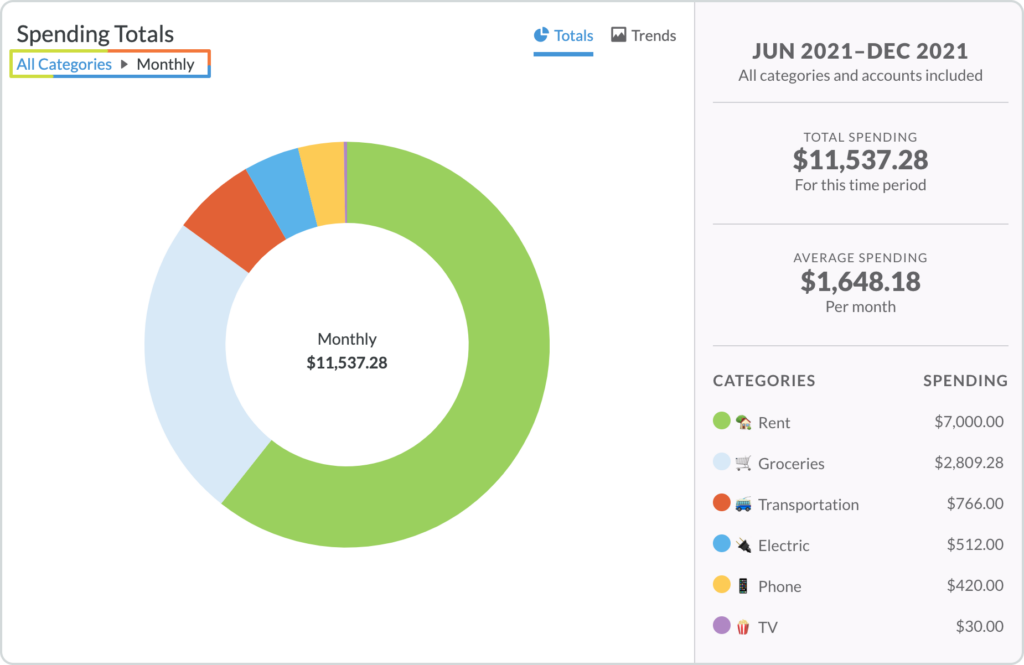

Within the Totals part of the Spending Report, you will notice a color-coded circle graph exhibiting your spending totals as a share of your general cash spent.

You may hover over every part of the circle graph to see each the overall quantity spent for every class together with the share of the overall quantity spent. You can even use the legend on the underside proper to find out which coloration corresponds to which class.

On the right-hand facet, you’ll see the timeframe, and which classes and accounts you might be at the moment viewing. Additionally, you will see your spending totals and averages for the chosen classes.

The default view will present you all chosen grasp classes. When you click on on a class within the circle graph (or within the legend) you possibly can then drill down into the subcategories of that exact grasp class. The part on the best will now present you the totals and common for less than that grasp class.

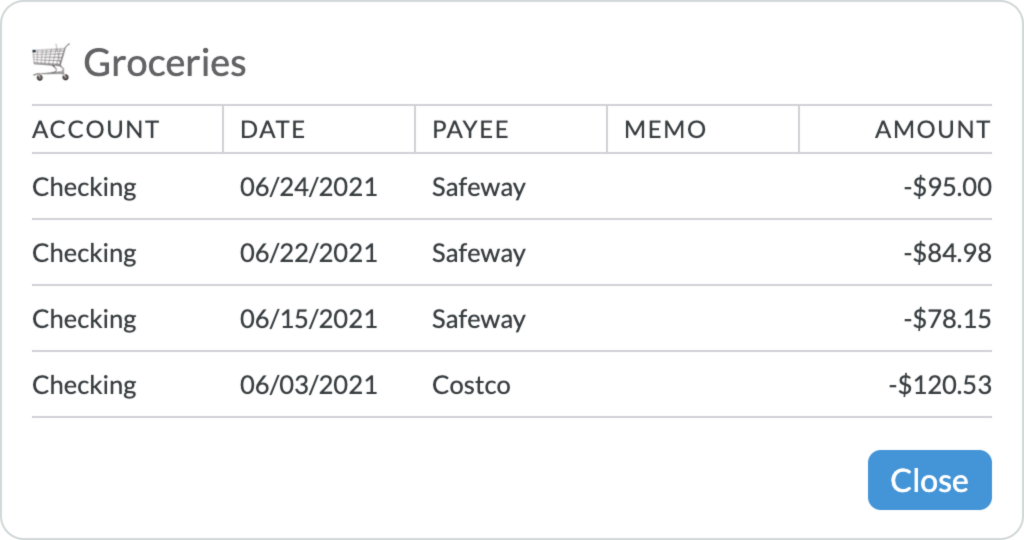

Within that grasp class, you possibly can drill down even additional to see the entire transactions tied to a subcategory by clicking on that subcategory within the circle graph or within the legend on the best.

(Be careful, seeing each greenback you spent on groceries can really feel a little bit painful.)

To return up a degree to see the entire grasp classes, simply click on on the “All Classes” (or “Some Classes”) hyperlink within the breadcrumbs within the high left:

Use Finances Stories to Examine Your Way of life Creep

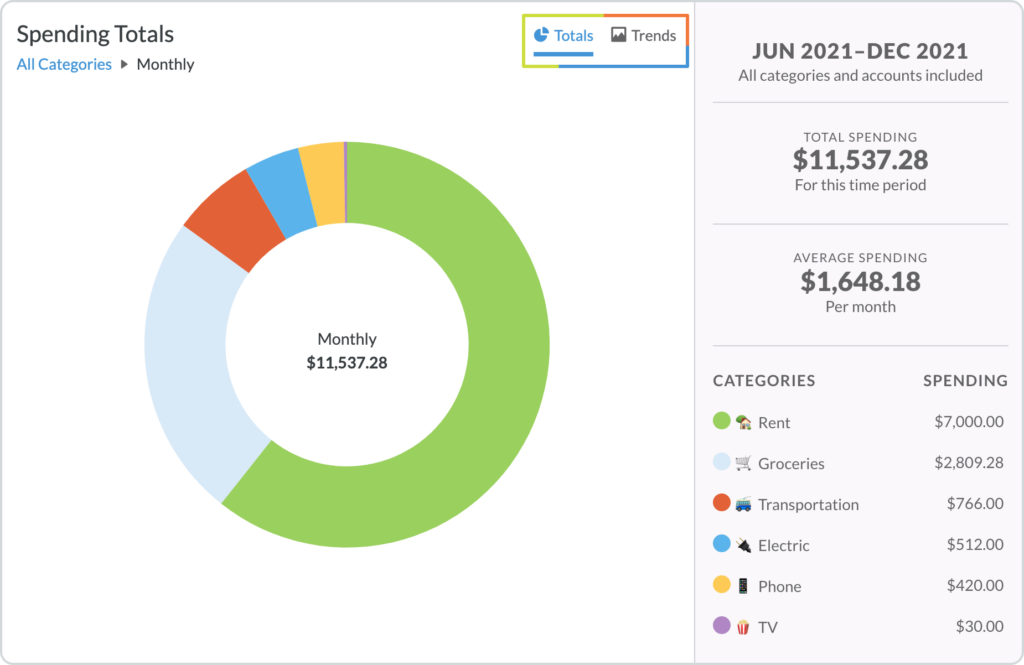

To see your spending traits, from month to month and over time, click on on the “Developments” button within the higher proper nook:

The Developments report is about up in the very same method because the Totals report. You could have your color-coded classes (now in a bar graph) on the left facet of the display and your whole, common, and graph legend on the best.

You may hover over every coloured class within the bar graph to see the overall and p.c of the overall spent for every month. By clicking on a coloured class, you’ll then drill down into that class to see how a lot cash was spent in every subcategory. As with the Totals report, you possibly can click on on every subcategory (within the bar graph or within the legend on the best) to view all transactions tied to that subcategory.

Stories may be…revealing. Try this video from the Finances Nerds on how get a deal with in your impulse spending for those who’re impressed to make some modifications!

Observe Your Internet Price

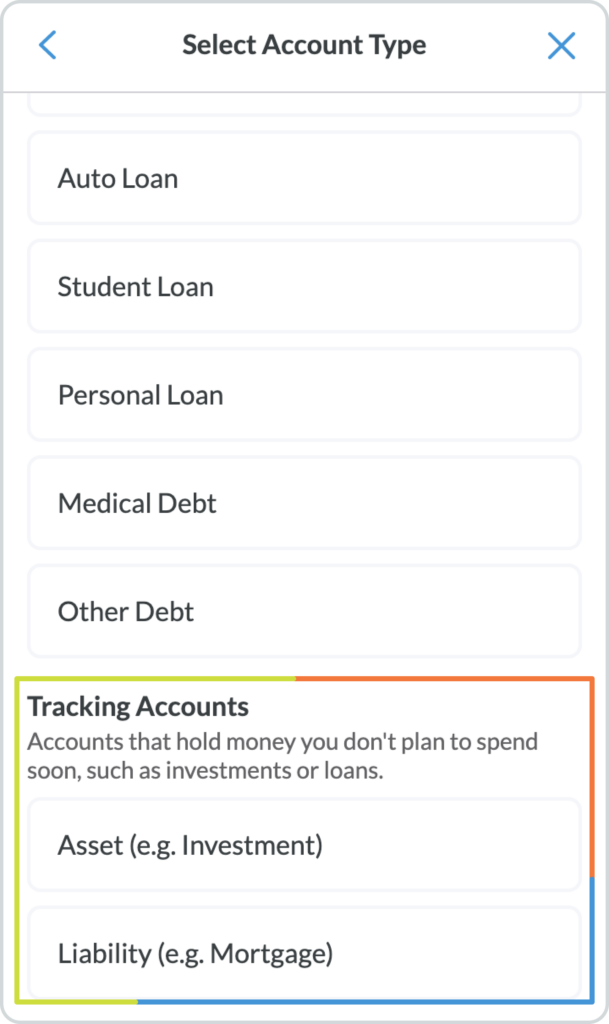

Breaking the paycheck to paycheck cycle is superior, however constructing wealth is an in depth second. The higher you finances, the sooner your Internet Price graph will climb. Your internet value is set by subtracting your debt out of your property. This report will hinge so much on Monitoring Accounts for issues like mortgages, financial savings and funding accounts alongside along with your on a regular basis accounts like checking and bank cards.

Your account kind is set if you arrange every account. Monitoring accounts don’t have an effect on your finances, however might help you monitor liabilities and property. To get a full image of your internet value, just be sure you have all property and liabilities in both monitoring or finances accounts:

The Internet Price report works moderately merely: money owed (or damaging accounts) are proven in purple whereas property (or constructive accounts) are proven in blue. Hover over every bar (each purple and blue) to see the breakdown of your money owed, property, and whole internet value for every month.

On the best, you will notice the timeframe, accounts, and whole change in internet value for the chosen timeframe. Moreover, you’ll see the itemized month over month change.

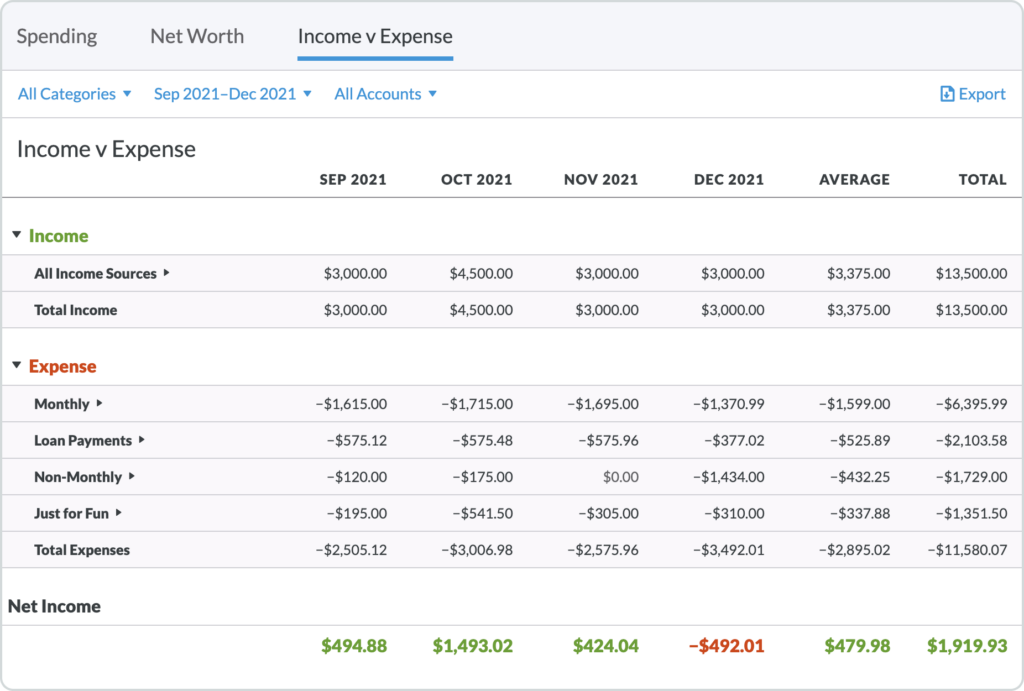

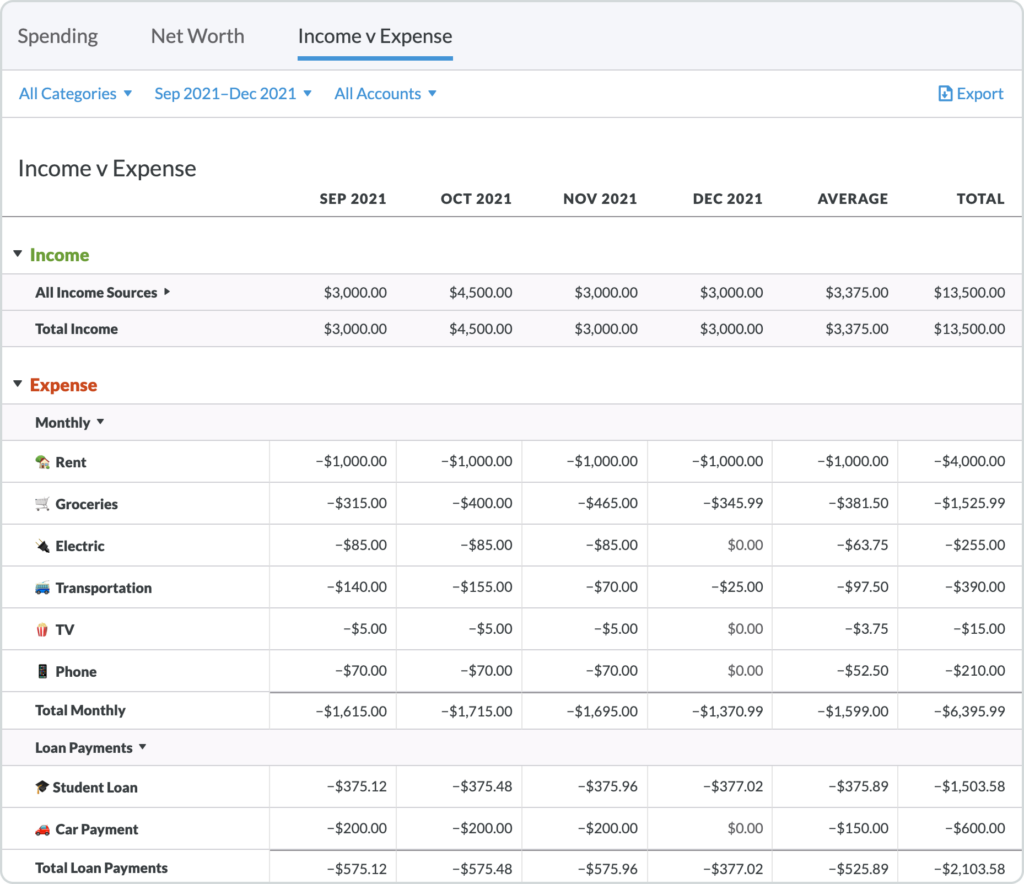

See What You Spent vs. What You Made

Within the Revenue v Expense report, your revenue is proven throughout the highest (beneath the inexperienced “Revenue” heading) whereas your entire bills (learn: spending) is proven on the backside (beneath the purple “Expense” heading).

This report maps each your revenue and bills month by month together with the averages and totals for every class.

If you wish to see subcategories, merely click on the arrow to the best of every grasp class and the subcategories will increase beneath.

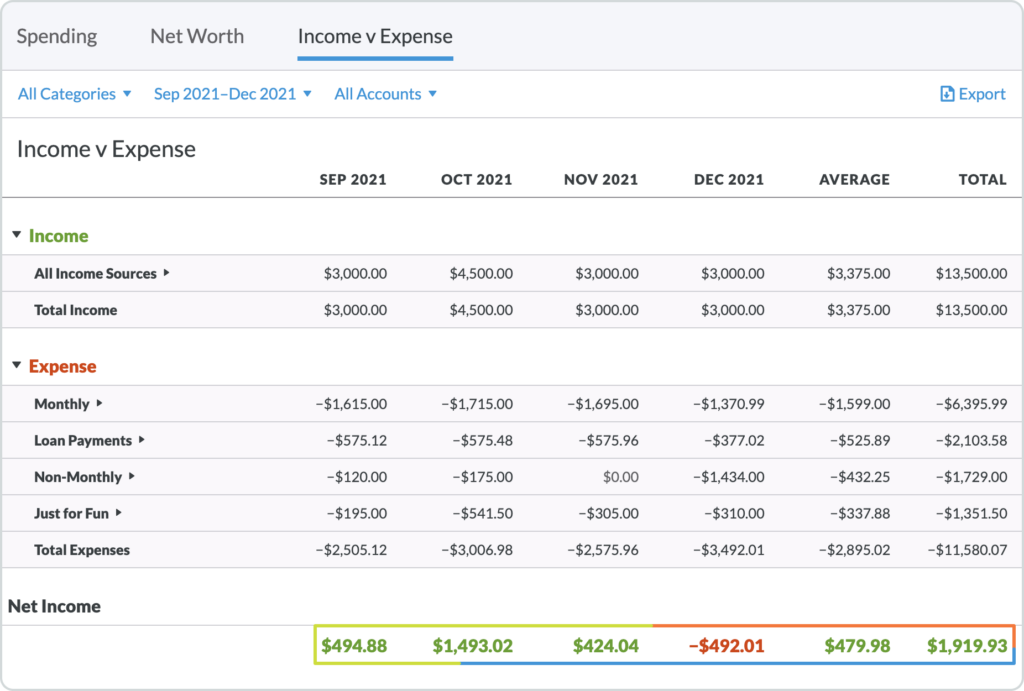

Maybe probably the most helpful data within the Revenue v Expense report is seen within the totals on the backside of every month (together with the general common and whole). Over finances months (hopefully these are uncommon!) are proven in purple whereas beneath finances months are inexperienced:

So, there you may have it: your entire revenue, spending, property and liabilities in studies which can be straightforward to filter, manipulate and dissect.

And fairly to have a look at and share. Dataheads, go loopy! The remainder of you, discover a little bit and see how one can put this data to work to realize much more management of your funds.

Desire a weekly dose of bite-sized budgeting ideas and tips? Join the YNAB Weekly Roundup.

This put up was initially revealed in October of 2016. It has been given a mini-makeover to assist it preserve its youthful look.