With so many several types of crucial sickness (CI) insurance coverage, how does one go about selecting?

We finally attain a stage of life the place we realise that when crucial sickness strikes, it doesn’t actually care about your loved ones historical past, what number of dependents it’s important to assist, or whether or not you’ve been consuming clear and exercising usually.

Studying from the expertise of pals round me, I quickly realized that those with the precise CI safety plans had a a lot simpler path to restoration since they didn’t have to fret in regards to the monetary stress. However for those who didn’t get their CI safety in time, they needed to bear the prices – and as such, stopping work was not an possibility.

Background

Previously, settling one’s crucial sickness insurance coverage was a a lot less complicated affair – we solely needed to determine whether or not we wished the protection to be tagged to our entire life plan or as a standalone CI time period coverage. However as medical diagnostics superior and allowed for extra crucial sicknesses to be recognized at an earlier stage – along with a better survival fee – it modified the insurance coverage scene as effectively.

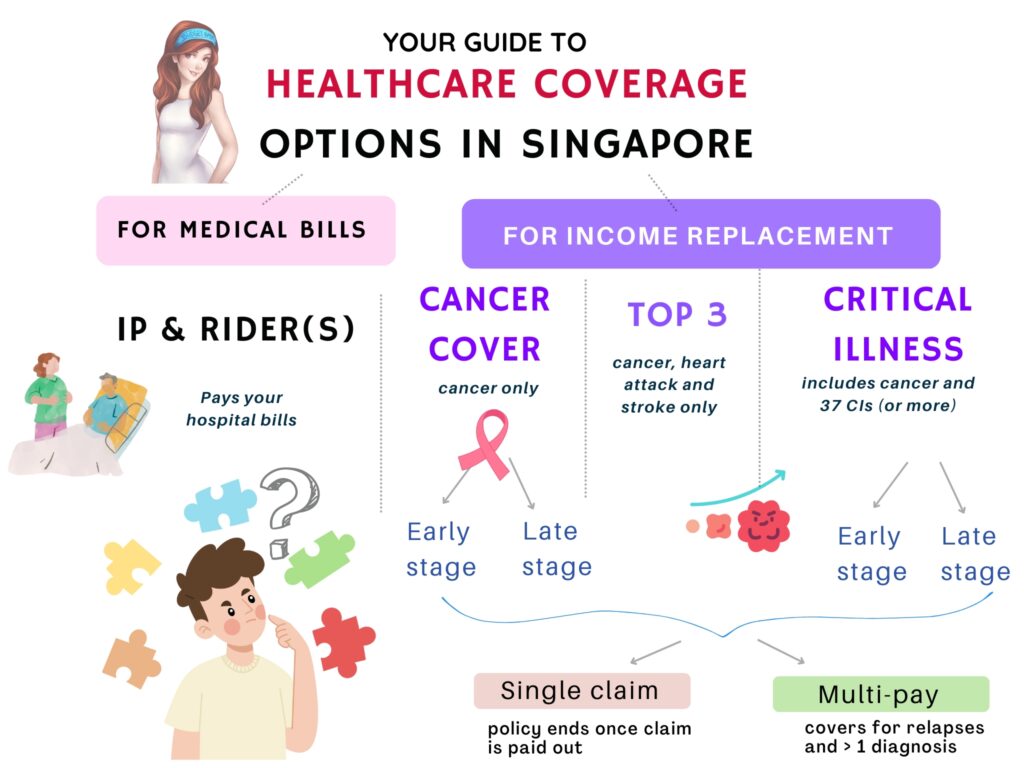

Customers can now select from the next choices on the subject of getting crucial sickness protection:

The issue is, with too many decisions, many individuals additionally find yourself not understanding which to choose.

If you happen to’re feeling misplaced by now, don’t fear – you’re not the one one.

The several types of CI protection right this moment

To simplify issues, I’ve summarised the assorted varieties of CI insurance coverage out there right this moment:

The price of healthcare medical therapies for crucial sicknesses might get lined by your Built-in Defend Plan (IP) (together with MediShield Life) and riders that assist scale back the money quantity you might want to pay.

Relying on the severity of your situation, most individuals both take day without work work to recuperate, or they go away the job / retrenched on account of lengthy intervals of absence. The issue is, our mortgage and different payments (e.g. residing bills on your aged mother and father, youngsters college charges, and so forth) nonetheless should be paid for even for those who get hospitalised! Even for those who have been to cease your job briefly and redirect your bodily power in the direction of a faster restoration, you continue to want a supply of revenue to pay for the non-medical payments. Your Built-in Defend Plan (IP) and riders is not going to cowl that.

That’s the place insurance coverage insurance policies that present lump sum money payouts can come in useful.

Within the occasion of a crucial sickness declare, you need to use the payouts out of your crucial sickness insurance coverage, prime 3 CI plan, or your complete CI coverage to assist pay for these different non-medical payments, in addition to any outpatient therapy medical prices (which can be ineligible for claims underneath your Built-in Defend plan).

And in contrast to your IP coverage (you possibly can solely maintain and declare from 1 Built-in Defend plan), you possibly can declare from all your CI insurance policies upon the analysis of CI.

Simply word that that is topic to the general declare limits and the CI definition in your coverage contract. Phrases and circumstances apply, the place relevant.

The best way to decide the precise CI plan?

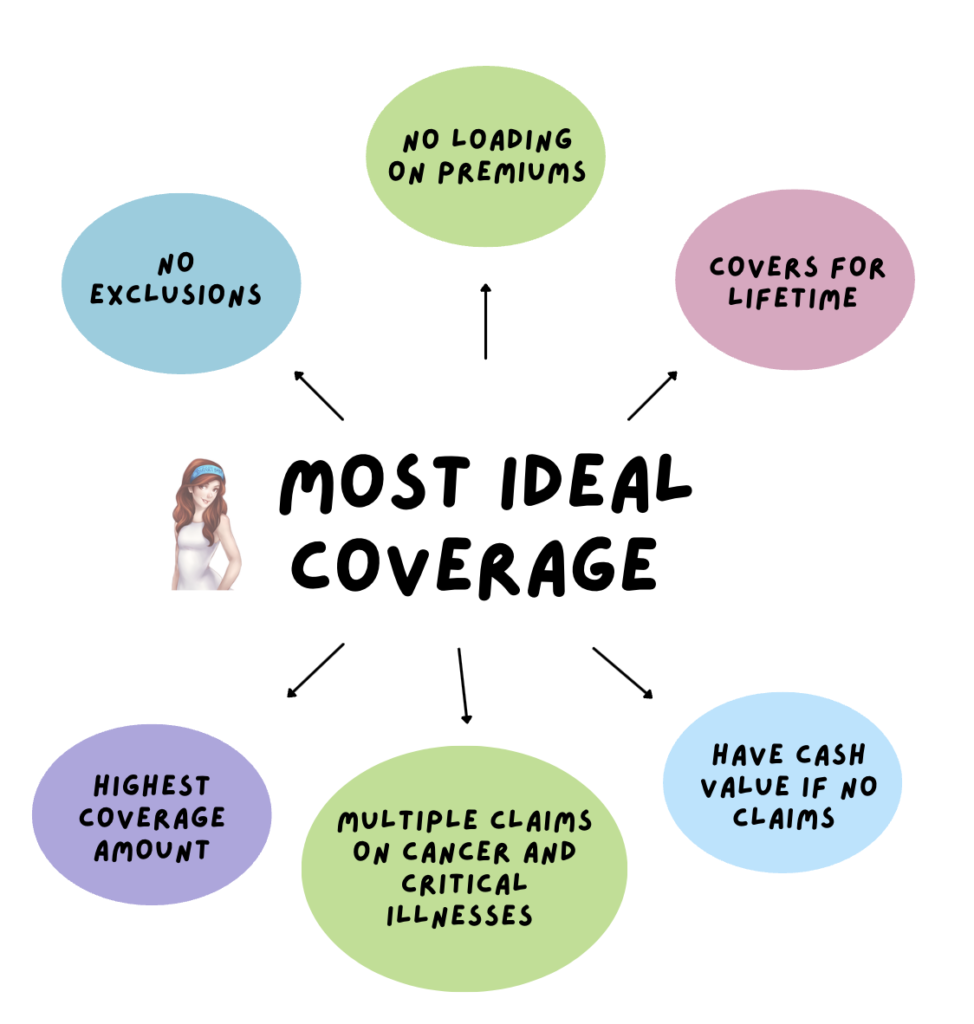

Probably the most splendid crucial sickness insurance coverage, for my part, could be one with the next options:

- No exclusions – all circumstances (together with pre-existing) are lined.

- No must pay increased premiums even if in case you have a pre-existing situation (idealistic, however not all the time possible within the fashionable world)

- Lifetime protection – up until age 100, or till we die.

- Have money worth if no claims are made – some of us favor a plan with money worth resembling a life plan as a result of they don’t like the concept that they “paid for nothing” once they made no claims.

- A number of claims allowed – to cowl for relapses, or every other subsequent analysis

- Highest protection quantity to cowl even any surprising future wants

Sadly, we stay within the actual world the place cash is an actual consideration, if not the most necessary issue that determines what and the way a lot protection we are able to get.

“As such, you might want to handle your expectations collectively together with your funds.”

Price range Babe

When you by no means wish to be able the place your value of insurance coverage is so excessive that it hinders your high quality of life in different areas, you additionally wish to keep away from being in a state of affairs the place you’re under-covered financially and unable to pay on your healthcare payments.

Tip 1: If funds is your largest limiting issue, go for a time period plan reasonably than an entire life coverage.

An entire life plan with crucial sickness protection prices considerably extra upfront to safe your protection for all times, particularly if the plan usually gives money worth or premiums refunds sooner or later.

Time period plans, then again, are payable yearly to keep up your protection, however typically don’t supply any money worth on the finish of the coverage time period.

The associated fee distinction is normally 4-digit (entire life) vs. 3-digit (time period) in premiums, which after all additionally varies and is determined by your age, gender and life-style i.e. smoker or non-smoker.

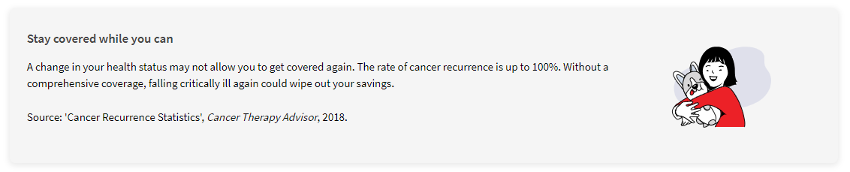

Tip 2: Get a complete CI coverage earlier than your well being adjustments.

Ideally, you’d wish to safe your monetary safety in opposition to as many crucial sickness circumstances if you are nonetheless wholesome and eligible for protection. A superb foundational plan to cowl your bases first would thus be a complete CI coverage which:

- covers you for 37 CIs (or extra),

- pays out even at early-stage analysis of some sicknesses, and

- comes with the choice for a number of claims (within the occasion of relapse or future CIs).

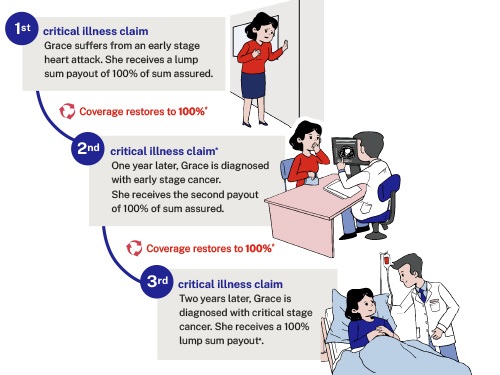

For instance, a plan like GREAT Essential Cowl: Full with Shield Me Once more rider ticks all of those above standards proper now. With a 100% lump-sum payout upon the analysis of CI at any stage(s) for every declare, and as much as 3 claims, it covers 53 totally different CIs – greater than the standard 37.

However what for those who can’t afford a complete CI plan?

Tip 3: Cheaper choices exist for masking the highest 3 CI solely.

Fortunately, you now have an possibility for getting protection for the highest 3 CIs as effectively. These didn’t exist a decade in the past once I was a fresh-faced working grownup shopping for insurance coverage!

Whereas masking for less than 3 crucial sickness sorts might not sound splendid, the actual fact is that 90% of CI claims are for these circumstances.

So, if you wish to insure your self in opposition to the circumstances with statistically highest odds, then contemplate a plan that covers for at the least most cancers. Even higher could be a plan that covers for most cancers, coronary heart assault and stroke.

Such plans can be utilized for primary safety or supplementary protection, particularly for those who really feel your present protection ranges are inadequate to manage in opposition to the rising prices of power sickness and residing bills. In that case, you possibly can contemplate having crucial sickness/most cancers insurance coverage to assist plug the hole.

If you happen to’re frightened in regards to the prices of most cancers, try GREAT Most cancers Guard which may defend you – as much as age 85 – throughout all phases of most cancers. One of the best half? Your premiums don't change with age^, so that you don’t have to fret about paying extra to keep up your protection as you become old. P.S. GREAT Most cancers Guard comes with 5 varieties of plans so that you can select your protection quantity until age 85 (subsequent birthday).

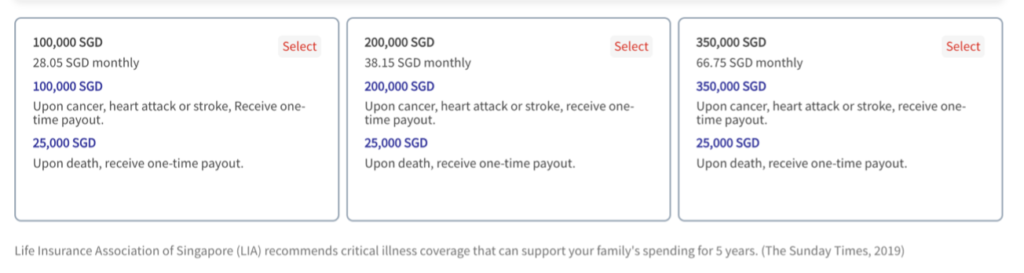

Tip 4: How a lot protection quantity ought to I get?

“With rising medical prices and value of residing, we are able to solely make best-guess estimates for what we expect we’ll want sooner or later.”

Price range Babe

Proper now, most plans assist you to select from as little as S$50k. LIA recommends for crucial sickness safety of ~4 occasions of 1’s annual revenue, however after all, some sufferers might be able to get better sooner and resume work earlier. Finally, how lengthy it takes will even rely in your bodily well being, how effectively your physique responds to the medication and coverings, in addition to the severity of your medical situation.

If 4X of your annual revenue interprets into hefty insurance coverage premiums that you just can’t pay for, then let your affordability decide which stage to go for.

Tip 5: Contemplate for those who want a multi-claim coverage.

Once I requested my pals who survived most cancers on what their largest concern was, most of them mentioned they have been frightened a couple of relapse and never having sufficient cash for it. Bear in mind, multi-claim insurance policies didn’t exist as an possibility previous to the interval earlier than the 2010s.

What’s extra, new knowledge has emerged to indicate some most cancers sorts have a better recurrence fee e.g. ovarian most cancers recurs in 85% of sufferers, whereas half of these with bladder most cancers develop recurrence after cystectomy.

After seeing a number of of my pals undergo from a relapse, I’m beginning to see the enchantment of getting a multi-claim / multi-pay coverage. Nevertheless, multi-claim plans naturally value greater than their single-claim counterparts, so it’s important to issue this into your funds.

For instance, plans like GREAT Essential Cowl Collection supply the choice so as to add a Shield Me Once more rider, which then insures you in opposition to recurrence threat (of being identified with one other crucial sickness) so that you just stay insured even after a analysis, for as much as two crucial sickness episodes after your first declare.

Conclusion

As you possibly can see, getting lined for crucial sickness is not a easy affair. With all of the several types of choices obtainable right this moment, it may possibly turn into fairly perplexing to decide on.

Nevertheless, one factor stays the identical: the extra complete your protection, the extra you’ll have to pay for insurance coverage premiums.

Which is why the finest insurance coverage coverage for you and your loved ones is the one that you could afford and covers your wants accordingly.

To determine this out, you need to use the guiding questions beneath that can assist you:

- What are the several types of CI protection I can select from right this moment?

- What are my monetary tasks?

- How a lot funds do I’ve?

- Can I afford to pay for a complete crucial sickness coverage which covers at the least 37 (or extra) crucial sicknesses?

- If not, can I at the least afford to insure myself in opposition to the statistically highest odds of most cancers, coronary heart assault and stroke?

- And even simply most cancers alone?

If you have already got current CI protection, then you possibly can ask your self these questions as an alternative:

- How a lot CI protection do I presently have?

- Does my (older) insurance coverage plan cowl me in opposition to early-stage CI claims, or is it restricted to late-stage claims solely?

- Do I would like so as to add on a multi-claim coverage?

- Are there any safety gaps in my portfolio now the place standalone most cancers or prime 3 CI plans would possibly be capable of fill?

Getting your self protected in opposition to the prices of crucial sickness doesn’t all the time need to be costly.

Try Nice Jap’s vary of plans, together with standalone plans for CI and most cancers:

| Essential sickness | Most cancers safety | ||

| GREAT Essential Cowl: Full | GREAT Essential Cowl: High 3 CIs | GREAT Most cancers Guard | |

| Variety of CIs lined | 53 | 3 (most cancers, coronary heart assault, stroke) | 1 (most cancers) |

| Sort of protection | All phases | All phases | All phases |

| Sum Assured | 50K – 350K | 50K – 350K | 50K – 300K |

| Payout | 100% lump sum | 100% lump sum | 100% lump sum |

| Variety of claims allowed? | As much as 3 occasions, 100% lump sum per declare (with Shield Me Once more rider) | As much as 3 occasions, 100% lump sum per declare (with Shield Me Once more rider) | 1 time, 100% payout |

| Loss of life profit | 25K | 25K | Nil |

| Entry Age (Age Subsequent Birthday) | 1 – 60 for Coverage Time period as much as age 85; 1 – 55 for Coverage Time period as much as age 65; | 1 – 60 | 17 – 55 |

| Coverage time period (as much as, Age Subsequent Birthday) | 65 or 85 | 85 | 85 |

| Premium construction | Doesn’t improve with age^ (stage) | Yearly improve | Doesn’t improve with age^ (stage) |

| Underwriting wanted? | Full underwriting | 3 Well being Questions | 3 Well being Questions |

| The place to purchase? | Through Nice Jap Monetary Representatives solely | On-line or through Nice Jap & OCBC Monetary Representatives | On-line or through Nice Jap & OCBC Monetary Representatives |

Additionally they have some present promotions which you need to use that can assist you save extra in your value of insurance coverage:

Disclosure: This publish is a sponsored collaboration with The Nice Jap Life Assurance Firm Restricted ("Nice Jap"). All opinions are that of my very own, and knowledge correct as of March 2024.

^For GREAT Essential Cowl: Full and GREAT Most cancers Guard: The premium quantity is decided on the age of entry and doesn't improve together with your age. For GREAT Most cancers Guard, the premiums are inclusive of and topic to prevailing GST. Premium charges of GREAT Essential Cowl: Full, GREAT Essential Cowl: High 3 CIs and GREAT Most cancers Guard will not be assured and could also be adjusted primarily based on future expertise of the plan. Adjusted charges, if any, might be suggested previous to coverage renewals. As these merchandise don't have any financial savings or funding function, there is no such thing as a money worth if the coverage ends or is terminated prematurely. That is solely product info offered by Nice Jap. The knowledge introduced is for basic info solely and doesn't have regard to the particular funding goals, monetary state of affairs or explicit wants of any explicit individual. It's possible you'll want to search recommendation from a professional adviser earlier than shopping for the product. If you happen to select to not search recommendation from a professional adviser, you must contemplate whether or not the product is appropriate for you. Shopping for medical health insurance merchandise that aren't appropriate for you might influence your potential to finance your future healthcare wants. If you happen to determine that the coverage shouldn't be appropriate after buying the coverage, you might terminate the coverage in accordance with the free-look provision, if any, and the insurer might get better from you any expense incurred by the insurer in underwriting the coverage. Protected as much as specified limits by SDIC. This commercial has not been reviewed by the Financial Authority of Singapore. Data right as at 6 March 2024.