As we go to press, the S&P 500 is at its highest degree in historical past: 5137. It set a file by passing 5000 for the primary time on February 12, then one other file excessive of 5100 two weeks later.

In actuality, after all, the S&P shouldn’t be rocketing upward. The S&P 7-to-10 is, with the opposite 490-493 shares as an afterthought. The highest 10 shares contributed 93% of the index’s 2023 beneficial properties. Goldman Sachs declares that the “S&P 500 index is extra concentrated than it has ever been,” whereas Amundi, Europe’s largest asset supervisor and one of many world’s high six, claims it’s merely “at its highest degree in over 30 years.” People attempting to ease nervousness about that time to the truth that the market has been extra concentrated earlier than: within the mid-60s, the highest 10 accounted for 40% of the market (which then … uhh, crashed), and on the finish of the 90s they hit 25% of the market (which then … uhh, crashed).

Torsten Sløk, chief economist at Apollo International Administration, a US non-public fairness agency with over $500 billion in property beneath administration, appears to suppose that’s a nasty signal. “The highest 10 firms within the S&P 500 at present are extra overvalued than the highest 10 firms had been throughout the tech bubble within the mid-Nineteen Nineties” (Day by day Spark, 2/25/2024). The Shiller CAPE ratio, which seems on the worth of shares relative to long-term earnings, sits at its third-highest degree in 150 years.

For the previous 15 years or so, that hasn’t been trigger for alarm. The interval we describe as The Nice Distortion noticed shares routinely achieve traditionally unprecedented valuations and undergo a sequence of comparatively cold crashes: the market would crash by a 3rd, then bounce promptly again. The Covid Crash took the market down 34% … and lasted simply over one month. These fast recoveries had been pushed by TINA: with nominal rates of interest close to zero, actual rates of interest beneath zero, and an infinitely ingenious Federal Reserve prepared with ever extra progressive rescue schemes, money was trash, bonds had been losers, and There Is No Various to the inventory market.

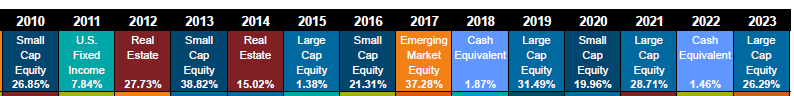

The Callan Desk of Periodic Funding Returns provides one technique to seize the impact of The Nice Distortion. Listed here are the top-performing asset lessons every year previous to The Nice Distortion.

And the perfect asset lessons within the years since. (Callan has achieved some relabeling, so index names within the outdated chart are changed by asset class names within the new one.)

Earlier than The Nice Distortion, US giant caps gained as soon as in 12 years (an 8% win fee, 1998-2009). Afterward, they gained 4 occasions (a 29% win fee, 2010-present). US equities gained 3 times (twice, small worth) in 13 years (23% win fee, with two wins by small worth) versus eight occasions in 14 years (a 57% win fee). Regardless of frequent crashes, US equities have been two to 4 occasions likelier to “win” than beforehand.

Many argue (doubtless, hope) that The Nice Distortion is ending. Rates of interest are within the neighborhood of their 100-year common, and the Fed appears disinclined to reward the markets with untimely reductions in them. That implies that money provides an actual return (one-month Treasuries are providing a 5.5% yield in early March 2024), and bonds have the potential to problem shares for buyers’ consideration.

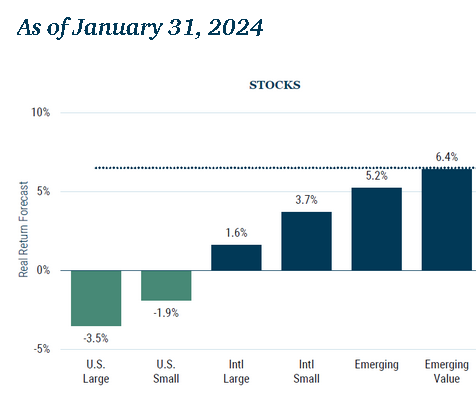

Should you consider that the markets are normalizing, then you definately may attend to the implications of GMO’s current asset class forecasts.

GMO, a Boston-based institutional funding agency based by Jeremy Grantham, has launched its newest “if solely the world had been regular” projections for five–7-year asset class efficiency. It’s a month-to-month train, maybe a public service, that garners some small discover within the investing neighborhood. The newest forecast, like most of its speedy predecessors, is profoundly unfavorable towards US fairness investments and comparatively constructive towards investments in rising markets.

The projections, they aver, are “primarily based upon the affordable beliefs of GMO” and embrace a projected inflation fee of two.3%. That implies that the “actual” returns projected above are projected asset class returns minus 2.3%.

Two notes:

-

Earlier than The Nice Distortion, when the US Fed discovered an almost-infinite array of how to prop up the market, GMO’s forecasts had been “stunningly correct.” The correlation between GMO and actuality was 0.94%, with GMO tending to be only a bit optimistic of their predictions. Mr. Grantham’s 10-year projection, from the start of the century by 2009, was “nearly precisely proper.”

That “precisely rightness” is mirrored within the efficiency of GMO’s methods within the years earlier than the Fed rushed to the rescue. Utilizing the fund screener at MFO Premium, I pulled the relative return rankings for all GMO methods. MFO Premium, MFO’s associate web site, provides essentially the most complete set of threat and efficiency information accessible to retail buyers and smaller RIAs. On this case, we requested, “What number of of GMO’s methods had high 20% returns every year within the early 2000s?” With eight methods, on common, 1.6 of them would land within the high tier. GMO crushed that threshold nearly yearly. For the sake of brevity, we’ll present solely the even-numbered years:

-

- 2000: 4 of 8 funds had high 20% returns

- 2002: 6 of 8 did

- 2004: 4 of 9 (they added a brand new EM debt fund)

- 2006: 1 of12 did (most had been common to above-average that 12 months)

- 2008: 6 of 13 did

On the whole, GMO was very proper, fairly often.

-

-

Since The Nice Distortion, “the precise efficiency of the most important asset lessons over the previous decade has been nearly completely inverse to GMO’s predictions” (“The Perils of Lengthy-Time period Forecasting – GMO Version,” Monetary Occasions, 8/17/2023). US large-cap shares, the property most benefited by the Fed’s largesse, “smashed all the things.”

As soon as the Fed blew up the connection between threat and reward, GMO’s projections turned contrarian indicators: all the things that was low cost acquired cheaper, and all the things that was costly acquired extra so.

It occurs. Talking with Pensions & Investments, GMO’s founder Jeremy Grantham defined:

My estimate is one thing like 85% of the time the market is roughly affordable, roughly environment friendly. Shut sufficient. After which 15% of the time, it’s not. That divides one thing like 11% or 12% loopy optimism and three% or 4% loopy pessimism. And that appears to be the mannequin. (“Jeremy Grantham’s funding bubble beneficial properties lengthen to his enterprise capital part,” PIOonline, 10/31/2023)

Different main buyers – not the Krypto Youngsters, actually, however people who’ve managed by lots of storms, appear to level in the identical common path as GMO.

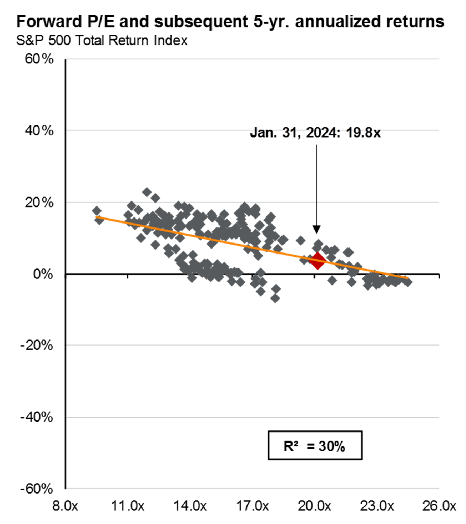

J.P. Morgan is simply barely extra optimistic in regards to the subsequent 5 years. They’ve plotted the five-year returns of the S&P primarily based on how excessive valuations had been at first of the interval.

I might learn that as “5% earlier than inflation” as their expectation (Information to the Markets, Q1/2024).

The fascinating Asset Allocation Interactive software, revealed by Analysis Associates, provides two projections for the 10-year returns on the US inventory market. If valuations matter, they anticipate actual returns of 1.5% per 12 months for a decade with volatility of 15.5%. If, nevertheless, valuations usually are not factored in, and we glance solely at dividends and development, then returns soar… to 4% per 12 months. In distinction, returns on EM fairness are projected at 7.5% (valuations matter) or 6.8% (solely yield and development issues).

The Implication

The tip of The Nice Distortion doesn’t imply that shares are about to crash. It’d imply that the securities that benefited essentially the most and the longest from the period of free cash and assured Fed safety, US mega-cap development shares, have misplaced their grip. Different property, not deeply undervalued relative to US giant caps, is likely to be anticipated to outperform with some consistency.

What to do about it?

There aren’t any ensures, which is the argument for diversification. As a result of 15 years is an eternity in investing, it’s an idea little-valued by many.

Think about an equal-weight S&P 500 index. These funds place an equal quantity in every of the index’s 500 shares. The flagship is Invesco S&P 500 Equal Weight ETF (RSP), which costs 0.20% and has outperformed the S&P 500.

Think about a fundamental-weight S&P 500 index. These are funds that weight the S&P 500 shares primarily based on the efficiency traits of the underlying company, not their shares’ recognition. The 2 Nice Owl funds there are Schwab Basic US Giant Firm Index (SFLNX) and Invesco S&P 500 Income ETF (RWL).

Think about an actively managed multi-cap fund. These are funds whose managers make investments throughout the dimensions spectrum, generally tilting towards bigger shares and generally towards smaller ones. Two Nice Owl funds to think about are Prospector Capital Appreciation (PCAFX) and Smead Worth (SMVLX).

Think about a versatile portfolio fund. These are funds whose managers have the liberty to maneuver towards what they understand because the market’s most tasty choices at any given level. Not like the funds above, they’re usually extra risk-conscious and oriented towards absolute returns (that’s, avoiding unfavorable years). Two Nice Owl funds to think about are FPA Crescent (FPACX, the most important single holding in Snowball’s portfolio) and Buffalo Versatile Revenue (previously Buffalo Balanced, BUFBX).

Think about including small worldwide shares. No funds on this realm earn a Nice Owl designation. Instead of that, we recognized funds with a mixture of the best Sharpe ratios – the usual measure of risk-adjusted returns – and Martin ratios – a measure that strongly weighs draw back efficiency. Three distinguished funds by these measures are Constancy Worldwide Small Cap (FISMX), Driehaus Worldwide Small Cap Progress (DRIOX), and Pear Tree Polaris Overseas Worth Small Cap.

Think about including rising markets shares. A lot of our most popular EM funds, Seafarer Abroad Progress & Revenue and Seafarer Abroad Worth as examples, don’t but have 15-year data. The 2 most distinguished funds which have crossed that threshold are each passive funds: SPDR S&P Rising Markets Small Cap ETF (EWX) and PIMCO RAE PLUS EMG (PEFFX). The PIMCO fund makes use of a Analysis Associates index which has a definite worth tilt.

Efficiency comparability, 15 years (by 01/2024)

| APR | Return vs friends | Sharpe ratio | US giant cap publicity | Nice Owl? | Morningstar | |

| Invesco S&P 500 Equal Weight | 16.0 | +2.7 | 0.89 | 35 | Sure | 5 stars |

| Schwab Basic US Giant Co Index | 16.4 | +3.2 | 0.95 | 68 | Sure | 5 stars |

| Invesco S&P 500 Income ETF | 115.8 | +2.6 | 0.95 | 67 | Sure | 5 stars |

| Prospector Capital App | 11.0 | -2.2 | 0.81 | 38 | Sure | 5 stars |

| Smead Worth | 16.6 | +3.4 | 0.92 | 46 | Sure | 5 stars |

| FPA Crescent | 10.2 | +1.7 | 0.83 | 31 | Sure | 4 stars, Gold |

| Buffalo Versatile Revenue | 10.9 | +2.3 | 0.81 | 72 | Sure | Three stars, Gold |

| Constancy Worldwide Small Cap | 11.7 | +1.6 | 0.65 | – | No | 5 stars, Impartial |

| Driehaus Worldwide Small Progress | 12.2 | +1.7 | 0.66 | – | No | 5 stars, Bronze |

| Pear Tree Polaris Overseas Worth Small Cap | 12.0 | +0.9 | 0.93 | – | No | 4 stars, Bronze |

| SPDR S&P Rising Markets Small Cap ETF | 9.5 | +1.8 | 0.44 | – | Sure | 5 stars, Bronze |

| PIMCO RAE PLUS EMG | 11.5 | +3.8% | 0.47 | – | Sure | 4 stars, Bronze |

| US Whole Inventory Market Index | 15.7 | 0.96 | 71 | No |

Supply: MFO Premium information screener. Be aware: Lipper peer teams differ from fund to fund, so the annual return in comparison with friends might sound inconsistent from one row to the subsequent. That’s merely completely different peer teams throughout the identical broad theme (worldwide smaller firms or multi-cap funds).

The Backside Line

Should you consider that The Nice Distortion has ended, that inflation is actual, and that rates of interest won’t return to the zero-to-negative vary they occupied since 2008, then you may additionally wish to take GMO’s projection extra critically.

That suggests relying much less on methods that depend upon Fed largesse and market mania and extra on methods which have labored properly even whereas out of favor. We shut with Mr. Grantham:

I might say that monetary markets are very inefficient, and able to extremes of being utterly dysfunctional. (Stephanie Dahle, “Get Briefed: Jeremy Grantham,” Forbes.com, 1/26/2009)