Expensive buddies,

In like a lion, out like a lamb? The Complete Inventory Market Index has risen 12% prior to now three months, as has the S&P 500. Nvidia inventory is up 76% in the identical interval whereas semiconductor shares inched up … 48%.

The thermometer in Davenport at the moment topped 76 levels, simply a bit heat for a late winter day. We heard that contributors within the March 1st Polar Plunges at areas throughout the higher Midwest needed to be handled for warmth stroke.

We dwell in attention-grabbing occasions. The one factor likeliest to assist us via them is the assist we provide each other, and our joint optimism that we are able to make it work!

On this month’s Mutual Fund Observer

Buyers appear mesmerized by the potential for inventory choices, and so-called Zero Day choices specifically, to carry out the feat that by no means has been (spoiler: and by no means shall be) finished earlier than: magically ship the inventory market’s positive factors with little of its pains. Cash is speeding in a torrent towards such investments. Our colleague Devesh Shah, who lifeless asleep is aware of extra about choices than any of the remainder of us do awake, takes us on a tour of the choices trade and its manifestation in funds and ETFs.

GMO releases month-to-month its seven-year asset class forecast. Within the wake of The Nice Distortion (2008-2023), their forecast has develop into a dependable contrarian indicator; their first shall be final and their final shall be first, so to talk. That masks the truth that their work was remarkably correct up till the period of zero-to-negative actual rates of interest and unbounded Fed creativity in propping up monetary markets. How many individuals keep in mind the emergency intervention within the in a single day repo markets in 2021, the place the Fed offered trillions of liquidity when the monetary sector refused to, a lot much less the truth that the Fed continued offering over a trillion till November 2023? If rates of interest and Fed habits return to their pre-2008 “regular,” GMO’s projections would possibly abruptly develop into surprisingly beneficial. I look at the argument, share the newest projection, and recommend six methods and twelve funds that is likely to be value taking a look at … quickly.

Most energetic fund methods would in all probability profit from being teleported into energetic ETFs, which are likely to have each structural value and tax benefits and a significant PR benefit. Whereas they’re gaining in recognition, they continue to be a surprisingly small area of interest. Lynn Bolin goes behind the curtains to determine the most effective – by way of efficiency and persistence – and discusses their integration right into a portfolio.

Buyers all love the thought of successful massive, a single dramatic guess paying off Las Vegas model. (“For those who’d invested $10,000 in Nvidia 5 years in the past, you’d have $200,330 at the moment!” Which misses the truth that you didn’t put money into Nvidia; you got a hashish ETF and Past Meat inventory.) The impulse towards “subsequent massive factor” investing is captured in funds specializing in investing in “disruptors.” For the advantage of these tempted, we take a look at the relative fortunes of two courses of funds: these claiming to be “disciplined” and people claiming to be “disruptive.”

The Shadow catches us up with trade information in Briefly Famous, but additionally highlights severe issues round one information merchandise. The property in passive methods have now surpassed energetic ones. The silly response is a kneejerk: “Effectively, good! Passive is cheaper and higher.” The extra considerate response is “Hmm… passive works as a free rider on the efforts of energetic managers to take care of some market self-discipline. However what occurs if there are too few energetic managers to take care of that self-discipline?”

Slippery when elevated

Prior to now six years, the market has crashed 3 times: down 20%(2018), 34% (2020) and 34% (2022). Regardless of that, by measures such because the Shiller CAPE, we stay in one of many three most costly markets prior to now 150 years. Doug Ramsey Chief Funding Officer & Portfolio Supervisor at Leuthold Administration reminds us,

… elevated valuations make the inventory market extra “accident inclined,” and up to date years (whereas constructive on a internet foundation) definitely illustrate this. Take into account that the final 5-1/2 years have seen three “main declines” within the S&P 500 (and considerably deeper losses for different indexes), regardless of the financial system having been in recession for simply two months out of that total span. (P/E Multiples Nonetheless Matter, 2/7/2024)

By his calculation, the 2022 bear market ended at valuations larger than the height of just about any bull market earlier than it.

All nice organizations have one factor in widespread

Over 40 years, I’ve constructed loads of high-functioning packages and have studied much more. One issue, greater than some other, distinguishes packages on a sustained upward path from these swirling round the bathroom.

The management in high-functioning packages isn’t threatened by the success of others; they’re safe within the information of their very own skills take pleasure in challenges and look to rent individuals higher than themselves.

The management in low-functioning packages dwells in existential terror; they strut round so much whereas wrought with angst, they’re afraid of being proven up and look to rent individuals who don’t threaten them.

Tutorial departments of speech or communication are usually not seen as being amongst a college’s elite items. “Residence to the soccer staff and the cheer squad” is the stigma. And but at Augustana, one wannabe kingmaker’s plaintive question was, “Why does the whole lot right here run via the communication division?” We offered extra Deans of the Faculty, affiliate deans, division heads, senate chairs, council presidents, and program initiatives than any different tutorial program. That mirrored a single impulse: we have been relentless in pursuing new hires who have been method higher than we have been, and adamant that we might slightly discover a one-year patch than rent somebody who didn’t excite us.

Because the longest-serving member of the division, I’m additionally, nearly by definition, its weakest hyperlink since I’ve solely been prepared to rent individuals higher than me after which individuals higher than those we’d simply employed.

It’s scary and exhausting, humbling and infinitely worthwhile.

All of which got here to thoughts as I learn Warren Buffett’s encomium to Charles Munger. It speaks to a profound humility, and a joyful embrace of a difficult rent, on Mr. Buffett’s half. It occupies the opening web page of Buffett’s annual letter to shareholders. I’d wish to quote a piece of it for you.

Charlie Munger died on November 28, simply 33 days earlier than his a centesimal birthday.

Although born and raised in Omaha, he spent 80% of his life domiciled elsewhere. Consequently, it was not till 1959 when he was 35 that I first met him.

In 1962, he determined that he ought to take up cash administration. Three years later he informed me – accurately! – that I had made a dumb resolution in shopping for management of Berkshire. However, he assured me, since I had already made the transfer, he would inform me appropriate my mistake.

In what I subsequent relate, keep in mind that Charlie and his household didn’t have a dime invested within the small investing partnership that I used to be then managing and whose cash I had used for the Berkshire buy. Furthermore, neither of us anticipated that Charlie would ever personal a share of Berkshire inventory.

However, Charlie, in 1965, promptly suggested me: “Warren, overlook about ever shopping for one other firm like Berkshire. However now that you just management Berkshire, add to it great companies bought at truthful costs and quit shopping for truthful companies at great costs. In different phrases, abandon the whole lot you realized out of your hero, Ben Graham. It really works however solely when practiced at small scale.” With a lot backsliding I subsequently adopted his directions.

A few years later, Charlie grew to become my companion in working Berkshire and, repeatedly, jerked me again to sanity when my outdated habits surfaced. Till his loss of life, he continued on this function and collectively we, together with those that early on invested with us, ended up much better off than Charlie and I had ever dreamed potential.

In actuality, Charlie was the “architect” of the current Berkshire, and I acted because the “normal contractor” to hold out the day-by-day development of his imaginative and prescient.

Charlie by no means sought to take credit score for his function as creator however as an alternative let me take the bows and obtain the accolades. In a method his relationship with me was half older brother, half loving father. Even when he knew he was proper, he gave me the reins, and once I blundered he by no means – by no means –jogged my memory of my mistake.

About midway via his lengthy letter, Mr. Buffett makes a passionate promise that I think few of the quazillionaires in his circle would echo:

I consider Berkshire can deal with monetary disasters of a magnitude past any heretofore skilled. This capability is one we is not going to relinquish. When financial upsets happen, as they may, Berkshire’s purpose shall be to operate as an asset to the nation – simply because it was in a really minor method in 2008-9 – and to assist extinguish the monetary fireplace slightly than to be among the many many firms that, inadvertently or in any other case, ignited the conflagration.

Our purpose is lifelike. Berkshire’s power comes from its Niagara of numerous earnings … We additionally function with minimal necessities for money, even when the nation encounters a protracted interval of worldwide financial weak point, worry and close to paralysis.

Your organization additionally holds a money and U.S. Treasury invoice place far in extra of what typical knowledge deems needed. Through the 2008 panic, Berkshire generated money from operations and didn’t rely in any method on business paper, financial institution traces or debt markets. We did not predict the time of an financial paralysis however we have been at all times ready for one.

Excessive fiscal conservatism is a company pledge we make to those that have joined us in possession of Berkshire. In most years – certainly in most many years – our warning will possible show to be unneeded habits – akin to an insurance coverage coverage on a fortress-like constructing thought to be fireproof. However Berkshire doesn’t need to inflict everlasting monetary harm – quotational shrinkage for prolonged durations can’t be prevented – on Bertie or any of the people who’ve trusted us with their financial savings.

Berkshire is constructed to final.

We’re richer for the work, and requirements, of such individuals. Would that there be extra of them.

Talking of Berkshire Hathaway … wow.

Professor Emerita Ruth Gottesman simply modified the lives of 1000’s. Dr. Gottesman donated a billion {dollars} to the Albert Einstein Faculty of Medication. The faculty is positioned in one of the vital impoverished elements of the town and the state of New York. Her reward quadruples the scale of the faculty’s endowment. The varsity instantly introduced its resolution to eradicate tuition for all college students. A medical e-newsletter walked via the implications of the reward: “This gesture is ready to liberate future physicians from the daunting common medical college debt of $202,453 within the U.S., permitting them to pursue their careers unencumbered by monetary pressure.”

Professor Emerita Ruth Gottesman simply modified the lives of 1000’s. Dr. Gottesman donated a billion {dollars} to the Albert Einstein Faculty of Medication. The faculty is positioned in one of the vital impoverished elements of the town and the state of New York. Her reward quadruples the scale of the faculty’s endowment. The varsity instantly introduced its resolution to eradicate tuition for all college students. A medical e-newsletter walked via the implications of the reward: “This gesture is ready to liberate future physicians from the daunting common medical college debt of $202,453 within the U.S., permitting them to pursue their careers unencumbered by monetary pressure.”

It can additionally enhance the probability that good youngsters who might by no means in any other case contemplate med college – first-generation faculty college students, the youngsters of immigrants, and the impoverished amongst them – would possibly develop into the form of docs who remodel communities.

NPR described her reward as “one of many largest charitable donations to an academic establishment in america and more than likely the biggest to a medical college.”

The motive force of the reward was her husband’s funding in Berkshire Hathaway. David Gottesman based First Manhattan Company (FMC, one in all whose funds we profiled), was an early investor in Berkshire Hathaway, and a companion of Mr. Buffett’s on a number of tasks. Mr. Gottesman is described by Fortune Journal as “a buddy of Buffett for six many years, and his early investments in Berkshire Hathaway Inc. gave him a internet value of just about $3 billion as of mid-2022, based on the Bloomberg Billionaires Index.”

A fast growl on the world’s stupidest charitable contribution

Giving cash to Harvard’s endowment. It’s completely idiotic and irresponsible. Harvard’s endowment is over $53 billion. That’s larger than the GDP of 120 nations (CBS, 12/23/2023) and it’s piling up relentlessly. It interprets to an endowment of over $2.1 million per scholar. At a 4% draw, that’s sufficient for Harvard to eradicate completely the $80,000 a yr it expenses.

However that’s not the way in which Harvard manages its finances. In consequence, it opens itself as much as blackmail from wealthy alumni who threaten to withhold further billions if the college doesn’t align itself with their political preferences. (Which, by the way in which, they’ve each proper and purpose to do.)

If there’s a “charity case” much less compelling than serving to Harvard construct towards its 54th billion, I haven’t seen it.

And if you wish to make a distinction, go assist the faculties that assist shiny youngsters who won’t in any other case make it, whether or not that’s the Albert Einstein Faculty of Medication or your area people faculties.

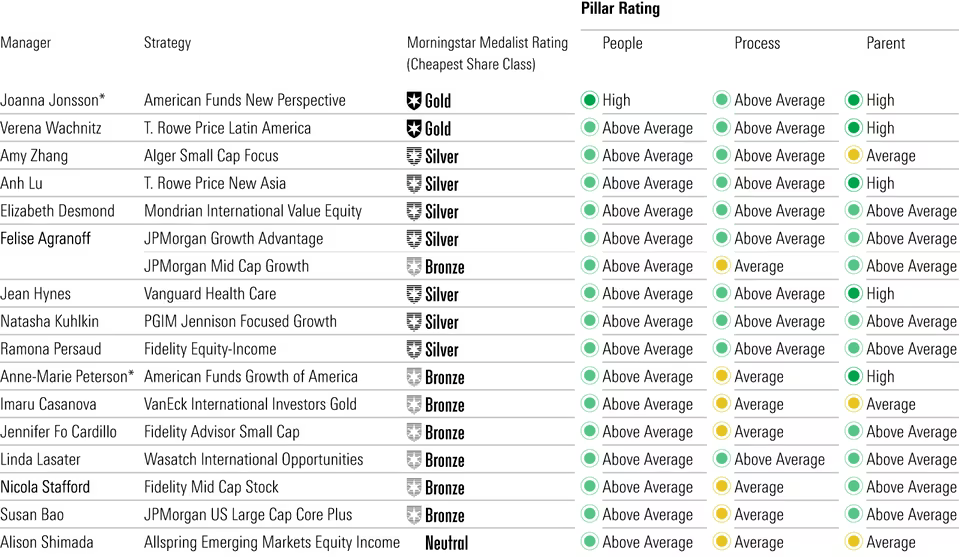

Morningstar acknowledges prime feminine fund managers

In celebration of Worldwide Ladies’s Day, Morningstar highlighted the work of 30 distinguished feminine fund managers. Historically, girls have been badly underrepresented as each skilled managers and particular person traders (the trade assumed it simply wanted to seek advice from “the person of the home”), so we have a good time the trouble.

Beneath is the record of managers in equity-oriented methods. For the fixed-asset and allocation honorees, observe the hyperlink to Morningstar’s website.

The New Trillionaires

Knight Frank, a British actual property “consultancy” based in 1896 has begun leaking to the media (the New York Occasions slightly greater than us) snippets from an upcoming report on intergenerational wealth switch. Knight Frank estimates {that a} beautiful $90 trillion is at play:

Over the subsequent decade or so, a large switch of wealth and property will happen because the silent technology and child boomers hand over the reins to millennials. The shift will see US$90 trillion of property transfer between generations within the US alone, making prosperous millennials the richest technology in historical past.

One affect will are available in how monetary merchandise are packaged and bought, however a extra consequential one would circulate from the very totally different ranges of climate-related consciousness and nervousness between youthful and older traders.

The generational variations in investing methods will fluctuate, however local weather change is only one instance via which capital shall be redirected. Trying solely on the top-line query on carbon emissions from our important Attitudes Survey of rich people and their advisors, millennials seem to have gotten the message in relation to chopping consumption – 80% of male and 79% of feminine respondents say they’re making an attempt to shrink their carbon footprints. Male boomers take a distinct view, with simply 59% making an attempt to scale back their affect, effectively under their feminine friends (67%).

These impending modifications make the trade’s ongoing Inexperienced Flight extra galling. Sustainability commitments that have been too typically the product of promoting calculations are crumbling underneath reactionary ire. The New York Occasions concludes, “Now, Wall Avenue has flip-flopped” (2/20/24) they usually share a substantial record to assist the conclusion. The latest retreat was “JPMorgan, State Avenue, and Pimco have just lately withdrawn from Local weather Motion 100+, a key worldwide coalition geared toward pushing companies towards greener practices.” (“Wall Avenue Corporations Retreat from Local weather Commitments Amid Rising Pressures,” One Inexperienced Planet, 2/2024). Their reasoning? The local weather group “had gone too far.”

Younger residents, on the cusp of inheriting trillions, would possibly fairly ask, “What the very F does that even imply? They haven’t finished something!”

Two modest portfolio updates

In December, we profiled the newly launched GMO US High quality ETF (QLTY). In February, Chip added it to her portfolio.

In February, in step with a plan that I mentioned in my annual portfolio overview, I elevated my investments in each Leuthold Core and RiverPark Strategic Earnings. Irked as I’m by the truth that the financial savings account at my financial institution pays 0.01% on all deposits – to not brag, however I pulled down effectively over $1.30 in curiosity final yr – I’m within the strategy of shifting a piece of it to David Sherman’s extra conservative fund, RiverPark Quick Time period Excessive Yield. Over the 13 years since its inception, David’s fund has the very best Sharpe ratio of any fund in existence: 2.52. To place this in perspective, that’s two and a half occasions better than the next-best fund there may be. The fund has averaged a 3.1% annual return; its lowest return in any 12 months was 0.6%. Its worst 12-month return is roughly 60X what Outdated Nationwide Financial institution has on supply, so …

Thanks, as at all times …

Because of the great people at Gardey Monetary and to Mark from Pennsylvania. (Hello, Mark! And thanks for the be aware. I, too, suspect that Lynn might in all probability muddle alongside fairly durn efficiently with out the assistance of a paid monetary advisor. He’s actually good, but additionally good sufficient to know his limits. I’m apt to go away full-time educating after one other yr and I have to have a severe sit-down discuss with one of many TIAA-CREF advisors out in Iowa Metropolis earlier than I do. If I hear something stunning, I’ll share.)

And, as ever, our Trustworthy Regulars: S & F Funding Advisors, Gregory, William, the opposite William, Stephen, Brian, David, and Doug.

As ever,