Enterprise danger is something that threatens the continued success of your apply, and it could assume many kinds. Sadly, many enterprise house owners overlook the potential dangers that may derail a long-standing enterprise. By understanding and addressing the potential dangers forward, you’ll be higher positioned to guard what you are promoting—and your shoppers.

To get you began, listed below are eight strategic dangers to pay attention to in your monetary advisory apply.

Danger 1: Competitors

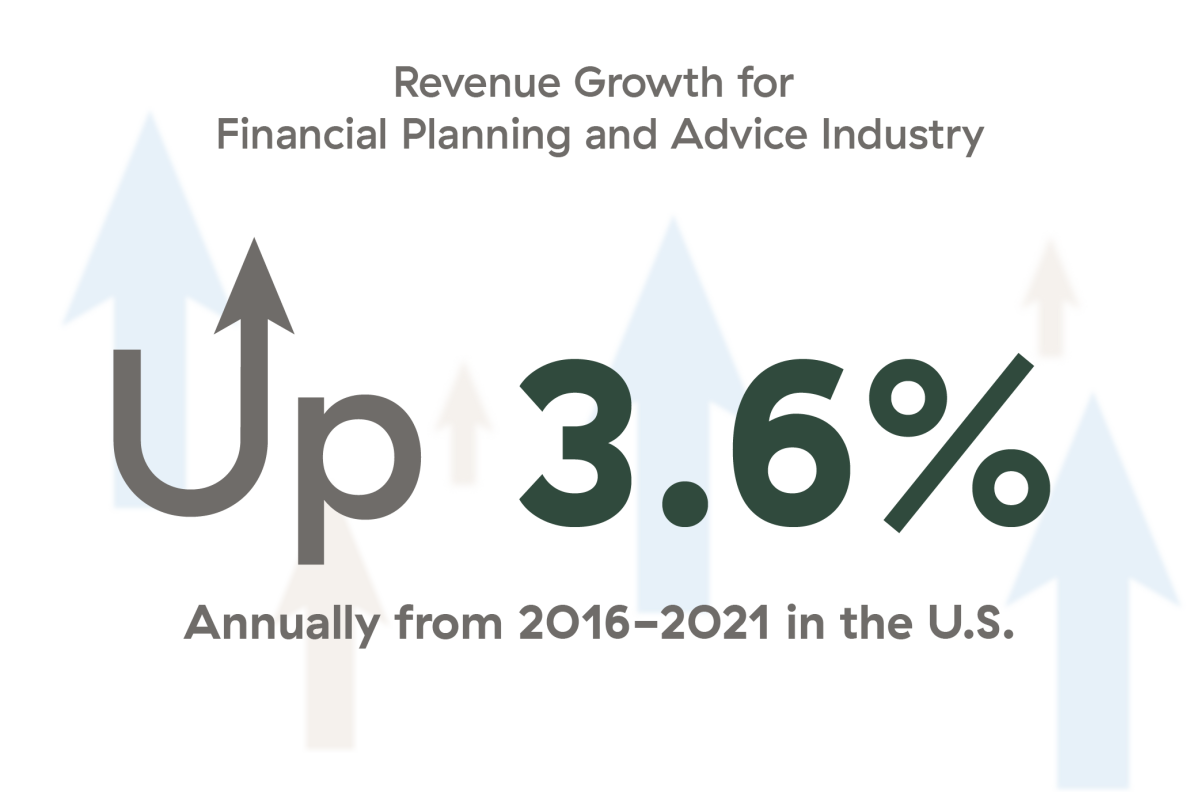

The competitors current within the monetary planning and recommendation business is continually rising and altering. In keeping with the market analysis agency IBISWorld, Ameriprise Monetary, Raymond James Monetary, and Graystone Consulting maintain the biggest market share, and income throughout the U.S. monetary planning and recommendation business confirmed regular progress from 2016 to 2021:

The competitors with robo-advisors is ongoing, with firms equivalent to Wealthfront, Betterment, and Acorns offering state-of-the-art cellular purposes and revolutionary investing methodologies.

Altering shopper demographics are calling for high-tech, high-touch companies for the rising prosperous market. If you wish to rating new, supreme shoppers, take into account exploring methods to succeed in out to millennials. And be ready to make clear the aggressive worth you present in areas equivalent to service, trustworthiness, and high quality relationships.

Danger 2: Income Development Strain

Good progress will allow you to reinvest in additional shopper companies—a plus on this aggressive market. Given price compression and elevated competitors for shopper {dollars}, discovering methods to develop is much more necessary. A couple of choices for driving your agency’s progress are:

As a phrase to the clever, take into account that progress is nice and vital for a thriving enterprise, however rising inefficiently will solely dilute the excessive stage of service and worth you convey to shoppers.

Danger 3: Specialization Calls for

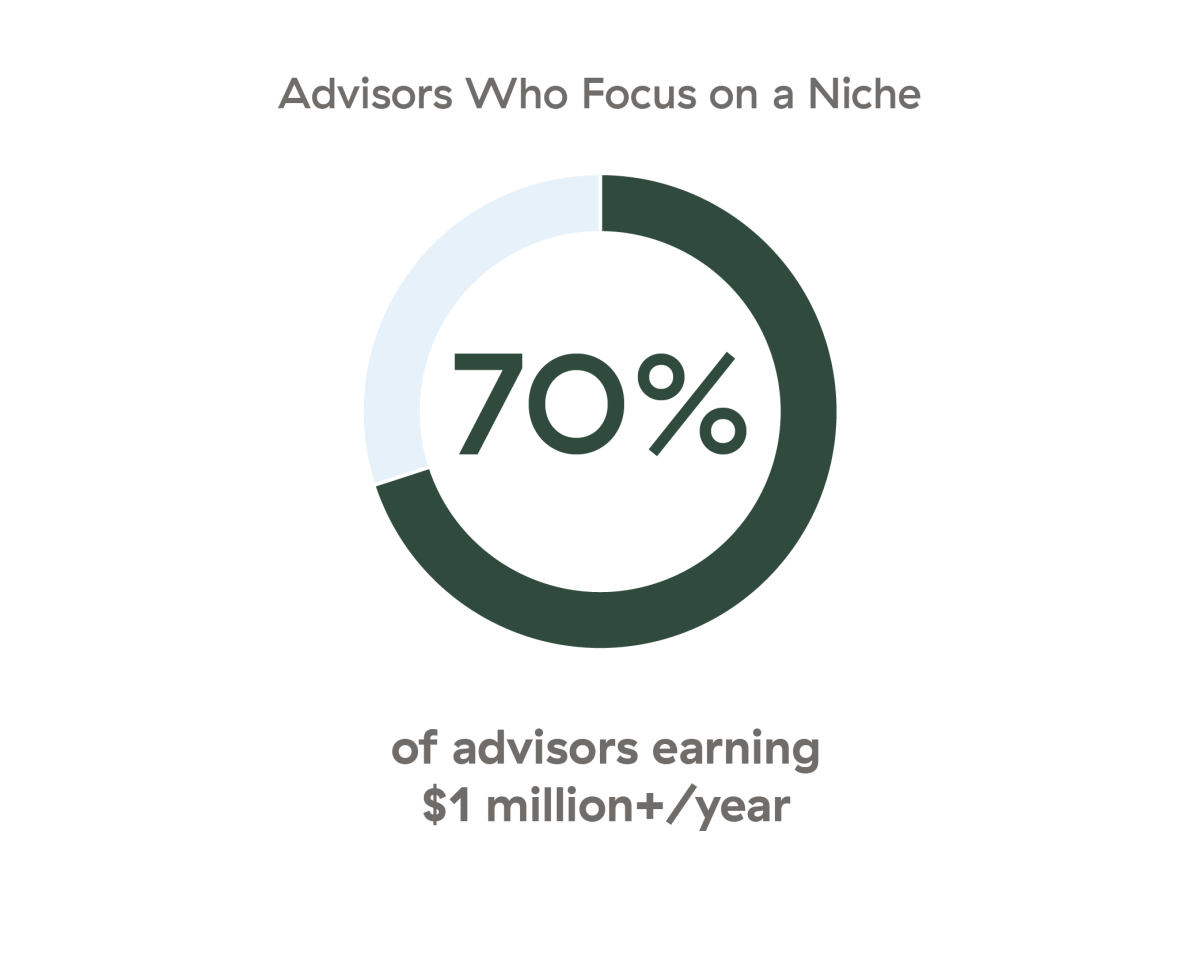

Growing your companies round a distinct segment may help with attracting supreme shoppers. Choosing an space you have an interest in, have expertise in, or have a ardour for will assist gasoline your success. Actually, knowledge collected by CEG Worldwide means that discovering a distinct segment focus might be an ideal subsequent transfer to develop your agency:

Danger 4: Advances in Expertise

It’s nicely documented that millennials favor monetary recommendation supported by know-how. A 2021 survey carried out by Roubini ThoughtLab uncovered the next knowledge:

In mild of those statistics, take into account assembly nearly with youthful shoppers, or use Twitter or LinkedIn to succeed in out to this group—simply as they’re utilizing social media to be taught extra about you.

Due to the Covid-19 pandemic, know-how has allowed us to proceed working seamlessly from wherever. Whereas this can be a blessing, it poses a further danger we beforehand hadn’t thought of. Your shoppers are snug and should really feel that Zoom conferences are actually the ‘’norm,’’ so there will not be a powerful want to fulfill in individual or to have an advisor with a neighborhood presence.

The power to obviously articulate the worth you ship to shoppers is extra necessary than ever. To remain aggressive, take into account the next actions:

Verify your search outcomes. Google your self and your agency to see what the search returns. If vital, improve your web site to precisely replicate each your skilled and private identities. This shift may assist you stand out from the opposite wealth managers and monetary advisors selling themselves on-line.

Spend money on new know-how. Expertise has additionally affected buying and selling instruments and automation by facilitating well timed trades and the supply of subtle funding methods in addition to creating extra safeguards in opposition to market downturns. Your capacity to make use of these instruments stands out as the decisive, strategic edge to draw shoppers. Plus, investing in know-how can create efficiencies, drive profitability, and allow you to proceed to thrive.

Danger 5: Human Capital Administration

Even with the rise of robo-advisors, don’t underestimate the human contact. Your market information and monetary planning and decision-making expertise ought to all the time provide you with an edge over robo-advisors. However you’ll must do your half in serving to shoppers acknowledge your worth by using the best-of-the-best people to work with them.

A human sources supervisor may help guarantee sensible hires. If sensible hiring practices should not used, your advisory enterprise may face a spread of human capital dangers, equivalent to:

-

Failure to draw workers

-

The hiring of the flawed individual

-

Unsatisfactory efficiency

-

Turnover

-

Absenteeism

-

Accident/damage

-

Fraud

-

Authorized/compliance points

Any of those dangers may interrupt what you are promoting, and two or three on the identical time may significantly disrupt it.

Danger 6: Elevated Regulation

You’re nicely conscious that the SEC regulates monetary corporations. But, debacles just like the Enron and Wells Fargo scandals, Bernie Madoff, and the 2008 monetary disaster occurred—and we are able to count on comparable occasions to proceed to occur. Most advisors count on extra, not fewer, rules sooner or later.

Within the present setting, elevated rules require cautious planning and allocation of sources to make sure that compliance doesn’t derail the profitability of your agency. To maintain abreast of business adjustments, evaluation FINRA’s report on its examination and danger monitoring priorities for 2022.

Danger 7: Scale and Capability

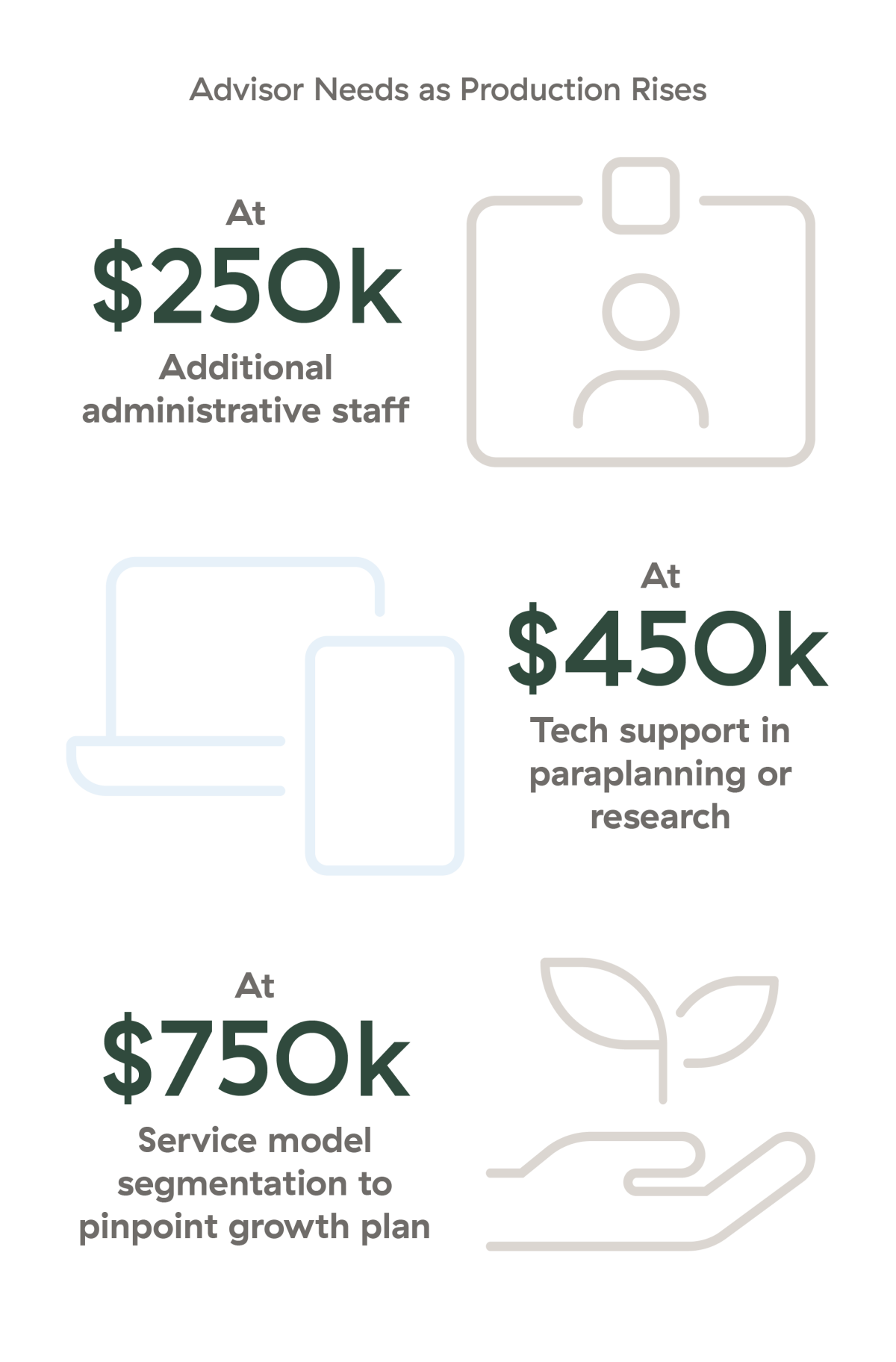

Right here at Commonwealth, our Observe Administration workforce has noticed that advisors are inclined to expertise “ache factors” at predictable intervals:

How will you cope with inflection factors equivalent to these? Begin by creating repeatable workplace procedures, in addition to understanding income distribution amongst shoppers, profitability by shopper, and optimum service fashions. If in case you have employees, work with them to assist with these duties—they usually know the workplace procedures and workflows intimately and should have concepts to enhance them.

Danger 8: Advisor Safety

Relating to defending your self, take into account an outdated insurance coverage gross sales query: “When you had a cash machine in your basement that pumped out $600,000 a yr, would you insure it?” After all, the punch line is that you are the cash machine. Are you defending your self in opposition to the losses that might derail your cash machine? Important loss threats embrace advisor loss of life or incapacity, key individual loss, an sudden catastrophe (pure or in any other case), lawsuits, and failure to plan for enterprise succession.

Greatest practices embrace insurance coverage and continuity plans to guard these property you can’t afford to lose. So, you should definitely carry out annual critiques to replace these plans in response to altering market circumstances.

Addressing the Chance of Danger at Your Agency

Now that we’ve coated some widespread enterprise dangers, take these subsequent three steps:

-

Draw a danger matrix with 4 quadrants.

-

Label the row headers with the implications of danger and the column headers with danger probability.

-

Brainstorm the dangers you understand in your agency and categorize them.

Lastly, use the next methods to deal with each danger in your quadrant matrix:

6 Methods to Construct a Higher Enterprise Plan

-

Develop a imaginative and prescient. The place do you wish to be in three years? What would you want to perform?

-

Assess your agency utilizing SWOT (strengths, weaknesses, alternatives, and threats) evaluation. The aim is to know your agency’s strengths and weaknesses on the within and alternatives and threats on the skin.

-

Create strategic directives. What actions can you are taking to attain your agency’s imaginative and prescient whereas maintaining danger discount in thoughts?

-

Outline significant annual targets. Use SMART targets—strategic, measurable, achievable, sensible, and time-bound.

-

Implement a plan of motion. Record duties and timelines to attain your targets. A clever individual as soon as mentioned, “In some unspecified time in the future, every little thing degenerates to work.”

-

Evaluation yearly. By constructing time to trace targets, you’ll be capable of alter your plan accordingly.