Homology Medicines (FIXX) (~$70MM market cap) is a scientific stage genetics biotech whose lead program (HMI-103) is supposed to deal with phenylketonuria (“PKU”), a uncommon illness that inflicts roughly 50,000 folks worldwide. In July, regardless of some early optimistic knowledge, the corporate decided to pursue strategic alternate options as FIXX would not be capable to increase sufficient capital within the present surroundings essential to proceed with scientific trials. Alongside the strategic alternate options announcement, the corporate paused growth and decreased its workforce by 87% which resulted in $6.8MM in one-time severance expenses.

Exterior of roughly $108MM in money (netting out present liabilities), FIXX has a doubtlessly priceless 20% possession stake in Oxford Biomedia Options (an adeno-associated virus vector manufacturing firm), a three way partnership that was fashioned in March 2022 with Oxford Biomedia Plc (OXB in London). As a part of the three way partnership, FIXX can put their stake within the JV to OXB anytime following the three-year anniversary (~March 2025):

Pursuant to the Amended and Restated Restricted Legal responsibility Firm Settlement of OXB Options (the “OXB Options Working Settlement”) which was executed in reference to the Closing, at any time following the three-year anniversary of the Closing, (i) OXB can have an choice to trigger Homology to promote and switch to OXB, and (ii) Homology can have an choice to trigger OXB to buy from Homology, in every case all of Homology’s fairness possession curiosity in OXB Options at a worth equal to five.5 occasions the income for the instantly previous 12-month interval (collectively, the “Choices”), topic to a most quantity of $74.1 million.

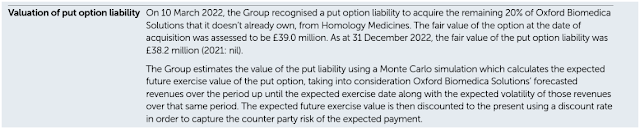

Poking round OXB’s annual report, they’ve the beneath disclosure:

Utilizing the present alternate fee, that is roughly $47MM in worth to FIXX. Now OXB is not a big cap phrama with an infinite stability sheet, so there’s some counterparty threat that OXB will in the end be capable to make good on this put. In my again of the envelope NAV, I’ll mark this at a 50% low cost to be conservative.

In contrast to GRPH, the working lease legal responsibility at FIXX is usually an accounting entry as the corporate’s workplace area is being subleased to Oxford Biomedia Options, however does not qualify for deconsolidation on FIXX’s stability sheet. I’ll take away that legal responsibility, be at liberty to make your personal assumption there. Moreover, despite the fact that HMI-103 could be very early stage, it wasn’t discontinued on account of a scientific failure and might need some worth regardless of me marking at zero since I am unable to choose the science.

It’s laborious to handicap the trail ahead, perhaps OXB buys them out, they may do a pseudo capital increase with FIXX’s money stability whereas eliminating the JV put possibility legal responsibility. Or FIXX might pursue the same old paths of a reverse-merger, buyout or liquidation.

Disclosure: I personal shares of FIXX