MRC International (MRC) ($920MM market cap) is a world distributor of pipes, valves, fittings (“PVF”) and different upkeep merchandise to gasoline utilities, industrials and power finish markets. The market appreciates the MRO/distributor enterprise mannequin as many pure-play industrial distributors commerce wherever from 10-15x EBITDA, nevertheless MRC International traditionally targeted on the cyclical oil and gasoline drillers and has largely traded at a major low cost to different industrial distributors (at present, about 6x EBITDA). Up to now decade, for the reason that oil market broke within the mid-2010s, MRC International has targeted on diversifying out to adjoining however much less cyclical markets like gasoline utilities, refineries (turnarounds/upkeep can solely be deferred for thus lengthy) and power transition initiatives (massive beneficiary of the Inflation Discount Act). However credit score for this combine shift has been onerous to return by in public markets as they proceed to commerce inline with extra upstream targeted NOW Inc (DNOW) (though NOW is debt free).

Traditionally, MRC International has battled being overleveraged, after a pair robust years they’ve lastly gotten that below management with debt/EBITDA roughly at 1x (for those who rely the convertible most well-liked as fairness). This previous spring, the corporate began the method to refinance their time period mortgage that comes due in September 2024, nevertheless, a administration described “enterprise disagreement” with their convertible most well-liked shareholder (who filed a lawsuit trying to dam the refinancing) led them to drag the deal. The corporate does have ABL capability to redeem the time period mortgage when it comes due subsequent yr, though that would not be a perfect steadiness sheet final result (apparently, due to their liquidity, administration has determined to account for the time period mortgage as long run debt although it matures in lower than a yr).

The convertible most well-liked is perpetual, pays a at present beneath market price of 6.5% and has a conversion value of $17.88 (versus a present value of $10.88). The popular holder is Cornell Capital, the namesake Henry Cornell was an authentic architect in rolling up distributors to what would grow to be MRC International whereas he was managing Goldman’s personal fairness enterprise. From their amended 13D following the lawsuit, it’s clear that Cornell needs to be cashed out:

The Lawsuit seeks, amongst different issues, (i) a declaration that the Issuer’s contemplated refinancing transaction violates the Issuer’s company constitution and (ii) an order to enjoin the Issuer from signing or executing any definitive documentation with respect to, or in any other case consummating, the Refinancing. Whereas MI objects to the Refinancing as contravening MI’s rights pursuant to the Certificates of Designations, MI has indicated to the Issuer that it wishes to barter a decision acceptable to all events. Such a decision might, for instance, contain the Issuer repurchasing the popular inventory held by MI in complete or partially for money or probably different types of consideration. Nonetheless, there could be no assurance that any such transaction will happen, or the phrases of any such transaction.

With that in thoughts, in seems the activist fund Engine Capital which owns roughly 4% of the shares excellent, of their quarterly letter, they outlined ideas that MRC International could possibly be offered for between $14-$18/share. Now administration is going through stress from an upcoming mortgage maturity, a grumpy most well-liked shareholder and an activist frequent inventory investor. On Halloween eve, information comes out from Bloomberg Information that MRC International is exploring a sale after receiving curiosity from personal fairness companies. A buyout would include a brand new time period mortgage in place, liquidity for Cornell Capital, appease Engine and probably obtain an fairness valuation that MRC International will not in public markets.

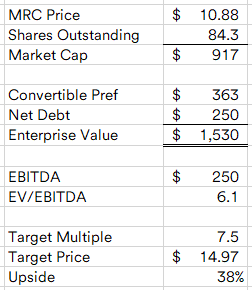

Once more, the closest peer is DNOW, though they’re much more uncovered to upstream oil and gasoline, there is a vast hole between the place MRC and DNOW commerce and different distributors. Given the leverage right here by the popular shares, a purchaser solely has to present MRC a bit a number of enlargement credit score for the improved enterprise combine shift for fairness shareholders to do nicely.

At 7.5x EBITDA (ahead estimate from Tikr.com), which admittedly is a a number of grabbed barely out of skinny air, you are taking a look at a couple of $15/share goal value, a pleasant premium to the present value. If a deal would not occur, there’s not a lot, if any, premium actually baked into the value. MRC International is going through some covid hangover headwinds of their quick rising (and the perfect section) gasoline utilities enterprise as their clients are destocking like many others after provide chain points triggered utilities to overorder in 2021-2022. However that section has grown at a ten+% CAGR for a decade and may return to development shortly. MRC has been a favourite pitch of these desirous to be lengthy oil and gasoline, however in a extra smart method than proudly owning the producers, if power does rally, MRC ought to profit together with it. In a method, it is the proper hated small cap worth inventory.

Disclosure: I personal shares of MRC