Greg Ip at The Wall Avenue Journal penned a chunk not too long ago that warned potential homebuyers concerning the prospect of low returns from present ranges:

I don’t want to supply any extra particulars from the story since you already know them. Housing costs are up so much. Mortgage charges are additionally up so much.

It is a honest warning.

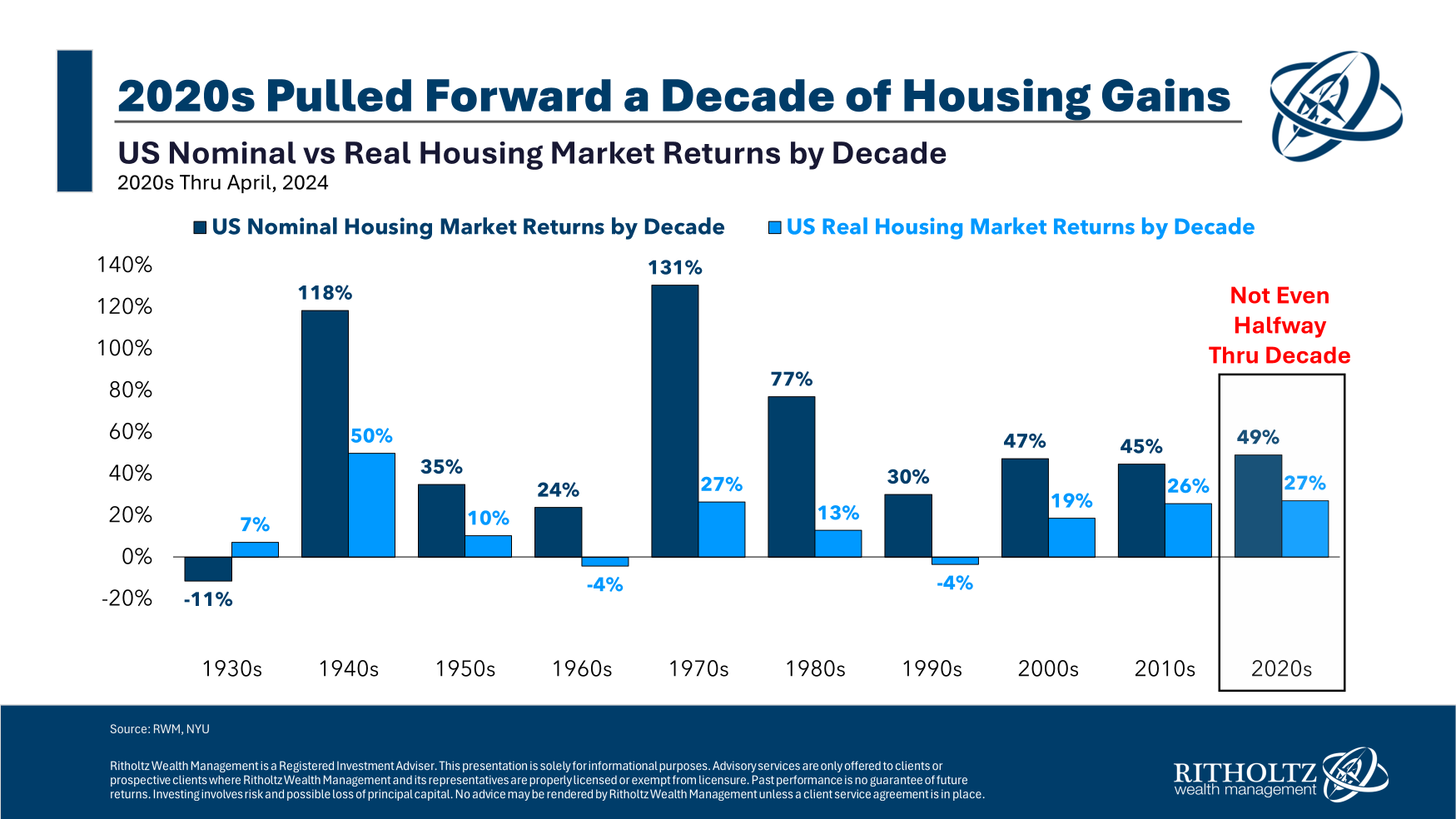

We primarily pulled ahead a decade’s value of housing returns into the primary few years of the 2020s:

Housing costs within the 2020s have already outpaced most many years. On an inflation-adjusted foundation, solely the Forties noticed increased returns and we nonetheless have five-plus years remaining.

If I had been a Wall Avenue pundit, I’d say the simple cash has been made, however I’m not going to fall for that entice.2

I don’t know if that is some kind of prime within the housing market. Given the positive factors, I wouldn’t be shocked if housing costs remained stagnant for some time. Even a pullback in costs wouldn’t be stunning.

My baseline assumption is that costs will rise by one thing near the inflation charge within the coming years, however predictions concerning the future are arduous. I don’t know the place housing costs will go from right here.

The concept of a prime in housing costs bought me desirous about what it could imply for these contemplating shopping for, promoting or staying put of their present dwelling. Listed below are two eventualities to contemplate:

Situation 1. Housing costs fall by 20%.

Situation 2. Housing costs go nowhere for the rest of the last decade.

How you’re feeling about both of those eventualities probably will depend on your present scenario or future plans.

From the angle of somebody who plans on being of their dwelling for the foreseeable future (me), neither of those eventualities makes a lot of a distinction.

Put apart the truth that a 20% decline in dwelling costs would probably be accompanied by some kind of monetary disaster, the worth of my dwelling is kind of irrelevant in my day-to-day life.

So long as I can proceed to pay the mortgage, insurance coverage, and property taxes, my life wouldn’t change in a significant approach if the worth of our home fell by 20% tomorrow. It’d take away my capacity to faucet fairness via a HELOC however I’m not overly reliant on that as a supply of capital.

It might be just a little annoying to look at another person come into our neighborhood and purchase a home on sale for 20% off. And certain, it could be painful if we had been pressured to promote for some motive however in that case the entire different homes would even be 20% cheaper. We might be buying and selling one asset at a cheaper price for one more at a cheaper price.2

My internet value would drop however it’s not just like the fairness in my house is liquid anyway.

If costs go nowhere for the remainder of the last decade, we’ve already skilled the pulled-forward positive factors this decade.

Anybody who has owned a house for various years is sitting fairly.

The householders who would really feel essentially the most ache in both of those eventualities can be folks shopping for proper now.

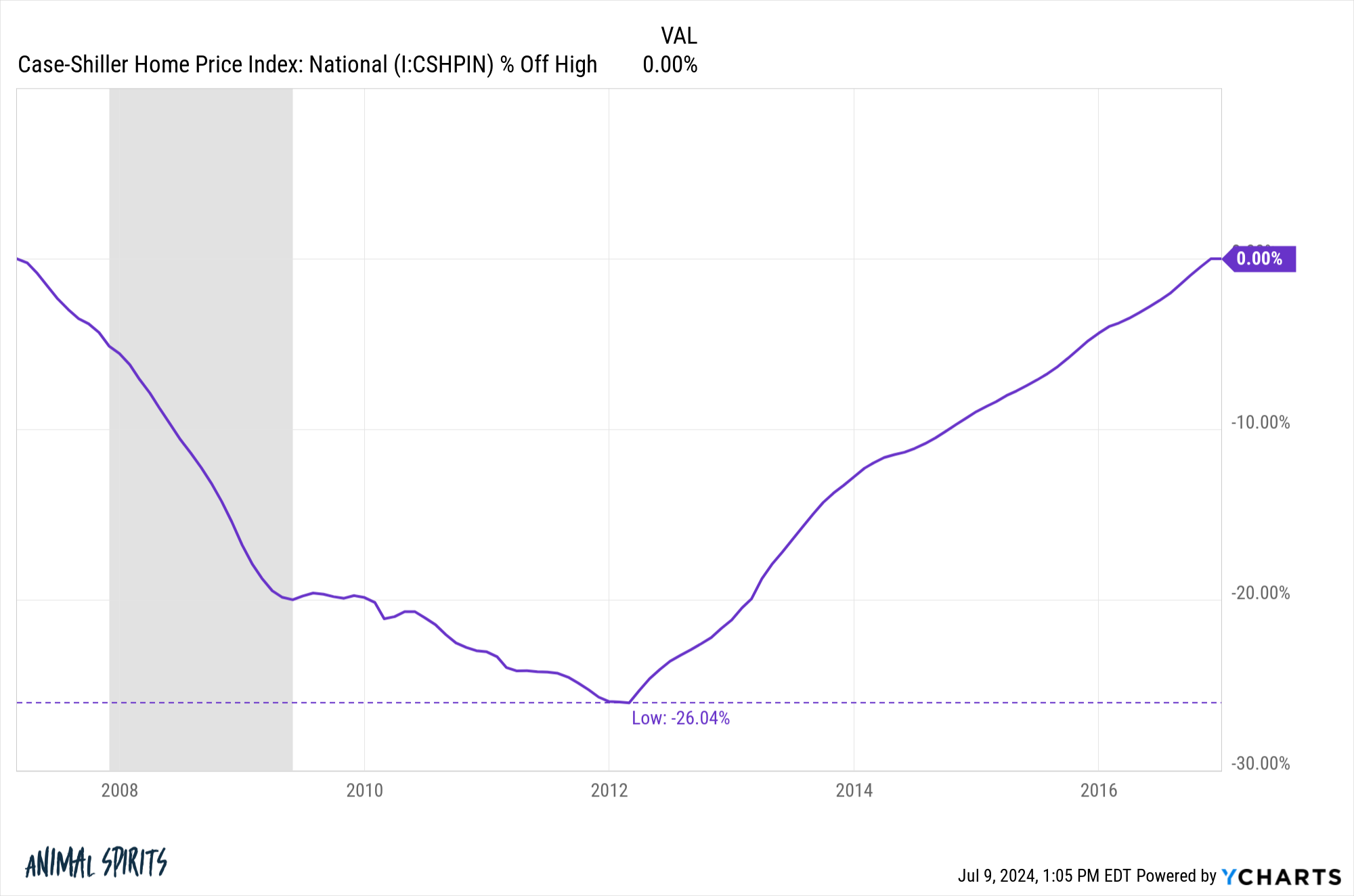

You don’t should look again that far in our nation’s historical past to see this play out. From early-2007 via late-2016, U.S. housing costs had been underwater from their historic peak up till that time:

Costs fell by greater than one-quarter alongside the way in which.

Greater than 6 million new and present properties had been bought in 2007, so loads of folks truly top-ticked the housing market again then.

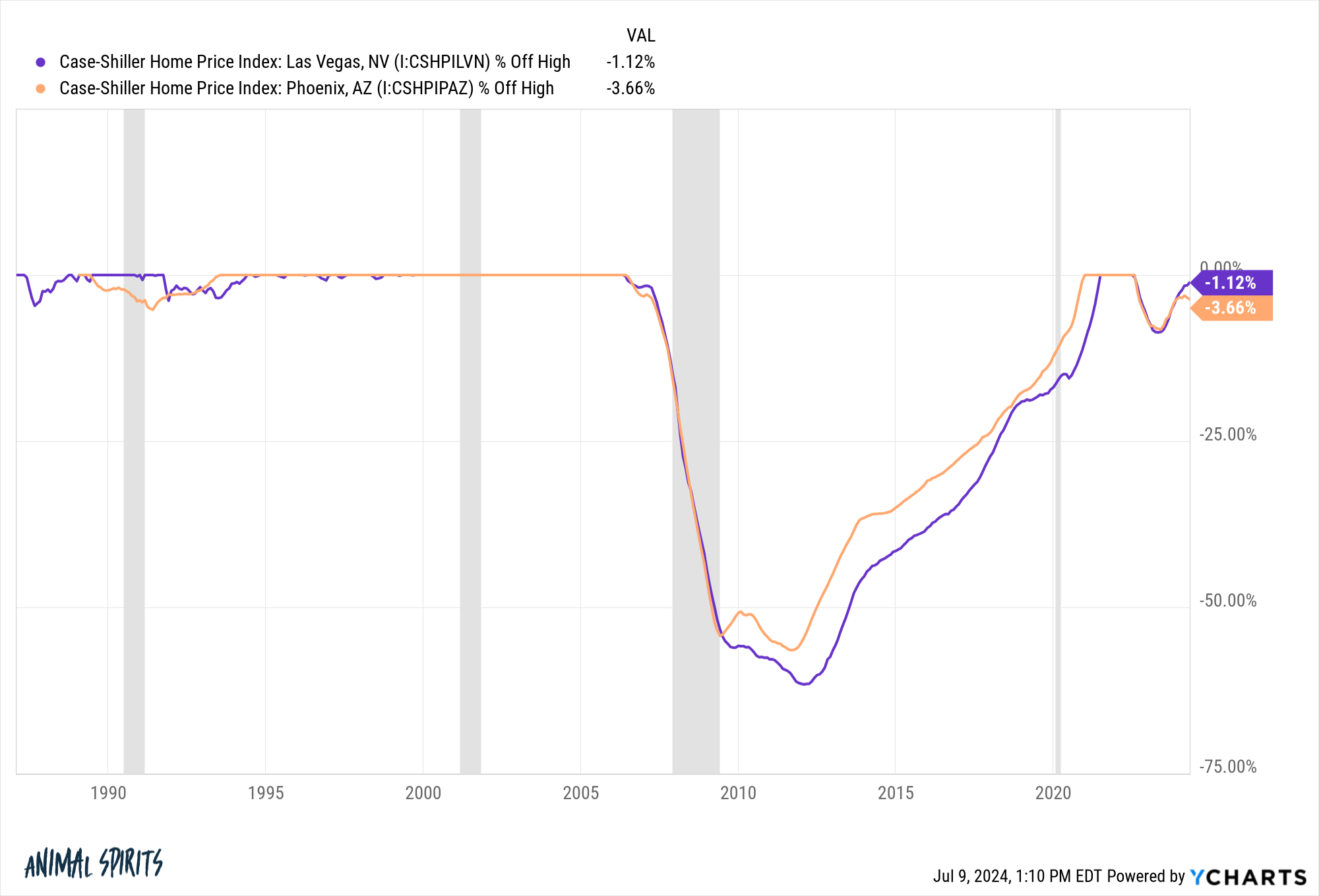

It was even worse within the hottest actual property markets within the nation. Housing costs had been underwater in Phoenix and Las Vegas from 2006 via 2020 and 2021, respectively:

There are not any certain issues in terms of housing costs. The nationwide housing market may do nicely for the remainder of the last decade whereas sure native markets wrestle. Or sure native markets may stay scorching whereas nationwide costs wrestle.

You actually should ask your self why you’re shopping for a home within the first place.

Is it purely a monetary asset the place you’re simply making an attempt to earn a excessive charge of return?

Or is a home one thing that gives psychic earnings as a spot to lift your loved ones, stay in a selected group and make your personal?

Most individuals most likely desire monetary and psychic returns, however it’s not a foregone conclusion that your own home will likely be an exquisite funding, particularly from present ranges.

I take into account our home a spot to stay, name our personal, and lift our children. It acts as an inflation hedge as a result of now we have a fixed-rate mortgage and there isn’t a lot land to construct on in our space. Plus, paying it off over time builds fairness.

The worth of the home doesn’t matter to me as a lot as our capacity to stay there for so long as we want.

A portfolio is the place funding returns matter.

A home is the place funding returns are a bonus.

Additional Studying:

The Downside with Timing the Housing Market

1Credit score to me.

2Identical to if we bought now we might be locking in positive factors however then paying a better worth for a brand new dwelling.