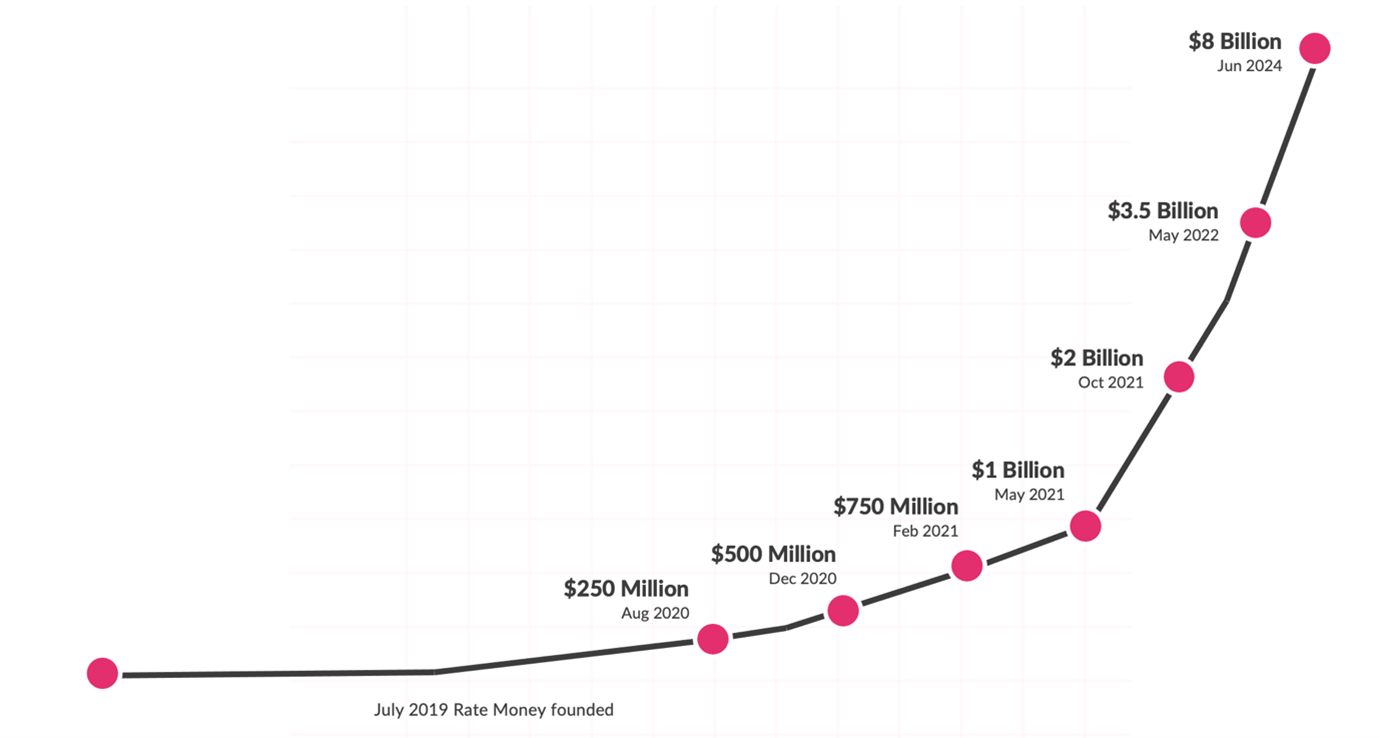

$4.5 billion in two years alone

Self-employed house mortgage specialist Fee Cash has reached a big milestone of $8 billion in loans written since its inception in 2019.

The corporate highlighted its fast development, with $4.5 billion of that sum achieved up to now two years alone.

Fee Cash, CEO, Ryan Gair (pictured above) stated he was thrilled to have reached the milestone in such a brief time frame.

‘We have now efficiently developed and executed on a plan to reshape the mortgage trade for the advantage of Australia’s 2 million-strong self-employed heroes,” stated Gair.

Gair attributed the corporate’s success to its give attention to disrupting the normal mortgage trade for the advantage of self-employed Australians.

Fee Cash removes charges like Lenders Mortgage Insurance coverage (LMI), threat charges, software charges, and valuation charges for greater than 8,000 prospects.

The corporate additionally claimed to be the primary to get rid of clawbacks with out threat charges, changing them with clear commissions for mortgage writers. Gair stated he noticed this as an indication of the corporate’s dedication to honest enterprise practices.

“They are saying imitation is the sincerest type of flattery and we’re proud to have influenced the remainder of the trade as they attempt to mimic the identical clawback reductions and take away the identical threat charges from their merchandise for Australia’s hard-working, uniquely bold small enterprise homeowners who huge financial institution lenders have traditionally uncared for,” Gair stated.

“We’re proud to be spearheading this variation and stay devoted to serving our prospects whereas driving transformation.”

Know-how and product innovation key to Fee Cash’s success

Fee Cash additionally credit its funding in expertise for its success. A custom-built CRM and automatic workflow methods have reportedly decreased turnaround instances and error charges.

“Over the previous 18 months, we skilled a rise in month-to-month name volumes of greater than 200% to our contact centre from our rising buyer base and maintained a Grade of Service within the high-90s,” Gair stated.

This was achieved by introducing automation to help our skilled buyer help officers.”

Current product improvements additionally contributed to the milestone.

In October 2023, Fee Cash launched a tax return product for self-employed prospects, simplifying the mortgage course of by requiring only one tax return as a substitute of the standard two years’ value.

Due to unique funding preparations with two companions, this product allows a sooner transition from low/alt-doc loans to full-doc loans.

Gair stated the corporate constructed its worth proposition round complete help, tailor-made options, and ongoing innovation, “guaranteeing each determination we make is in the perfect curiosity of our prospects, brokers, and franchisees”.

“Our dedication to navigating the advanced challenges of self-employment and proactively monitoring market developments has allowed us to offer distinctive worth to our prospects,” Gair stated

“We stay up for persevering with our work of remodeling the mortgage trade for the higher and serving to self-employed Australians succeed as we do.”

What do you concentrate on Fee Cash’s newest milestone? Remark beneath.

Associated Tales

Sustain with the newest information and occasions

Be a part of our mailing listing, it’s free!