A reader asks:

I contemplate myself a superb conservative cash supervisor for my private funds however lately I’ve been searching for a pleasant home that I can take pleasure in for years to come back. I’m 56 and an early retiree. I simply bought my rental and now have a complete of $3.6 million largely invested in broad market ETFs apart from the $450k in money put aside for a brand new home. The homes that I actually like are actually $700k as a substitute of the $450k-$550k that I had deliberate. I’ve an annuity that may begin paying $3k monthly at age 63, plan on $2k in Social Safety at 67 and in any other case, need to reside off my investments. I’m single, no children, no present well being points and many hobbies. I’m questioning if I ought to splurge on a home like this or keep extra conservative like I had initially deliberate.

There are actually solely two varieties of folks in terms of cash:

1. Individuals who spend an excessive amount of.

2. Individuals who save an excessive amount of.

That is an excessive overgeneralization and there are clearly folks someplace within the center however you get the thought.

Scott Rick, a researcher on the College of Michigan seemed into the psychology behind these two varieties of folks. He calls them tightwad and spendthrifts:

“Tightwads” expertise an excessive amount of ache when contemplating spending and subsequently spend lower than they might ideally wish to spend. In contrast, “spendthrifts” expertise too little ache and subsequently spend greater than they might ideally wish to spend. Neither are proud of how they deal with cash.

I’ve seen an identical bifurcation working with retirees through the years.

There’s an enormous cohort of people that spent their whole profession watching their spending and saving cash. These tightwads have bother spending down their nest egg in retirement for concern it is going to all be gone sometime.

There’s additionally a gaggle of retirees who didn’t save sufficient and plan on spending every part they’ve earlier than the clock runs out.

Each tightwads and spendthrifts fear about cash however for various causes.

There’s a unending feeling of uncertainty in terms of retirement planning.

That uncertainty consists of longevity threat, rising healthcare prices, long-term care, inflation, rates of interest, the timing of bear markets, monetary market returns, sequence of return threat and extra.

On the opposite aspect of the equation, the long run is promised to nobody. I’ve heard numerous tales of individuals scrimping and saving their whole lives with hopes of residing it up in retirement solely to drop lifeless unexpectedly or contract a live-altering medical problem earlier than they even have the prospect to take pleasure in their cash.

This query is being requested by somebody tilted extra in the direction of the tightwad aspect of the cash spectrum.

She isn’t alone.

There’s analysis galore from monetary companies that reveals sure folks can not convey themselves to spend in retirement.

Right here is a few information from New York Life in a report known as Understanding Underspending in Retirement:

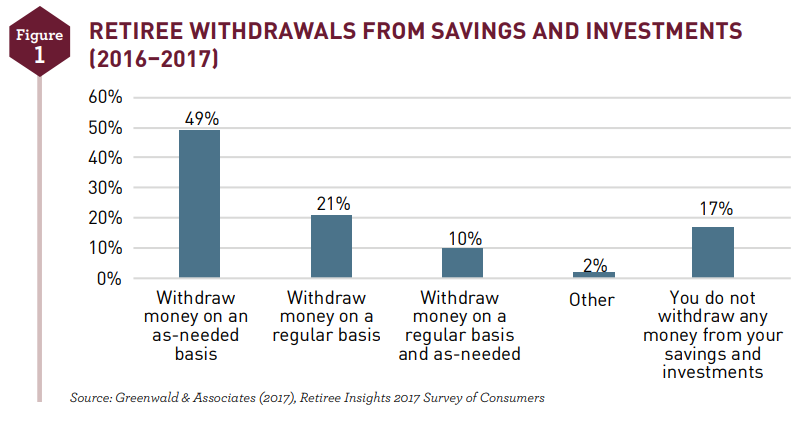

Findings from a 2023 New York Life research present that solely 16% of retirees withdraw from their portfolios on an everyday, systematic foundation and 30% don’t withdraw any cash from their financial savings accounts and funding portfolios in any respect.

Even when retirement bills are larger than initially deliberate for, retirees are nonetheless reluctant to make the most of portfolio belongings.

In keeping with the Society of Actuaries, they cut back their prices slightly than deplete their belongings at any time when doable.

As an alternative of spending down their principal, these retirees would slightly reduce their spending.

Monetary advisors typically speak about the 4% rule however few folks truly observe a disciplined withdrawal technique:

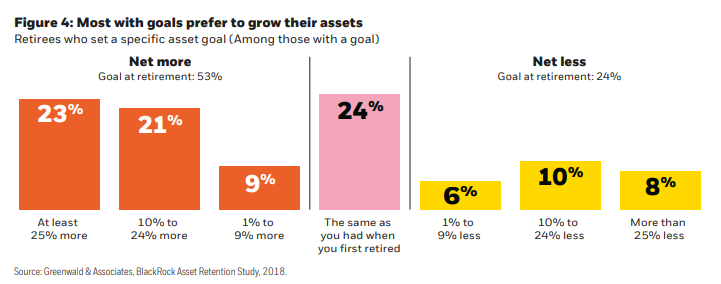

A research from Blackrock reveals most retirees would slightly develop their portfolio than spend them down:

Only a few wish to faucet into their financial savings to finance their spending in retirement, particularly these with excessive ranges of belongings who’re very content material to depart all or a big quantity of financial savings unspent. Just one in 4 feels they should spend down principal in any respect to fund their desired life-style. For many, retirement isn’t a time to reside it up, it’s extra essential to really feel financially safe.

Right here’s a visible of the outcomes:

One other rule of thumb is that you just’ll spend someplace within the vary of 70-80% of your pre-retirement earnings throughout retirement.

A Goldman Sachs report finds many retirees spend far lower than that:

The report discovered that 51% of respondents who’re at the moment retired reported that they’re residing on lower than 50% of their pre-retirement annual earnings, together with 29% who report residing on 40% or much less. Solely 25% of retirees generate what many estimate as the quantity wanted to keep up their way of life – 70% or extra.

Having a large nest egg and being too afraid to spend it down is a greater scenario than spending every part from a smaller pile of cash. However it is a actual psychological phenomenon for many individuals.

You will have all of this cash however concern of the unknown holds you again from having fun with it.

This individual has a wholesome seven-figure portfolio, an enormous down cost, no dependents and a few extra mounted earnings to sit up for within the years forward.

My recommendation right here is straightforward:

Purchase a pleasant home!

Splurge a little bit (or so much). You will have loads of cash. You clearly know how one can save and management your spending habits. Even if you are going to buy one million greenback dwelling you may have sufficient for a ~50% down cost.

You’ll be able to’t say sure to every part in retirement however the entire level of delaying gratification if you’re youthful is to permit your self some gratification if you’re older.

You solely reside as soon as.

Purchase the home.

You gained’t remorse it.

Invoice Candy joined me on Ask the Compound this week to speak about this query and extra:

We additionally mentioned exit taxes, understanding Roth 401ks, the tax implications of annuities and monetary planning for early retirement.

Additional Studying:

You In all probability Want Much less Cash Than You Suppose For Retirement