The previous few years have been difficult for bond buyers as central banks quickly raised rates of interest, which created uncertainty and volatility for each equities and significantly for long-term bonds.

After many years of very low yields, the Federal Reserve launched into a really fast fee climbing program in March 2022, shifting the Fed Funds fee from practically zero to over 4% in simply 9 months. This had an impression on the bond market, and the losses have been worse for holders of long-term bonds, together with:

- 50% declines in some 30-year US Treasuries

- 75% declines in a 100-year Austrian bond

As losses develop, it might appear straightforward to surrender on bonds.

However when you’ve been paying consideration, you will have seen that bonds are coming again into the highlight now that the Fed is anticipated to both halt or minimize rates of interest quickly.

In any case, bonds carry out higher when rates of interest begin to decline, which is a stark distinction from 2022 the place rising charges led to vital losses for each bonds and equities.

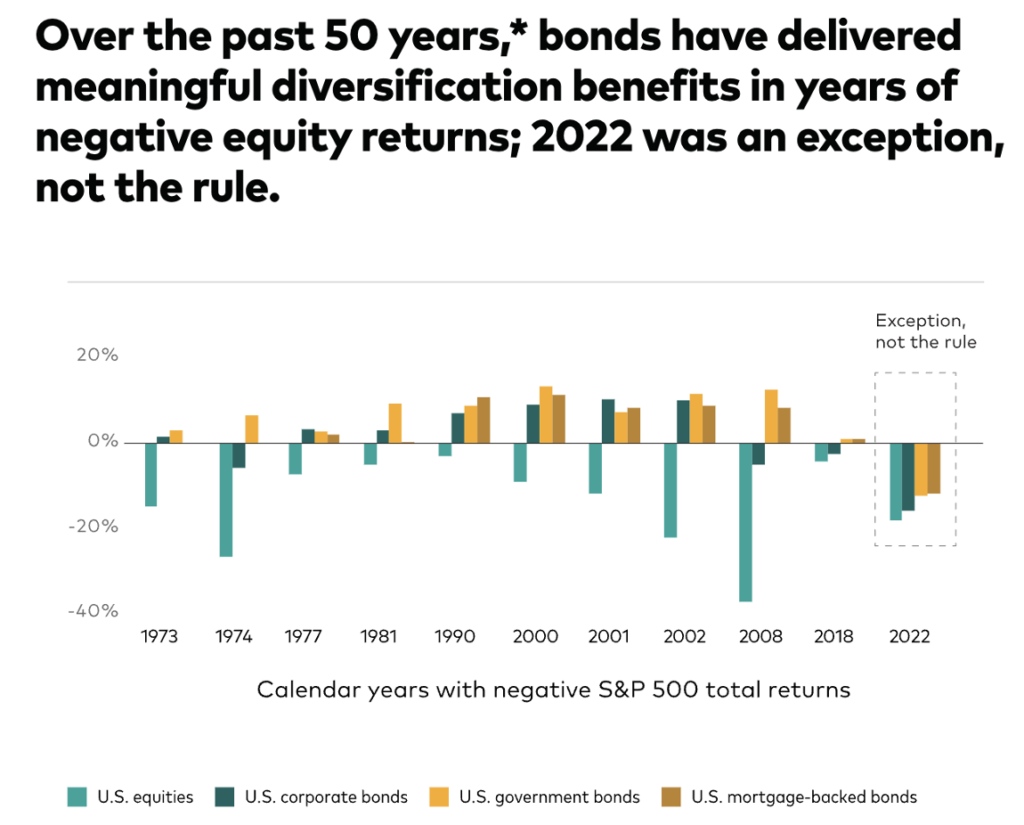

Many finfluencers have been advocating the S&P 500 as an alternative of bonds – particularly given its latest historic returns – however when you assume placing 100% of your portfolio into the S&P 500 is “protected”, I recommend you assume it by way of once more.

As a substitute, I imagine that the present bond market sell-off supplies a pretty risk-reward trade-off with actual yields now at multi-decade highs…supplied you recognize the place and how one can search for it.

Why would buyers put cash in bonds?

Historically, bonds have all the time been a mainstay of defensive portfolios, given the way it supplies dependable revenue, assist to cushion the volatility of shares and ease the ache of a bear market (the place shares sometimes fall and bonds carry out higher relative to shares).

What’s extra, bonds usually come issued with mounted maturity dates, which additionally permits you as an investor to know when you may anticipate to obtain your principal again.

Bonds are typically redeemed at maturity and this offers you:

- The knowledge of mounted revenue

- The knowledge of understanding while you’ll get your principal again

Bonds subsequently not solely offer you mounted revenue payouts, but in addition assist you to match your capital redemption with any future deliberate bills (e.g. shopping for a brand new home or welcoming a brand new child).

Personally, I primarily spend money on bonds to steadiness the chance from holding solely equities in my portfolio. What’s extra, I’m cognisant that there’s all the time the chance of a recession, the place one might get laid off and see their fairness investments go down on the similar time.

Proudly owning bonds for his or her mounted revenue and stability helps me to diversify towards asset class dangers that means. A few of you may even recall just a few of my public weblog posts from a number of years in the past, the place I discussed discovering a bond that may pay me a hard and fast rate of interest of 4.35% p.a. each 6 months. As that bond has not too long ago matured, I can verify now that I not solely acquired paid my passive (coupon) revenue for the final 5 years, but in addition obtained my principal again in full on the finish of it.

Is that this an excellent time to take a look at the bond markets once more?

Despite the fact that youthful buyers might solely bear in mind studying the dangerous information about bonds lately, however what it’s possible you’ll not notice is that given the inverse relationship between bonds and rates of interest, bonds costs will rise when the Fed lowers rates of interest.

You might already see this beginning to play out within the markets.

And due to the latest sell-offs, there could also be some nice investments to be made in bonds – if you recognize the place and how one can search for it.

Particular person bonds vs. Bond ETFs

Usually, rates of interest have considerably adjusted from their low ranges and are comparatively enticing from a historic perspective. Bond buyers now have an opportunity to lock in these excessive historic yields for themselves if they want, the place these increased present yields additionally assist a much-improved outlook for bond returns going ahead and should assist present a stronger base for future returns if the Fed begins slicing charges.

Particular person bonds

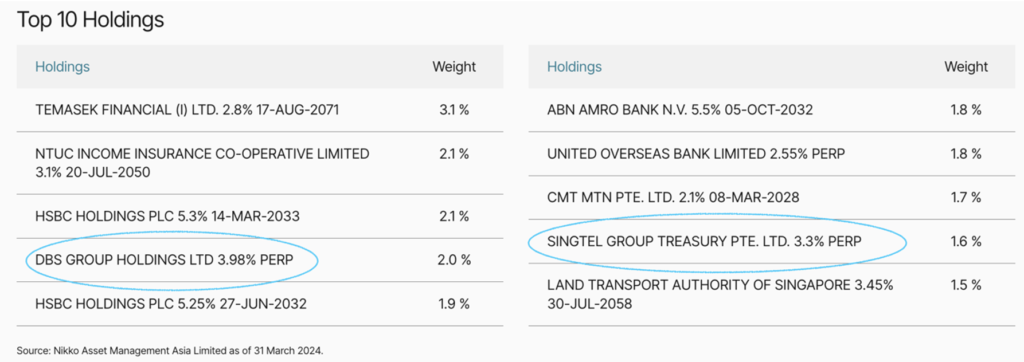

Check out DBSSP 3.980% Perpetual Corp (SGD) – an thought I acquired off from NikkoAM SGD Funding Grade Company Bond ETF’s Prime 10 Holdings – for example, which continues to be at the moment buying and selling under par worth (as of right this moment) and pays out mounted revenue twice in a 12 months till its maturity due date in 2025.

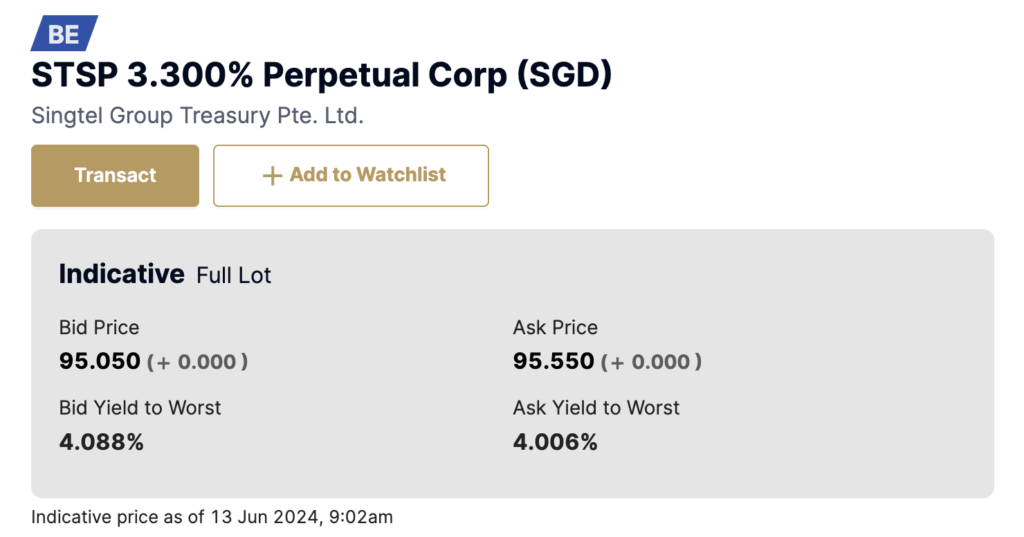

That isn’t the one bond buying and selling under par both – right here’s one other instance of a bond I noticed as buying and selling under its par worth: the Singtel Group Treasury 3.3 Perpetual Corp (SGD).

Bond ETFs

However placing your cash in particular person bonds might nonetheless be seen dangerous for some, particularly if the underlying bond issuer doesn’t redeem the bond after the said interval. A neater means is to spend money on a bond ETF, the place you don’t receives a commission immediately by the bond or get your principal again on the finish of a hard and fast interval. As a substitute, the ETF supervisor is chargeable for making your mounted revenue funds and managing a diversified bond portfolio.

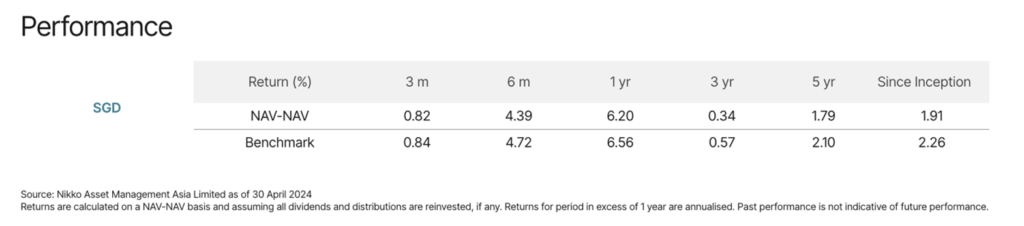

In fact, you would proceed to display for undervalued bonds and analyse them individually, however when you favor to not put your cash in simply 1 bond, the NikkoAM SGD Funding Grade Company Bond ETF lets you diversify throughout these and several other different investment-grade bonds without delay.

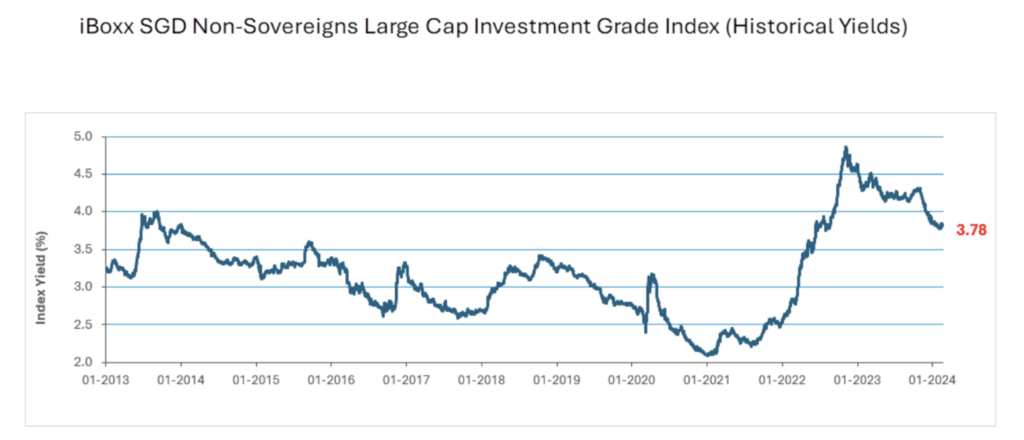

This ETF tracks the iBoxx SGD Non-Sovereigns Giant Cap Funding Grade Index, which is made up of funding grade bonds issued by a majority of Singaporean firms and Singaporean statutory boards. And in case you haven’t seen, this fund is already up 6.20%* up to now 12 months (as final reported on 30 April 2024)

*Returns are calculated on a NAV-NAV foundation and assuming all dividends and distributions are reinvested, if any. Returns for interval in extra of 1 12 months are annualised. Previous efficiency isn’t indicative of future efficiency.

Actually, the upper yields and decrease bond costs out there right this moment implies that this may be an opportunistic time to take a look at bonds, particularly investment-grade ones.

Authorities bonds ETFs vs. T-bills

Or, when you favor a safer selection with SGD authorities bonds, one other ETF it’s possible you’ll need to take a look at can be the ABF Singapore Bond Index Fund.

The ABF Singapore Bond Index Fund is one instance of a bond fund that could be attention-grabbing for buyers who want to earn passive revenue by way of a portfolio of Singapore authorities bonds (one of many highest rated on this planet), and are additionally on the lookout for some potential medium to long-term capital appreciation ought to – or when – rates of interest begin to fall.

In fact, the flip aspect can be true i.e. buyers might undergo capital losses particularly if rates of interest proceed to rise.

In case you’re primarily on the lookout for one that can assist diversify your portfolio past equities, then you definitely’d respect how traditionally, the index of this ETF has principally carried out nicely in periods of inauspicious market circumstances.

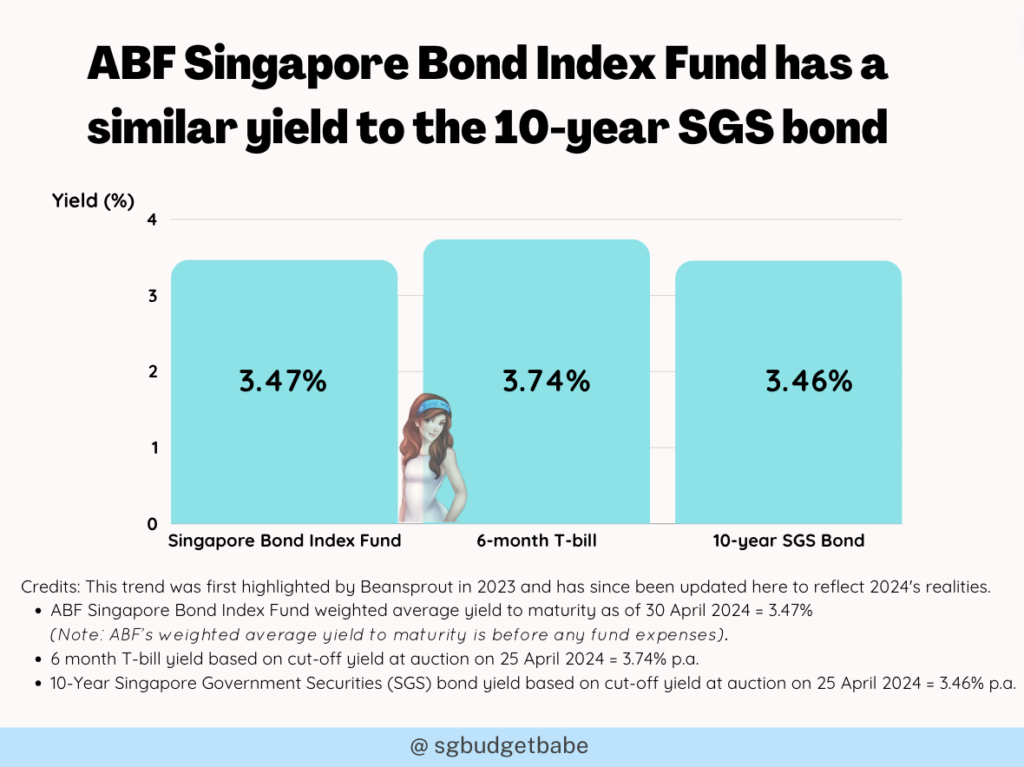

As T-bills have captured loads of investor consideration recently, you’d in all probability be questioning how the ABF Singapore Bond Index Fund compares towards it.

| T-bill | ABF Singapore Bond Fund | |

| Internet Yield | Greater yield at the moment, however might not all the time be the case. * | Decrease yield |

| Minimal funding | S$1,000 | As little as about S$1 |

| Most particular person holding | No restrict | No restrict |

| Time period | 6 or 12 months for T-bill | Present weighted common maturity of about 10 years, however will probably be reinvested by fund supervisor |

| Capital assured | Obtain principal quantity at maturity. Potential rate of interest threat if bought earlier than maturity. | Not capital assured |

| Capital appreciation potential | Obtain principal quantity at maturity. Potential for capital appreciation if rates of interest fall and bought earlier than maturity. | Potential for capital appreciation if rates of interest fall |

| Flexibility | No early redemption however will be bought in secondary market | Trades on the SGX |

| Diversification | Must construct bond ladder to diversify holdings | Diversified holdings that will probably be reinvested by fund supervisor |

Despite the fact that T-bills are displaying increased yields at the moment, please be aware that this isn't all the time the case – yields on T-bills are solely increased presently due to the inverted yield curve.(An inverted yield curve means the rate of interest on long-term bonds is decrease than the rate of interest on short-term bonds. That is usually seen as a foul signal for the financial system.). Underneath regular market circumstances shorter finish maturity bonds & payments would have decrease yields.

The important thing factor it is best to observe is that investing in T-bills require you to tackle work of managing it by your self, i.e. constructing your personal bond ladder of T-bills or SGS bonds to construct your passive revenue. You’ll must actively monitor your personal bond portfolio and rotate your cash on a frequent foundation (each 6 months for T-bills) as you retain reinvesting the funds.

So when you discover that an excessive amount of of a problem, then what you’d get by shopping for the ABF Singapore Bond Index Fund is similar diversification by way of a portfolio of Singapore authorities bonds.

Conclusion: Don’t strike bonds off

With many of the on-line chatter at the moment targeted on advocating for the S&P 500, I’ve seen many individuals – particularly youthful buyers – go all-in with a 100% equities portfolio.

However bear in mind, most buyers will need to purchase low and promote excessive. With the steep sell-off within the bond markets proper now, that is when it may be price taking one other take a look at bonds once more.

I hope this text serves as an excellent reminder so that you can recalibrate your funding technique and assessment your portfolio.

In any case, investing in bonds can supply a balanced mix of revenue, security, diversification, and threat administration, which makes bonds a useful asset class for quite a lot of funding methods for buyers.

Sponsor’s Message:

To seek out out extra in regards to the bond ETFs talked about on this article, try their fund pages right here:

– NikkoAM ABF Singapore Bond Index Fund

– NikkoAM SGD Funding Grade Company Bond ETF

– Different ETFs by NikkoAM

Disclosure: This publish is dropped at you in collaboration with Nikko Asset Administration Asia Restricted. All analysis and opinions are that of my very own. I extremely advocate that you simply use this as a place to begin to grasp extra in regards to the numerous ETFs supplied by NikkoAM (which you can even use for SRS and CPF investing) and my insights shared above that will help you determine whether or not any of them matches into your funding aims.

Essential Info by Nikko Asset Administration Asia Restricted:

This doc is solely for informational functions solely as a right given to the precise funding goal, monetary scenario and specific wants of any particular individual. It shouldn't be relied upon as monetary recommendation. Any securities talked about herein are for illustration functions solely and shouldn't be construed as a suggestion for funding. It is best to search recommendation from a monetary adviser earlier than making any funding. Within the occasion that you simply select not to take action, it is best to contemplate whether or not the funding chosen is appropriate for you. Investments in funds are usually not deposits in, obligations of, or assured or insured by Nikko Asset Administration Asia Restricted (“Nikko AM Asia”).Previous efficiency or any prediction, projection or forecast isn't indicative of future efficiency. The Fund or any underlying fund might use or spend money on monetary by-product devices. The worth of models and revenue from them might fall or rise. Investments within the Fund are topic to funding dangers, together with the doable lack of principal quantity invested. It is best to learn the related prospectus (together with the chance warnings) and product highlights sheet of the Fund, which can be found and could also be obtained from appointed distributors of Nikko AM Asia or our web site (www.nikkoam.com.sg) earlier than deciding whether or not to spend money on the Fund.

The knowledge contained herein will not be copied, reproduced or redistributed with out the specific consent of Nikko AM Asia. Whereas cheap care has been taken to make sure the accuracy of the knowledge as on the date of publication, Nikko AM Asia doesn't give any guarantee or illustration, both specific or implied, and expressly disclaims legal responsibility for any errors or omissions. Info could also be topic to vary with out discover. Nikko AM Asia accepts no legal responsibility for any loss, oblique or consequential damages, arising from any use of or reliance on this doc. This commercial has not been reviewed by the Financial Authority of Singapore.

The efficiency of the ETF’s value on the Singapore Change Securities Buying and selling Restricted (“SGX-ST”) could also be completely different from the online asset worth per unit of the ETF. The ETF might also be suspended or delisted from the SGX-ST. Itemizing of the models doesn't assure a liquid marketplace for the models. Traders ought to observe that the ETF differs from a typical unit belief and models might solely be created or redeemed immediately by a taking part vendor in giant creation or redemption models.

The Central Provident Fund (“CPF”) Unusual Account (“OA”) rate of interest is the legislated minimal 2.5% each year, or the 3-month common of main native banks' rates of interest, whichever is increased, reviewed quarterly. The rate of interest for Particular Account (“SA”) is at the moment 4% each year or the 12-month common yield of 10-year Singapore Authorities Securities plus 1%, whichever is increased, reviewed quarterly. Solely monies in extra of $20,000 in OA and $40,000 in SA will be invested below the CPF Funding Scheme (“CPFIS”). Please check with the web site of the CPF Board for additional data. Traders ought to observe that the relevant rates of interest for the CPF accounts and the phrases of CPFIS could also be diversified by the CPF Board sometimes.Neither Markit, its Associates or any third occasion information supplier makes any guarantee, specific or implied, as to the accuracy, completeness or timeliness of the information contained herewith nor as to the outcomes to be obtained by recipients of the information. Neither Markit, its Associates nor any information supplier shall in any means be liable to any recipient of the information for any inaccuracies, errors or omissions within the Markit information, no matter trigger, or for any damages (whether or not direct or oblique) ensuing therefrom. Markit has no obligation to replace, modify or amend the information or to in any other case notify a recipient thereof within the occasion that any matter said herein adjustments or subsequently turns into inaccurate. With out limiting the foregoing, Markit, its Associates, or any third occasion information supplier shall don't have any legal responsibility in any respect to you, whether or not in contract (together with below an indemnity), in tort (together with negligence), below a guaranty, below statute or in any other case, in respect of any loss or harm suffered by you because of or in reference to any opinions, suggestions, forecasts, judgments, or every other conclusions, or any plan of action decided, by you or any third occasion, whether or not or not based mostly on the content material, data or supplies contained herein. Copyright © 2023, Markit Indices Restricted.

The Markit iBoxx SGD Non-Sovereigns Giant Cap Funding Grade Index are marks of Markit Indices Lmited and have been licensed to be used by Nikko Asset Administration Asia Restricted. The Markit iBoxx SGD Non-Sovereigns Giant Cap Funding Grade Index referenced herein is the property of Markit Indices Restricted and is used below license. The Nikko AM SGD Funding Grade Company Bond ETF isn't sponsored, endorsed, or promoted by Markit Indices Restricted.

Nikko Asset Administration Asia Restricted. Registration Quantity 198202562H.