There’s a cohort of people that assume the inventory market is rigged.

They assume it’s a on line casino the place solely sure individuals win and everybody else loses.

Or all the pieces is manipulated by the Fed and the outcomes are faux.

If it weren’t for the bailouts or falling rates of interest or authorities spending or the Taylor Swift Eras Tour, the entire home of playing cards would collapse.

There are, in fact, checks and balances in our system which have been useful to the financial system and inventory market over time.1

Nevertheless it’s ridiculous to imagine this implies the beneficial properties within the inventory market are in some way rigged, faux or manipulated.

There isn’t a man backstage pulling levers to make sure shares go up.

The truth is, over the long term, fundamentals nonetheless play an vital function within the inventory market’s success.

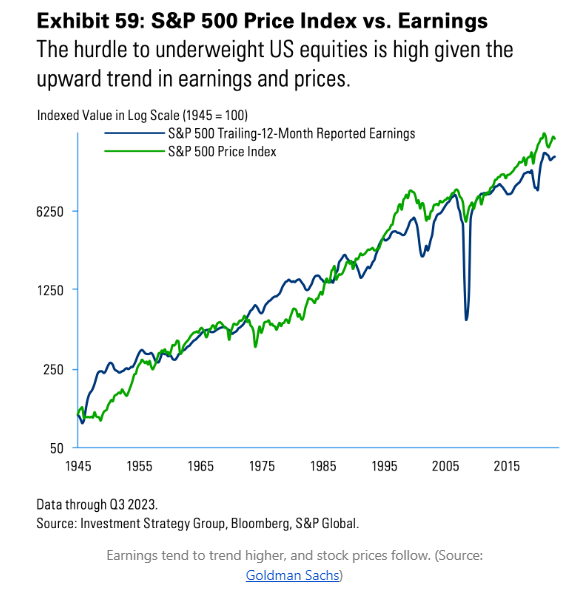

Try this chart2 of earnings vs. the S&P 500 index going again to the tip of World Warfare II:

There have been instances when costs have gotten forward of themselves however for probably the most half inventory costs have been going up as a result of earnings have been going up.

One other delusion of the inventory market is that all the beneficial properties are because of a number of growth. Whereas it’s true that valuations have been slowly rising over time as markets have gotten safer, a number of growth has in all probability performed a smaller function than most individuals assume.

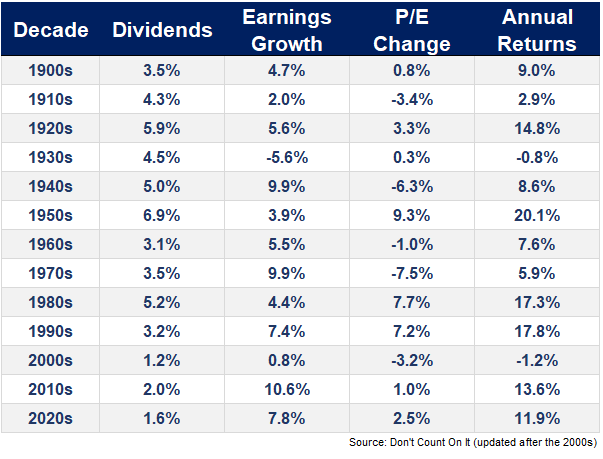

The late-John Bogle had a easy formulation for anticipated returns within the inventory market that appears like this:

Anticipated Inventory Market Returns = Dividend Yield + Earnings Progress +/- the Change in P/E Ratio

In his ebook Don’t Rely on It, Bogle utilized his formulation to every decade within the inventory market going again to the flip of the twentieth century to see how effectively elementary expectations matched up with the precise returns.

The distinction between the 2 is basically human feelings.

Bogle revealed the information by the 2000s so I’ve been updating his work into the 2010s and 2020s. Right here’s the newest information by the tip of 2023:

There was some a number of growth within the 2010s and 2020s however nothing just like the Nineteen Eighties, Nineteen Nineties and even the Thirties.

Earnings development has been the primary driver of inventory market returns because the finish of the Nice Monetary Disaster.

It’s additionally price noting that though dividend yields have been comparatively low in current a long time, the expansion in dividends paid out by firms has been wholesome.

S&P 500 dividends grew at an annual common development fee of simply 3% within the 2000s.3 That’s effectively beneath the historic common of greater than 5%.

However since 2010, dividends are up greater than 8% per yr.4

Dividend and earnings development have been sturdy and so has the inventory market.

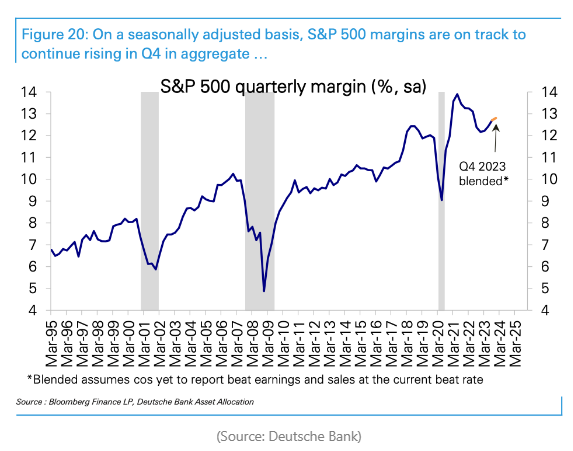

Another excuse returns have been so stellar is as a result of U.S. firms are a lot extra environment friendly now.

Simply take a look at the upward development in margins because the creation of the Web:

There was this concept that revenue margins had been probably the most mean-reverting time sequence in all of finance due to competitors and capitalism. Expertise shares have put this concept to relaxation.

Margins went up and by no means reverted again to earlier averages.

This one chart helps clarify the dominance of U.S. shares over the remainder of the world for the previous 15 years or so.

The inventory market has been good partially as a result of the basics have been good. There are different components at play, however that’s the only clarification.

It’s price noting, nevertheless, that inventory costs are all the time going to be much more risky than the basics, particularly within the brief run. The inventory market is forward-looking however that doesn’t imply it is aware of tips on how to forecast what’s going to occur subsequent.

Costs transfer round much more than earnings or dividends due to worry and greed.

However in the long term fundamentals are inclined to win out.

The basics of the U.S. inventory market have been distinctive.

Additional Studying:

What I Discovered From Jack Bogle

1And there all the time will likely be these checks and balances. What politician or authorities official would permit the monetary system to implode if that they had a method of saving it?!

2Tip of the cap to Sam Ro for this chart.

3The GFC clearly didn’t assist right here.

4I’m utilizing Robert Shiller’s dividend information right here which is just up to date by June 2023.