A 401k is among the strongest funding automobiles for retirement — and it’s IWT’s favourite factor ever for a number of causes:

- Pre-tax investments. You don’t get taxed on the cash you contribute till you withdraw it at retirement age. This implies you’ve got extra money to compound and develop.

- Free cash with employer match. Most corporations will match your 401k earnings as much as a sure proportion. It’s principally free cash!

- Automated investing. The investments you make are taken out of your paycheck robotically every month — which is a HUGE psychological profit.

With all these superior advantages although comes a price: You possibly can’t withdraw any of it till you hit the age of 59 ½.

For those who do, you’ll be topic to taxes in your withdrawal in addition to a ten% penalty from the federal authorities.

This, my buddies, is the monkey’s paw. It’s the lethal consequence of King Solomon’s golden contact. It’s the deal that you should carry Madame Zeroni up the mountain otherwise you and your loved ones shall be cursed for at all times and eternity.

Borrowing out of your 401k shouldn’t be completed evenly. The truth is, you actually shouldn’t do it in any respect since dipping into your 401k can severely decelerate your retirement objectives.

As a substitute, reserve it for clear instances of emergencies like medical payments, pressing automobile repairs, or residence repairs.

Whereas a 401k presents a number of advantages, you want to be diligent and keep away from withdrawing early — lest you undergo the results.

BUT there’s a strategy to borrow cash out of your 401k with out incurring these penalties: 401k plan loans.

What’s a 401k plan mortgage?

A 401k plan mortgage is one of some methods you may borrow cash out of your 401k early with out incurring a penalty.

Whereas 401k plan loans will range relying on which plan your organization presents, a couple of guidelines are fixed:

- The utmost quantity you may take out of your 401k is 50% of the vested account quantity.

- It’s possible you’ll borrow not more than $50,000.

- If 50% of your vested account quantity is lower than $50,000, you may withdraw as much as $10,000.

- You need to repay the mortgage inside 5 years.

You’re “borrowing” the cash out of your future self while you take a 401k mortgage — and your future self goes to need that cash again with curiosity.

That’s as a result of while you take the cash out, it’s now not compounding and accruing curiosity. This implies you’ll lose the features on any quantity you borrow. The rate of interest is there to compensate for the loss in features.

Now let’s check out find out how to borrow out of your 401k.

How one can borrow out of your 401k

For the reason that precise stipulations on your 401k plan mortgage will range from employer to employer, you’re going to wish to name the plan supplier and ask them these primary questions:

- “How a lot curiosity do I’ve to pay?” As stated earlier than, the curiosity quantity will range from supplier to supplier. Be sure that the curiosity together with the principal received’t dip into your dwelling bills.

- “Can I pay again by way of payroll deductions?” Most plan suppliers will can help you robotically deduct the quantity you borrowed out of your paycheck.

- “Can I proceed to speculate whereas my cash is borrowed?” Some suppliers received’t can help you make investments into your 401k till you’re completed paying off what you borrowed — which could have an effect on your determination to take action.

- “What occurs if I go away my employer earlier than the mortgage is paid?” Crucial query. Sometimes, you’re on the hook for the remainder of the mortgage steadiness inside 60 days of leaving your job.

After getting the questions answered and also you’re certain that you simply wish to take a mortgage out of your 401k, making use of is fairly easy.

You’ll doubtless be capable of do it on-line by way of your 401k plan supplier’s web site or your organization’s advantages portal. If this isn’t the case, you may need to contact your organization’s human sources division the place they’ll handle it for you, otherwise you’ll must fill out some paperwork.

There aren’t any credit score checks and no loopy bureaucratic paperwork you want to fill out. You simply must have the cash to borrow.

This makes it extremely straightforward — and in addition tempting — to dip into your 401k for a lot of monetary issues. Is it value it although?

The advantages of borrowing out of your 401k

Keep away from borrowing out of your 401k as a lot as attainable. A bit later, I’ll offer you some options to doing so — however there could be a few upsides to getting a 401k mortgage.

First, should you’re in an emergency and require cash inside a couple of days, a 401k mortgage can provide you entry to probably $10,000 – $50,000 (relying on how a lot you’ve got).

You can take out a hardship withdrawal, which lets you attain cash out of your 401k in sure instances. Nevertheless, this comes with a ten% penalty and also you’ll must pay taxes on it. So a 401k mortgage will be a lovely choice in monetary emergencies like sudden medical bills.

Additionally a 401k mortgage could be a higher different than turning to a financial institution or different creditor for a mortgage. Because you’re borrowing from your self, the curiosity you pay again goes to you rather than a 3rd occasion.

Getting a 401k plan mortgage can also be a lot easier than attaining a mortgage elsewhere, since there aren’t any credit score or background checks.

And if the five-year compensation time isn’t sufficient time for you, some 401k plans permit for an extension on the mortgage time period should you’re utilizing it for sure purchases comparable to your first residence.

“However wait, don’t I lose out on features if my cash is withdrawn and never compounded?”

That’s a stable worry to have, hypothetical straw man. When your cash isn’t invested, you’re not going to make features on it — however as I acknowledged above, that’s what the curiosity funds are for.

These are the advantages of borrowing from a 401k plan — now what about its drawbacks?

The downsides of borrowing out of your 401k

As we talked about within the earlier part, there’s an opportunity that you simply lose cash on the compounding features even together with your compensation in case your funding features are greater than your curiosity.

Let’s check out a simplified instance:

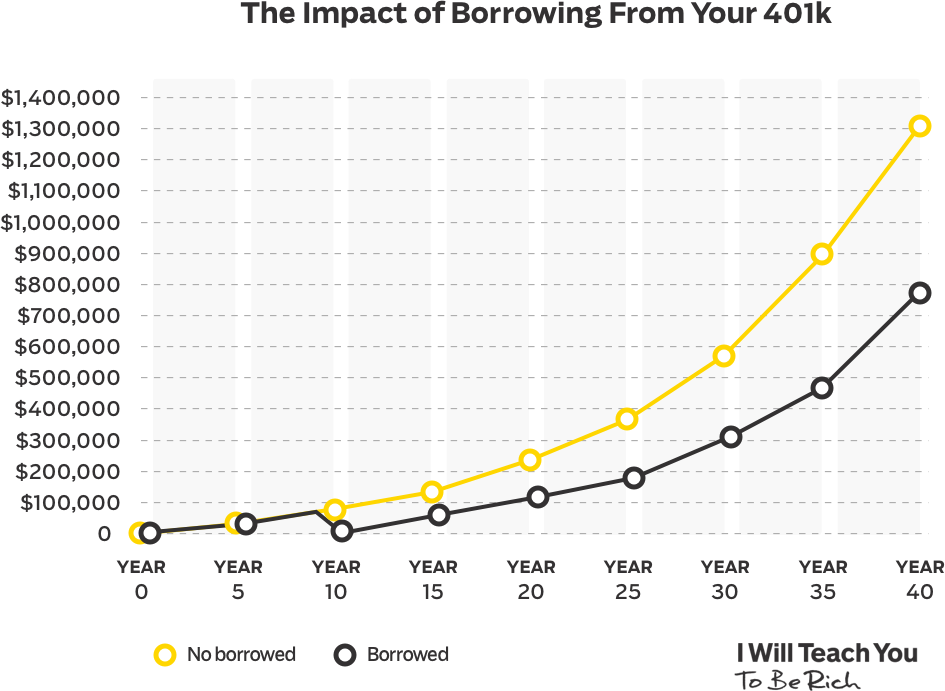

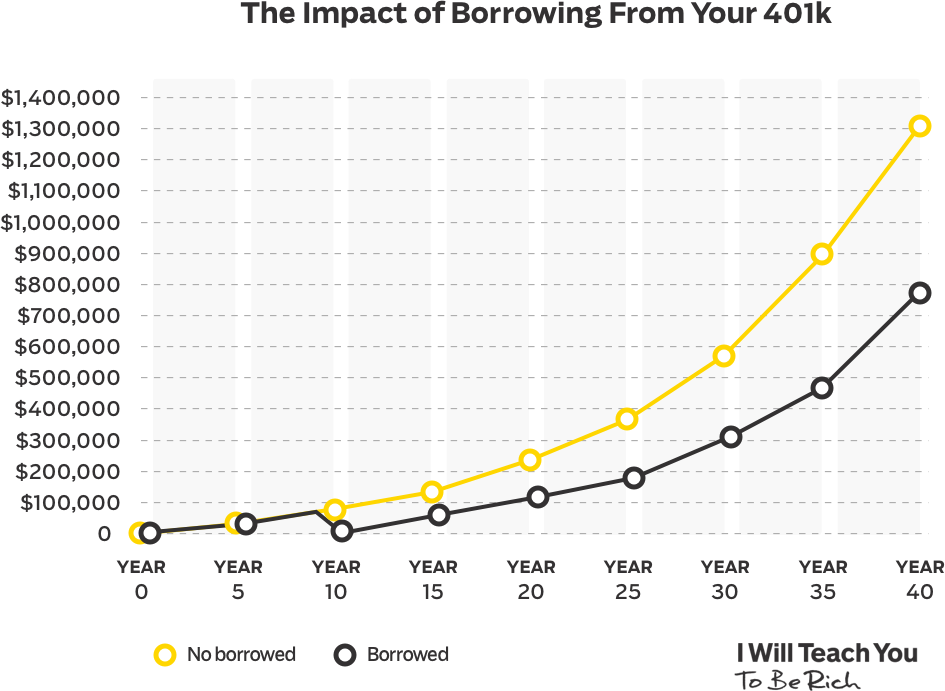

Think about there are two traders: Derek and Cindy.

Each contribute about $5,000 / 12 months to their 401k, which experiences 8% curiosity development every year.

Nevertheless, within the tenth 12 months of investing, Derek decides to borrow $50,000 for a brand new residence. How a lot do you assume he slowed down his financial savings?

Derek by retirement age: $793,185.99.

Cindy by retirement age: $1,296,318.82

Derek’s going to be behind Cindy by $503,132.83 as a result of he borrowed from his 401k!

Guess what? If Derek stop or was fired from his job, he’d be anticipated to pay again the whole mortgage inside 60 days.

And should you default on the 401k mortgage for any purpose, the mortgage will be topic to earnings tax in addition to a ten% penalty from the federal authorities should you’re beneath the age of 59 ½.

For instance, should you borrowed $50,000 out of your 401k and had been solely capable of repay $20,000 earlier than you had been let go out of your job and compelled to default in your mortgage, you’d be taxed on the whole $30,000 you owe AND be pressured to pay a charge of $3,000 (since that’s 10% of the quantity you owe).

On prime of all that, the mortgage funds you make are made with after-tax cash. So it received’t make the identical amount of cash when all is alleged and completed.

However maybe the largest draw back comes psychologically. When you dip into your 401k as soon as, you’re going to be MUCH extra prone to dip into it once more. Treating your 401k prefer it’s an everyday financial savings account is a horrible behavior to get into. Earlier than you already know it, you is perhaps exhausting every thing you’ve got for retirement attributable to a slippery slope of dangerous monetary choices.

With the penalties and potential for misplaced features, borrowing out of your 401k simply isn’t value it more often than not.