In my final publish, I checked out banking as a enterprise, and used a easy banking framework to advance the notion that the important thing ingredient tying collectively the banks which have failed thus far in 2023 is an absence of stickiness in deposits, created partially by depositor and deposit traits (older are stickier than youthful) and partly by progress in deposits (excessive progress will increase stickiness). I additionally used the banking framework to argue that good banks have stickier deposits, with the next precent of those deposits being non-interest bearing, that they put money into loans and funding securities on which they earn rates of interest that cowl and exceed the default danger in these investments. Whereas differentiating between good and dangerous banks could be easy, it doesn’t comply with that purchasing good banks and promoting dangerous banks is an efficient funding technique, since its success relies upon completely on what the market is incorporating into inventory costs. An investor who buys financial institution at too excessive a value, given its goodness, will underperform one who buys a nasty financial institution at too low a value, given its badness. On this publish, I’ll start by find out how to worth banks and comply with up with an examination of investor views of banking have modified, by pricing, earlier than inspecting divergences in how banks are priced available in the market at the moment.

The Intrinsic Worth of Financial institution Fairness

I’m a dabbler in all issues valuation-related, and I discover the method fascinating, as tales about companies get translated into valuation inputs, and at last into worth. I take pleasure in difficult valuations, however banks stay, at the least for me, the final frontier in valuation, just because a lot of what we do in typical valuation doesn’t work with banks, and a disaster or panic can upend even essentially the most rigorously accomplished financial institution valuation.

All Fairness, On a regular basis!

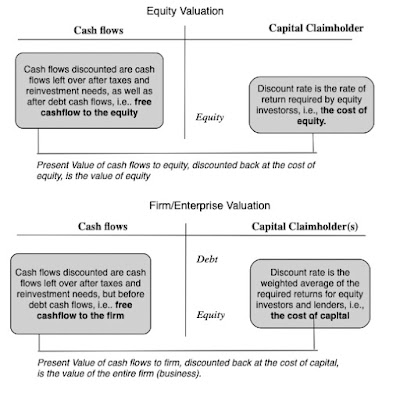

With most non-financial service companies, you face a alternative in the way you method valuation. You’ll be able to worth the enterprise or your entire enterprise, specializing in valuing the operations or property of the enterprise, and think about capital as inclusive of each debt and fairness. Alternatively, you’ll be able to worth simply the fairness within the enterprise, specializing in money flows left over after debt funds and discounting again at a price of return that displays the chance that fairness buyers face:

With banks, this alternative doesn’t exist, since debt to a financial institution could be expansively outlined to incorporate deposits as nicely, making it successfully uncooked materials for the financial institution’s operations, the place the target is borrow cash (from depositors and lenders) at a low price and lend it out or make investments it at the next price. Consequently, you’ll be able to solely worth the fairness in a financial institution, and by extension, the one pricing multiples you need to use to cost banks are fairness multiples (PE, Value to Guide and many others.). The notion of computing a price of capital for a financial institution is fanciful and fruitless, and any try to compute an enterprise worth for a financial institution is destined to finish in failure.

Fairness Valuation 101 and Dividend Low cost Mannequin

Staying on fairness valuation, the intrinsic worth of fairness could be written as a perform of the money flows left for fairness buyers, after reinvestment and taxes, and in any case different declare holders have been paid, and the price of fairness:

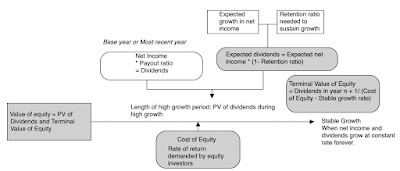

Over the many years, analysts making an attempt to place this mannequin into apply with banks have run into hassle estimating money flows for banks, utilizing the standard construction, since gadgets like capital expenditures and dealing capital are unattainable to measure at banks. It ought to come as no shock that, at the least with banks, analysts fell again on the one observable money flows to fairness, i.e., dividends;

It’s this line of reasoning, i.e., that it’s tough, if not unattainable, to estimate banking free cashflows to fairness, that I used previous to 2008, once I argued for using the dividend low cost mannequin to worth banks In utilizing the dividend low cost mannequin, I used to be making two implicit assumptions. The primary was that banks had been run by wise individuals, who paid out what they might afford to in dividends, neither holding again on paying dividends nor paying an excessive amount of in dividends. The opposite was that the financial institution regulatory framework operated successfully, stopping banks from overreaching on danger or being underneath capitalized.

A Financial institution FCFE Mannequin

The occasions of 2008 dispelled me of each delusions that allowed for using the dividend low cost mannequin, because it grew to become clear that the managers of banks had been something however wise and the regulatory framework had giant holes in it that had been exploited. Within the years after, I’ve changed dividends with a variant on free money circulate to fairness, outlined by means of the lens of a banking enterprise, discounted again at a price of fairness reflecting banking dangers (period mismatches, low regulatory capital and riskiness of mortgage/funding portfolios).

Word the variations between the financial institution FCFE and financial institution dividend low cost fashions.

- The primary is that not like dividends, that are floored at zero, the free money circulate to fairness for a rising or severely undercapitalized financial institution could be detrimental, reflecting the necessity to increase recent fairness to outlive.

- The opposite is that by tying cashflows to capitalization, it permits us to herald that very same issue into danger and prices of fairness, with underneath capitalized banks have greater prices of fairness.

- As a last part of financial institution fairness worth, and 2023 has introduced this house to us is the truth that even a wholesome, worthwhile financial institution can see its worth soften away in days, if its depositors determine, for good, dangerous or no causes in any respect, to withdraw their deposits and put the financial institution into the dying spiral from which restoration could be near unattainable. Since this danger is existential, it’s virtually unattainable to construct into a reduced money circulate mannequin, which is for a going-concern, and needs to be integrated as a danger of failure.

Briefly, the banking model of a FCFE mannequin offers us entry to levers that enable us to distinguish throughout banks and produce within the components that make some banks higher than others.

Valuing Citi

Intrinsic valuation fashions join solely when utilized to actual corporations, and within the desk under, I used the Financial institution FCFE mannequin described above in my valuation of Citi (a alternative which will strike you as odd, however which you’ll perceive for those who learn the remainder of my publish). To set the desk, within the battle of massive banks for investor acclaim, Citi has clearly misplaced the battle not solely towards JP Morgan Chase, however towards a lot of the different huge US banks. It has delivered low progress and subpar profitability, however it has constructed up buffers in its capital ratios and nonetheless has a banking mannequin that delivers a profitable rate of interest unfold.

In my valuation, I’ll assume that Citi will proceed on its cautious, low-growth path, rising its risk-adjusted property at 3% a 12 months in perpetuity, somewhat decrease than its 3.74% progress price over the past 5 years. Over time, I count on some enchancment within the return on fairness, which was 8.78% in 2022, to its five-year common of 9.50%, which remains to be decrease than the price of fairness of 11.67% that I’m utilizing for big industrial banks (see image under for a way I’m computing an implied value of fairness for the 25 largest banks). Lastly, I’ll assume that the financial institution will proceed to marginally enhance its Tier 1 capital ratio, at present at 14.80% to succeed in a goal of 15.00%, in 5 years:

Word that the mix of low progress and a wholesome, present regulatory capital ratio maintain the wants for reinvesting in regulatory capital low, permitting for big potential dividends. These excessive money flows, despite the fact that they’re delivered by a financial institution that earns and expects to proceed to earn an ROE lower than its value of fairness translate into a price of fairness for Citi of about $69, making it about 32% underneath valued auto the inventory value of $46.32, at shut of buying and selling on Could 5, 2023. Clearly, you should have very totally different views about Citi than I do, and you might be welcome to obtain the spreadsheet and enter your numbers not only for Citi, however for any financial institution.

The Pricing of Financial institution Fairness

You’ve gotten heard me say this earlier than, however I do not assume there’s any hurt in repeating this. Worth and value are phrases which might be usually used interchangeably, however they arrive from totally different processes and might yield totally different numbers for a similar asset or firm.

Since pricing requires comparability throughout corporations, usually with totally different models (numbers of shares excellent), we usually convert market values into pricing multiples, to permit for this comparability. As we famous within the final part, the pricing multiples that we use to match banks must be fairness multiples, with value earnings rations and value to e-book ratios being the most typical selections.

Value to Guide Ratio: Selection and Drivers

There isn’t any sector the place value to e-book ratios get used greater than in banking and monetary providers, for 2 causes. The primary is that the e-book worth of fairness for a financial institution, by turning into the premise for regulatory capital, has working penalties, since actions or occasions that decrease than e-book worth of fairness (an sudden loss, a regulatory fantastic, a buying and selling shortfall) could cause a financial institution to change into undercapitalized and exit of enterprise. The opposite is that marking to market is extra frequent in banks than at different sectors, the hold-to-maturity loophole however, and that ought to make e-book worth of fairness a extra significant determine than e-book worth of fairness at a software program or a client product firm.

To make use of the value to e-book ratio to cost banks, I start by figuring out its drivers, and that’s easy to do, for those who begin with an intrinsic fairness valuation mannequin. In reality, utilizing the best fairness valuation mannequin that I can consider, which is a steady progress dividend low cost mannequin, we get:

Dividing each side by e-book worth of fairness, and setting progress price = (1- Payout ratio) ROE, we are able to simplify this equation:

This equation, in its easy, steady progress type, means that whether or not a financial institution trades at under or above its e-book worth of fairness can be pushed by whether or not buyers count on banks to earn greater than their value of fairness (value to e-book>1), roughly the price of fairness (value to e-book = 1) or lower than the price of fairness (value to e-book <1).

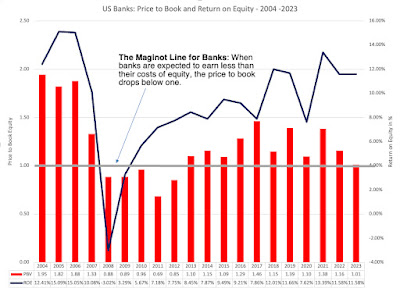

Value to Guide for Banks: Over time

To get a measure of how banks are being priced at the moment, it’s value getting perspective as to how investor views on financial institution profitability and danger have modified over time. To achieve this attitude, I regarded on the aggregated value to e-book ratio of all US banks, obtained by first aggregating the market capitalizations of all banks and dividing by the aggregated e-book fairness from 2004 to 2022, on the finish of every 12 months, and in Could 2023:

If there’s a lesson within the graph, it’s that the 2008 disaster has left a long-lasting impression, as US banks have struggled since that disaster to raise value to e-book ratios. At the same time as returns on fairness have slowly recovered near pre-2008 ranges, the value to e-book ratios haven’t recovered, whilst the remainder of the market has seen rising value to e-book ratios, attributable to decrease rates of interest. In reality, the 2023 disaster has diminished the mixture value to e-book ratio for US banks to shut to at least one, the Maginot line under which buyers are assuming that banks will generate return on fairness roughly equal to their value of fairness in the long run.

For some, this drop in value to e-book ratios over time is an indication of market overreaction, and there are some worth buyers who’ve overweighted their financial institution holdings as a consequence. Which will very nicely be the case, however I believe it’s prudent to see if there are elementary causes for the shift:

-

Greater Threat: One rationalization is that buyers understand banks to be riskier than they had been previous to 2008, and at first sight, that appears puzzling since banks have change into higher capitalized over the past decade, because the regulatory authorities have reacted to the 2008 disaster by tightening security capital necessities:

As you’ll be able to see the Tier 1 capital at US banks collectively has risen to 13-14% from 10-11% within the years main into the 2008 disaster and after. It’s true, although, that fairness as a % of whole property dipped particularly in 2020 and 2021, earlier than bouncing again, however even that statistic has proven little change over the last decade.

-

Decrease Profitability: One other is that buyers do not belief web revenue reported by banks as last numbers, given the propensity of some banks to shock them with after-the truth and sudden losses (from buying and selling errors and asset write-downs) or consider that banks have gotten much less worthwhile over time. To see if that is so, I regarded on the curiosity revenue and bills over time at banks:

Just like the e-book fairness, the unfold dropped in 2020 and 2021, with 2022 exhibiting a restoration. Nonetheless, as rates of interest have risen, it’s probably that charges on deposits will rise quicker than charges earned on loans and investments within the close to time period, maybe a supply of concern for buyers.

- Enterprise Economics; If banks will not be extra dangerous, at the least collectively, and curiosity spreads have held their very own, the one remaining rationalization is that buyers consider that the banking enterprise is way much less more likely to be value-adding now than twenty years in the past. Virtually each side of banking is underneath stress, with deposits turning into much less sticky, elevated competitors for the mortgage enterprise from fintech and different disruptors and elevated dangers of contagion and disaster, and whereas banks stay worthwhile on the floor, buyers have good motive to wonder if the nice occasions will final.

I do know {that a} contrarian take, particularly after the previous couple of months, would counsel investing in banking as a sector, however I consider that the long run developments for the enterprise are detrimental.

The Pricing of Banks – Throughout Banks

Though I might not make a collective guess on banks collectively, I do consider that, as in any disaster, particular person banks are getting mis-placed. Thus, as buyers panic and promote regional banks, it’s probably that good regional banks and lumped in dangerous ones, within the dump, and if that cash is being redirected to the larger banks, a few of these banks might not advantage the value will increase. Staying with value to e-book as my pricing metric for banks, I regarded on the distribution of value to e-book ratios throughout banks, each on the finish of 2022, and in Could 2023, because the banking disaster has unfolded:

As you’ll be able to see, the disaster has lowered value to e-book ratios throughout the board, with the median value to e-book ratio dropping from 1.12 on the finish of 2022 to 0.94 in Could 2022. That decline is sort of completely the results of a decline in market capitalization, for the reason that e-book values of fairness for banks had been little modified between the third quarter of 2022 (used for the top of 2022 calculation) and the top of 2022 (used for the Could 2023 calculation).

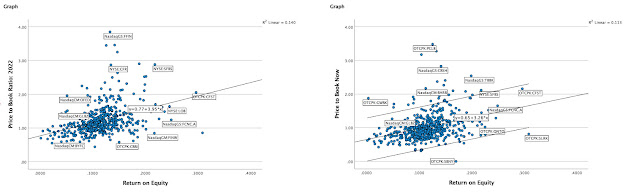

Because the key driver of value to e-book ratio is the return on fairness, I regarded on the distribution of returns on fairness at US banks in 2021 and 2022:

Not like corporations in different sectors, the place there are large variations throughout corporations, the returns on fairness at banks is tightly clustered, with 50% of banks having 9.38% (9.24%) and 14.80% (13.75%) in 2021 (2022). Nonetheless, there are clearly banks that generate greater returns on fairness than different banks, and that ought to play a task in explaining variations in value to e-book ratios. To test how intently value to e-book ratios at banks hew to the returns on equities generated by banks, I did a scatter plot of value to e-book towards ROE, each on the finish of 2022 and once more in Could 2023:

Whereas banks with greater ROE usually commerce at greater value to e-book ratios, there’s important noise within the relationship, although extra in Could 2023 (with an R squared simply above 11%) than in December 2022 (with an R squared simply above 14%). In a last visible show, I regarded a 3D scatter plot, of PBV towards ROE and Tier 1 capital ratios:

I’ve highlighted the mix that characterizes essentially the most underneath valued banks (low value to e-book, excessive ROE and a excessive Tier 1 capital ratio) in addition to the mix for essentially the most over valued banks (excessive value to e-book, low ROE and low Tier 1 capital

The Largest Banks- Trawling for Bargains!

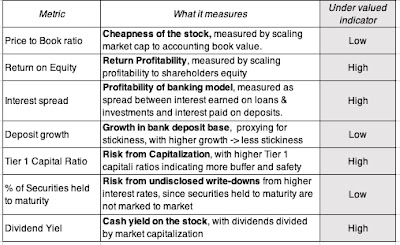

One of many workout routines that I discover helpful, when pricing, is to search for the proper underpriced inventory, one that appears low cost with no good motive for why it’s so low cost. Making use of that apply to banks, here’s what you’d wish to see in your underpriced financial institution:

Making use of this method to the 25 largest banks, for example, I computed the median values for every of those variables for the 25 largest US banks, by way of market cap, and used it because the dividing line for good and dangerous on every of the variables. Thus, a return on fairness greater than the median of 12% is taken into account (and in inexperienced) and fewer than 12% is taken into account dangerous (and in pink).

|

| Supply: S&P Capital IQ |

Put merely, you might be in search of a preponderance of inexperienced numbers in your underneath priced banks, and whereas there no all inexperienced banks, Citi comes closest to assembly the assessments, scoring nicely on danger (with the next than median Tier 1 capital ratio and a decrease % of securities held to maturity among the many 5 greatest banks), deposit stickiness (with low deposit progress) and trades at half of e-book worth (the bottom value to e-book ratio). Its weakest hyperlink is a return on fairness of 8.11% (in 2022) and 9.50% (common from 2018-2022), decrease than the median for US banks, and whereas that will counsel a decrease than median value to e-book ratio, the low cost at Citi exceeds that expectation. Citi’s banking enterprise, although gradual rising, stays profitable with the upper rate of interest unfold on this pattern. I can be including Citi to my portfolio, because it provides the very best mixture of cheapness and low danger, and hope that it may at the least keep its profitability, although a rise could be icing on the cake. It’s a slow-growth, stodgy financial institution that appears to be priced on the presumption that it’s going to not solely by no means earn a ROE even near its value of fairness, and that makes it funding.

On the different finish of the expectation scales, JP Morgan Chase scores nicely on working metrics, with a excessive ROE, low deposit progress and a excessive Tier 1 capital ratio, however it trades at a a lot greater value to e-book ratio than the opposite banks, and iwith a decrease dividend yield. I’ve owned JPM Chase for near a decade in my portfolio, and I do not see something on this desk that will lead me to promote, although I might not be in a rush to purchase both, at at the moment’s costs, if I didn’t personal it.

As a price investor, I might be uncomfortable investing in Citi, purely based mostly upon this pricing evaluation, and it’s for that motive that I retraced my steps to do the intrinsic valuation of the financial institution that you simply noticed within the final part. That reinforces a extra normal level that even buyers who’re true believers in valuation can profit from understanding and utilizing pricing, simply as merchants, who play the pricing recreation, can profit from an understanding of the core rules of intrinsic valuation.

Wrapping up

In my final publish, my focus was on the qualities that made for the excellence between good and dangerous banks, and people qualities contains deposit stickiness, a low rate of interest on deposits mixed with a excessive rate of interest (given default danger) on loans and investments and a giant buffer towards shocks (with excessive e-book fairness and Tier 1 capital ratios). On this publish, I shifted consideration to the investing facet of the image, and that places the value you pay to accumulate banks on middle stage. Buying financial institution, whereas paying too excessive a value, will make for a nasty funding, simply as buying a nasty financial institution, at a discount value, can be funding. On the competition of banking high quality, JP Morgan Chase would beat Citi handily, with a excessive return on fairness and continued progress, mixed with security, however within the contest for investing {dollars}, Citi is the higher priced financial institution. Since I’ll have each shares in my portfolio beginning tomorrow, I’ll have a ringside seat to observe this contest play out over the subsequent few years.

YouTube Video

Posts on the Banking Disaster 2023

- Breach of Belief: Decoding the Banking Disaster (of 2023)

- Good (Dangerous) Banks and Good (Dangerous) Investments: On the proper value…

Financial institution Valuation Spreadsheet