Blended charge actions recorded

In its weekly charge wrap-up, Canstar reported combined actions in residence mortgage charges, with some lenders rising charges whereas others made cuts – a development reflecting ongoing uncertainty available in the market concerning future charge adjustments.

Residence mortgage charge adjustments abstract

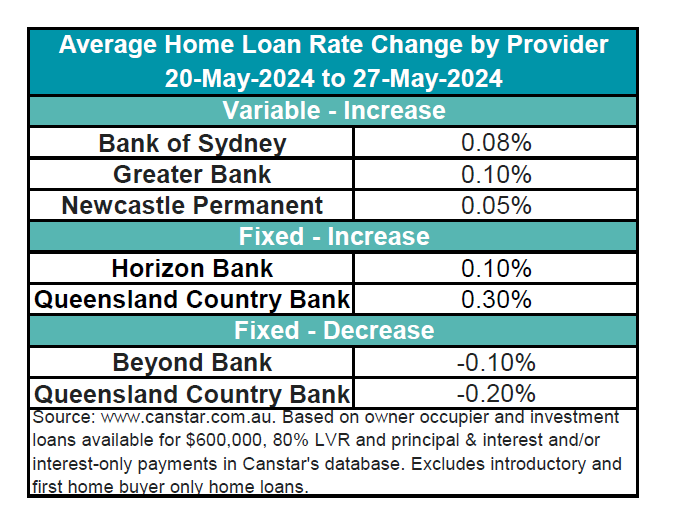

Prior to now week, three lenders elevated 15 owner-occupier and investor variable charges by a mean of 0.07%, whereas no lenders reduce variable charges. Moreover, two lenders raised 27 mounted charges for owner-occupiers and traders by a mean of 0.28%, and two lenders diminished 16 mounted charges by a mean of 0.13%.

See desk under for the abstract of charge adjustments final week.

“The development of accelerating mounted mortgage charges seems to be slowing, with a mixture of hikes and cuts over the previous week suggesting that lenders are adopting a wait-and-see method,” Josh Sale (pictured above), Canstar’s group supervisor of analysis, rankings, and product knowledge.

“This means some uncertainty available in the market concerning future charge actions.”

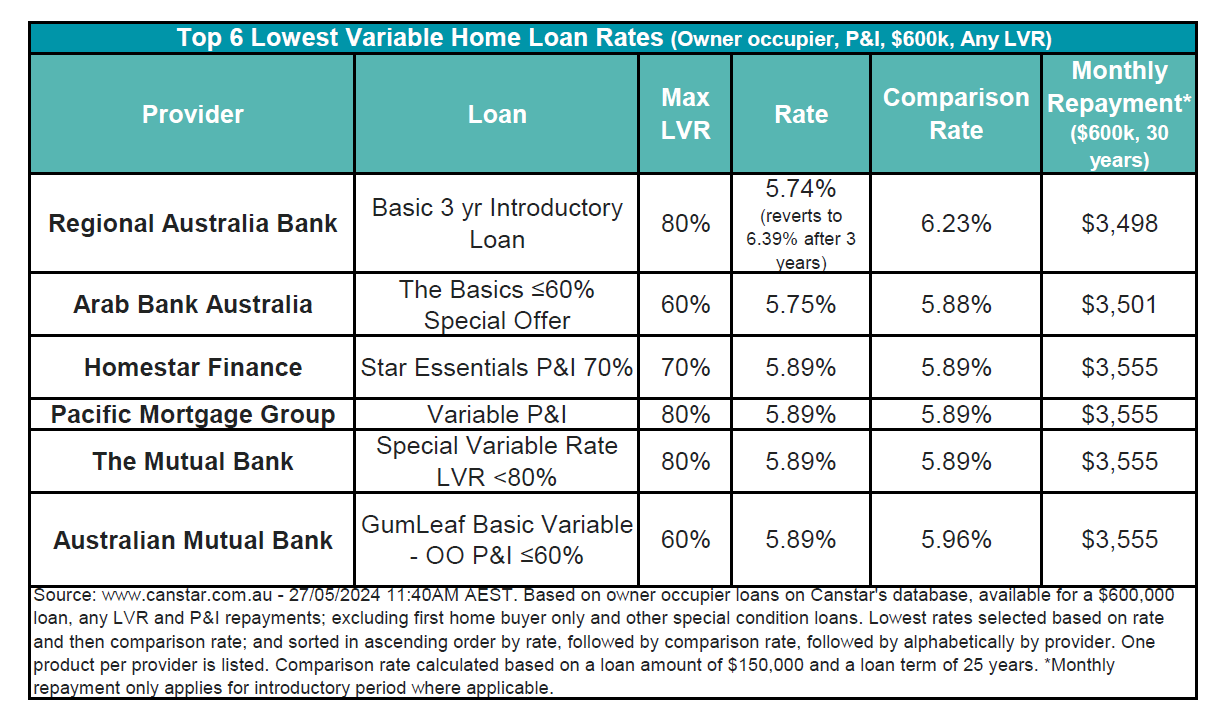

The typical variable rate of interest for owner-occupiers paying principal and curiosity is now 6.88%, with the bottom variable charge for any LVR at 5.74%, supplied by Regional Australia Financial institution.

Different banks providing residence mortgage charges under 5.75% embody Australian Mutual Financial institution, Financial institution Australia, Horizon Financial institution, LCU, Individuals’s Selection, Police Credit score Union, Queensland Nation Financial institution, RACQ Financial institution, The Mac, and Unity Financial institution.

See desk under for the bottom variable charges on the Canstar database.

CommBank’s new digital mortgage

Sale highlighted a notable improvement – CommBank’s launch of a digital-only mortgage product, Digi Residence Mortgage. The brand new mortgage gives a aggressive charge of 6.15%, which is 0.34 share factors under the financial institution’s earlier lowest variable charge of 6.49%.

“Focused at new-to-bank clients refinancing on-line from different monetary establishments, this product guarantees to supply a streamlined and doubtlessly lower-cost possibility for tech-savvy debtors in search of a self-managed expertise,” Sale mentioned.

“It is going to be fascinating to see how the product is obtained by customers, and different main banks will seemingly be watching with curiosity.”

Canstar on upcoming financial indicators

Sale additionally pointed to essential upcoming financial indicators.

“The month-to-month Client Value Index (CPI) for April, due this Wednesday, shall be essential,” the Canstar chief mentioned.

“Nevertheless, the important thing perception will come from the June quarter CPI, which can seemingly point out the Reserve Financial institution of Australia’s subsequent charge transfer.

“April numbers from the US confirmed a slight slowing of inflation from March, and Australian mortgage holders shall be eagerly awaiting comparable information this week.”

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day publication.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing checklist, it’s free!