4 charts concerning the financial system you would possibly discover stunning:

1. Wages are cumulative too. The Congressional Finances Workplace launched new analysis evaluating inflation on a basket of products and companies households at totally different earnings ranges devour between now and 2019 together with modifications in wages.

Right here’s the chart:

And the reason:

For households in each quintile (or fifth) of the earnings distribution, the share of earnings required to pay for his or her 2019 consumption bundle decreased, on common, as a result of earnings grew sooner than costs did over that four-year interval.

Individuals are fast to level out that the present 3.5%-ish inflation charge is deceiving as a result of the inflation for the reason that pandemic is cumulative.

Guess what else is cumulative? Wages, which have elevated much more than costs, on mixture.

In order for you a proof for the continued power of the buyer and the financial system, look no additional than greater wages.

When folks make extra, they have an inclination to spend extra.

2. Younger persons are higher off than their dad and mom. For years, pundits have been complaining about the truth that so many younger persons are worse off than their dad and mom’ technology on the similar age.

The Economist shared analysis from a brand new paper that disputes this declare.

Right here’s the chart:

And the reason:

A brand new paper by Kevin Corinth of the American Enterprise Institute, a think-tank, and Jeff Larrimore of the Federal Reserve assesses People’ family earnings by technology, after accounting for taxes, authorities transfers and inflation. Millennials have been considerably higher off than Gen X–these born between 1965 and 1980–after they have been the identical age. Zoomers, nonetheless, are a lot better off than millennials have been on the similar age. The everyday 25-year-old Gen Z-er has an annual family earnings of over $40,000, greater than 50% above baby-boomers on the similar age.

Every technology has seen greater inflation-adjusted wages than their dad and mom.

Each younger technology has challenges, and as we speak isn’t any totally different.1

This doesn’t imply everybody is best off however median incomes for Gen Z are greater than millennials on the similar age, which have been greater than Gen X on the similar age which have been greater…you get the image.

That is progress.

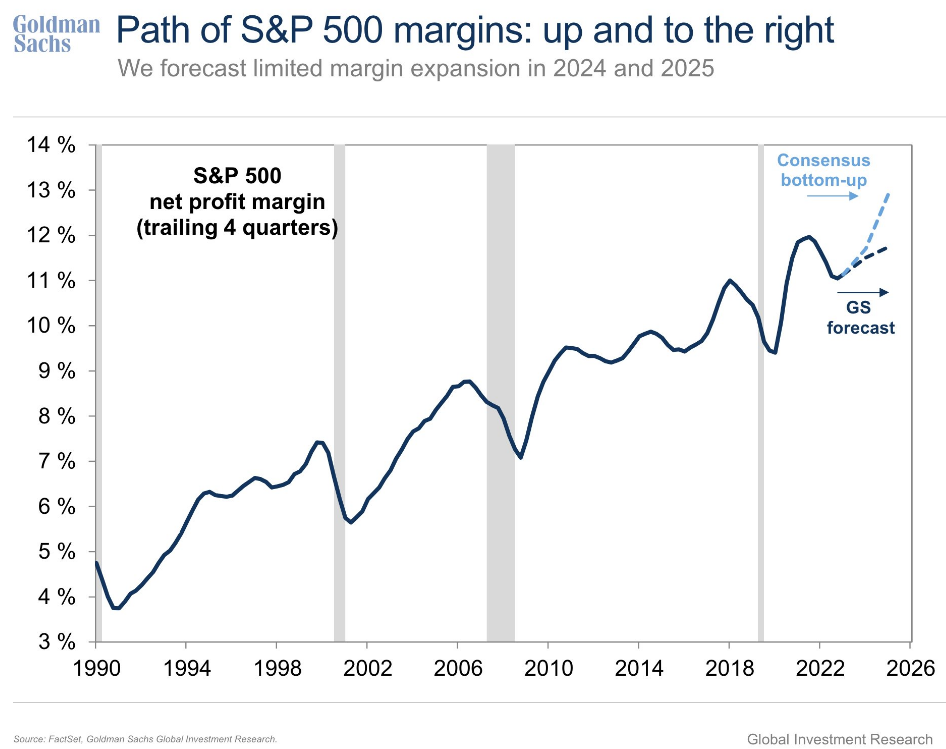

3. Giant companies aren’t feeling inflation’s influence. Customers hate inflation. Small companies aren’t a fan. Politicians don’t prefer it a lot both.

However giant companies?

They appear simply effective relating to revenue margins.

Right here’s the chart:

And the reason:

Companies are paying greater wages and enter prices however they merely raised costs to fight these greater prices.

Company America places revenue first, second, and third, which is likely one of the causes the inventory market is so resilient.

If it looks as if companies at all times win it’s principally true. They know easy methods to adapt whatever the macro atmosphere.

That’s why revenue margins have solely improved through the highest inflation in 4 many years.

4. The USA is the world’s main oil producer. When Russia invaded Ukraine within the spring of 2022, the worth of oil rapidly shot up from round $90/barrel to $120/barrel.

Vitality specialists and macro vacationers alike got here out with $200/barrel predictions. It made sense on the time!

That struggle nonetheless rages on, together with an extra battle within the Center East. Prior to now, this is able to have despatched oil costs skyrocketing. The oil disaster was a giant motive we had stagflation within the Nineteen Seventies.

Not this time round. Oil costs are again right down to $80/barrel. On an inflation-adjusted foundation, oil costs are primarily flat since 2019 simply earlier than the pandemic.

Contemplating the macro and geopolitical atmosphere, I by no means would have believed this is able to be the case but right here we’re.

Why is that this the case?

Right here’s the chart (through Torsten Slok):

And the reason:

This is likely one of the most important causes we neve received $200 oil.

The U.S. changing into the most important oil producer on the planet is likely one of the most necessary macro developments of the previous 20-30 years, but you not often hear about it.

This can be a big deal!

As dangerous as inflation has been these previous few years, it might have been far worse had oil gone above $150/barrel, which might have despatched fuel costs to one thing like $6 a gallon.

The post-pandemic financial system has been stronger than most individuals predicted.

Larger wages, greater revenue margins and decrease oil costs are all a giant motive for this.

It might have been loads worse.

Additional Studying:

Inflation on the Grocery Retailer

1At present, we have now a traditionally unaffordable housing marketplace for younger folks. I will probably be curious to see what occurs when these greater wages compete with greater housing costs. You possibly can make the case this can put a ground below housing costs if younger folks plug their noses and hold shopping for.