A reader asks:

I ran throughout this weblog publish by Econ blogger Noah Smith, “People are nonetheless not apprehensive sufficient concerning the danger of world warfare.” He makes the case that we may properly be in what he calls “the foothills” of one other battle on the size of World Battle II, arguing that proper now feels rather a lot just like the mid-late Nineteen Thirties will need to have felt as conflicts broke out the world over and steadily merged into what we now name World Battle II. I briefly tried to analysis private finance approaches for this type of situation, however every thing appears to be within the class of making ready for complete civilizational breakdown and strikes me as ridiculous. Are there any ideas you guys have on what people may do to hedge this type of danger from a private finance perspective? Shouldn’t somebody in 1938 have taken concrete steps to organize for the doable outbreak of a serious battle?

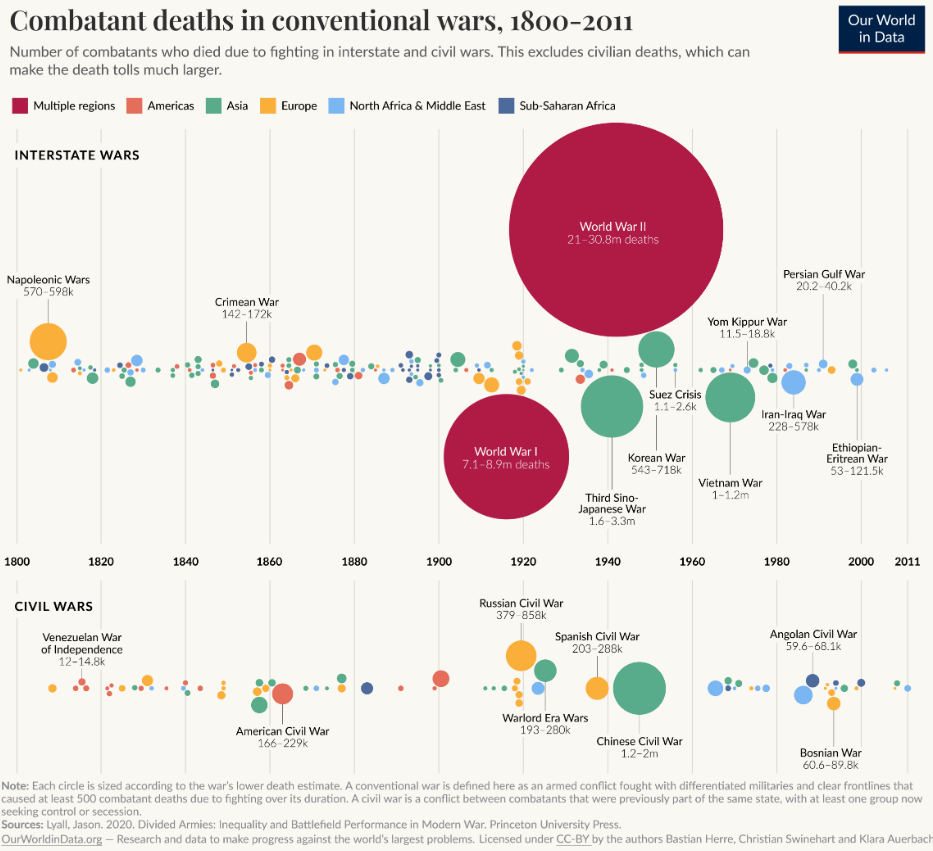

Our historical past as a species is plagued by warfare.

Our World in Knowledge estimates greater than 37 million combatants have died preventing in wars worldwide since 1800 (that quantity is rather a lot bigger if you happen to embody civilian casualties):

The 2 world wars stand out from all of the others.

I want to suppose cooler heads will prevail however I don’t know if the U.S. and China will go to warfare within the years forward. Geopolitics are fickle. Who is aware of how sure politicians will react or what the varied leaders of nations across the globe are pondering?

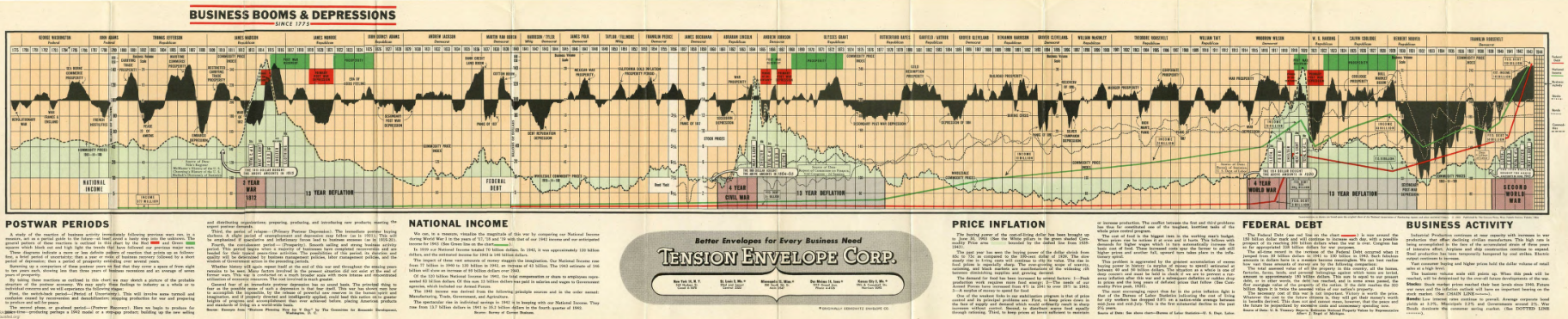

There truly was once a playbook for investing throughout wartime as a result of that was the way in which of the world again then:

That is onerous to learn so enable me to summarize the everyday post-war financial response within the pre-WWII period:

- There can be a downturn on the outset of the warfare.

- Then there can be a growth from all of the war-time spending.

- This was adopted by a interval of uncertainty as nations shifted from war-time to peace-time manufacturing.

- The post-war financial restoration included hypothesis, an inflationary spike from all of the spending and overheating from all of the excesses.

- These excesses would inevitably result in a post-war melancholy which included a deflationary bust. There have been 13-year durations of deflation following the Battle of 1812, the Civil Battle, and World Battle I.

- Lastly, a interval of prosperity would kick in as issues bought again to regular.

This playbook labored till it didn’t. Every part modified after World Battle II, which was adopted by growth instances with out the deflationary bust within the economic system as a result of the federal government provided the entire troopers returning house so many incentives to get their lives again on monitor by way of the GI Invoice.

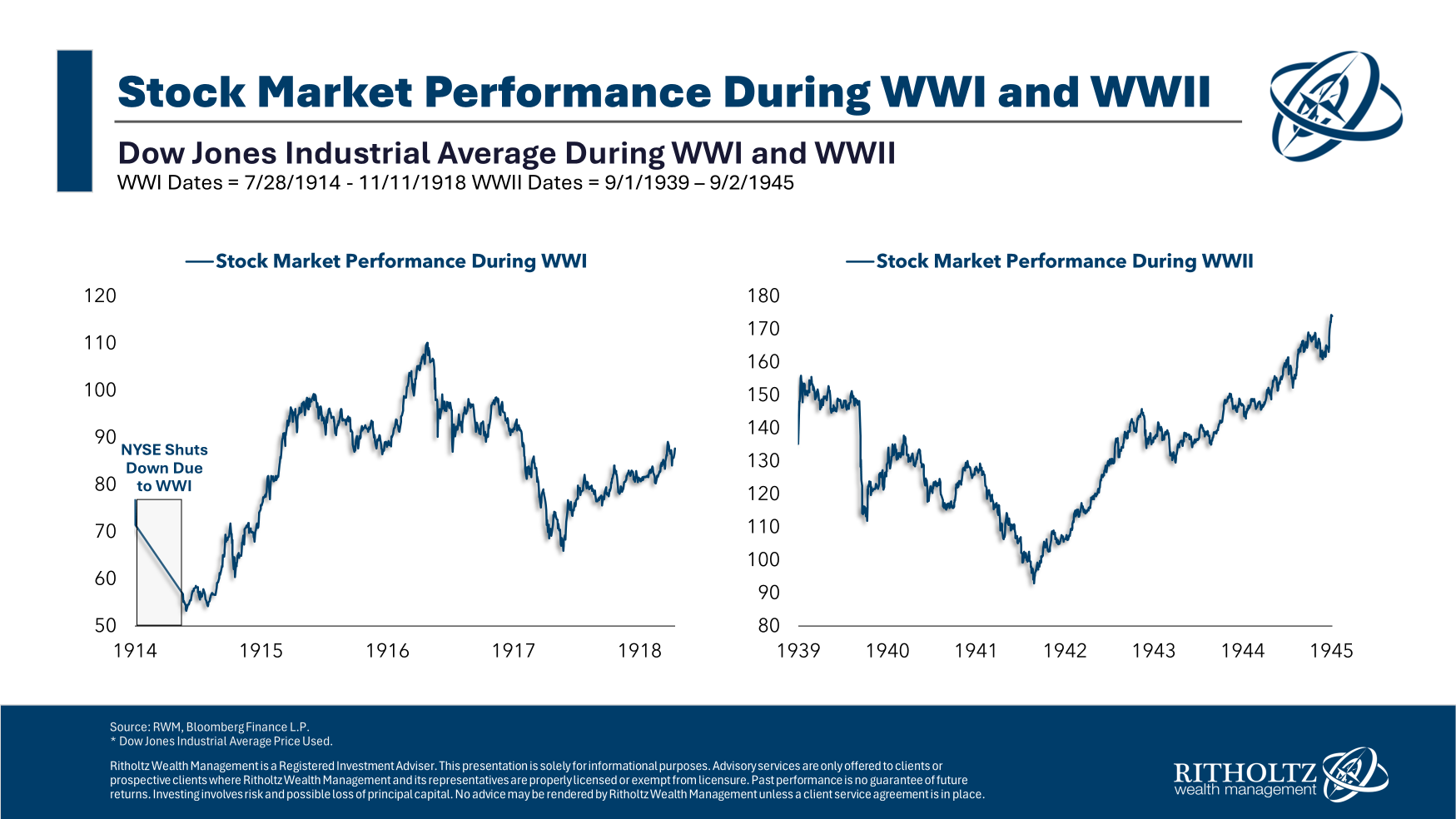

There aren’t any ensures for any situation however volatility would appear to be essentially the most logical end result if world powers got here to blows. Right here’s a take a look at the efficiency of the Dow in World Battle I and World Battle II:

There have been a handful of loopy market outcomes in World Battle I. On the warfare’s outset in 1914, the inventory market shut down for six months. Liquidity merely dried up since so many individuals went to combat. It opened a lot decrease, however then a humorous factor occurred–shares took off like rocketships in 1915.

1915 stays the very best 12 months ever for the Dow, up greater than 80% on the 12 months.

From the beginning of the Nice Battle in the summertime of 1914 by way of the tip of the warfare on the tail finish of 1918, the Dow confirmed a complete return of greater than 43% or practically 9% per 12 months.

There was a downturn on the outset of World Battle II as properly. U.S. shares had been down double-digits in 1940 and 1941.

By 1942, issues seemed bleak for the Allied nations. Germany managed most of Europe and had but to endure any defeats in battle. But that’s the identical time the inventory market bottomed and was off to the races.

From the beginning of the warfare in 1939, when Hitler invaded Poland, by way of the autumn of 1945, when the warfare ended, the Dow gained a complete of fifty%, ok for an annualized return of greater than 7% per 12 months.

Even with some volatility as warfare broke out, the inventory market carried out admirably through the two world wars.

The inventory market will be counterintuitive and heartless during times of battle. And there may be clearly no assure we’ll see the same end result if one thing flares up between world superpowers within the years forward.

So how would you hedge your portfolio in opposition to the opportunity of World Battle III?

I’m undecided there are any massive secrets and techniques concerned right here.

You match your danger profile and time horizon so that you’re capable of steadiness long-term targets with short-term wants.

You put money into danger belongings which have anticipated returns above the speed of inflation so that you don’t fall behind from rising costs.

You construct downturns into your funding plan with the understanding that shares can get crushed from time-to-time.

You don’t attempt to predict the long run as a result of predicting the long run is unimaginable however you do put together your self for a variety of outcomes.

I’m positive there are specific industries, firms or belongings that may do higher or worse if the US went to warfare with China.

However one of the best ways to hedge the danger of World Battle III is similar means you hedge in opposition to some other future unknown.

We bought into this query on the newest episode of Ask the Compound:

Ritholtz Wealth Administration monetary advisor Michelle Katzen joined me on the present this week to debate questions on learn how to account for house fairness in your monetary plan, borrowing in opposition to your portfolio, what constitutes a final will and testomony and the way retirement planning truly works.

Additional Studying:

Pandemics vs. Publish-Battle Recoveries