It’s no secret that I used to be on Staff Cashback all through my 20s. Again then, as a single feminine who was spending lower than $800 every month, cashback playing cards made probably the most sense for me as a result of even when I clocked 4 miles for each single greenback, I’d solely have sufficient for a 1-way enterprise class flight to Philippines (3 hours) at most after a whole 12 months. Naturally, getting 1 month again in bills was way more engaging to me!

Now, in case you have the same life profile and like to have chilly, onerous money again in your pocket so that you can spend on different stuff, then cashback playing cards should still make sense for you.

TLDR: If you happen to spend lower than $1,000 a month, then cashback playing cards could attraction to you. Usually, this is able to be the recent grads, or of us of their 20s / 30s who aren’t but married with youngsters and maintain their spending to a minimal.

Quick ahead to at this time (a decade later) the place I’m now a mom of two and CFO of my family. That additionally implies that I pay (upfront) for the majority of our household’s bills, which provides as much as a cool $7,000+ each month. For the primary 2 years, I attempted to proceed my cashback playing cards recreation technique…however failed miserably because the cashback limits stored slapping me throughout the face.

Ultimately, I spotted it was time I converted to Staff Airmiles.

Which was why 2 years in the past, I made peace with my former on-line nemesis The Milelion after I advised him I lastly gave up on cashback playing cards and was now accumulating miles. And at this time, we’re combining forces in SingSaver’s Final Showdown between cashback and miles.

What my typical family bills seem like

Limits of cashback playing cards

particularly when you run a family

Let’s speak about how cashback playing cards reallllly maintain you again when your bills are simply 4 to five digits a month.

As an example, the Maybank Household & Pals card may give 8% cashback to your groceries, meals, transport, telco invoice, Netflix and even live performance tickets (amongst others) – these usually cowl nearly all of my spending classes. The one drawback? That is capped at S$25 cashback every for five classes (S$312 spending), and you will get not more than S$125 in complete per calendar month even when you cross the $800 month-to-month minimal spend. However hey, take a look at how a lot my bills are in these classes:

| Class | Month-to-month Spend | 8% Cashback |

| Groceries | $600 | $48 |

| Meals | $800 | $64 |

| Transport | $200 | $16 |

| Telco & Web | $70 | $6 |

| Netflix | $19.98 | $2 |

| Complete | $1,690 spent | $135 is over caps = $125 cashback = $10 misplaced! |

For my on-line purchasing, I used to depend on my UOB One card to get 10% cashback, however then realised I couldn’t constantly hit the $500 minimal spending a month required to be eligible if I used to be pairing it with my above Maybank card. In any other case, I might additionally use the UOB EVOL card for 8%, however with the cashback capped at $20 per class and requiring $600 minimal spend on the cardboard monthly, that meant $250 for on-line purchasing and me to spend a minimum of $350 elsewhere each, single month.

I couldn’t hit that.

What’s extra, I couldn’t discover a approach to get first rate cashback on my revenue taxes, household insurance coverage premiums and kids’s schooling charges ever since lots of the banks nerfed the cashback advantages on CardUp, leaving simply Financial institution of China Household and Maybank Platinum Visa because the final remaining contenders (however capped at $2,400 spend month-to-month i.e. $28.8k a 12 months). And guess what? Final 12 months alone, these 3 classes already added as much as a cool $75,000 for us.

Regardless of how I labored inside my arsenal of cashback playing cards, the capped class cashback limits ($250 – $300) monthly made it virtually unattainable for me to match each greenback to a minimum of some type of acceptable cashback yield.

So after making an attempt for a 12 months, I gave up and switched to miles bank cards as an alternative.

Out of the blue, my monetary life turned a lot much less worrying! I used to be free of the foolish class spending caps which are a mainstay in most cashback playing cards, and solely wanted to look at:

(i) which classes,+

(ii) the utmost spend

that I placed on every miles card each month.

No kidding, check out how these the classes and max month-to-month spend seems like on these 4 mpd playing cards:

Is it any marvel why I switched?! In reality, I ought to have finished it sooner – from as early as 2018 as soon as I turned a dad or mum.

Earn as much as 34,000 bonus miles plus items once you apply for miles playing cards this month

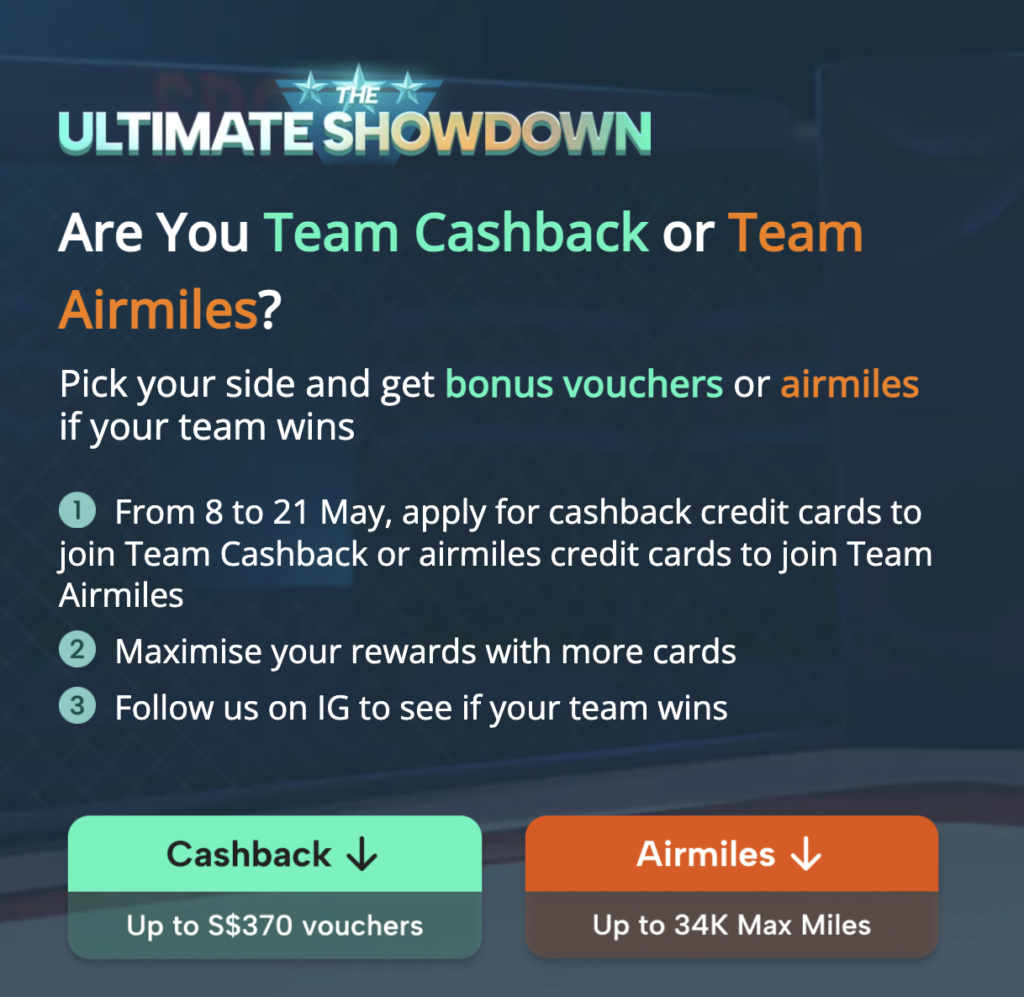

If you happen to’ve been pondering of making use of for any bank card to up your miles recreation, I counsel you do it from now between 8 Could to 4 June 2024 by way of SingSaver. That’s as a result of not solely do you get extremely beneficiant sign-up rewards, you additionally get to vote (along with your card functions) to find out whether or not Staff Miles or Staff Cashback will win!

Lots of you ask which playing cards I personally use and would suggest, so I’d counsel that you just first get these 3 playing cards to begin incomes 4 miles for each greenback throughout the next classes:

| UOB Woman’s | Eating, Transport (consists of petrol and public transport), Magnificence, Leisure, Journey (select any 2) | max $1,000 spend monthly (or $2,000 for Solitaire) |

| HSBC Revolution | Purchasing, Experience-hailing, Air Tickets, Cruises | max $1,000 spend monthly |

| Citi Rewards | On-line (consists of subscriptions), Medical, Journey (paired with amaze) | max $1,000 spend monthly |

However after all, if you wish to actually earn most miles by placing even your youngsters’ schooling charges, household insurance coverage premiums and revenue taxes in your bank card, then I’d suggest that you just learn my article right here to see the whole miles bank card stack to get.

Within the meantime, right here’s a fast overview of what I personally use for the under classes because the family CFO each month:

One of the best half is that in contrast to cashback playing cards, miles playing cards don’t require you to hit a minimal month-to-month spend earlier than you’re eligible to begin incomes rewards. That means that you can begin incomes miles out of your very first greenback.

My expensive nemesis-turned-ally Milelion insisted that I wanted to publicly clarify why I had switched sides, so I hope this submit lets you perceive why.

TLDR: Funds Babe grew up, had youngsters and therefore spends 4-digits each month for her family and dependents…so cashback playing cards not match her spending wants.

On the finish of the day, the selection between miles vs. cashback playing cards actually comes right down to a person’s life-style profile and preferences. I mentioned this identical line earlier than in 2017 so nothing has modified…aside from my life stage spending habits.

It was good to have been in a position to maintain my bank card payments under $1,000 a month after I was a younger, single feminine with no youngsters to be financially accountable for…however alas, life occurs 🙂

In fact, when you’re younger and frugal (like I used to be!), miles playing cards could not essentially serve you properly as a result of it’ll take ceaselessly earlier than you earn your first free flight; however when you’re a dad or mum paying for greater than 1 individual’s monetary dues (i.e. your youngsters or the aged), then cashback playing cards will solely maintain you again.

Your selection between a much and cashback bank card ought to align along with your spending habits and life-style. Nothing has modified.

Apply for one of the best miles (or cashback) playing cards for you right here + vote along with your card functions on SingSaver at this time!

You’ll additionally get as much as 34,000 bonus miles plus items like Apple iPad, Dyson, Samsonite luggages, amongst different items and fortunate attracts (which could simply see you win a free return Enterprise Class journey to Switzerland)!

Singapore, let’s see whether or not it’ll be Staff Airmiles or Staff Cashback to emerge champion in June.

With love,

Funds Babe