Brokers react to RBA rate of interest pause

The Reserve Financial institution of Australia (RBA) has maintained the established order by holding the money price at 4.35% for the third time in a row following its two-day board assembly. This comes regardless of the newest inflation knowledge coming in greater than anticipated, elevating issues about persistently excessive costs.

Whereas the choice to keep up the money price would possibly counsel a continued method to stability, the RBA adopted its most hawkish stance but since Michele Bullock took over the reins as RBA governor.

For debtors, these holding out for a drop in rates of interest may need to attend somewhat longer as cost-of-living pressures attain “excessive ranges”, based on Finder’s Price of Dwelling Stress Gauge.

“The financial outlook stays unsure and up to date knowledge have demonstrated that the method of returning inflation to focus on is unlikely to be easy,” the RBA Board stated in a press release. “The central forecasts, based mostly on the idea that the money price follows market expectations, are for inflation to return to the goal vary of 2–3% the second half of 2025, and to the midpoint in 2026.”

“Returning inflation to focus on inside an affordable timeframe stays the Board’s highest precedence. That is per the RBA’s mandate for worth stability and full employment.”

“The Board must be assured that inflation is transferring sustainably in the direction of the goal vary. Up to now, medium-term inflation expectations have been per the inflation goal and it’s important that this stays the case.”

Brokers react to RBA rate of interest pause

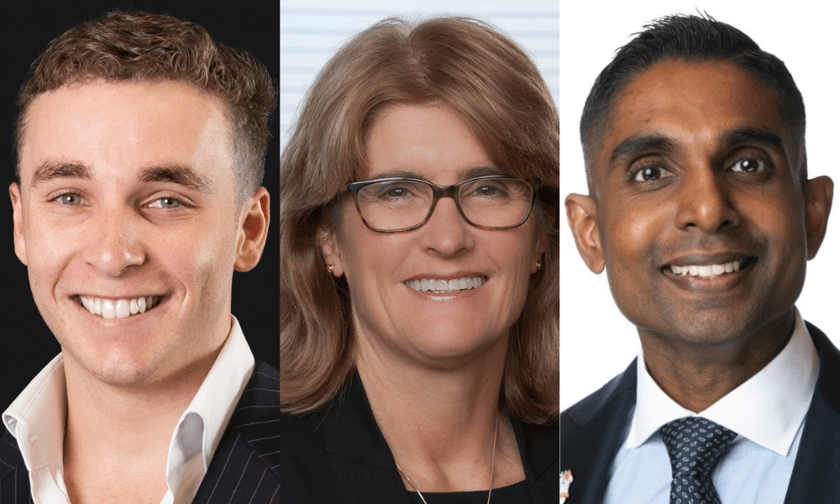

With practically all consultants predicting the speed pause, mortgage brokers Will Frazer and Sadish Visvalingham weren’t shocked by the RBA’s choice to carry the money price.

““It appears aligned with present financial situations, and most analysts anticipated that stability is perhaps the plan of action for now,” stated Visvalingham (pictured above left), founding father of Premier Monetary Advocates.

“Holding the speed unchanged ought to present a little bit of aid to debtors, significantly these with variable price mortgages, because it retains their funds secure for now. This stability is necessary and will assist enhance client sentiment, though we’re nonetheless navigating some robust financial waters on account of persistent inflation.”

Nonetheless, Frazer (pictured above proper), director of OurLoan Finance Brokers, lamented that economists have “suggested the nation completely different data” all through the final couple of months.

“Charges needs to be on maintain till later this yr, the place we are going to hopefully begin to see decreases,” stated Frazer, who’s doubtlessly certainly one of Australia’s youngest mortgage brokers.

“Sadly, the media is now predicating the potential of a ‘hawkish’ stance from the RBA as soon as once more. This reveals to be fairly alarming on account of the truth that the CPI knowledge launched on April 24 revealed that inflation has continued to ease yearly.”

The feedback come after Westpac and Commonwealth Financial institution just lately revised their money price forecasts, with each not anticipating the RBA to chop charges till November.

Others like Judo Financial institution’s Warren Hogan had even predicted the money price to climb to five.10% by Christmas.

“I strongly imagine that if charges have been to repeatedly enhance, debtors would fall into hardship or arrears and have the danger of extra downsizers, transferring to extra inexpensive suburbs and even homelessness having a risk,” Frazer stated.

Are debtors holding out on shopping for till charges come down?

Till just lately, the traditional knowledge amongst economists was that rates of interest would drop someday this yr. This led to many debtors weighing the prices and advantages of borrowing cash

“They’re watching the market carefully, hoping for a price reduce earlier than making important monetary commitments like shopping for a house,” he stated. “That is comprehensible, given the speculations that we would see some price changes by the RBA later subsequent yr.”

Nonetheless, Frazer stated he has discovered that debtors are nonetheless trying to find property, particularly buyers.

He stated this was on account of excessive rental costs at the moment throughout Australia; the place persons are beginning to benefit from this to “basically purchase into the disaster”.

“Knowledge has proven that there are extraordinarily excessive yielded suburbs and development inside sure areas,” Frazer stated. “For instance, Perth has had a 9.7% development of their market within the earlier 12 months, the place the median worth for a home is now at a excessive of $965,000 and hire being at a median of $750 per week with a 11.9% of development throughout the final 12 months.”

“Many buyers at the moment are beginning to buy right here on account of this impact out there.”

For owner-occupiers, Frazer stated he’s nonetheless noticing debtors nonetheless wanting to purchase while charges are nonetheless excessive, “solely to the truth that they might fairly pay their very own mortgage, fairly than paying another person’s in the event that they have been to hire”.

“Many Millennial and Gen Z debtors are eager to get their foot into the market, fairly than wait with the likelihood that it’s going to ultimately turn out to be unaffordable to reside in sure suburbs.”

Will money price pauses nonetheless be the norm?

The Reserve Financial institution’s choice to carry rates of interest regular these days has been a welcome break for debtors. Nonetheless, with predictions about future price modifications changing into much less sure, many are questioning if this pause in price hikes will final.

Visvalingham stated pause might certainly turn out to be a norm this yr, because the financial outlook stays full of uncertainties.

“Most economists, together with myself, are taking a look at a doable begin to price cuts within the second half of 2024, supplied the inflation continues to ease and financial situations start to stabilize,” he stated.

“This forecast aligns with a number of financial predictions suggesting that whereas rapid modifications are unlikely, there’s a potential for alleviating within the close to future.”

Whereas Frazer believes the identical, he admitted he can solely take educated guesses and assumptions based mostly on the info.

“The one method for us (Australians) to know is by persevering with to learn the info during which we’re being introduced with from the Australian Bureau of Statistics (ABS),” he stated.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!