Since retiring practically two years in the past, I’ve been aligning our property with tax traits of our accounts following the Bucket Method. On this article, I overview the tax legal guidelines that sundown on the finish of subsequent yr, President Biden’s proposed tax adjustments, tax traits of account varieties, and supply instance funds for these accounts.

2017 TAX CUTS AND JOBS ACT (TCJA)

Key Factors: Components of the 2017 Tax Reduce and Jobs Act will expire on the finish of subsequent yr.

The Federal deficit as a share of gross home product has been growing for the reason that early 1970’s exasperated by the Monetary Disaster and COVID Pandemic except 1997 by 2001 throughout Invoice Clinton’s Presidency. I imagine that is unsustainable and that the answer consists of each constrained spending and better taxes.

The Patriotic Millionaires level out that the 2017 Tax Cuts and Jobs Act (TCJA) “disproportionately benefited the wealthy, nevertheless it bears repeating as a result of lots of the provisions of the TCJA expire in 2025.” In “A Nearer Look”, they state:

The TCJA applied a lot of adjustments to the tax code that benefited low-income households, most notably elevating the usual deduction and doubling the worth of the Baby Tax Credit score. However the truth stays that its largest provisions – amongst different issues, slashing the company tax charge from 35% to 21%; decreasing the highest marginal particular person earnings tax charge from 39.6% to 37%; doubling the property tax exemption from $11 million to $22 million (for a married couple) – overwhelmingly labored within the pursuits of the rich. The top end result? In 2025, the TCJA will enhance after-tax incomes of households within the high 1% by 2.9%, whereas households within the backside 60% will see a 0.9% enhance. “

Anna Jackson wrote “7 Information About Individuals and Taxes” for the Pew Analysis Heart saying, “A majority of Individuals really feel that firms and rich individuals don’t pay their justifiable share in taxes, in accordance with a Heart survey from spring 2023. About six in ten U.S. adults say they’re bothered quite a bit by the sensation that some firms (61%) and a few rich individuals (60%) don’t pay their justifiable share.” About three-quarters of Democrats and Democratic-leaning independents say they’re bothered quite a bit by the sensation that some rich individuals (77%) don’t pay their justifiable share. Over forty p.c of Republicans and GOP leaners say this in regards to the rich.

PROPOSED TAX CHANGES

Key Level: The Biden Administration proposes elevating taxes on the ultra-wealthy to cut back inequality and the Federal deficit.

Constancy Wealth Administration writes in “The Newest Biden Tax Proposal” that the Biden Administration’s proposed tax adjustments “are unlikely to develop into legislation given obstacles in Congress.” They add that “it could be sensible to contemplate sure methods in anticipation of a future high-tax atmosphere.” “Usually talking, the earnings tax adjustments specified by the funds would influence a really small variety of taxpayers in the event that they had been applied—particularly, those that earn greater than $400,000 in annual earnings.” Constancy lists the proposed adjustments:

- The highest particular person earnings tax charge would rise to 39.6% from 37% for earnings above $400,000 (single filers) or $450,000 (married submitting collectively).

- The web funding earnings tax charge would rise to five% from 3.8% for these incomes greater than $400,000 in common earnings, capital beneficial properties, and pass-through enterprise earnings mixed. The extra Medicare tax charge for these incomes greater than $400,000 would additionally enhance to five% from 3.8%.

- Certified dividends and long-term capital beneficial properties could be taxed as extraordinary earnings, plus the web funding earnings tax, for earnings that exceeds $1 million.

- Transfers of property by reward or loss of life would set off a tax on the asset’s appreciated worth if in extra of the relevant exclusion.

- Roth IRA conversions could be prohibited for high-income taxpayers, and “backdoor” Roth contributions, the place after-tax conventional IRA contributions could be rolled right into a Roth IRA regardless of earnings limits, could be eradicated.

It is very important acknowledge that long-term investments have the extra advantage of inventory appreciation rising tax-free till offered along with the decrease capital beneficial properties tax charge. The US is aggressive globally on taxes. In accordance with the Tax Basis, twelve of the nations in Western Europe have a capital beneficial properties tax charge of 26% to 42%. Nevertheless, most nations use the Worth Added Tax [VAT] based mostly on consumption whereas the US relies extra on earnings. A greater comparability is whole taxes paid as a share of GDP. The Tax Coverage Heart wrote that “In 2021, taxes in any respect ranges of US authorities represented 27 p.c of gross home product (GDP), in contrast with a weighted common of 34 p.c for the opposite 37 member nations of the Organisation for Financial Co-operation and Growth (OECD).” There are efforts for international tax reform and The World Financial Discussion board describes that “136 nations have signed a deal aimed toward guaranteeing corporations pay a minimal tax charge of 15%” so as to cut back tax avoidance.

On this altering tax panorama, Constancy Wealth Administration describes six essential steps to constructing a well-thought-out funding technique that’s versatile, suited to your distinctive scenario, and constructed to face up to probably the most troublesome market situations.

- Begin with a agency understanding of your objectives and desires

- Construct and preserve a well-diversified portfolio

- Make the most of tax-smart investing strategies

- Follow your plan and keep invested

- Contain your loved ones when planning and making choices

- Think about partnering with a trusted monetary skilled

BUCKET APPROACH

Key Level: The Bucket Method could be aligned to be tax-efficient.

Feedback from Readers are that the Bucket Method is just too difficult or there must be extra buckets. The quote attributed to Albert Einstein, “Make all the pieces so simple as attainable, however not easier” is acceptable for the Bucket Method.

Christine Benz at Morningstar wrote “The Bucket Method to Constructing a Retirement Portfolio” which describes the simplistic idea of segregating property into short-, intermediate, and long-term buckets. She goes into extra element in “The Bucket Investor’s Information to Setting Retirement Asset Allocation” by which she offers a dose of actuality:

“The previous steps all relate to setting a retirement asset allocation to your whole portfolio. However the actuality of positioning your precise retirement portfolio is apt to be messier, difficult by the truth that you’re possible holding your property in numerous tax silos (conventional tax-deferred accounts like IRAs, Roth accounts, and taxable accounts), every with its personal withdrawal guidelines and tax implications.”

Ms. Benz provides the ultimate element of withdrawal methods and taxes in “Get a Tax-Good Plan for In-Retirement Withdrawals” the place she says, “it’s often finest to carry on to the accounts with probably the most beneficiant tax therapy whereas spending down much less tax-efficient property.”

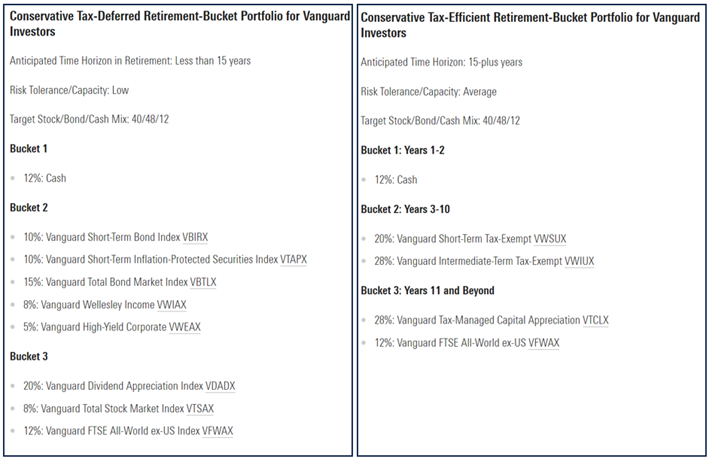

Lastly, Ms. Benz offers some examples of tax-deferred and tax-efficient portfolios for savers and retirees in “Our Greatest Funding Portfolio Examples for Savers and Retirees”. In Determine #1, I examine her mannequin portfolios for conservative traders at Vanguard. One generalization is that Bucket #1 incorporates money, Bucket #2 incorporates largely bonds that are taxed as extraordinary earnings, and Bucket #3 incorporates largely inventory. Within the MFO April E-newsletter, I recognized the Vanguard Tax-Managed Capital Appreciation Admiral Fund (VTCLX) to be a single long-term fund for a tax-efficient account.

Determine #1: Tax-Deferred and Tax-Environment friendly Mannequin Portfolios for Vanguard Funds

MANAGING TAXES

Key Level: Funding location and withdrawal methods could be adjusted to fulfill completely different or a number of objectives considering taxes.

“How you can Make Retirement Account Withdrawals Work Greatest for You” by Roger Younger, CFP, at T. Rowe Value Insights, is an insightful article. Mr. Younger says, “Sadly, the traditional knowledge method might end in earnings that’s unnecessarily taxed at excessive charges. As well as, this method doesn’t take into account the tax conditions of each retirees and their heirs.”

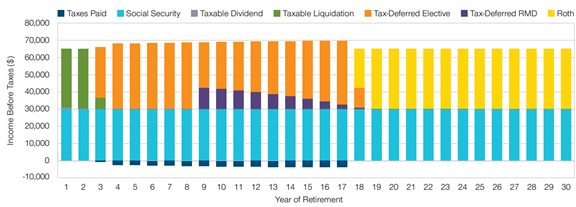

Determine #2 reveals the “Standard Knowledge” for withdrawal methods the place one withdraws first from taxable funds, then tax-deferred fund elective withdrawals, then RMDs, and eventually withdrawals from Roth IRAs. Mr. Younger factors out that the traditional “method leads to pointless taxes throughout years 3 by 17”.

Determine #2: Standard Method to Retirement Withdrawals

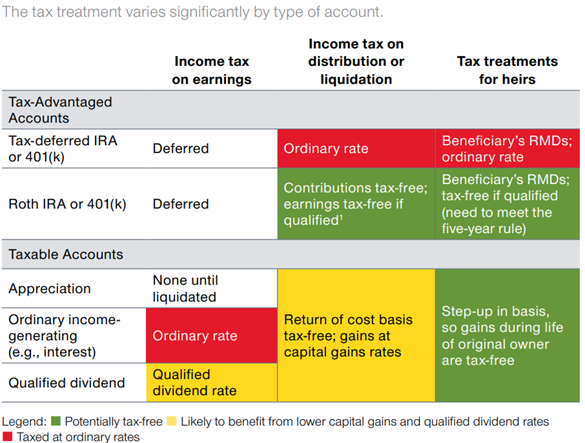

He additionally reveals the tax traits of several types of accounts as proven in Desk #1.

Desk #1: Tax Traits of Totally different Property

The article considers three aims that retirees might have:

- Extending the lifetime of their portfolio

- Extra after-tax cash to spend in retirement

- Bequeathing property effectively to their heirs

Whereas the examples might not match everybody’s scenario, the ideas can be utilized to personalize a monetary plan.

One other approach of utilizing after-tax accounts tax effectively is utilizing municipal funds. Constancy Cash Market Fund Premium Class (FZDXX) has a present annualized yield of 5.15% whereas Constancy Tax-Exempt Cash Market Fund Premium Class (FZEXX) has a yield of three.76% or 27% decrease than FZDXX. To be within the 2023 24% federal marginal tax bracket, one’s adjusted gross earnings could be between $95,376 and $182,100 for a single tax filer and $190,751 and $364,200 for married submitting collectively. For earnings greater than these brackets, proudly owning municipal cash market and bond funds might make sense. There are different components to contemplate as effectively.

“Medicare Premiums 2024: IRMAA for Components B and D” by Donna Levalley at Kiplinger describes how Medicare Components B and D are elevated based mostly on earnings. Earnings from tax-exempt funds is just not included in Adjusted Gross Earnings for federal taxes; nevertheless, they’re included in Modified Adjusted Gross Earnings (MAGI) for Medicare Premium calculations.

Ben Geier (CEPF) wrote “IRA Required Minimal Distribution (RMD) Desk for 2024” at Good Asset describing how RMDs enhance with age based mostly on the IRS’ Uniform Lifetime Desk. Required Minimal Distributions begin at about 3.8% of tax-deferred property at age 73 however enhance to over 6% at age 85 which when mixed with pensions, Social Safety, and funding earnings, might push a retiree into a better tax bracket or influence Medicare Premiums.

For these with a big share of property in tax-deferred Conventional IRAs and 403b plans, the time in retirement earlier than beginning to attract Social Safety and/or earlier than RMDs begin is a perfect time to transform a standard IRA into Roth IRA whereas earnings could be stored low. Within the occasion that the 2017 Tax Cuts and Job Act expire on the finish of 2025, one might take into account that there are benefits to doing a Roth Conversion whereas taxes are decrease.

FINANCIAL PLANNING

Key Level: Right here is an instance template for monitoring the Bucket Method for a number of account varieties.

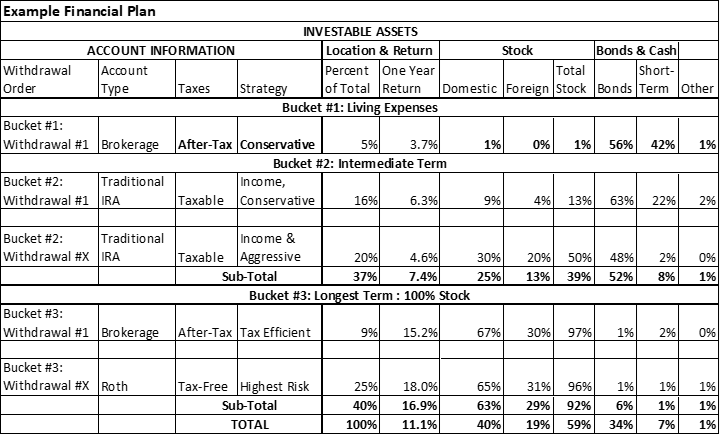

Desk #2 is a template that I exploit to assist family and friends in addition to myself with monetary planning. It begins by itemizing accounts so as of withdrawals. The accounts must be aligned for threat and tax effectivity. The allocation to every bucket relies upon upon time horizon, quantity of financial savings, assured earnings, bills, and threat tolerance.

Desk #2: Writer’s Monetary Planning Instrument Template

My technique is to do reasonable Roth Conversions for the subsequent few years till RMDs start. Bucket #1 (Dwelling Bills) can be replenished from Conventional IRAs in Bucket #2. I’ll proceed to fulfill with my Monetary Planners and alter as justified.

FUNDS BY BUCKET AND ACCOUNT TYPE

Key Level: Potential funds are listed for every bucket and account kind.

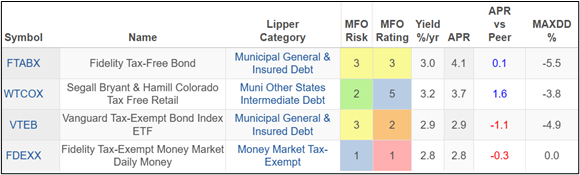

For these wishing to attenuate taxable earnings, Bucket #1 may comprise conservative municipal cash markets and bond funds equivalent to these proven in Desk #3.

Desk #3: Bucket #1 (Quick Time period): Tax Environment friendly Funds – 1 12 months Metrics

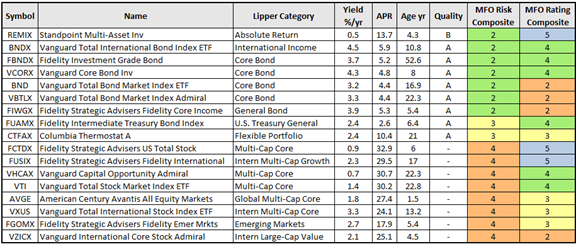

Tax-deferred accounts are perfect for holding tax-inefficient bonds which might be taxed as extraordinary earnings in Bucket #2. They might comprise largely tax-inefficient bond funds equivalent to these proven in Desk #4. Accounts later within the withdrawal order might have greater allocations to shares the place tax effectivity is just not a precedence. Constancy Advisor funds are solely obtainable to these utilizing their wealth administration providers.

Desk #4: Bucket #2 (Intermediate Time period): Funds for Tax Deferred Accounts – 1.5 12 months Metrics

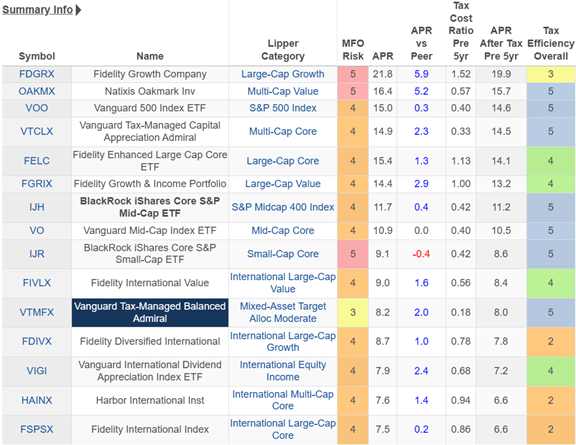

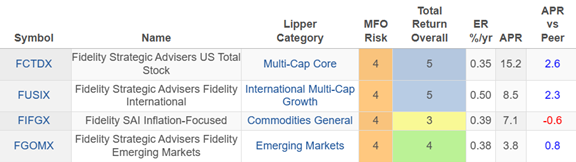

Bucket #3 can have a better allocation to shares in tax-efficient after-tax accounts as proven in Desk #5. These are often index funds or these with low turnover. Roth IRAs aren’t restricted to tax-efficient funds and are proven in Desk #6. Roth IRAs could also be perfect for actively managed funds with greater turnover and/or greater dividends.

Desk #5: Bucket #3: Funds for Taxable Accounts – 5 12 months Metrics

Desk #6: Bucket #3: Funds for Roth Accounts – 5 Years Metrics

Closing

The ideas on this article aren’t new. Altering my mindset from saver to retiree was new for me. I had a monetary plan and labored with Monetary Planners, however adjustments introduced new enlightenment. The Planners have mentioned extra adjustments for later within the yr. Monetary Planning is a journey, not a vacation spot.

One of many objects on my Colorado Bucket Listing is to go to Yellowstone Park. I’ve now booked that journey and am busy planning my subsequent journey on what to see and do. Prior to now month, I’ve taken a day journey to a nature space and one other to the Drala Mountain Heart. Life in retirement is nice!