Should you’re new to actual property and making ready to make a suggestion on a property, you could be questioning what mortgage is greatest for a first-time house purchaser.

That is particularly essential now that mortgage charges have basically doubled, placing budgets entrance and middle.

It additionally means the favored 30-year mounted is now not the default choice for house patrons, with cheaper adjustable-rate mortgages now a consideration.

Whereas each seasoned householders and first-time patrons could wind up with the identical actual house mortgage, there are further choices to contemplate in case you’ve by no means purchased a house earlier than.

Let’s discover the numerous mortgage selections obtainable at present to find out what could be greatest within the present surroundings.

Residence Mortgage Varieties to Contemplate If You’re a First-Time Purchaser

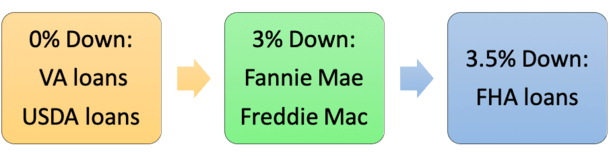

- Fannie Mae HomeReady (3% down fee)

- Freddie Mac Residence Doable (3% down fee)

- FHA loans (3.5% down fee)

- VA loans (0% down fee for vets/lively obligation)

- USDA loans (0% down fee for rural house patrons)

- State Housing Finance Company loans (down fee help and assist with closing prices)

- Additionally search for native and nationwide grants for first-time house patrons and Mortgage Credit score Certificates (MCCs)

I’ve listed the most typical mortgage sorts obtainable to first-time house patrons, a lot of that are additionally an choice for present householders.

These typically don’t require a lot by way of down fee, which appears to be a chief want/need for first-time patrons that don’t have the fairness of move-up patrons.

Personally, I want to put down 20% on a house buy to keep away from pricey mortgage insurance coverage and to acquire a decrease mortgage charge, however I perceive that isn’t at all times practical.

If a veteran/lively obligation, there are VA loans that require 0% down fee and include decrease mortgage charges relative to different mortgage sorts.

If shopping for in a rural space, USDA loans additionally enable 0% down fee and aggressive mortgage charges.

There are fewer restrictions on FHA loans, which require a 3% down fee however enable credit score scores as little as 580.

As well as, conforming loans backed by Fannie Mae and Freddie Mac solely require a 3% down fee.

Notice that for Fannie/Freddie loans, you will get your loan-level value changes (LLPAs) waived in case you’re a first-time house purchaser with qualifying earnings ≤100% space median earnings (AMI) or 120% AMI in high-cost areas.

Or if the mortgage is HomeReady/Residence Doable, meets Responsibility to Serve necessities, is in a excessive wants rural area, a mortgage to a Native American on tribal land, or a mortgage originated by a “small monetary establishment.”

So for these missing belongings, the packages listed above are in all probability start line, particularly in case you qualify for LLPA waivers.

Is Your First Residence a Starter Residence or a Ceaselessly Residence?

- All the time take into consideration how lengthy you’ll keep within the property you’re shopping for

- It could be potential to save cash by selecting an ARM in case you plan on transferring quickly

- Many first-time patrons move-up to bigger properties inside just a few brief years

- Your anticipated tenure can also be a key consideration with regard to paying factors

When you select a mortgage sort, you possibly can determine on a selected mortgage program, reminiscent of a 30-year mounted, 15-year mounted, or an ARM.

Whereas most first-time patrons will finally go along with a 30-year mounted, let’s talk about how the property itself may dictate your financing determination.

The first factor I’d contemplate when shopping for a primary house could be how lengthy you propose to maintain it. A whole lot of of us purchase what are referred to as “starter houses” initially, then transfer as much as bigger houses inside just a few years.

For instance, in case you simply received married and wish to purchase a house subsequent, you may additionally be fascinated about beginning a household shortly after that.

This typically ends in outgrowing that first house, and requiring a brand new, bigger property. Relying in your timeline, this might all occur inside only a few years.

In that case, it may make sense to go along with a hybrid adjustable-rate mortgage (ARM) such because the 5/1 ARM or 7/1 ARM.

Whereas mounted mortgage charges aren’t rather more costly than ARMs for the time being, this isn’t at all times the case. Generally it’s considerably cheaper to go along with an ARM.

And these hybrid ARMs supply a fixed-rate interval for the primary 5 or seven years earlier than you even have to fret about an rate of interest adjustment.

In different phrases, it operates precisely like a 30-year fixed-rate mortgage up till its first adjustment – by then you possibly can have already bought and moved on to a brand new property.

Tip: It could be simpler to skip the starter house as a result of entry-level houses are typically essentially the most in demand. You might even keep away from having to maneuver a second time!

Be Conscious About Paying Factors Upfront

One other consideration is whether or not or to not pay mortgage factors – once more, how lengthy you propose on staying has rather a lot to do with it.

These factors are a type of pay as you go curiosity that decrease the rate of interest you obtain in your mortgage. In brief, you pay at present (at mortgage closing) for a reduction whilst you maintain the mortgage.

For instance, you would possibly pay one level for a 0.375% low cost in charge for the subsequent 30 years.

Nonetheless, there’s no level (no pun supposed) in paying factors on a mortgage you’ll solely preserve for just a few years. Usually it takes a few years to break-even on low cost factors paid.

Even in case you keep within the house, you might refinance your mortgage sooner reasonably than later, making factors a shedding proposition.

Contemplate the present mortgage charge surroundings, and the place rates of interest could possibly be headed after you purchase.

The exception to this could be a momentary buydown, particularly if it’s paid for by the lender or vendor, because you get the total worth within the first couple years. Or doubtlessly a refund in case you refinance/promote early.

You Don’t Need to Be Home Poor

- You might expertise fee shock or change into home poor when shopping for your first house

- This implies going from paying a comparatively small quantity to a big quantity month-to-month

- Additionally contemplate the opposite payments you’ll must pay like householders insurance coverage and property taxes

- Don’t take a look at the mortgage like a nasty debt, it’s typically the most cost effective debt you’ll have the enjoyment of repaying

It could be tempting to go along with a shorter-term mortgage such because the 15-year mounted, seeing that it may possibly minimize your curiosity expense considerably. However it is going to additionally practically double your month-to-month fee.

One factor mortgage lenders contemplate when extending house loans to first-time patrons is fee shock.

Merely put, in case you go from paying $1,000 monthly in hire to $3,000 on a mortgage, they might fear that you just’ll have a tricky time adjusting to the upper funds.

And so they have good purpose to fret as a result of it’s all supported by information.

Even if you’re authorised for a shorter-term mortgage, it could be higher to take issues sluggish as a substitute of going all-in on the mortgage.

Certain, it’s nice to repay a big debt shortly, however a mortgage is usually a good debt, and is commonly the most cost effective debt you’ll have.

Regardless of the 30-year mounted coming in nearer to six.5% or greater at present, it’s nonetheless comparatively low-cost in comparison with different debt like bank cards and so forth.

And, it’s at all times potential to make further mortgage funds if you wish to pay your mortgage off early, no matter which mortgage program you select.

So you will get the flexibleness of a 30-year mortgage with the choice to prepay it like a 15-year mortgage in case you so select.

Verify Out Residence Mortgage Packages Solely for First-Time Patrons

- Go to your state’s housing finance company to see what particular packages they provide

- It could be potential to get a mortgage with nothing down in case you don’t have a lot cash saved up

- Additionally seek for first-time house purchaser grants and Mortgage Credit score Certificates which may be obtainable to you

- Evaluate each conventional and first-time purchaser mortgage packages to find out best choice

Whereas it’s potential to use for any house mortgage on the market, sure mortgage packages are reserved just for first-time house patrons.

These are supposed to be extra accommodating to those that could have bother qualifying, typically attributable to down fee.

Should you take a look at your state’s housing finance company (HFA) for homebuyer help, it is best to see mortgage packages geared particularly towards first-time patrons.

This may embrace down fee help, closing price help, or each, helpful in case you haven’t saved a lot prior to buy.

One current instance is the Dream For All Shared Appreciation Mortgage, which doesn’t require a down fee however works as in case you put 20% down.

Notice: These housing companies should not lenders, so that you’ll must analysis them then use their “discover a mortgage officer” part to see which lenders supply their merchandise.

It’s also possible to do that in reverse in case you’re already working with a lender. Ask what HFA packages they provide to first-time house patrons.

It could even be potential to get a first-time house purchaser grant with a big financial institution, native credit score union, or direct mortgage lender.

Make sure you seek for native grants as a result of they’re typically forgivable, that means it doesn’t have to be paid again!

One instance is the U.S. Financial institution Entry Residence Mortgage, which affords as much as $12,500 in down fee help and a lender credit score as much as $5,000.

The one caveat to a few of these mortgage packages is that you just would possibly want to finish a homeownership class, although it may be helpful and is often fairly primary and never all that point consuming.

One other perk first-time patrons would possibly have the ability to make the most of is a Mortgage Credit score Certificates (MCC), which may scale back your tax legal responsibility, thereby saving you cash not directly in your mortgage.

It could additionally let you qualify for a bigger mortgage quantity in some circumstances.

Lastly, look past mortgage packages for first-timers. You might not want any particular mortgage program, and it may truly be cheaper to stay to a conventional one as a substitute.

Who Are the Greatest Mortgage Lenders for First-Time Patrons?

I don’t know of 1 financial institution or lender that focuses on financing for first-time house patrons, although there are corporations that solely cater to house patrons, reminiscent of Tomo.

And with mortgage charges considerably greater at present, most lenders are pivoting to be house shopping for specialists anyway.

Look out for particular affords and incentives because the mortgage market turns into largely purchase-driven.

In the end, you’ll in all probability discover a variety of the identical mortgage packages irrespective of the place you look, barring a number of the distinctive choices mentioned within the prior part associated to grants and state housing companies.

This implies you’ll have the ability to get an FHA mortgage, USDA mortgage, or VA mortgage from most banks/lenders on the market. The one distinction could be the mortgage charges and/or lender charges.

You must also have the ability to acquire a Fannie Mae HomeReady or Freddie Mac Residence Doable mortgage from nearly any lender.

As famous, each require simply three % down when buying a house and include different potential pricing reductions.

Contemplate a Mortgage Dealer If You’re a First-Time Residence Purchaser

As a substitute of specializing in a single lender, it could be higher to get in contact with an skilled mortgage dealer, particularly in case you’re a first-time purchaser.

These people can information you thru the mortgage course of and evaluate charges and packages from dozens of lenders directly.

Or construction your mortgage to avoid wasting on mortgage insurance coverage and/or mortgage charge with particular down funds.

They are often useful in case you have a lot of mortgage questions, which is commonly the case for somebody buying their very first house.

You may not get the identical degree of service with a big financial institution or call-center lender.

Alternatively, you possibly can attain out to a HUD-approved housing counselor in case you want one-on-one help or are unsure of the place to show for financing.

An skilled actual property agent may be useful, as a lot of them are fairly well-versed in mortgages.

Simply make sure you due your personal diligence and look past their very own suggestions. You don’t have to make use of their “particular person.”

In the end, educating your self on mortgages earlier than reaching out to others could be one of the best ways to start out your property shopping for journey. Being educated means being financially empowered.

Maybe the “greatest mortgage” for a first-time house purchaser is just one they absolutely perceive.

Learn extra: What is an efficient value for a first-time house purchaser?