That is that point within the funding world once you as an investor is leaping in hoping to make it massive. It’s a time once you say – “what can go mistaken now?”

You’re in all probability pulling cash out of Mounted Deposits and conservative choices and put money into fairness.

Why not?

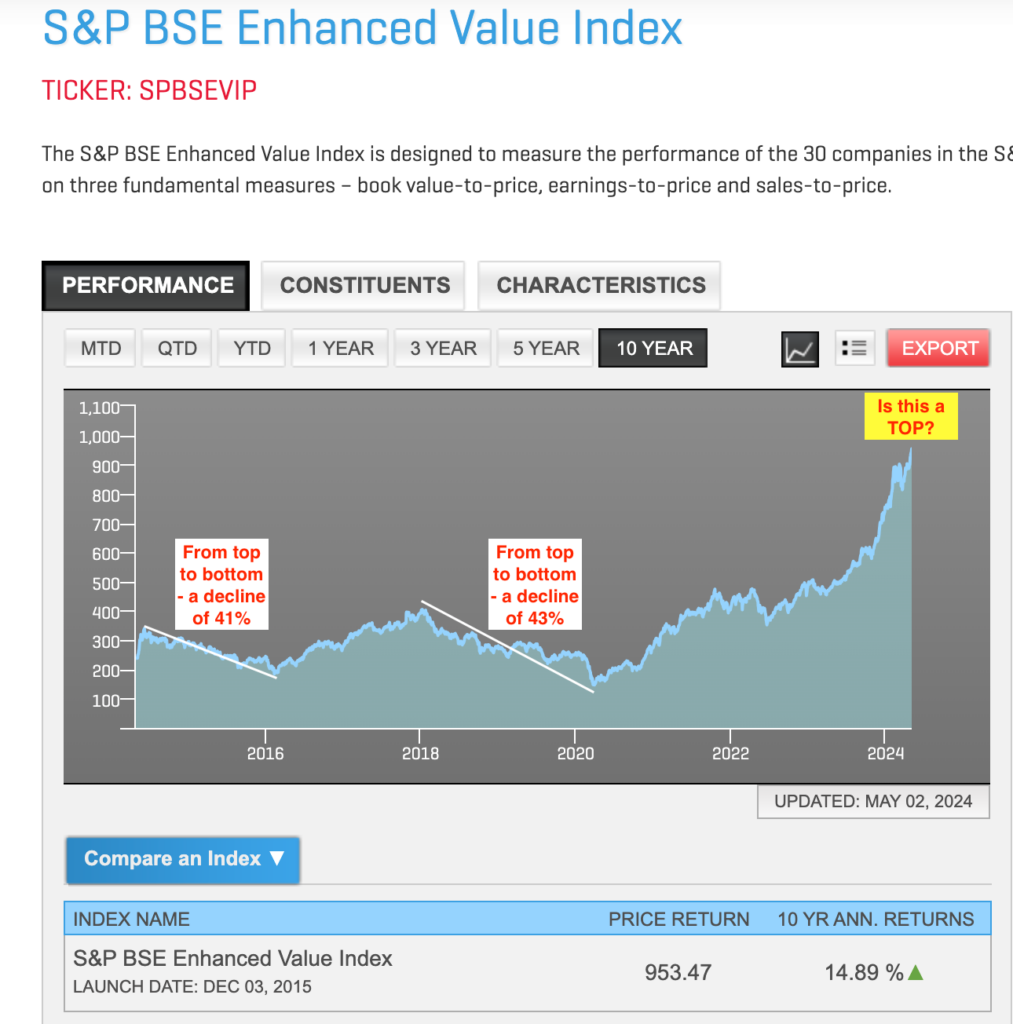

Right here’s an instance. Within the final 1 12 months, BSE S&P Enhanced Worth Index has grown by 90.45% (as on Could 2, 2024). The CAGR for the final 5 years is a formidable 27.37%.

In case you go to Worth Analysis and type (descending order) the funds for final 1 12 months efficiency, Motilal Oswal BSE S&P Enhanced Worth Index fund (a 30 inventory portfolio which replicates the above index) ranks #1 with an astounding return of 95.46%.

Sufficient to make anybody’s mouth water! And in case you are NOT an investor right here, makes you punch your self to have missed out on this performer extraordinaire’.

One of the best of occasions, the worst of occasions

As within the instance above, these are occasions when even worth investing, which is the not thought-about an thrilling technique to put money into the markets, is roaring.

Martin Currie of Franklin Templeton Investments has written a publish “Is worth investing set to roar again within the 2020s?

JP Morgan asset administration printed an analogous view too.

I’m not positive when you’ve got heard of the Quantum Lengthy Time period Fairness Worth Fund, a predominantly massive cap fund which swears on its worth orientation. Even this fund lastly appears worthy – once more. The funds’ 10 12 months CAGR is at 14.45% and 15 12 months CAGR is at 17.39% (as of Could 2, 2024).

Its one 12 months return alongside and of different worth oriented funds is now within the 40s and 50s.

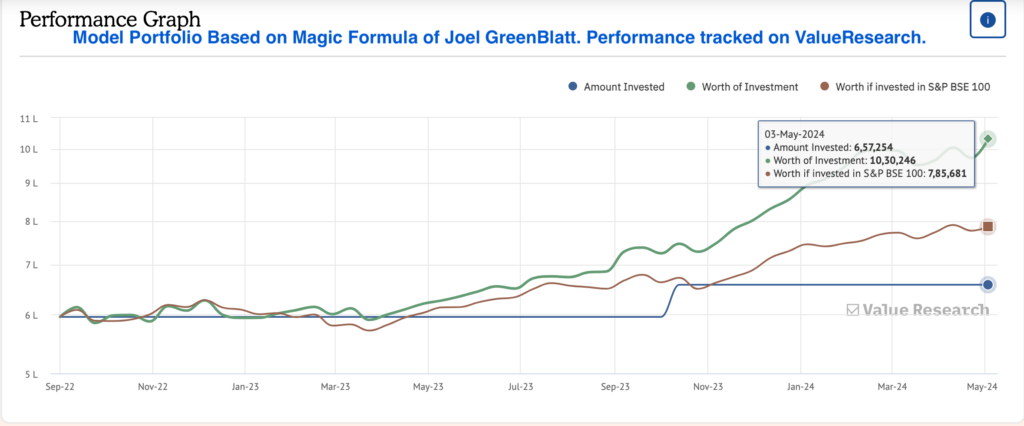

I too monitor a mannequin portfolio primarily based on Joel GreenBlatt’s Magic Method utilizing a mixture of high quality and worth.

The final 12 months return of 66% is a success out of the stadium.

Now, are you getting get carried away with these superlative numbers?

Let me present you the opposite facet of the story.

You see, worth investing shouldn’t be a simple operation to run. Quantum’s Lengthy Time period Fairness Worth fund underwent a really tough interval.

In case you take a look at the BSE S&P Enhanced Worth Index, the historic ten 12 months CAGR of the index is 14.89%. A far cry from the final 12 months’s 90%.

Within the final ten years, it additionally had two durations of nice decline – down by 40%+. See picture beneath.

Equities are risky. They go up after which they arrive down in worth.

Take a very good look once more on the picture above and see what occurs as soon as the fund makes form of a high. What’s subsequent?

It appears to be like scary not only for worth investing however for anybody who’s throwing warning to the winds.

—

Don’t overlook Asset Allocation

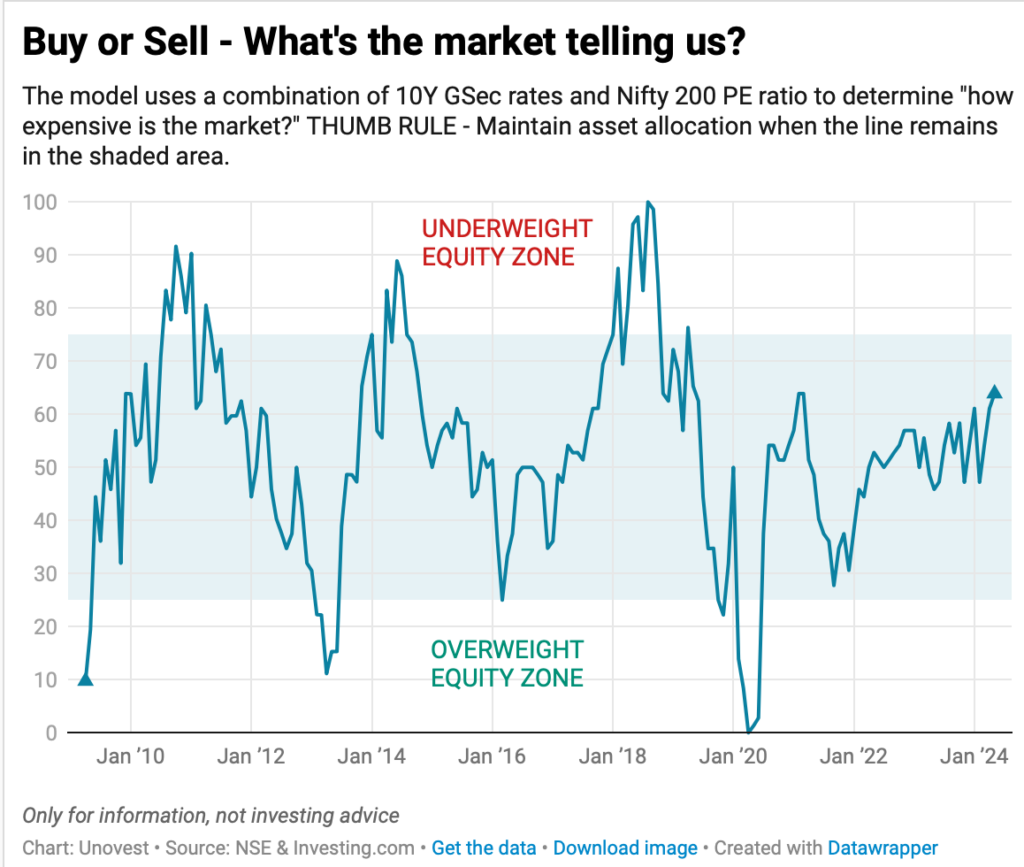

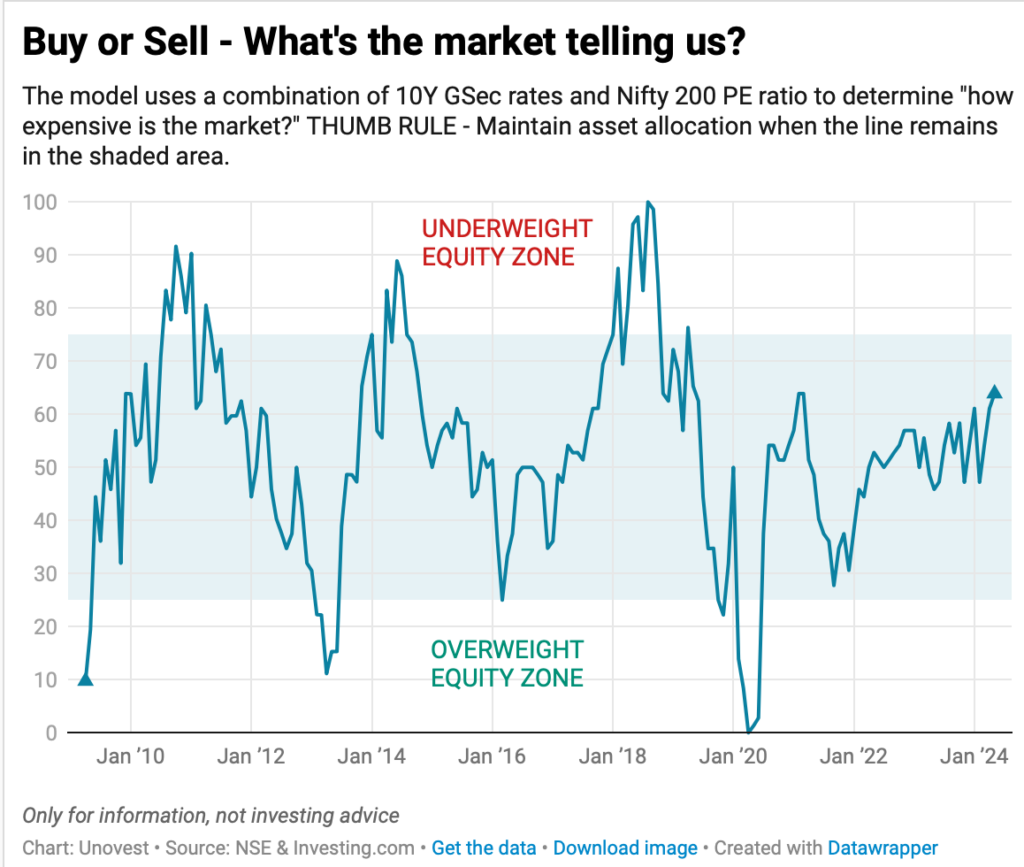

Let’s additionally check out what the asset allocation mannequin is telling us now?

The message is straightforward.

Don’t get grasping.

Comply with a plan.

Worth investing has arrived or not, the most secure and the sanest technique to trip the vagaries of the market is “asset allocation“.

Bengaluru of us: If you want to satisfy up on Could 18 or Could 19 in Bengaluru metropolis, do write again to me.