A colleague lately requested me to run the 30 12 months annual returns for U.S. shares, bonds and money.

He simply needed the returns. I couldn’t assist however slice and cube the numbers and overanalyze the info as a result of that’s what we do right here.

Let’s dig in.

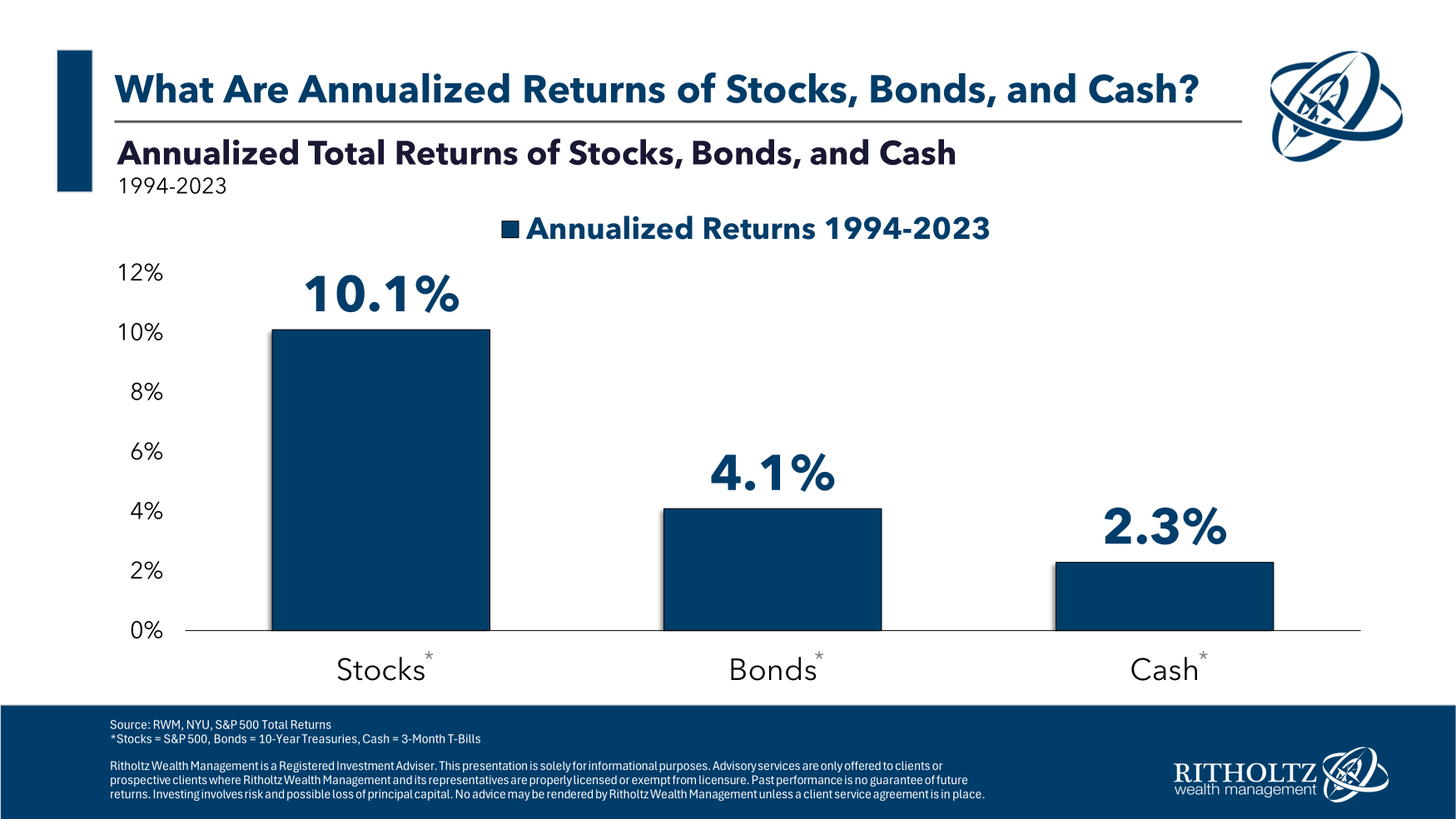

First the annual return numbers for the S&P 500, 10 12 months treasuries and three month T-bills over the 30 years ending in 2023:

Some ideas about these numbers:

Inventory returns look common regardless of the turmoil. From 1994 to 2023, there was the dot-com bubble, a 50% crash, 9/11, a housing bubble, the Nice Monetary Disaster (which got here with one other 50%+ crash), a handful of wars, 3 recessions and a pandemic.

And but…the inventory market was up 10% per 12 months.

We had booms and busts, ups and downs, good and dangerous, however issues nonetheless turned out OK.

No ensures in regards to the future however that’s nonetheless fairly spectacular.

Bond returns weren’t dangerous regardless of the bear market. Yields on authorities bonds have been under common for a while now. We’re nonetheless within the midst of the worst bond bear market of all-time.

In 2022 and 2023, 10 12 months Treasuries have been down 22% in whole.1

The 5 worst calendar 12 months returns for U.S. authorities bonds since 1928 have all come prior to now 30 years. Three of these 5 years have occurred since 2009.

Beginning yields have been larger within the mid-Nineties2 and falling charges helped, particularly within the first decade of this century.

However 4% returns are usually not dangerous contemplating how bizarre the yield state of affairs has been for the previous 15 years or so.

Money returns have been respectable regardless of 0% yields for therefore lengthy. T-bill returns of somewhat greater than 2% per 12 months aren’t nice when contemplating inflation within the 30 years ending 2023 was 2.5% per 12 months.

Greater than half (16) of the previous 30 years have been returns beneath 2%. Eleven occasions the returns have been beneath 1% in a calendar 12 months.

However now T-bill yields are over 5%!

I don’t know the way lengthy that’s going to final but it surely means returns are a lot larger (for now) than they’ve been in a few years.

The truth is, the prospects for money and bonds are each in a significantly better place than they’ve been in a while.

Listed below are some extra quick-hit stats:

- Shares have been up 80% of the time over the previous 30 years. The inventory market was down double digits 4 occasions however up double digits in 19 out of 30 years. 4 out of each 10 years the S&P 500 was up 20% or extra. The perfect annual return was +37%. The worst annual return was -37%.

- Bonds have been up 80% of the time over the previous 30 years. The bond market was down double digits twice (2022 and 2009) and up double digits in 9 years. The perfect annual return was +24%. The worst annual return was -18%.

- Money didn’t have a single unfavorable (nominal) 12 months but it surely additionally had the worst annual returns over the previous 30 years. The perfect annual return was +6% whereas the worst return was 0%.

I don’t know what the subsequent three a long time will carry however there’ll probably be recessions, bear markets, geopolitical crises, battle, perhaps pestilence, and who is aware of what else.

However I do know that not investing your cash ensures you’ll fall behind inflation.

And I’ve a sense threat shall be rewarded with larger returns.

I simply don’t know precisely what these returns shall be.

They wouldn’t be known as threat belongings if there was no threat.

Additional Studying:

Historic Returns For Shares, Bonds & Money

1That means yields included.

2Round 6% heading into 1994.

This content material, which comprises security-related opinions and/or info, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here shall be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory companies. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency will not be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.