You could have heard of goal date funds as the favored selection for retirement savers within the US. So, why are they not the default right here? The new Retirement digiPortfolio by your neighbourhood financial institution is about to vary that, however guess what’s even higher? It goes above and past what a goal date fund can provide, since you possibly can personalise your individual retirement age as an alternative of getting to stay to the fund’s preset ending 12 months. It doesn’t have to finish there both – in order for you, you possibly can even go for DBS to proceed managing the portfolio for you thru your retirement (whether or not it’s 20 / 30 / 40 years of it!)

Robo-advisors are a well-liked answer for amongst each the younger and dealing adults who want to get began with investing however

- Don’t actually know how one can make investments for retirement

- Too busy with work, not a lot time left to review the markets

- Need skilled assist…however don’t wish to pay for the energetic administration charges and gross sales expenses related to human advisors

Nonetheless, after the closure of unbiased robos Neatly after which MoneyOwl, the repute of robo-advisors in Singapore has suffered successful. To keep away from an analogous destiny, some buyers would relatively go for robo-solutions provided by banks, that are perceivably safer and doesn’t depart the portfolio fully within the fingers of preset algorithms and robots.

There’s solely 3 to select from proper now, and probably the most accessible is the DBS/POSB digiPortfolio, which is offered in-app for the hundreds of thousands of DBS and POSB prospects in Singapore.

Lots of it’s possible you’ll already be invested in a digiPortfolio as a result of it helps you earn extra bonus curiosity in your DBS/POSB Multiplier account 🐰.

Message from DBS:

We created digiPortfolio to democratise entry to wealth to everybody, as a part of our financial institution’s mission in the direction of monetary inclusivity.

Such curated portfolios had been beforehand solely accessible to excessive internet price (HNW) prospects with investments of S$500,000 and above.

With a simple-to-understand, ‘hands-off’, ready-made portfolio, beginning at an reasonably priced S$100, you don’t want to carry off on investing anymore.

For these of you who bear in mind, when DBS/POSB first launched their hybrid-human robo-advisory answer i.e. digiPortfolio again in 2019, they made the sudden transfer of opening up entry to DBS funding workforce’s experience which was beforehand restricted to the financial institution’s excessive internet price shoppers solely. Since then, they’ve grown their choices from 2 to five, so now you can select and even arrange totally different portfolios to suit your investing goals.

I’ve beforehand reviewed the opposite 4 portfolios right here (Asia and International) and right here (SaveUp and Earnings), so you possibly can examine these out.

Overview of Retirement digiPortfolio

Bear in mind goal date funds? It’s an age-based funding technique the place you’re taking extra threat if you’re youthful, and get extra conservative as you close to your goal retirement 12 months. Equally, DBS/POSB Retirement digiPortfolio follows the identical glidepath technique (that’s why you see the advert with the surfer gliding the waves!), however that is the place the similarities finish and Retirement digiPortfolio comes out superior.

TLDR: TDFs are cohort-based the place all buyers make investments in line with the TDF’s pre-determined finish date. For instance, a 2030 TDF’s glidepath is fastened for all its buyers and can de-risk from immediately to 2030.

Retirement digiPortfolio, alternatively, is extra versatile and allows you to set your individual retirement age relatively than finish date. What’s extra, if a person needs to tweak their retirement age in a while, the portfolio will mechanically calibrate the asset combine to the person’s life stage and retirement timeline at any time.

There’s extra! After retirement, Retirement digiPortfolio permits buyers to automate their drawdowns through a decumulation withdrawal plan in line with their retirement revenue wants.

Sounds good, however how precisely does this work?

On this article, I’ll be diving into their newest Retirement Portfolio to know the way it works, who it’s good for (and who isn’t), and why.

How ought to your funding portfolio seem like?

A holistic portfolio sometimes has a mixture of totally different asset lessons (e.g. shares, bonds, property, money), with the proportions adjusted accordingly to the investor’s wants.

The perfect portfolio is one which means that you can sleep nicely at night time whereas compounding over time for long-term beneficial properties.

To realize this, any savvy investor will inform you that you want to design and modify your portfolio as your age and threat urge for food adjustments.

- Whenever you’re youthful with out a lot monetary commitments or dependents (kids / aged mother and father), you possibly can normally afford to tackle extra dangers with a higher publicity to equities and shares. This allows you to capitalise on long-term progress and compounding over the following few a long time.

- As you progress into your subsequent life stage, your monetary duties enhance and also you abruptly can’t afford to threat a lot anymore, lest you lose cash meant in your mortgage or kids’s college faculty charges.

- As you inch nearer to retirement, you’ve got much less time left to capitalize on market progress, so that you begin caring extra about having steady, fastened revenue. Your coronary heart can not take as a lot volatility as you probably did in your early profession years.

A simple manner to consider it could be to allocate in another way based mostly on age.

For instance:

In your 20s – 30s: 80% shares, 15% fastened revenue, 5% money

In your 40s – 50s: 60% shares, 35% fastened revenue, 5% money

In your 60s – 80s: 15% shares, 80% fastened revenue, 5% money

Word: These usually are not prescribed percentages. Chances are you’ll want to modify your individual based mostly in your preferences and threat urge for food.

That is also called a glidepath technique, and you’ll then manually rebalance your portfolio as you age so that you just shield your beneficial properties and scale back the percentages of shedding the retirement funds you painstakingly compounded through the years…within the occasion of an premature market crash.

However…what when you might automate it as an alternative?

DBS Retirement digiPortfolio overview

That is precisely what you are able to do with the DBS Retirement digiPortfolio.

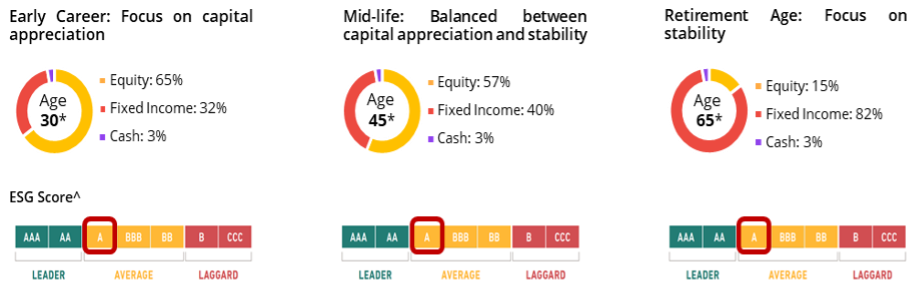

DBS has designed this portfolio based mostly on the idea that buyers ought to solely tackle threat applicable to their life stage (outlined as Early Profession, Mid-life, and Retirement).

It elements in how far-off you’re from your required retirement age, and adjusts yearly via an computerized rebalancing in your birthday.

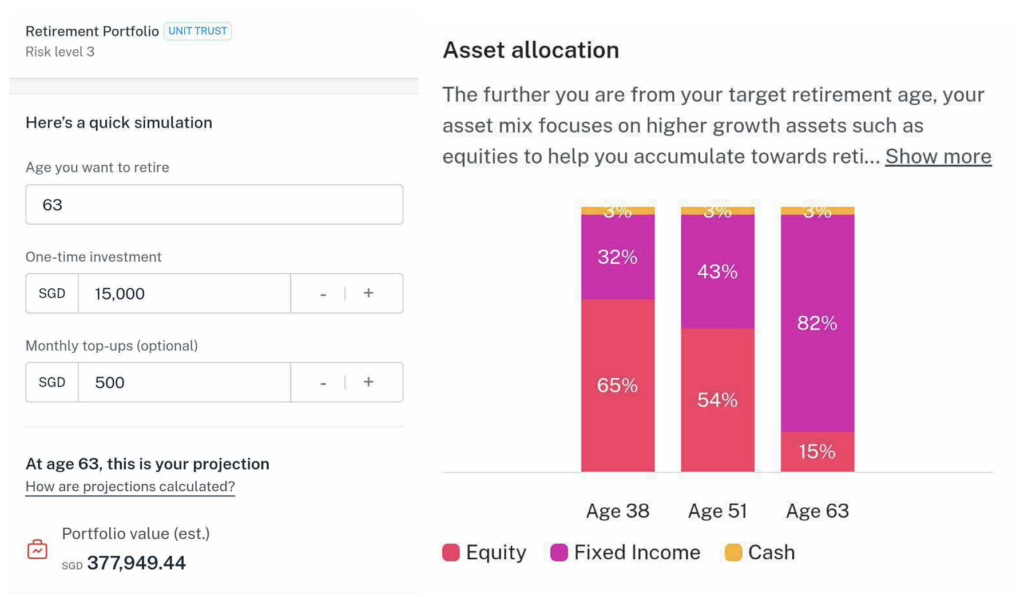

The above reveals an illustrated instance of how an investor’s asset allocation in DBS Retirement digiPortfolio can change via the years. Word that your precise portfolio allocation is predicated on your indicative years to retirement.

- Whenever you’re youthful and have an extended funding time horizon, the portfolio will allocate a higher publicity to equities vs. fastened revenue whereas preserving 3% in money.

- Yearly as you get nearer to your retirement age, the portfolio will “glide” with you and de-risk accordingly to cut back your publicity to equities, whereas placing a heavier emphasis on fastened revenue so you’re cushioned towards market volatility.

That manner, even when you’re so suay to witness a 50% market crash if you’re simply 1 12 months to retiring, your $1,000,000 retirement portfolio gained’t be affected to the extent that it abruptly drop to only $500,000 in a single day, eroding the cash that was in any other case meant to see you thru your non-working years.

What’s extra, the DBS Retirement digiPortfolio doesn’t cease even after your preset retirement age or if you begin withdrawing from it. DBS has mentioned that the portfolio will proceed to be managed in your behalf, to make sure that it stays up to date to the financial institution’s funding workforce’s newest funding views.

The way it actually works

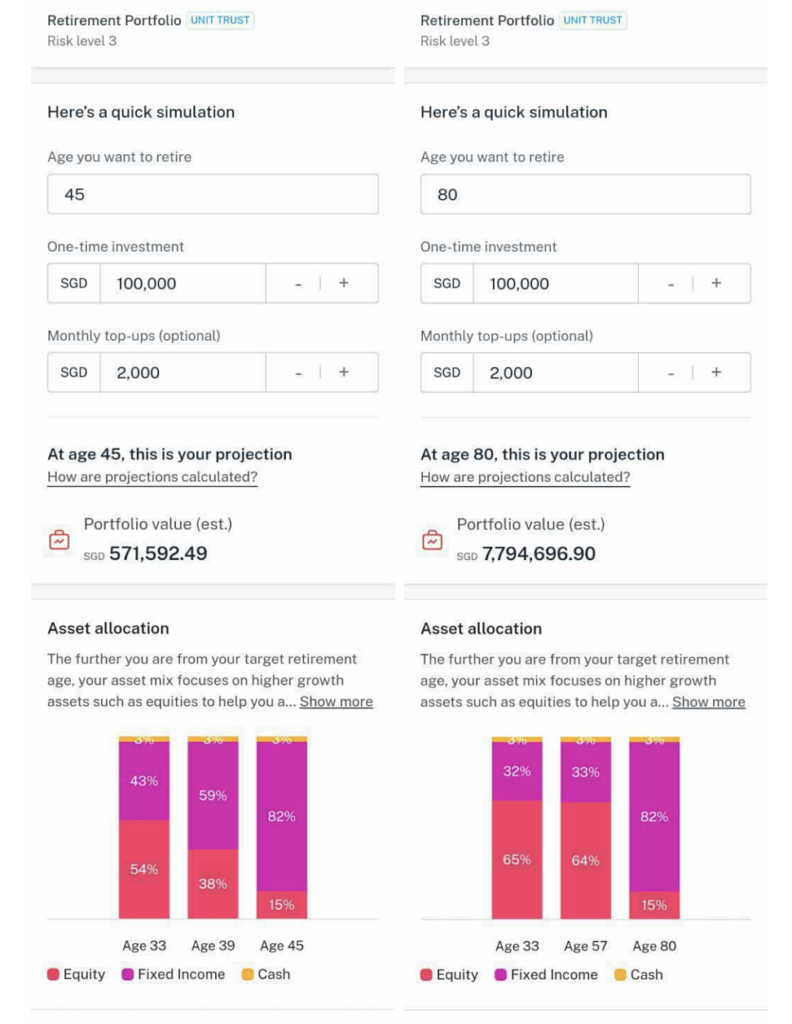

Let’s say you’ve got a sizeable pile of money financial savings now which you wish to make investments so you possibly can retire at 60, 80…or perhaps earlier at age 45.

The software reveals that when you had been to begin now and diligently add $2,000 to the portfolio each month, with over 4 a long time to compound earlier than you retire at 80, you might find yourself with an estimated $7.7 million for retirement.

However when you want to retire even earlier (35 years forward of schedule), then the identical capital injections is estimated to finish up at ~$570k if you flip 45.

In distinction, attempting to time the market with a $100,000 lump sum with out the following top-ups in a disciplined method might depart you wanting the $571k projection.

Discover how the asset allocation adjustments based mostly on how far-off you’re to the specified retirement age entered?

- Retire at 45: 54% equities, 43% fastened revenue, 3% money

(shorter time horizon to retirement) - Retire at 80: 65% equities, 32% fastened revenue, 3% money

(longer time horizon to retirement)

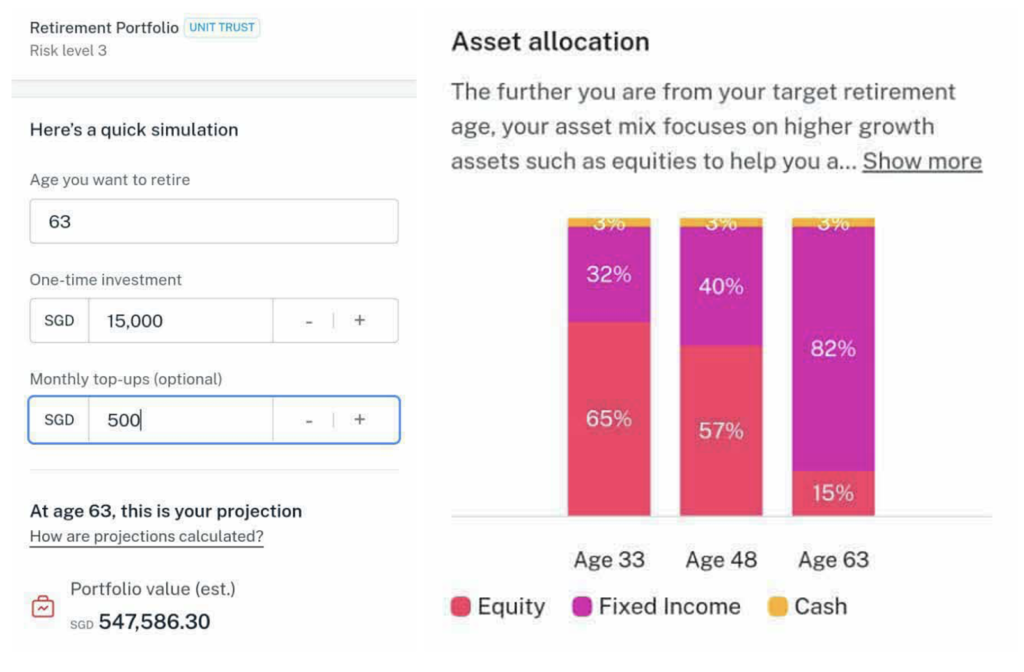

Now let’s have a look at what when you’ve got much less money and wish to decide to investing $500 a month as an alternative, whereas retiring at Singapore’s official retirement age (at present 63)?

Right here’s what the end result would seem like for an investor aged 33:

vs. somebody 5 years older:

The portfolio fashions and the ‘glidepath’ shall be professionally managed by DBS, guided by views from the DBS Chief Funding Workplace and J.P. Morgan Asset Administration. DBS says that is an extension of its years-long effort to decrease limitations of entry to investing and democratise retail buyers’ entry to wealth administration companies.

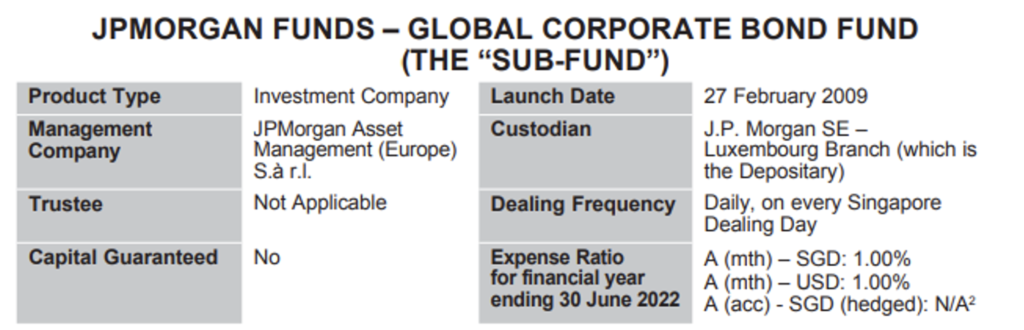

Since this retirement portfolio is created in collaboration with J.P. Morgan Asset Administration (JPMAM), in order you would possibly anticipate, all the underlying holdings are in JPMAM funds:

In abstract, for equities, your cash will go right into a US Giant-Cap fund, an Asia Development fund, a Japan fund and a Europe fund. The precise allocation will fluctuate relying on the years you’ve got left to retirement – see under for an instance:

| Investor who’s 30 years from retirement | Investor at retirement | |

| US equities | 30% | 6% |

| Europe equities | 15% | 4% |

| Asia ex-Japan equities | 15% | 3% |

| Japan equities | 5% | 2% |

| Authorities bonds | 12% | 27% |

| Company bonds | 10% | 40% |

| Rising markets debt | 10% | 15% |

For fastened revenue, your cash will get invested into models of an Rising Market bond fund, a International Company bond fund, and a International Authorities bond fund.

Based mostly on the glidepath technique, the precise combine of those fairness and glued revenue funds will change yearly to de-risk step by step in the direction of retirement.

How a lot are charges?

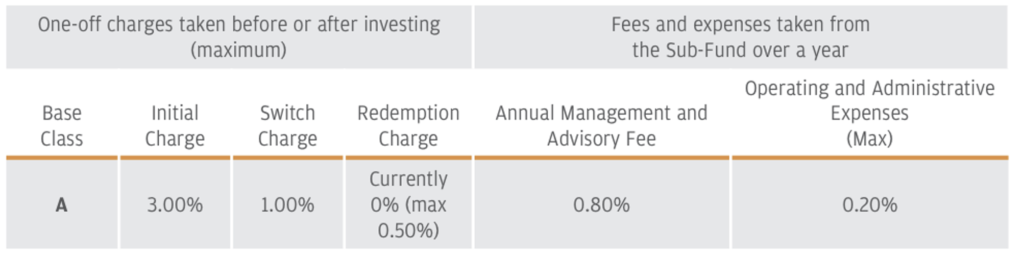

As a DIY investor, shopping for into funds and rebalancing them every time incur frequent transaction and switching prices. For many who see worth in having full-time funding groups monitor and modify methods in line with altering market conditions, you’d in all probability admire how DBS shouldn’t be charging something for the transaction prices that you’d in any other case incur by yourself if you purchase and promote instantly into these particular person underlying funds.

As a DIY investor, shopping for into funds and rebalancing them every time incur frequent transaction and switching prices. Right here’s an instance of the “Preliminary Cost” and “Swap Cost” within the desk under, that are charges that DIY buyers who select to purchase these funds instantly might incur. That is taken from simply 1 out of the 7 funds. You must, nonetheless, observe that these 2 lessons of charges are NOT relevant to digiPortfolio.

For many who see worth in having full-time funding groups monitor and modify methods in line with altering market conditions, you’d in all probability admire how DBS is not charging something for the transaction prices that you’d in any other case incur by yourself if you purchase and promote instantly into these particular person underlying funds.

Actually, outsourcing this to Retirement digiPortfolio will get it completed mechanically for you at a flat 0.75% annual administration price.

What’s extra, to make the portfolio much more accessible and reasonably priced for buyers with retirement in thoughts, charges will fall even additional to only 0.25% p.a. (as an alternative of 0.75% p.a.) when you hit your chosen retirement 12 months.

Now that you just perceive how the product works, let’s dive into who it is likely to be appropriate for, and who wouldn’t.

Who this portfolio is for vs. who it isn’t

Who it is likely to be for

Realizing all the above, you possibly can think about the Retirement Portfolio if:

- You wish to make investments to construct your wealth for retirement through the years

- You’re busy along with your profession or private life, and actually don’t have the time to actively monitor markets

- You’re feeling safer with the reassurance of specialists serving to you in your portfolio, but additionally wish to pay a decrease price for it

- You propose to cut back your threat publicity from progress to stability as you get nearer to your goal retirement age. Doing it your self shall be extra tedious and you want to be ready incur fairly a little bit of charges if you promote and purchase totally different holdings with the intention to de-risk your portfolio

- You want to complement your different retirement plans (e.g. CPF Life) to attain your required retirement targets

Who it may not be for

However when you’ve already arrange your individual funding portfolio on one other platform and desire to proceed actively managing your complete portfolio by your self, then this answer might not appear as enticing to you. Outsourcing it to DBS will incur 0.75% p.a. flat price for the portfolio administration, so for people preferring to DIY 100% and usually are not eager on diversifying exterior of it, it’s possible you’ll not discover this as compelling.

For buyers additionally desire to put money into passive exchange-traded funds monitoring the market as an alternative of professionally-managed energetic unit trusts and mutual funds, it’s possible you’ll then not admire such a portfolio.

That is additionally not appropriate for these who wish to use their joint account to fund and make investments in the direction of their joint retirement portfolio, as a result of DBS at present solely accepts funding from particular person accounts. You have to to make use of your individual single account to fund or obtain revenue from this digiPortfolio as an alternative.

And for {couples} who wish to use this to speculate in the direction of their joint retirement portfolio, this may not be appropriate in your wants because the portfolio was designed based mostly on the investor’s age to retirement. Plus, I can see why this could be a tough process for DBS/POSB to fulfil (i.e. even my husband and I aren’t the identical age, and we actually gained’t be retiring in the identical 12 months!)

The workaround answer can be to speculate individually – not tough since DBS has made it such which you could arrange inside only a few faucets in your digibank app.

Conclusion

The DBS Retirement digiPortfolio is a welcome addition to the financial institution’s robo-advisory choices as a result of it lastly presents an all-in-one portfolio answer for people wanting to speculate for retirement and comes with no lock-ins or penalty expenses.

Previous to this, your solely different possibility was to DIY or to make use of one other robo (largely not backed or owned by the banks).

After all, in case your focus is solely on lowest charges, then you must observe that from a price perspective, DIY virtually all the time wins.

The larger query is whether or not YOU can efficiently DIY. Should you can, nice!

Most buyers, sadly, fail to stay to the plan and make emotional choices corresponding to staying out of the markets when it crashes, or piling in as a result of FOMO when the markets are rallying (like now). If that’s what you’ve got been doing too, then perhaps you want a unique answer.

Additionally do not forget that when you had been to commerce or prime up your funding usually, each single transaction will incur a price. Alternatively, a plan like DBS digiPortfolio adopts a price construction the place prospects can prime up, withdraw, or practise dollar-cost averaging a number of occasions all through the month and nonetheless solely incur the 0.75% p.a. price – nothing extra.

With digiPortfolio, it makes it simple for you automate your investments so you possibly can make investments via dollar-cost averaging and keep invested available in the market to construct your long-term wealth.

In any case, actively managing your portfolio and manually rebalancing it may be time intensive. It requires you to trace altering asset values, and manually make choices to purchase or promote. Should you don’t benefit from the work (like I do), it may be arduous to remain the course.

TLDR: DBS Retirement digiPortfolio is price contemplating in your long-term funding goal of retirement, as it may be automated to

- care for your portfolio asset allocation and de-risks step by step annually in the direction of your retirement

- helps you dollar-cost common

- ensures your self-discipline and that you just keep invested

- removes emotional decision-making which may negatively have an effect on your long-term funding returns

and extra importantly, unencumber time so you are able to do what you’re keen on, whereas understanding that your long-term retirement wants are being taken care of.

Sponsored Message

Attempting to speculate in your retirement however don’t understand how?

Faucet on “Make investments” in your DBS/POSB digibank app and choose digiPortfolio to try the DBS/POSB Retirement portfolio immediately!

Disclosure: This text is dropped at you in collaboration with DBS, who helped to make sure that all the pieces I write right here is factual and correct. All opinions are of my very own.

Disclaimers:All investments include dangers and you'll lose cash in your funding. The Retirement digiPortfolio consists of funds which can be topic to market fluctuations and different dangers.

This text is written in collaboration with DBS Financial institution Ltd, Firm Registration. No.: 196800306E ("DBS”), an Exempt Monetary Adviser as outlined within the Monetary Advisers Act and controlled by the Financial Authority of Singapore and is for basic data solely and shouldn't be relied upon as monetary recommendation. This publication is probably not reproduced, or communicated to every other individual with out prior written permission.

It doesn't bear in mind the particular funding goals, monetary state of affairs or wants of any explicit individual. Earlier than coming into into any transaction involving any product talked about on this publication, the place relevant, you must search recommendation from a monetary adviser relating to its suitability in your personal goals and circumstances. Should you select not to take action, you must make an unbiased evaluation and do your individual due diligence on the product. This commercial has not been reviewed by the Financial Authority of Singapore.

The knowledge herein shouldn't be supposed for distribution to, or use by, any individual or entity in any jurisdiction or nation the place such distribution or use can be opposite to legislation or regulation.

This commercial has not been reviewed by J.P. Morgan Asset Administration. Neither J.P. Morgan Asset Administration nor its associates makes any illustration or guarantee as to its adequacy, completeness, accuracy or timeliness for any explicit objective and accordingly, takes no duty for the accuracy of the contents of this publication nor accepts any legal responsibility for any assertion or misstatement made on this publication.

All investments include dangers and you'll lose cash in your funding. Make investments provided that you perceive and might monitor your funding. The worth of the models within the funds and the revenue accruing to the models, if any, might rise or fall. Earlier than investing, you must learn the prospectus and Product Highlights Sheet for the funds within the Retirement digiPortfolio, which can be obtained from the digiPortfolio tab in DBS digibank.