Credit score restore is the method of fixing your credit score report, and ideally enhancing your credit score rating.

Spotty credit can restrict your means to do loads of issues, together with buying a automobile, house, getting a bank card, and in some instances, even a job. Being creditworthy actually has its benefits.

Should you don’t have good credit score, there are steps you’ll be able to take to repair it. The method is known as credit score restore. You are able to do it by your self or have somebody assist you, for a price after all.

Let’s break down what credit score restore is and whether it is price paying somebody to assist restore your credit score.

How Does Credit score Restore Work?

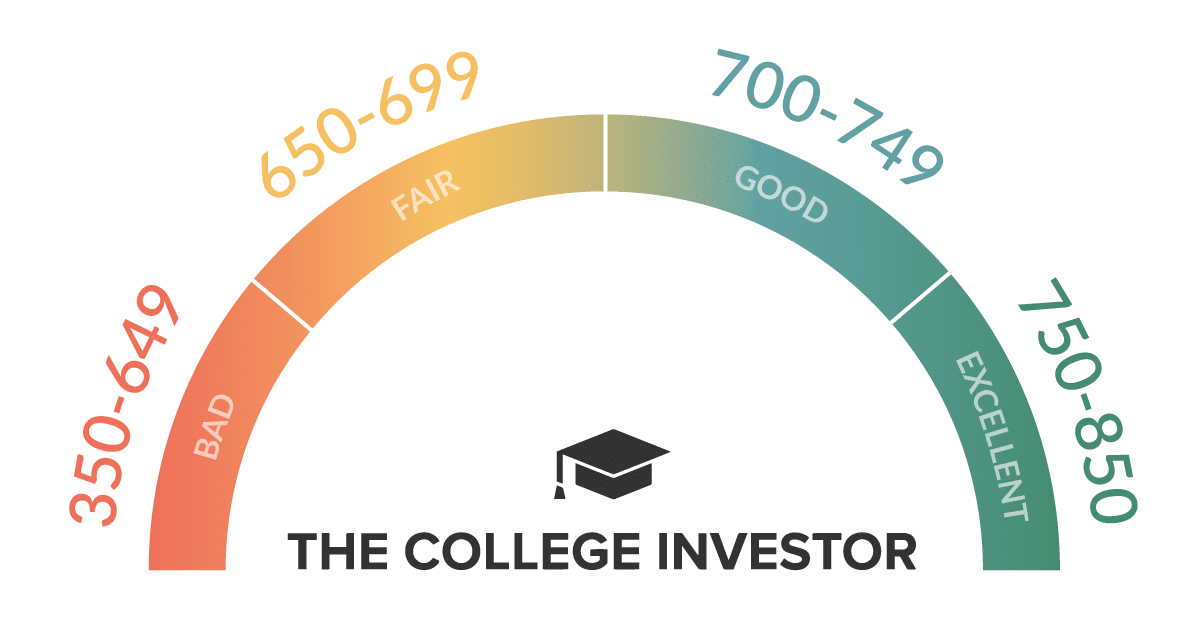

Credit score restore is commonly a long-term course of that step by step raises your credit score rating. A credit score rating is a quantity that displays your creditworthiness. The upper the quantity, the higher. In order for you any sort of mortgage or bank card, you’ll want an honest credit score rating.

There are a variety of how to method credit score restore and every is exclusive to a particular state of affairs.

Usually although, credit score restore begins with getting a replica of your credit score historical past, and in search of any errors or issues. Upon getting your credit score historical past, you’ll be able to start to see what points is likely to be inflicting a decrease credit score rating.

Be aware: Be sure to get a replica of your credit score report from all three main credit score bureaus.

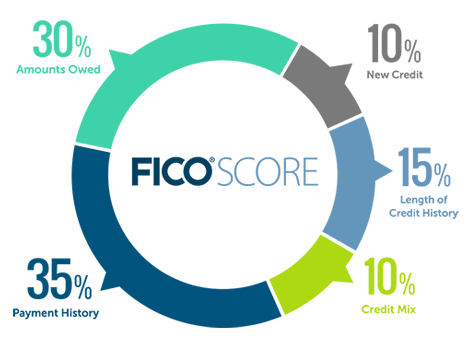

This is how your FICO Rating is calculated:

Supply: MyFICO

When you see the problems, you can begin addressing them – specializing in the most important areas that affect your credit score rating.

This often begins with catching up on any late funds. From there, funds are persistently made on time. Being late on a cost is likely one of the worst issues you are able to do to your credit score.

As soon as money owed are made present and also you’ve been making on-time funds, it’s best to begin noticing an improve in your credit score rating. As extra debt is paid down, your rating will proceed to rise.

Can You Do It Your self?

Sure! You’ll be able to completely restore your credit score by your self.

How profitable you’ll be is determined by the complexity of your state of affairs. Credit score restore does take time and plenty of analysis — if you’re ranging from the start. However if you’re formidable, repairing your credit score by your self can actually be finished.

Step one is to get a replica of your credit score report, which you are able to do at AnnualCreditReport.com. Then undergo your report and establish all overdue accounts and something that is likely to be incorrect. You’ll be able to contact every credit score bureau to repair any errors.

Following the steps talked about within the earlier part are a very good start line:

- Convey any money owed present by paying overdue quantities and late charges.

- Proceed to make on-time funds.

From there, entry to new credit score may also assist enhance your credit score rating. You probably have a low credit score rating, it’s unlikely any bank card firm will situation you an unsecured bank card. Nonetheless, you’ll be able to apply and certain get accepted for a secured bank card.

Secured bank cards require a deposit. You’ll be able to spend as much as the deposit quantity. It really works similar to an unsecured bank card besides with a decrease credit score restrict. Your secured bank card actions might be reported to credit score bureaus, which is what you need.

As an apart, attempt to put away $1,000 in money for an emergency fund. This can assist to pay for emergencies with money relatively than placing them on a bank card. Surprising bills might embrace automobile repairs, a damaged sizzling water heater, or a medical invoice.

The FTC web site additionally has some DIY (do-it-yourself) recommendations on its web site right here.

Should you don’t need to tackle rebuilding your credit score by your self, there are many firms on the market who may help. However are they price it?

What About Credit score-Constructing Apps And Instruments?

If you are going to do it your self, it’s best to most likely get a credit score monitoring instrument to begin with. These instruments are usually free, and so they can at the least assist you monitor your credit score report “reside”.

That method, as you are making progress in your credit score report, you’ll be able to see the development in your rating.

The preferred free instruments are Credit score Karma, Credit score Sesame, and Experian Enhance.

Should you at the moment have a Chase or American Specific bank card, each of those firms even have a free monitoring instrument. Chase is known as Chase Credit score Journey, and Amex is known as My Credit score Information. I personally suppose that the Amex model is best.

Paying A Firm to Assist Construct Your Credit score

Having somebody information you thru the credit score restore course of generally is a nice thought for many who need extra help. It appears there’s no finish to the variety of firms keen to take your hard-earned money in alternate for a better credit score rating. You’ll be able to count on to spend at the least $60/month as much as over $100/month for credit score restore providers throughout 4 to 12 or extra months. The size of time will depend upon the complexity of your restore.

In response to a latest research, 48% of shoppers who used an organization for credit score restore noticed their rating rise by over 100 factors inside 6 months.

A credit score restore service will take a look at your credit score report, put collectively a sport plan, and have you ever execute on it, whereas checking progress with you every month. You’ll have somebody obtainable to reply your entire questions as effectively.

In case your credit score restore is advanced and also you’re extra snug talking with somebody as a substitute of researching by yourself, investing a number of months of funds into schooling and help with a credit score restore firm is likely to be price it. If after a number of months you are feeling snug executing on the remaining duties to your credit score restore, you’ll be able to discontinue the service and save a number of hundred {dollars}.

Earlier than you utilize an organization, try this glorious deep dive into the Secret World Of Debt Settlement and perceive what you are doubtlessly stepping into.

Beneath are firms that present credit score restore providers:

- CreditRepair.com: $14.99 one-time price plus $99.95/month. They declare to extend your credit score rating by 40 factors in 4 months.

- KeyCreditRepair.com: $139.95/month to $189.95/month, relying on the plan. They declare a rise of 90 factors on common in 90 days.

- SkyBlueCredit.com: $79/month. Declare: “Clear up your credit score report. Enhance your scores.”