Opposite to widespread perception, the Federal Reserve doesn’t exert full management over mortgage charges. As a substitute, it influences them, with the bond market figuring out the following plan of action. The Federal Reserve oversees the Fed Funds charge, which represents the in a single day lending charge for banks and stands on the shortest finish of the yield curve.

When the quick finish of the yield curve experiences a rise, it impacts charges for longer durations. For instance, if cash market funds supply a 5% return and are simply accessible, buyers would demand even larger rates of interest for longer-dated Treasury bonds to justify locking up their cash. It’s the bond market that in the end assesses whether or not the Federal Reserve’s rate of interest choices are justified, main to numerous yield curve situations.

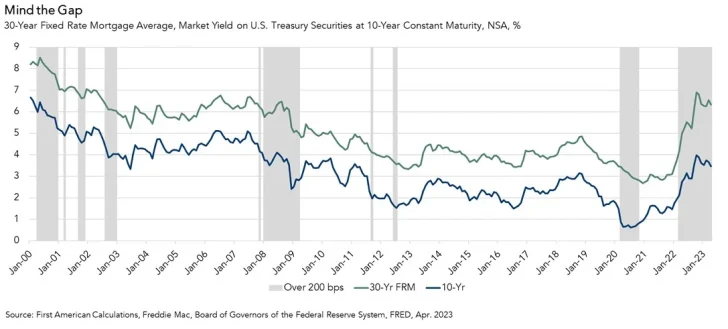

In the end, mortgage charges carefully observe the 10-year Treasury bond yield somewhat than the Fed Funds charge.

Amid international anticipation for the Federal Reserve to lastly minimize charges, let’s dissect the elements influencing mortgage charge fluctuations. Understanding these parts will assist handle expectations relating to how a lot a minimize within the Fed Funds charge may impression mortgage charges. In flip, this data will assist you make higher actual property funding choices.

Elements That Have an effect on Mortgage Charges

Within the first quarter of 2022, the Federal Reserve commenced a sequence of rate of interest hikes in response to inflation, which reached its peak at 9.1% in mid-2022. Following 11 charge hikes, mortgage charges additionally skilled a big uptick.

Beneath, we analyze the elements contributing to this rise, which noticed mortgage charges quickly spike from 3% to eight%. Out of the 5% enhance in mortgage charges:

- 2.5%, or half of the motion, stemmed from changes in Federal Reserve coverage charges.

- 0.8%, or 16% of the rise, was attributed to the enlargement of the Time period premium.

- 0.8%, additionally constituting 16% of the motion, was pushed by prepayment threat.

- 0.4%, equal to eight%, resulted from adjustments within the Choice-Adjusted-Unfold (OAS), measuring the yield distinction between a bond with an embedded choice (resembling an MBS or callables) and Treasury yields.

- 0.3%, representing 6% of the rise, was on account of lender charges.

- One other 0.3%, additionally accounting for six% of the rise, was influenced by inflation.

The figures supplied are estimates by Aziz Sunderji from House Economics, derived after analyzing knowledge from the Fed, Barclays, and Freddie Mac. Whereas it is not possible to pinpoint the precise proportion weightings for the elements influencing the mortgage charge motion, these estimates are thought of sufficiently correct.

How A lot Will Mortgage Charges Decline As soon as The Fed Begins Reducing Charges?

The first intention of this evaluation is to forecast the potential decline in mortgage charges if the Federal Reserve begins chopping charges by the top of 2024 or in 2025.

In keeping with the evaluation, each 25 foundation factors (0.25%) minimize within the Fed’s charges is anticipated to cut back mortgage charges by roughly 12.5 foundation factors (0.125%). If the Fed implements 4 consecutive 25 foundation factors cuts, leading to a complete 1% discount within the Fed Funds charge, mortgage charges are prone to lower by 0.5%.

Moreover, mortgage charges may probably decline even additional than this 1:1/2 ratio if different contributing elements additionally lower. These elements may embrace decrease inflation expectations, heightened competitors, and elevated confidence within the economic system’s resilience.

Associated: 30-12 months Mounted versus An Adjustable Charge Mortgage

Newest Expectations For The Fed Funds Charge

The most recent market expectations for Fed Funds Charges by way of April 2026 point out a delay in anticipated charge cuts following higher-than-expected inflation knowledge within the first quarter of 2024.

Nevertheless, if the Fed adjusts charges based mostly on this revised outlook, it is projected that mortgage charges may lower by 25 foundation factors (0.25%) by the top of 2024 and by 65 foundation factors (0.65%) by the top of 2025.

Regardless of these reductions being considerably modest in comparison with earlier expectations, the sturdy state of the economic system means that mortgage charges could stay elevated for an prolonged interval.

The Mortgage-Treasury Unfold Might Slim

One other issue that would probably drive mortgage charges decrease is the imply reversion of the unfold between the common 30-year mortgage charge and the 10-year Treasury charge. That is known as the Mortgage-Treasury Unfold as proven within the yellow parts of the primary chart above.

Because the conclusion of the Nice Recession, the 30-year fastened mortgage charge has sometimes remained 1.7 proportion factors (170 foundation factors) larger than the 10-year Treasury bond yield, on common.

Nevertheless, the Mortgage-Treasury Unfold widened to over 3 proportion factors (300 foundation factors) in 2023. A part of the reason being on account of extra volatility and financial uncertainty, which requires banks to earn a better return.

In 2024, we have seen a decline within the Mortgage-Treasury Unfold to round 270 foundation factors as banks are reducing their lending charges and providing extra aggressive mortgage charges given a decrease likelihood of a tough touchdown. That mentioned, the unfold continues to be about 1% larger than its historic common.

Why Mortgage Charges Seemingly Cannot Go A lot Increased

Contemplating the robustness of the U.S. economic system, there’s a chance for each the Fed Funds charge and mortgage charges to rise. Nevertheless, this situation seems unlikely given the present stage of the financial cycle.

A number of elements contribute to this evaluation: inflation has already peaked, the S&P 500 is buying and selling at greater than 20 occasions ahead earnings, the risk-free charge exceeds inflation by no less than 1%, and the extent of U.S. authorities debt is turning into more and more burdensome.

An examination of the U.S. curiosity fee situation reveals a big burden. With none charge cuts by the top of 2024, the annual curiosity fee on U.S. Treasury debt may soar to $1.6 trillion. This staggering determine underscores the significance of fastidiously managing rates of interest to mitigate the impression on authorities funds.

How does $1.6 trillion evaluate to different U.S. authorities liabilities?

Let’s contemplate one measure: U.S. curiosity expense versus protection spending and Social Safety spending. Gross curiosity expense has already exceeded protection spending and is on monitor to surpass Social Safety spending.

This example highlights a difficult dilemma for the federal government. The Federal Reserve can not afford to lift rates of interest additional with out risking the financial collapse of our nation.

Tame Your Expectations About Mortgage Charge Declines

If you happen to’re eagerly anticipating a decline in mortgage charges on account of imminent Fed charge cuts, mood your expectations. Not solely will the Fed’s affect on mortgage charges be restricted to about 50%, but it surely’s additionally prone to take a few years and even longer for the Fed to cut back charges to ranges that really feel extra accommodating for debtors.

Given the numerous pent-up demand for actual property ensuing from excessive mortgage charges since 2022, the Fed can not enact speedy cuts. Doing so may set off a surge in demand, additional driving up residence costs.

Consequently, it’s essential to contemplate how lengthy you are keen to delay your plans earlier than buying your dream residence. The longer mortgage charges keep excessive, the larger the pent-up demand given life goes on, e.g. marriage, youngsters, job relocation, divorce, and so on.

Personally, as a middle-aged particular person, I used to be unwilling to place my life on maintain. With my youngsters aged three and 6 on the time of my residence buy in October 2023, I wished to maneuver ahead with life as quickly as attainable. I acknowledged that after they attain maturity, I will not have as a lot time to spend with them.

Now that you simply higher perceive the parts that have an effect on mortgage charges, hopefully, you may make a extra rational residence buying choice. When it comes to the place rates of interest will go long run, I imagine rates of interest will ultimately revert to its 40-year pattern of down.

Reader Questions And Strategies

Had been you conscious that the Fed is barely partially chargeable for the rise and fall of mortgage charges? Do you assume the Mortgage-Treasury Unfold will revert to its long-term imply of 1.7 proportion factors? What different parts have an effect on mortgage charges?

If you happen to’re in search of a mortgage, examine on-line at Credible. Credible has a community of lenders who will compete for your enterprise. Get no-obligation personalised prequalified charges in a single place.