Petronet LNG Ltd. – First LNG terminal in India

Integrated in 1998 as a three way partnership amongst GAIL, IOCL, BPCL & ONGC, Petronet LNG Ltd. (PLL) is presently one of many quickest rising world-class corporations within the Indian vitality sector. The corporate was fashioned to develop, design, assemble, personal and function Liquefied Pure Fuel (LNG) import and regasification terminals in India. PLL commenced its operations by establishing nation’s first LNG receiving and regasification terminal at Dahej, Gujarat and one other terminal later at Kochi, Kerala. As of 31 March 2023, the corporate with a mixed capability of 17.5 million metric tonnes every year (MMTPA) of LNG account for round 33% fuel provides within the nation and deal with round 75% LNG imports in India.

Merchandise and Companies

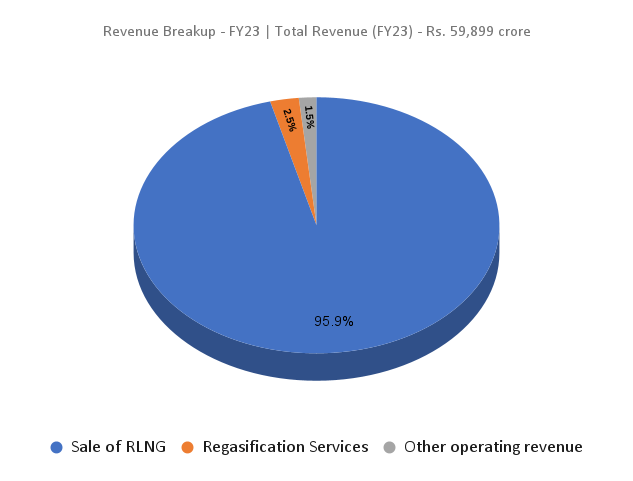

PLL is an vitality firm that operates within the LNG sector of the pure fuel trade. PLL’s predominant enterprise actions consists of Import of Liquefied Pure Fuel (LNG) and sale of Regasified – LNG (RLNG) & Regasification/ Dealing with of LNG and ancillary providers.

Subsidiaries: As of FY23, the corporate has 3 subsidiaries and a pair of joint ventures.

Key Rationale

- Renewal of Qatar deal – The corporate just lately renewed its long-standing take care of Qatar for added 20 years from 2028 until 2048. The offers ensures regular provide of seven.5 MMTPA LNG from Qatar to India, bolstering the nations vitality safety. The 20-year deal is an extension of an current contract for LNG provides signed in 1999 which runs till 2028. The deal is taken into account to be of nationwide significance making certain a gentle provide of regasified LNG to key sectors comparable to fertilisers, metropolis fuel distribution, refineries, petrochemicals, energy and different industries.

- Growth plans: To reinforce the current LNG storage capability of round 1 million CuM at Dahej terminal, building of two extra LNG storage tanks of gross capability of 1,85,000 CuM every has been taken up at a price of approx. Rs.1,250 crore with a building schedule of 36 months (September, 2024). The corporate can also be endeavor a extremely cost-effective brownfield enlargement of regassification capability of Dahej Terminal from 17.5 MMTPA to 22.5 MMTPA at an estimated value of Rs. 600 crore.

- New enterprise initiative – Diversifying its enterprise traces, the corporate is endeavor a brand new petrochemical PDH/PP (propane dehydrogenation and polypropylene) plant together with an ethane dealing with facility in Dahej terminal at an outlay of Rs.20,658 crore, anticipated to be commissioned in FY27-28. 250 KTA from the proposed 750 KTA capability of the PDH plant has already been tied up with a buyer for 15 years, extendable for an additional 5 years. Remaining 500 KTA propylene will likely be transformed to PP. The administration expects to ship an IRR of 20% and fairness IRR of 30%.

- Q3FY24 – In the course of the quarters, the corporate income declined by 7% to Rs.14,747 crore as in comparison with the Rs.15,776 crore of Q3FY23. Income improved marginally with working revenue rising by 2% to Rs.1,705 crore and web revenue rising by 1% to Rs.1,191 crore. Nonetheless, in comparison with the earlier quarter (Q2FY24), income elevated by 18%, working revenue improved by 40% and web revenue surged by 46%. The quarter additionally reported highest ever PBT and PAT recorded within the 9-month interval.

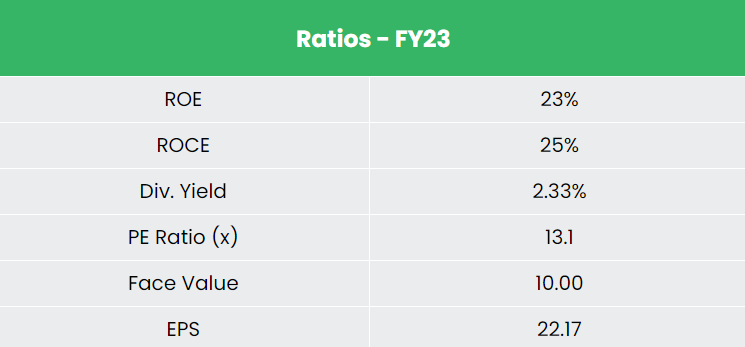

- Monetary efficiency – The corporate has generated income and PAT CAGR of 19% and 6% over the interval of three years (FY20-23). Common 3-year ROE & ROCE is round 25% and 28% for FY20-23 interval. The corporate has sturdy capital construction with a debt-to-equity ratio of 0.20.

Business

The oil and fuel sector is among the many eight core industries in India and performs a serious function in influencing the decision-making for all the opposite essential sections of the financial system. Being the third largest shopper of vitality and oil on this planet India’s financial development is carefully associated to its vitality demand, subsequently, the necessity for oil and fuel is projected to extend, thereby making the sector fairly conducive for funding. Pure Fuel consumption is forecast to extend at a CAGR of 12.2% to 550 MCMPD by 2030 from 174 MCMPD in 2021. Notably, India can also be the 4th largest importer of liquefied pure fuel (LNG).

Development Drivers

- Authorities of India has allowed 100% overseas direct funding (FDI) in lots of segments of the sector, together with pure fuel, petroleum merchandise and refineries, amongst others.

- India has set a goal to boost the share of pure fuel within the vitality combine to fifteen% by 2030 from about 6.7% now.

- A complete of 88% of the nation’s geographical space overlaying 98% of the inhabitants has been approved for the event of Metropolis Fuel Distribution community.

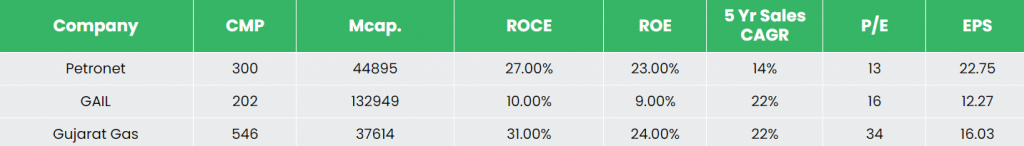

Opponents: GAIL (India) Ltd, Gujarat Fuel Ltd and so forth.

Peer Evaluation

Compared to the above rivals, PLL is essentially the most undervalued inventory with wholesome returns on the capital employed and secure development in gross sales.

Outlook

The corporate is properly positioned to achieve from the federal government’s push for vitality effectivity from pure fuel. At the moment Dahej terminal is utilised at 96% capability and the plans to increase capability to 22.5 MMTPA by March 2025 is predicted to present additional turnover for the corporate. The corporate additionally has different worth added providers in pipeline comparable to pipeline connectivity from Coimbatore to Krishnagiri pending completion by year-end, terminal in Gopalpur, and so forth. Nonetheless, the entry into non-core petchem enterprise the place current petchem corporations are already struggling to make affordable returns may very well be margin dilutive to the corporate.

Valuation

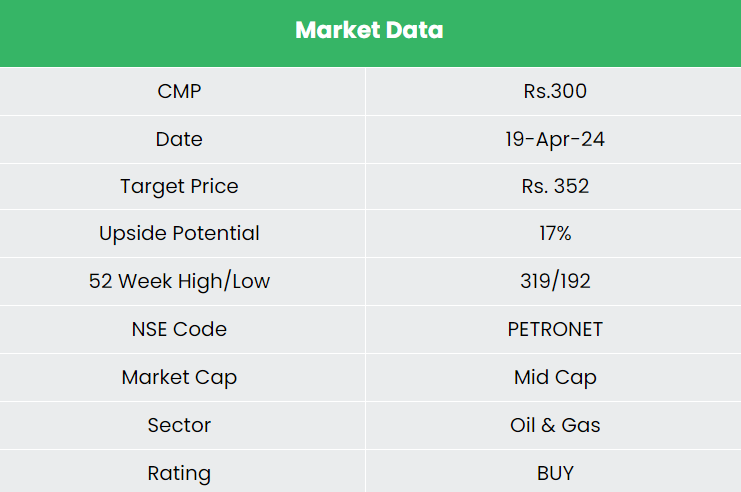

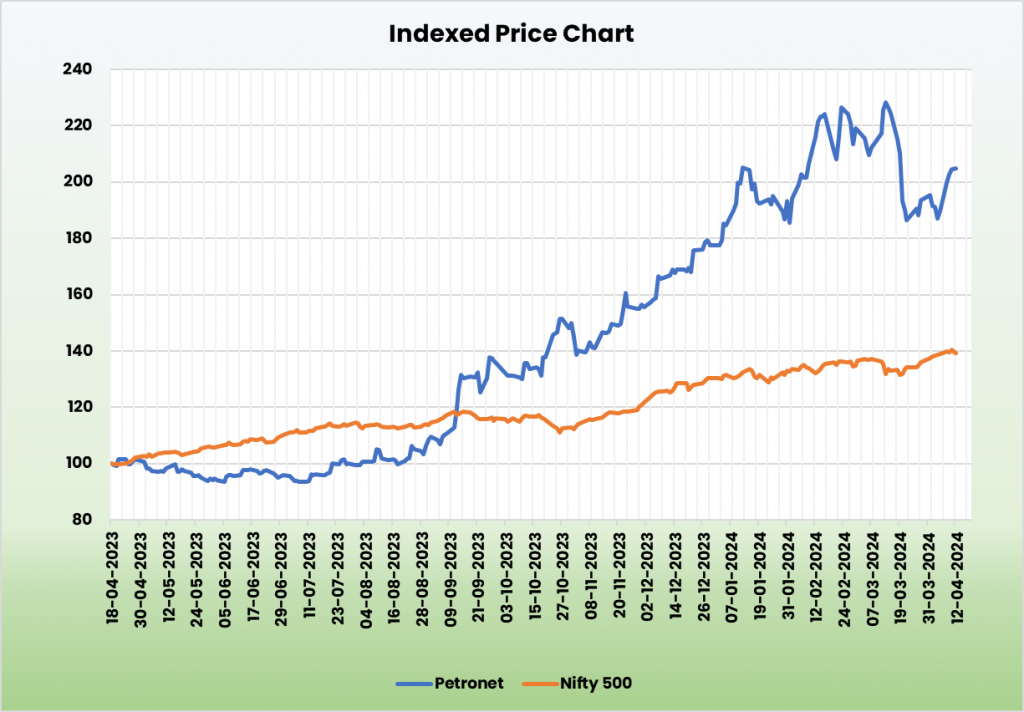

We imagine Petronet LNG Ltd. is properly positioned to learn from the super potential that India has to supply for the exponential development in vitality consumption. We advocate a BUY score within the inventory with the goal value (TP) of Rs.352 14x FY25E EPS.

Dangers

- Geopolitical disturbances – Geopolitical dangers comparable to battle outbreaks, authorities instability or some other social unrest of the like might lead to acute provide chain disruption thereby impacting the corporate’s operations.

- Capital misallocation danger – Capex plans into non-core petchem enterprise may stress the corporate’s capital allocation and stability sheet. The corporate expects to fund the challenge by a debt: fairness mixture of 70:30 to optimise its capital construction and proceed with the present degree of dividend payout. Petchem funding wants very excessive margins to fulfill administration targets of profitability.

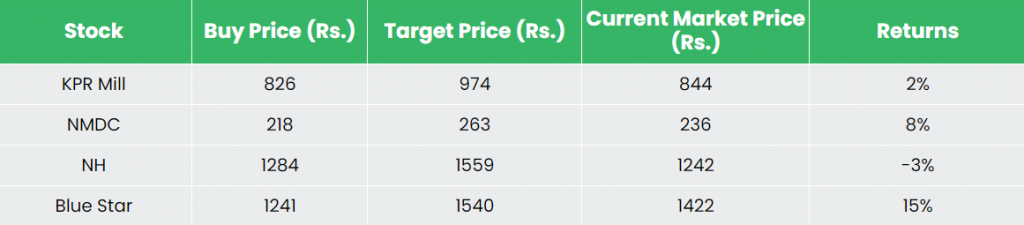

Recap of our earlier suggestions (As on 19 Apr 2024)

Different articles you could like

Publish Views:

132