Fredericton: House costs poised to rise with price cuts

Fredericton marks the third and ultimate metropolis the place the extra required earnings to buy a house stays beneath $1,000. The common dwelling value there rose $2,600 on a month-to-month foundation to $292,900, which pushed the minimal earnings up by $430, to $68,170. In accordance with CREA, Fredericton dwelling gross sales declined 15.2% over the course of the month.

This displays actual property traits in New Brunswick as a complete, as dwelling costs have steadily elevated over the previous three months. That is primarily as a consequence of shrinking provide, as new listings stay 12.1% beneath the five-year common for March. Nevertheless, gross sales and provide could possibly be poised to perk up ought to rate of interest cuts materialize later this summer time.

The least reasonably priced locations to purchase in Canada

Toronto, Hamilton and Vancouver sit on the backside of the listing.

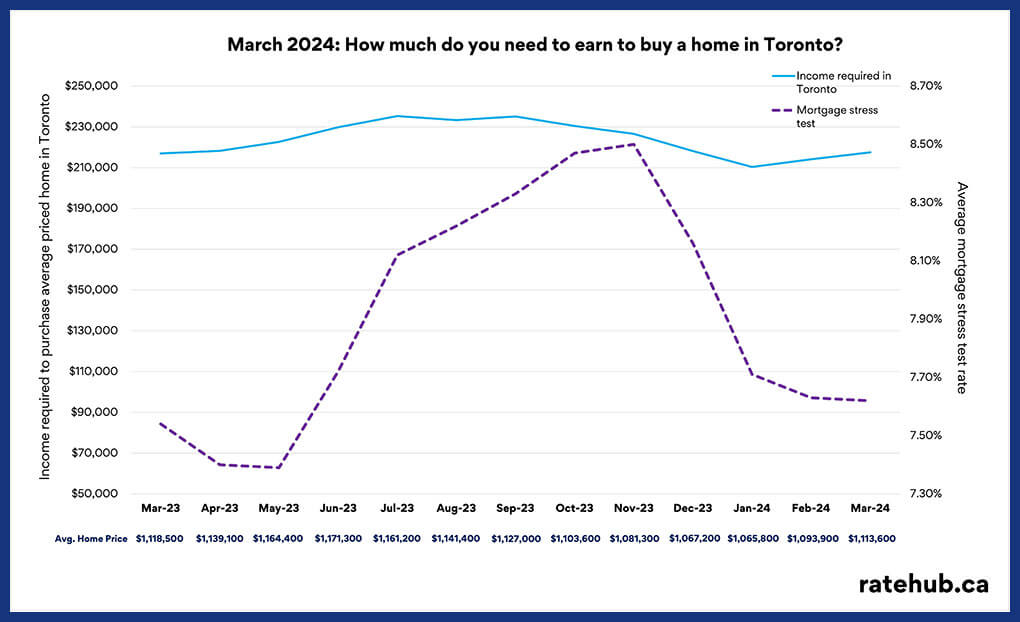

Toronto: The hardest place to purchase a house in March

It ought to come as no shock that Toronto dwelling patrons are probably the most financially squeezed; dwelling costs there escalated sharply over the pandemic’s lockdown years, and remained elevated at a median of $1,113,600 in March, up $19,700 from February. That resulted within the common purchaser needing an annual earnings $3,400 greater than they did in February, making it now $217,500.

Whereas dwelling gross sales have chilled barely firstly of the 12 months, the Toronto Regional Actual Property Board (TRREB) says sufficient competitors stays available in the market to push costs greater, and that this can solely tighten additional as rates of interest begin to decline.

Hamilton: One other difficult Golden Horseshoe market

The Metropolis of Hamilton—which boomed in reputation in recent times as an actual property vacation spot—got here in second by way of worsening affordability. The common dwelling value does stay underneath the $1-million mark, making it a way more reasonably priced possibility when in comparison with neighbouring Toronto. However that hole is narrowing sharply, up by $14,600 in March to a median of $850,500. By way of earnings, a Hamilton purchaser must earn $169,640 yearly, a rise of $2,540.

Vancouver: Softening gross sales, however demand nonetheless drives costs

The Metropolis of Vancouver stays Canada’s costliest housing market, with a median value of $1,196,800 in March, up $13,500 from the earlier month. Because of this, a purchaser there should earn $232,620 with the intention to qualify for the required mortgage, a rise of $2,270 in comparison with February.