Options to the 24.3% Gen Z gender property hole

You’ve got in all probability heard in regards to the gender pay hole and the superannuation hole, however there’s one other important hole that usually goes unnoticed: the gender property hole.

CoreLogic‘s newest Girls and Property report sheds mild on this ignored subject, revealing some hanging revelations.

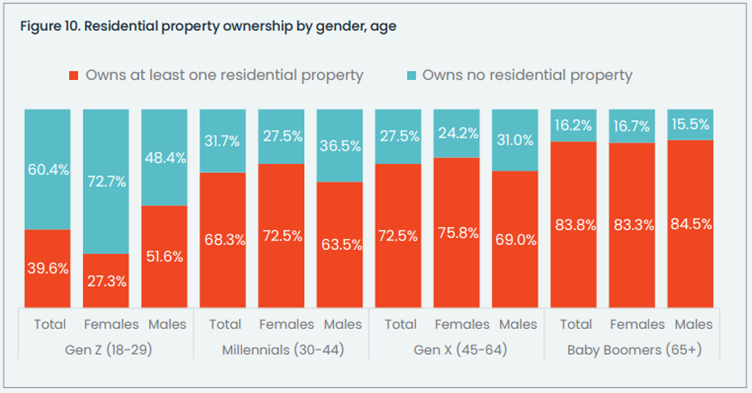

Initially, it could seem to be progress when contemplating general property possession charges: ladies barely surpass males, with a 68.7% possession charge in comparison with males’s 67.4%. Nevertheless, a more in-depth look reveals a distinct story, particularly amongst youthful generations.

Mortgage dealer Alex Veljancevski (pictured above) emphasised the significance of understanding these developments, significantly when serving younger feminine shoppers.

“All brokers, no matter gender, ought to look at this hole and contemplate the right way to alter our companies to raised meet our shoppers’ wants and slender the divide,” Veljancevski mentioned.

Unveiling the gender property hole

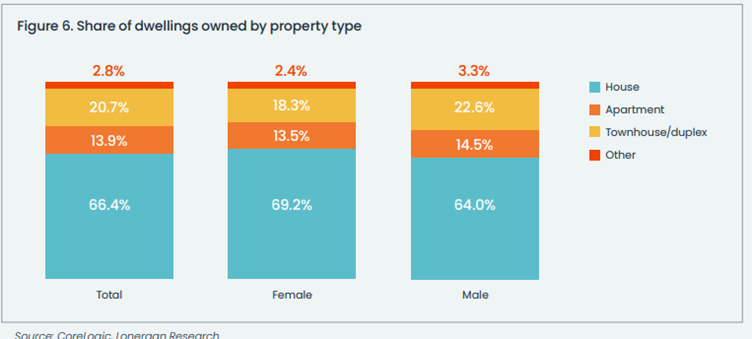

Delving deeper, CoreLogic’s analysis highlights disparities in funding patterns. Males keep a better charge of funding in residential dwellings, with 14.1% proudly owning a minimum of one residential funding property in comparison with 12.5% of females.

The survey additionally requested about different types of property funding, offering the examples of business property, industrial property, or vacant land. Simply 2.2% of males reported having a minimum of one different type of funding property, barely greater than 1.2% of females.

Furthermore, the report touches on the valuation and debt dynamics, revealing intriguing insights.

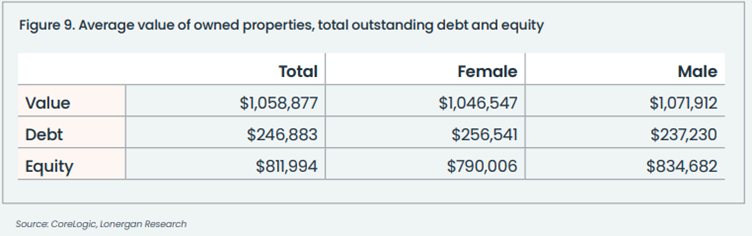

Regardless of ladies proudly owning a better proportion of homes, usually extra worthwhile than items, their common reported worth is barely decrease than that of males ($1,046,547 for ladies in comparison with $1,071,912 for males).

Feminine-owned property values are inclined to cluster between $500,000 and $1,499,999, whereas males’s properties present a flatter distribution.

Regardless of this, ladies report barely greater common excellent debt, leading to a decrease general residence fairness place.

The function of joint possession

The best way ladies purchase property additionally contributes to the gender property hole.

Joint possession emerges as a prevalent avenue for ladies to entry the property market, with extra ladies than males utilizing this association.

For girls on decrease revenue, this may be an efficient method to get onto the property ladder sooner by means of sharing of housing prices. Nevertheless, this has its personal complexities probably creating conditions of monetary dependence and monetary abuse.

This may increasingly additionally pose some vulnerability for ladies who’re single, or people who expertise a relationship breakdown.

Affordability constraints amongst Gen Z ladies

Affordability constraints considerably contribute to the gender property hole, significantly amongst youthful generations. Whereas ladies could aspire to homeownership, restricted monetary sources typically pose a big barrier.

Respondents incomes lower than $100,000 yearly exhibit a house possession charge of 61.4%, in comparison with 86.6% amongst these incomes greater than $100,000.

Numerous components contribute to this hole. Age performs a vital function, as each residence possession and better incomes are usually achieved later in life. Moreover, socio-economic background influences entry to property possession, with higher-income people typically benefiting from household wealth or inheritance.

Apparently, ladies keep a better charge of property possession when revenue is taken into account. For girls incomes lower than $100,000, the possession charge was 62.1% (in comparison with 60.6% for males), rising to 91.0% for these incomes over $100,000 (83.2% for males).

Nevertheless, the notable hole that persists amongst Gen Z respondents (51.6% of males personal a property in comparison with solely 27.3% of girls) can partly be chalked all the way down to variations in revenue.

Gen Z ladies, on common, have decrease incomes and are more likely to have interaction in part-time or informal employment.

This discovering is intriguing as a result of discussions about earnings for women and men typically centre on the well-documented hole ensuing from older ladies assuming unpaid parental or caregiver obligations.

“Clearly, affordability constraints exacerbate the gender property hole amongst younger folks, underscoring the necessity for focused interventions to deal with this systemic subject,” Veljancevski mentioned.

Different causes for the gender property hole

Whereas affordability constraints play a task, they don’t absolutely clarify the hole’s persistence. Veljancevski identifies three foremost components.

First, the typical man earns greater than the typical lady – for each $1 earned by males, 88c is earned by ladies, in line with the Office Gender Equality Company.

How brokers can tackle the gender property hole

Addressing these disparities requires a multifaceted strategy.

How one can tackle the pay hole

A part of the explanation the gender pay hole exists is as a result of males usually tend to be in positions of authority than ladies.

“As a result of people usually tend to favour (typically unconsciously) folks like them, it means, all issues being equal, that males usually tend to rent and promote males than ladies,” Veljancevski mentioned. “That will apply as a lot to the mortgage broking trade as society typically.

“So if the trade made a aware effort to extend the share of feminine illustration – solely 26.9% of brokers are ladies, in line with the MFAA – we’d have the ability to slender the pay hole, a minimum of in our trade.”

How one can tackle the danger tolerance hole

“Brokers – particularly male brokers – have to recognise that the typical lady requires extra reassurance round shopping for property and taking over debt than the typical man,” mentioned Veljancevski.

“Meaning now we have to offer the typical feminine consumer with extra training.”

How one can tackle the monetary literacy hole

“We additionally have to recognise that the typical lady has much less monetary literacy than the typical man. Once more, that requires extra training – nevertheless it must be delivered in a method that feels empathetic slightly than patronising.”

The underside line

In the end, closing the gender property hole isn’t just a matter of equality; it is about empowering people to attain monetary safety and well-being.

Brokers, as key gamers within the monetary panorama, have a pivotal function in driving this modification.

How do you service your younger feminine shoppers? Remark under.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!