One of many hardest duties for advisors is figuring out funding alternatives on your purchasers that verify the suitable containers. Certain, names like Apple, Microsoft, and Fb seem to be a secure guess. But it surely’s the diamonds within the tough that may elude even skilled funding professionals. So, the place do you start in relation to sourcing recent concepts?

It’s actually difficult to distill the noise and middle our deal with a manageable investing universe. To assist overcome that impediment, I’ve seemed to some legendary traders—plus the Funding Analysis workforce right here at Commonwealth—to uncover the highest methods for investing success. So, what do the consultants say?

Spend money on What You Know

Two of my favourite funding books are by Peter Lynch, who, as portfolio supervisor of the Constancy Magellan Fund, amassed a staggering 29.2 % annual return over 14 years. When you’ve by no means learn Lynch’s One Up on Wall Road or Beating the Road, I extremely suggest them.

Lynch was well-known for his maxim “spend money on what you recognize.” He seemed for localized but beneficial information factors to tell his selections and assist “flip a mean inventory portfolio right into a star performer.” However native information is simply a part of the equation for figuring out funding alternatives. We additionally want a measure on the basics.

The PEG ratio. Lynch was an enormous fan of the PEG ratio, which divides an organization’s trailing P/E ratio by its five-year anticipated progress charge. Though it’s not one thing for use by itself, the PEG ratio is an effective technique to evaluate firms in comparable industries, capturing a relative worth of future earnings progress.

In keeping with Lynch, a PEG ratio of 1 (by which its P/E ratio is the same as its anticipated progress charge) is “pretty valued.” However a PEG ratio of 1 or decrease might be difficult to seek out in a market atmosphere the place valuations are elevated. For instance, for those who use Finviz to display screen for firms with PEG ratios lower than 1, the outcomes embody industries presently beneath stress (e.g., automotive producers, insurers, and airways).

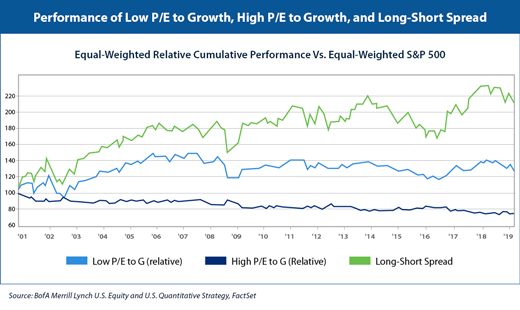

Usually, shares with essentially the most optimistic expectations have a lot larger PEG ratios. This doesn’t imply these shares can’t be smart investments, however legwork is required to find out if the premium valuation is warranted. Over the previous 18-plus years, nevertheless, low PEG shares have crushed out these on the upper finish of the PEG spectrum (see the graph under). So, possibly Lynch was proper?

Grow to be a Bookworm

Let’s flip to a well-known title: Warren Buffett. At a Berkshire Hathaway assembly in 2013, Buffett was requested whether or not he used screens to slender his funding universe. He responded:

No I don’t know the right way to. Invoice’s nonetheless attempting to clarify it to me. We don’t use screens. We don’t search for issues which have low P/B or P/E. We’re companies precisely if somebody supplied us the entire firm and suppose, how will this look in 5 years?

Buffett’s concepts stem largely from his voracious studying; in response to Farnam Road, he reportedly spends roughly 80 % of his day “studying and pondering.” Thus, if you wish to make investments like Buffett, begin studying extra!

Some have tried to reverse engineer Buffett’s intrinsic worth methodology. The American Affiliation of Particular person Traders (AAII) constructed a Buffett-like display screen primarily based on the work of Robert Hagstrom, creator of The Warren Buffett Means. The AAII display screen seems for firms producing extra free money movement, with a beautiful valuation primarily based on free money movement relative to progress.

Measure Threat and Reward

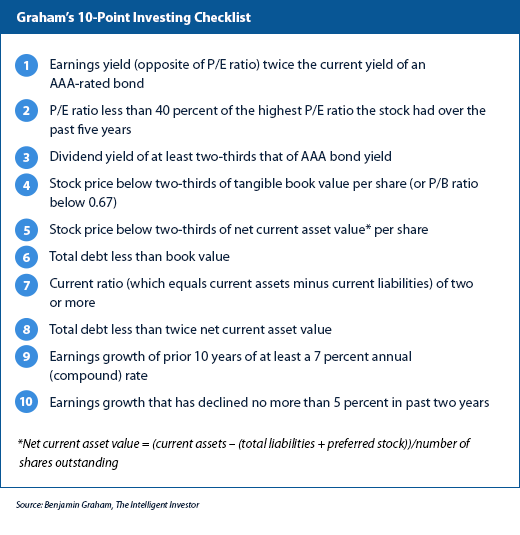

A have a look at the legends should embody Buffett’s mentor, Benjamin Graham. He wrote a seminal e-book on investing, Safety Evaluation, and the extra novice-friendly The Clever Investor. In Graham’s 10-point investing guidelines, the primary 5 factors measure reward and the latter 5 measure threat.

Graham seemed for 7 of the ten standards when figuring out funding alternatives. However I’ve discovered that it’s practically not possible to seek out even a couple of shares that cross that hurdle. And a 1984 examine revealed within the Monetary Analysts Journal concluded that utilizing simply standards 1 and 6 would end in outsized returns.

However, nonetheless, it’s price noting that AAII has a modified Graham display screen that loosens a few of the pointers, and it has carried out fairly effectively.

Create a Manageable Universe

Commonwealth’s Funding Analysis workforce makes use of screening (in FactSet) to pick funding choices on our fee-based Most popular Portfolio Companies® platform. For our Choose Fairness Revenue SMA portfolio, we have a look at dividend progress historical past, together with different measures together with ahead P/E ratio, return on invested capital, and whole debt percentages.

Our mannequin takes a multifactor method, mixing rankings of every issue into an total mixture rating. Often, we choose shares that aren’t included within the issue rankings, however solely after intently inspecting the basics.

Keep away from the worth entice. After all, screening can’t be your total funding course of. This method works for quantitative managers with strong multifactor analysis processes. However for the common investor? It’s a shedding sport. Worth screens that leverage standards corresponding to low P/E and high-dividend yield can result in out-of-favor names that is perhaps a worth entice.

For instance, I ran a pattern display screen utilizing low P/E (beneath 13.5) and high-dividend yield (above 3.5 %). It led to firms with some apparent challenges, together with Philip Morris, Ford, and AT&T. I’m not saying these are unhealthy investments. However by tweaking your screens, you possibly can discover firms that higher suit your standards. (A requirement that the debt-to-equity ratio have to be under 50 % would utterly take away the aforementioned shares out of your display screen.)

Further Assets

For a charge, Argus and Morningstar® (each of which can be found to Commonwealth advisors by way of the agency’s analysis package deal) present glorious elementary analyses that can be utilized as a supply for concept technology. And Worth Line, additionally a part of the package deal, provides one-pagers for equities that help you shortly scroll by way of a big subset of concepts.

John Huber—portfolio supervisor of Saber Capital Administration and author of a implausible weblog (Base Hit Investing)—says that one in all his fundamental sources of concept technology includes “paging by way of Worth Line” to present him “a continuing have a look at 3500 or so firms every quarter.” It is a time-consuming method, nevertheless it exhibits there’s a wealth of data proper at your fingertips.

Then there are the no-cost choices to contemplate. I’ve discovered the SecurityAnalysis discussion board on Reddit to be invaluable—largely for the crowdsourced assortment of quarterly fund letters. One other useful resource is Whale Knowledge, a free assortment (though paid upgrades can be found) of the current 13-F filings for fashionable fund managers. Lastly, Finviz is a free inventory screener that has a complete library of information factors obtainable for customers.

When you’re keen to spend slightly dough, AAII is a superb useful resource for screening concepts and is past affordable at $29 per 12 months. Searching for Alpha ($20/month) can be effectively price the associated fee for extra in-depth evaluation.

The Artwork of Investing

Discovering the suitable methods for investing success might be extra artwork than science. As such, not one of the methodologies or sources mentioned right here must be thought-about foolproof. Nonetheless, whether or not you’re working with a novice investor or one who’s extra skilled, I hope you now have a couple of extra instruments in your advisor toolbelt.

The views and opinions expressed on this article are these of the creator and don’t essentially replicate the official coverage or place of Commonwealth Monetary Community®. Reference herein to any particular business merchandise, course of, or service by commerce title, trademark, producer, or in any other case, doesn’t essentially represent or suggest its endorsement, advice, or favoring by Commonwealth.