Current motion amongst monetary advisors appears to lean in direction of the registered funding advisor mannequin, with many giant wirehouse and regional brokerage groups breaking away and beginning their very own unbiased companies.

Simply this week, a crew of Merrill Lynch advisors with a reported $491 million in belongings left the wirehouse to launch their very own RIA in Southern Pines, N.C. One other North Carolina duo of advisors with $700 million in consumer belongings broke away from Merrill to hitch Sanctuary Wealth’s unbiased platform.

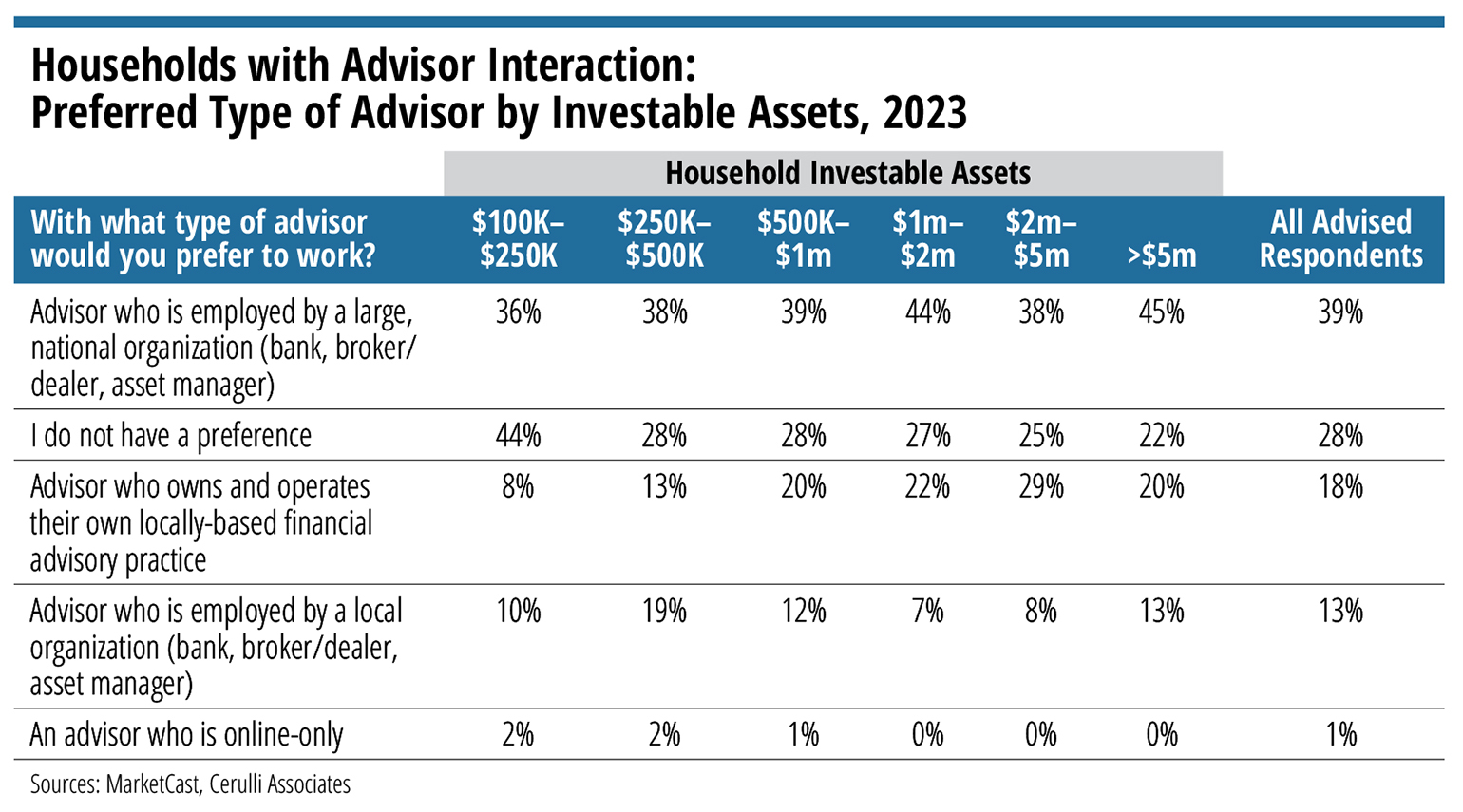

However a brand new survey from Cerulli Associates signifies a special desire amongst traders. Thirty-nine % of suggested traders throughout all wealth tiers stated they like to work with an advisor who’s employed by a nationwide group, whether or not that’s a financial institution, dealer/supplier or asset supervisor. That was additionally the highest desire for traders who will not be at present working with an advisor, at 32%.

That alternative was much more pronounced amongst extra prosperous traders. Amongst these with $5 million or extra in investable belongings already working with an advisor, 45% favor to work with these employed by a big agency. Amongst unadvised traders, 37% of these with $5 million favor these advisors, 38% of these with $2 to $5 million have that desire, and 40% of these with $1 to $2 million lean that method.

The Cerulli report attributes these outcomes to the truth that the rich are inclined to skew older and have a larger consolation degree with established manufacturers.

In the meantime, simply 18% and 19% of suggested and unadvised traders, respectively, favor to work with an advisor who owns and operates their very own locally-based apply. Among the many largest wealth tier (greater than $5 million in belongings) that’s at present unadvised, that drops to 11%.

“These general desire ranges current a little bit of a problem to rising registered funding advisors (RIAs) and unbiased dealer/supplier (IBDs) advisors, as they hardly ever possess excessive ranges of unaided consciousness amongst potential shoppers of their intervals of vital recommendation want,” says Scott Smith, director of recommendation relationships at Cerulli.

These native practices have a weaker displaying among the many much less prosperous who have already got an advisor, with simply 8% desire amongst these with $100,000 to $250,000, which Cerulli states displays “the problem native companies have competing with main manufacturers for brand new consumer acquisition.”

On-line-only advisors have been the least favored throughout the wealth spectrum, with simply 1% of suggested respondents and 5% of unadvised respondents selecting them.