As we enter the final quarter of 2023, it has been a curler coaster of a 12 months. We began the 12 months with important uncertainty about whether or not the surge in inflation seen in 2022 would persist in addition to about whether or not the economic system was headed right into a recession. Within the first half of the 12 months, we had constructive surprises on each fronts, as inflation dropped after than anticipated and the economic system stayed resilient, permitting for a comeback on shares, which I wrote about in a publish in July 2023. That restoration however, uncertainties about inflation and the economic system remained unresolved, and people uncertainties turned a part of the market story within the third quarter of 2023. In July and the primary half of August of 2023, it seemed just like the market consensus was solidifying round a soft-landing story, with no recession and inflation underneath management, however that narrative developed cracks within the second half of the quarter, with markets giving again good points. On this publish, I’ll take a look at how markets did through the third quarter of 2023, and use that efficiency as the idea for analyzing threat capital’s presence (or absence) in markets.

The Markets within the Third Quarter

Coming off a 12 months of rising charges in 2022, rates of interest have continued to command middle stage in 2023. Whereas the rise in treasury charges has been much less dramatic this 12 months, charges have continued to rise throughout the time period construction:

Whereas quick time period charges rose sharply within the first half of the 12 months, and long run charges stabilized, the third quarter has sen a reversal, with quick time period charges now stabilizing and long run charges rising. Firstly of October, the ten-year and thirty-year charges have been each approaching 15-year highs, with the 10-year treasury at 4.59% and the 30-year treasury price at 4.73%. As a consequence, the yield curve which has been downward sloping for the entire final 12 months, turned much less so, which can have significance for individuals who view this metric as an impeccable predictor of recessions, however I’m not a kind of.

Shifting on to shares, the energy that shares exhibited within the first half of this 12 months, continued for the primary few weeks of the third quarter, with shares peaking in mid-August, however giving again all of these good points and extra in the previous couple of weeks of the third quarter of 2023:

As you’ll be able to see, it has been a divergent market, taking a look at efficiency throughout 2023. Despite shedding 3.65% of their worth within the third quarter of 2023, giant cap shares are nonetheless forward 12.13% for the 12 months, however small cap shares are actually again to the place they have been at the beginning of 2023. The NASDAQ additionally gave again good points within the third quarter, however is up 27.27% for the 12 months, however these gaudy numbers obscure a sobering actuality. Seven corporations (NVIDIA, Apple, Microsoft, Alphabet, Meta, Amazon and Tesla) account for $3.7 trillion of the rise in market cap in 2023, and eradicating them from the S&P 500 and NASDAQ removes a lot of the rise in worth you see in each indices.

Lastly. I checked out international equities, damaged down by area of the world, and in US {dollars}, to permit for direct comparability:

India is the one area of the world to publish constructive returns, in US greenback phrases, within the third quarter, and is the most effective performing market of the 12 months, working simply forward of the US; notice once more that of the $5.2 trillion improve in worth US equities, the seven corporations that we listed earlier accounted for $3.7 trillion. Latin America had a brutal third quarter, and is the worst performing area on this planet, for the year-to-date, adopted by China. If you’re an fairness investor, your portfolio standing at this level of 2023 and your returns for the 12 months will probably be largely decided by whether or not you had any cash invested within the “hovering seven” shares, in addition to the sector and regional skews in your investments.

Worth of Threat

The drop in inventory and bond costs within the third quarter of 2023 can partly be attributed to rising rates of interest, however how a lot of that drop is as a result of value of threat altering? Put merely, greater threat premiums translate into decrease asset costs, and it’s conceivable that political and macroeconomic components have contributed to extra threat in markets. To reply this query, I began with the company bond market, the place default spreads seize the worth of threat, and seemed on the motion of default spreads throughout rankings courses in 2023:

As you’ll be able to see, bond default spreads, after surging in 2022, had a quiet third quarter, lowering barely throughout all rankings courses. Wanting throughout the 12 months so far, there was little motion within the greater rankings courses, however default spreads have dropped considerably during2023, for decrease rated bonds.

The fairness threat premium declined within the first half of the 12 months, from 5.94% on January 1, 2023, to five.00% on July 1, 2023, however have been comparatively steady within the third quarter, albeit on prime of upper threat free charges. Thus, the fairness threat premium of 4.84% on October 1, 2023, when added to the ten-year T.Bond price of 4.58% on that day yields an anticipated return on fairness of 9.42%, up from 8.81% on July 1, 2023. Put merely, however the ups and downs in inventory costs and rates of interest within the third quarter of 2023, there’s little proof that adjustments within the pricing of threat had a lot to do with the volatility. A lot of the change in inventory and company bond costs within the third quarter has come from rising rates of interest, not a heightened concern issue.

In a post in the midst of 2022, I famous a dramatic shift in threat capital, i.e., the capital invested within the riskiest investments in each asset class – younger, money-losing shares in equities, high-yield bonds within the company bond market and seed capital, in enterprise capital. After a decade of extra, the place threat capital was not simply plentiful, however overly so, threat capital retreated to the sidelines, creating ripple results in personal and public fairness markets. In making that case, I drew on three metrics for measuring threat capital – the variety of preliminary public choices, the quantity of enterprise capital funding and unique issuances of excessive yield bonds, and I made a decision that it’s time to revisit these metrics, to see if threat capital is discovering its approach again into markets.

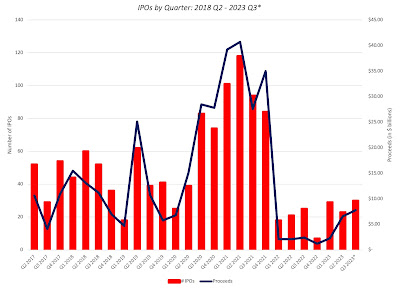

With IPOs, there have been constructive developments in current weeks, with a couple of high-profile IPOs (Instacart, ARM and Klaviyo) hitting the market, suggesting a loosening up of threat capital. To get a broader perspective, although, I took a glance a the variety of IPOs, in addition to proceeds raised, in 2023, with the intent of detecting shifts:

The excellent news is that there was some restoration from the final quarter of 2022, the place there have been nearly no IPOs, however the unhealthy information (for these within the IPO ecosystem) is that that is nonetheless a stilted restoration, with numbers effectively beneath what we noticed for a lot of the final decade. As well as, it needs to be famous that the businesses which have gone public in the previous couple of weeks have had tough going, post-issuance, despite being priced conservatively (relative to what they’d have been priced at two years in the past).

The drop off in enterprise capital investing that we noticed within the second half of 2022 has clearly continued into 2023, with the second quarter funding down from the primary. I’ve lengthy argued that enterprise capital pricing is tied to IPO and younger firm pricing in public markets, and on condition that these are nonetheless languishing, enterprise capital is holding again. Briefly, in case you are a enterprise capitalist or an organization founder, battered by down rounds and withheld capital, the top isn’t in sight but.

Lastly, corporations which have rankings beneath funding grade want entry to threat capital, to make unique issuances of bonds. Within the chart beneath, I take a look at company bond issuances in 2023:

The excellent news is that companies are again to issuing bonds, maybe recognizing that ready for charges to come back down is futile. Nonetheless, the portion of those issuances which can be high-yield bonds has stayed low for the final six quarters, suggesting that the marketplace for these bonds remains to be sluggish.

Wanting throughout the chance capital metrics, however the restoration we’ve got seen in equities this 12 months, it appears like threat capital remains to be on the facet strains, maybe as a result of that restoration is concentrated in giant and money-making corporations. Till you begin see inventory market good points widen and embrace smaller, money-losing corporations, it’s unlikely that we’ll see bounce backs within the enterprise capital and high-yield bond markets. Even when that restoration comes, I imagine that we’ll not return to the excesses of the final decade, and that’s, for my part, an excellent improvement.

What now?

Getting into the final quarter of 2023, it’s placing how little the terrain has shifted during the last 9 months. The 2 huge uncertainties that I highlighted at the beginning of the 12 months – whether or not inflation would persist or subside and whether or not there can be a recession – stay unresolved. If something, the failed prognostications of economists and market gurus on each of those macro questions has left us with even much less religion of their forecasts, and extra adrift about what’s coming down the pike. On the economic system, the consensus view at the beginning of 2023 was that we have been heading right into a recession, with the one questions being when it might kick in, and the way deep it might be. One cause for market outperformance this 12 months has been the efficiency of the economic system, which has managed to not solely keep away from a recession but additionally ship sturdy employment numbers:

It’s true that in the event you squint at this graph lengthy sufficient, you might even see indicators of slowing down, however there are few indicators of a recession. This information could clarify why economists have turn into extra optimistic in regards to the future, over the course of 2023, as will be seen of their estimates of the likelihood of a recession:

The economists polled on this survey have diminished their chance of a recession from greater than 60% to about 40%, with the steepest drop off occurring within the final two months.

On inflation, we began the 12 months with the consensus view that inflation would come down, however solely due to financial weak point. The constructive shock for markets in 2023 is that inflation has come down, with no recession but in sight:

The drop off in inflation within the first half of 2023 was steep, each in precise numbers (CPI and PPI) and in expectations (from surveys of shoppers and the treasury market). Whereas the third quarter noticed of leveling off in these good points, it’s clear that inflation has dropped over the course of the 12 months, albeit to ranges that also stay about Fed targets. If you’re a kind of who argued that inflation was transitory, this 12 months isn’t a vindication, since costs, even when they stage off, will probably be about 20% greater than they have been two years in the past. There may be work to be carried out on the inflation entrance, and declaring untimely victory will be harmful.

Valuing Equities

In response to what this implies for the market, I’ve to begin with a confession, which is that I’m not a market timer, making it impossible that I’ll discover the market to be mis-valued by a big magnitude. In line with a follow that I’ve used earlier than (see my start-of-the 12 months and mid-year valuations), I valued the S&P 500, given present market rates of interest and consensus estimates of earnings for the long run:

As you’ll be able to see, with the 10-year treasury bond price at 4.58% and the earnings estimates from analysts for 2023, 2024 and 2025, I estimate an intrinsic worth of the index of 4147, about 3.4% beneath the precise index stage of 4288, making it near pretty valued.

My evaluation is a little bit of a cop-out, since they’re constructed on present rate of interest ranges and consensus earnings estimates. To the extent that your views about inflation and the economic system diverge from that consensus may cause you to reach at a special worth. I’ve tried to seize 4 eventualities within the image beneath, with a distinction to the market consensus situation above, and computed intrinsic worth underneath every one:

As you’ll be able to see, your views on inflation (cussed or subsides) and the economic system (delicate touchdown or recession) will lead you to very totally different estimates of intrinsic worth, and judgments about underneath or over valuation.

Since I’m incapable of forecasting inflation and financial progress, I fall again on one other instrument in my arsenal, a Monte Carlo simulation, the place I enable three key variables (threat free price, fairness threat premium, earnings in 2024 & 2025) to fluctuate, and estimate the impact on index worth:

The median worth throughout 10,000 simulations is 4199. 2.1% beneath the index worth of 4288, confirming my base case conclusion. If there’s a concern right here for fairness buyers, it’s that there’s extra draw back than upside, throughout the simulation, and that needs to be a think about asset allocation choices. It may well additionally clarify not solely why there’s reluctance on the a part of buyers to leap on the bandwagon, but additionally the presence of high-profile buyers, quick promoting your entire fairness market.

Conclusion

YouTube Video

Spreadsheets