In Sovereign Debt Disaster, Dimitris Chorafas defines Japanification “as a time period of financial plight which is neither outright chapter nor significantly better than a corridor of mirrors.” In different phrases, Japanification is a attribute of an economic system that has misplaced traction in its development and is caught in an prolonged interval of low rates of interest, low inflation, and excessive authorities indebtedness.

A lot of the developed world is at completely different phases of Japanification, with Europe being the furthest alongside. Some rising nations (e.g., China) may probably observe go well with. So, how ought to we allocate capital in a world the place development is subdued, risk-free investments (in lots of situations) are unfavorable yielding, and recession might be lurking across the nook?

Deglobalization: An Consequence of Japanification?

The 1985 Plaza Accord resulted in a big appreciation of the yen, bringing Japanese exports to a standstill and abruptly halting development. Consequently, the federal government in Tokyo launched a collection of expansionary financial insurance policies: rates of interest have been slashed, and monetary stimulus was launched. These measures resulted in asset bubbles, notably within the inventory and actual property markets. In a delayed response to the bubble burst, the Financial institution of Japan launched into an unconventional path of a zero rate of interest coverage (ZIRP) in 1999.

However ZIRP failed to boost inflation in Japan. Europe and the U.S. have had comparable experiences with low, zero, and even unfavorable rates of interest. One potential argument is that in a globalized world, aggressive forces result in lack of pricing energy by corporations. How can U.S. producers compete with cheaper Chinese language producers which have comparable scale? The present wave of commerce wars and deglobalization, thus, seems to have some roots in an incapacity to supply inflation or a worry of deflation.

The Rise of the Strolling Lifeless

When the bubble burst in Japan within the Nineties, the Financial institution of Japan tried to stimulate development by way of rock-bottom rates of interest and monetary stimulus. This transfer gave start to “zombie” corporations, which have been saved on life help by low cost financing. These companies are in such dangerous form that they can’t even service their present debt with their present earnings. In a well-functioning capitalist system, such corporations could be allowed to go belly-up, releasing up assets from the extra productive components of the economic system.

Sadly, sustained low charges led to a thriving inhabitants of those zombie corporations, not simply in Japan but additionally in the remainder of the world. Based on the Financial institution for Worldwide Settlements, throughout 14 superior economies, zombies now quantity 12 p.c of all publicly listed corporations. The variety of zombie companies within the S&P 1500 elevated from 2 p.c to 14 p.c between 1987 and 2018, in accordance with evaluation by Bianco Analysis.

After we prop up a military of strolling useless corporations, productiveness suffers and inflation stays subdued. When charges are low, such zombies fly underneath the radar. But when charges rise even modestly, or a recession pummels everybody throughout the board? A impolite awakening might await such corporations and their traders. Expert energetic traders ought to be capable of determine and keep away from such troubled corporations. However passive traders in, say, the S&P 1500 will discover 14 p.c of their portfolio zombified. If a wave of company defaults ensues, it may result in panic basket promoting, deepening a sell-off.

The (De)inhabitants Bomb

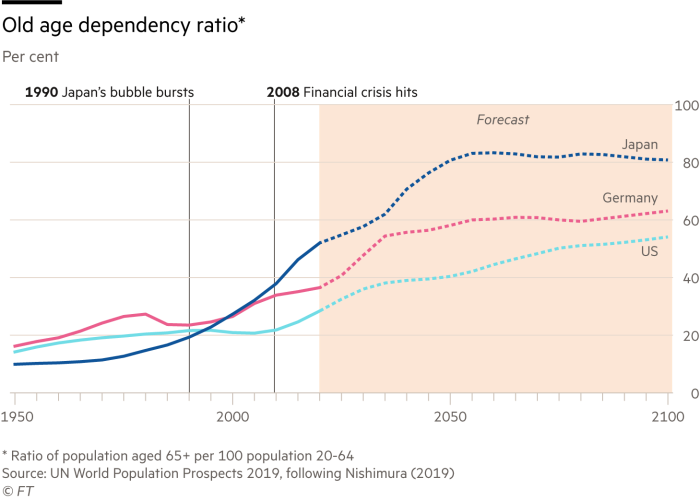

In 1968, the discharge of Paul Ehrlich’s best-selling e-book, The Inhabitants Bomb, percolated fears {that a} inhabitants bomb would tip the world into chaos. The truth that many nations face in the present day—and that Japan has been coping with for almost three many years—is sort of the opposite. Japan’s working-age inhabitants (aged 15-64) peaked in 1991, and the whole inhabitants began to say no in 2011. Statisticians, nonetheless, continued to forecast a return to greater start charges. That forecast led to overcapacity and deflation as a result of corporations mistakenly overinvested within the expectation of a better inhabitants.

The subsequent 20 years will contain dramatic getting older in developed nations, with Korea and China additionally at a turning level. As folks age and retire, they spend much less and save extra. This dynamic pushes down costs and rates of interest. Inhabitants decline generally is a slowly ticking time bomb, which might be combated by permitting motion of capital and labor. If an economic system is totally globalized, then even when the home inhabitants declines, the worldwide inhabitants nonetheless grows. Financial savings from an getting older economic system may stream right into a youthful economic system that may supply greater funding returns. This isn’t an possibility, nonetheless, when nations are doing precisely the other—closing their borders.

How Do You Put money into a Japanified World?

Sadly, Japanification to completely different levels is probably going the brand new regular for many of the world, a actuality that we might discover ourselves in for many of our investing careers. When investing on this backdrop, you will need to preserve three factors in thoughts.

First, when inflation is prone to stay low whilst financial coverage reaches the boundaries of chance, we wish to discover ourselves invested in corporations which have pricing energy that can’t be competed away. In different phrases, search for corporations which might be shielded from new entrants as a consequence of constraints (mental capital, coverage, community results, and many others.).

Second, rates of interest are prone to stay subdued within the close to to medium time period in many of the developed world. At such low charges of financial development, it doesn’t take a lot to tip economies right into a recession. When recession hits, steadiness sheet fundamentals change into critically necessary, and solely the strongest survive. You do not need to be stranded holding a handful of zombies on the day of reckoning.

Third, a secular stagnation in an economic system can probably be addressed with aggressive fiscal and financial coverage. There are, in fact, penalties to such measures, as we noticed within the case of Japan. However a secular stagnation in inhabitants requires adaptation by the human race, which is extra complicated and might take a for much longer time. Within the meantime, companies that adapt to or service a altering demographic will thrive, and people are the companies that traders ought to take into account.

Secular and aggressive benefits of corporations which have pricing energy, have sturdy fundamentals, and have a enterprise mannequin that caters to a altering world demographic can assist us navigate the maze of Japanification.

Editor’s Be aware: The authentic model of this text appeared on the Impartial Market Observer.