Fund households that get it proper, again and again

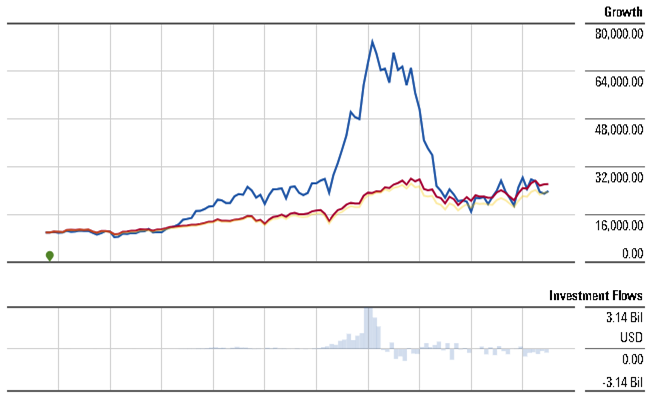

Briefly sensible efficiency isn’t all of the robust. It requires somewhat extra luck the talent and it may be wildly worthwhile for the adviser, although lethal for the buyers. ARK Innovation ETF is, after all, the present poster youngster for boom-then-bust. The fund posted triple-digit returns in 2020, noticed its property explode then promptly (and predictably) crashed. Anybody who purchased 5 years in the past and has devoutly held on has misplaced 1% yearly and has trailed 99.9% of all related buyers. Those that purchased on the peak three years in the past have clocked annual losses of 30.3%.

In collaboration with the oldsters at Morningstar, MFO determined to establish the companies that had been least prone to ever betray their buyers by hovering after which smashing.

In collaboration with the oldsters at Morningstar, MFO determined to establish the companies that had been least prone to ever betray their buyers by hovering after which smashing.

The MFO Premium screener charges each fund household primarily based on the efficiency of their current funds. We assign each household of 5 or extra funds into tiers primarily based on absolutely the efficiency of their funds towards their friends. The households with the “prime” score are within the prime 20% of all households for uncooked efficiency. We monitor that score over a wide range of durations, as a measure of constant excellence. By our measure, solely 10 households have excelled in each interval we monitor.

The fly within the ointment is survivorship bias. We solely analyze the data of funds that also exist; if an adviser had 15 funds a decade in the past and was compelled to liquidate 10 of them, they might nonetheless obtain a Prime rating if the 5 survivors had been glorious. With the intention to fight  survivorship bias, we enlisted the help of Dillon McConnell, an Affiliate Quantitative Analyst at Morningstar, who was in a position to question Morningstar’s survivorship-free database for us. He recognized companies with a 100% 10-year success price. That signifies that each fund that the agency had 10 years in the past continues to be in operation and has overwhelmed its friends over the previous decade. There are 68 companies with a 100% 10-year success price, though nearly all of these are advisers with a single fund (e.g., Bretton Fund). Forty-one of these companies even have an ideal five-year report. (The whole record is right here.)

survivorship bias, we enlisted the help of Dillon McConnell, an Affiliate Quantitative Analyst at Morningstar, who was in a position to question Morningstar’s survivorship-free database for us. He recognized companies with a 100% 10-year success price. That signifies that each fund that the agency had 10 years in the past continues to be in operation and has overwhelmed its friends over the previous decade. There are 68 companies with a 100% 10-year success price, though nearly all of these are advisers with a single fund (e.g., Bretton Fund). Forty-one of these companies even have an ideal five-year report. (The whole record is right here.)

Now we have melded these two lists to establish the fund households (5 or extra funds) which have persistently gotten in proper by each MFO requirements (prime 20% batting common for the previous 1-, 3-, 5- and lifelong durations) and Morningstar’s requirements (above common efficiency whereas factoring within the results of fund liquidations and mergers).

Prime Tier Fund Households, knowledge by means of 6/30/2024

| MFO Lifetime score | One-year score | Three-year score | 5-year score | Morningstar 10-year success price | Morningstar 5-year success price | Morningstar “mother or father” score | |

| Dodge & Cox | Prime | Prime | Prime | Prime | 100 | 100 | Excessive |

| Boston Companions | Prime | Prime | Prime | Prime | 86 | 70 | Above common |

| Marsico | Prime | Prime | Prime | Prime | 83 | 100 | Above common |

| FPA | Prime | Prime | Prime | Prime | 67 | 71 | Above common |

| Gotham | Prime | Prime | Prime | Prime | 67 | 38 | Common |

| Third Avenue | Prime | Prime | Prime | Prime | 67 | 100 | Under common |

| Hotchkis & Wiley | Prime | Prime | Prime | Prime | 63 | 80 | Above common |

| Driehaus | Prime | Prime | Prime | Prime | 50 | 75 | Above common |

| AQR | Prime | Prime | Prime | Prime | 37 | 40 | Common |

| Easterly | Prime | Prime | Prime | Prime | 25 | 50 | Common |

Supply: MFO Premium (columns 2-5), Morningstar Direct (columns 6-7), Morningstar.com (column 8)

The unambiguous winner is Dodge & Cox. Dodge & Cox was based in 1930 by Van Duyn Dodge and E. Morris Cox. They shared the assumption that the funding companies of their day had been undisciplined and self-serving; that’s, the principals put their very own pursuits forward of their shoppers’. Dodge and Cox aimed to vary that.

The unambiguous winner is Dodge & Cox. Dodge & Cox was based in 1930 by Van Duyn Dodge and E. Morris Cox. They shared the assumption that the funding companies of their day had been undisciplined and self-serving; that’s, the principals put their very own pursuits forward of their shoppers’. Dodge and Cox aimed to vary that.

The agency describes its core this fashion:

“A somewhat chaotic funding world” describe the Roaring Twenties—when high-priced funding merchandise flooded {the marketplace}—and our founders believed shoppers deserved a brand new sort of funding agency. Dodge & Cox was based with the purpose of placing shoppers’ pursuits first by means of a centered set of funding methods designed to protect and improve their funding capital over the long run and supplied at affordable and clear charges. These rules nonetheless information our agency greater than 90 years later.

Now we have constructed our agency to resist durations of turbulence on the bedrock of unbiased possession, monetary power, a dedication to lively, value-oriented investing, and a deep perception within the energy of elementary analysis, various views, and teamwork. Our tradition emphasizes our fiduciary duty to our shoppers and Fund shareholders above all else.”

The agency’s seven methods are all team-managed. They launch a brand new technique about as soon as a era and deal with supervisor succession exceptionally nicely. Whereas there was some concern in 2023 that CIO David Hoeft is likely to be front-running his agency’s funds by shopping for inventory for his private account forward of a agency’s buy of the identical inventory, D&C’s inner overview concluded in any other case and Morningstar continues to affirm their excessive opinion of the corporate.

From each Morningstar’s metrics and ours, three companies stand out as advisers who get it proper with startling consistency. Right here is one fund it is best to be taught extra about from every household.

Dodge & Cox World Bond simply handed its 1o-year anniversary. At $2.8 billion, it’s small and nimble by D&C requirements. The fund

…seeks to generate enticing risk-adjusted complete returns by investing throughout world credit score, foreign money, and rate of interest markets. We consider every funding with a three- to five-year funding horizon in thoughts, however repeatedly modify our positioning in response to adjustments in fundamentals and market pricing.

Over the previous decade, it’s had the fifth-highest returns of a fund in Lipper’s world revenue peer group.

Comparability of Lifetime Efficiency (06/2014-06/2024)

| Annual return | Most drawdown | Ulcer Index |

Sharpe Ratio |

|

| Dodge & Cox World Bond | 2.8 | -14.7 | 4.9 | 0.20 |

| Lipper World Earnings Class | 0.8 | -20.2 | 7.7 | -0.12 |

Every of the seven managers has invested greater than $1 million of their very own cash within the fund.

WPG Companions Choose Small Cap Worth is one in all Boston Associate’s two latest launches; the opposite is the newly launched Choose Hedged Fund, which is an extended/quick small-cap fund. The agency launched it on the behest of present buyers. The fund makes an attempt to “establish out of cycle corporations with clear catalyst and occasion paths by means of bottom-up elementary analysis, government suite engagement, and broad trade information.”

The Choose Small Cap Worth fund is a public manifestation of a longer-running technique. The Choose Small Worth technique was launched in December 2018. Since inception, the technique has returned 18.97% yearly which crushes the Russell 2000 Worth’s 6.7%. The fund launched in December 2021 and maintains an enormous efficiency hole over the benchmark.

Comparability of Lifetime Efficiency (01/2022-06/2024)

| Annual return | Most drawdown | Ulcer Index |

Sharpe Ratio |

|

| Boston Companions WPG Companions Choose Small Cap Worth | 11.4 | -18.8 | 6.9 | 0.37 |

| Lipper Small Core Class | -0.1 | -22.9 | 11.8 | -0.18 |

The fund’s sole supervisor is Eric Gandhi. He joined the WPG Group in 2012 as an analyst and is now supervisor, or co-manager, of 4 WPG micro- to small-cap methods. He has invested between $100,000 – 500,000 within the fund.

Marsico Worldwide Alternatives, the smallest of the Marsico funds, launched in June 2000. Founder Tom Marsico took over the reins in 2017 and added his sons Peter and James as co-managers in 2023. They joined the agency as analysts in 2008 and 2009, respectively, and now co-manage a variety of funds with their father.

The fund makes an attempt to “capitalize on numerous secular tendencies fueling progress throughout the globe by means of a portfolio of top quality, growth-oriented worldwide corporations.” The fund is concentrated, a Marsico hallmark, with use 27 shares, an unusually excessive funding in US-domiciled corporations (38% of the portfolio) and an lively share of 90.

Comparability of Marsico-led Efficiency (07/2017-06/2024)

| Annual return | Most drawdown | Ulcer Index |

Sharpe Ratio |

|

| Marsico Worldwide Alternatives | 8.9 | -36.8 | 14.0 | 0.37 |

| Lipper Int’l Giant Development Class | 6.4 | -34.3 | 12.9 | 0.25 |

Mr. Marsico the Elder has invested between $500,000 – $1 million within the fund whereas his co-managers have chosen to not commit their very own funds to it.

Backside Line

There aren’t any ensures in life or in investing. At greatest, an investor can search an edge: an everlasting benefit they possess over their friends. One edge you possess is time arbitrage; if you’re a long-term investor in a world of short-term merchants, you largely have to make a handful of wise commitments after which stroll away from the madding crowd and their howling handlers. The opposite edge you possess is the power to establish funding companions who hold getting it proper: they hardly ever launch funds, they hardly ever abandon funds, they usually outperform over affordable time frames.

We’ve recognized simply 10, out of tons of, of funding companies that meet that threshold. We commend them to you.