I got here throughout a bunch of charts up to now few weeks about Europe’s financial and market struggles.

Let’s have a look.

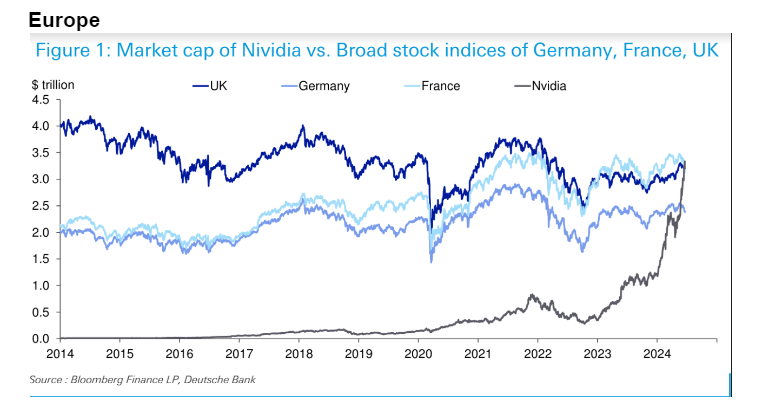

These charts that present how the most important corporations within the U.S. inventory market are as large or greater than a few of the greatest financial powers in Europe all the time get me:

The UK has one thing like 1,900 shares on the London alternate. The primary exchanges in France and Germany have roughly 800 and 500 shares, respectively. Nvidia has fewer than 30,000 staff.

I’m undecided there may be something actionable about charts like this, however it makes you assume.

The Economist has a chart that exhibits the slide in each GDP and inventory market capitalization in Europe this century:

Europe makes up 25% of world GDP however just a bit greater than 15% of world inventory market capitalization. America has roughly the identical weight in GDP at 25% however makes up greater than 60% of the world market cap.

America (China too) is dominating Europe on the non-public market aspect of the ledger too:

Issues had been pretty even within the early-2010s. Not anymore.

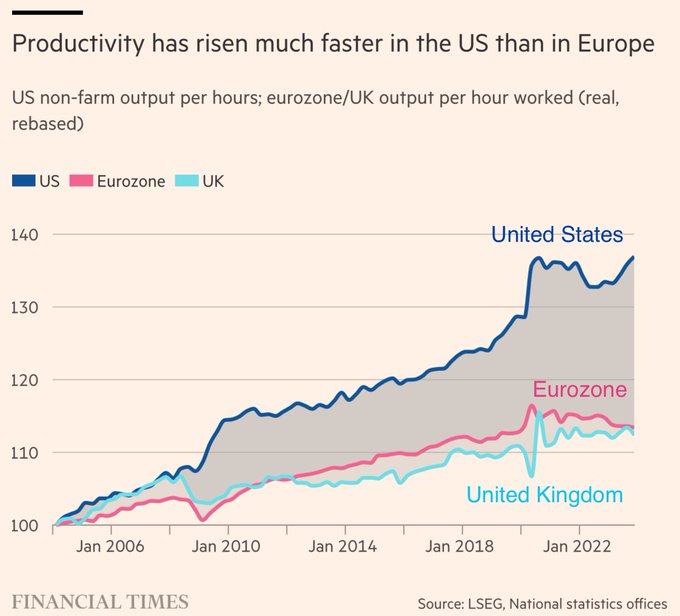

The Monetary Instances has a chart that exhibits the divergence in productiveness since simply earlier than the Nice Monetary Disaster:

It’s like somebody flipped a swap after the 2008 crash when U.S. employees and corporations grew to become extra environment friendly than the Eurozone.

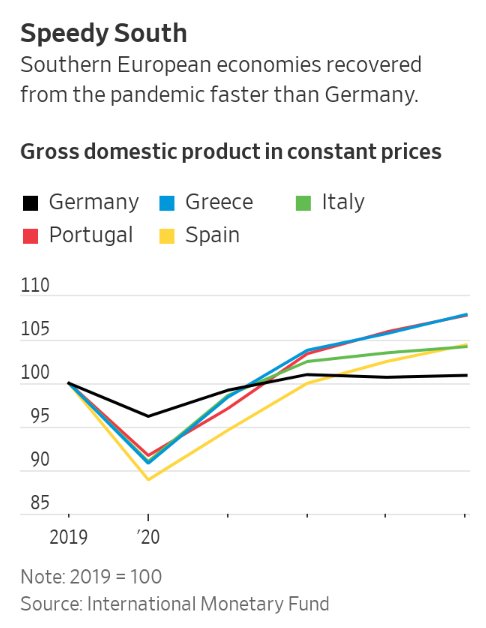

The Wall Road Journal had a narrative this week that makes it sound like free-spending American vacationers are the Eurozone’s solely financial driver:

They present that vacationer nations have skilled increased development for the reason that pandemic:

That is in all probability a little bit of a stretch, however you’ll be able to’t deny that the Eurozone has fallen behind this century on the subject of financial and monetary market development.

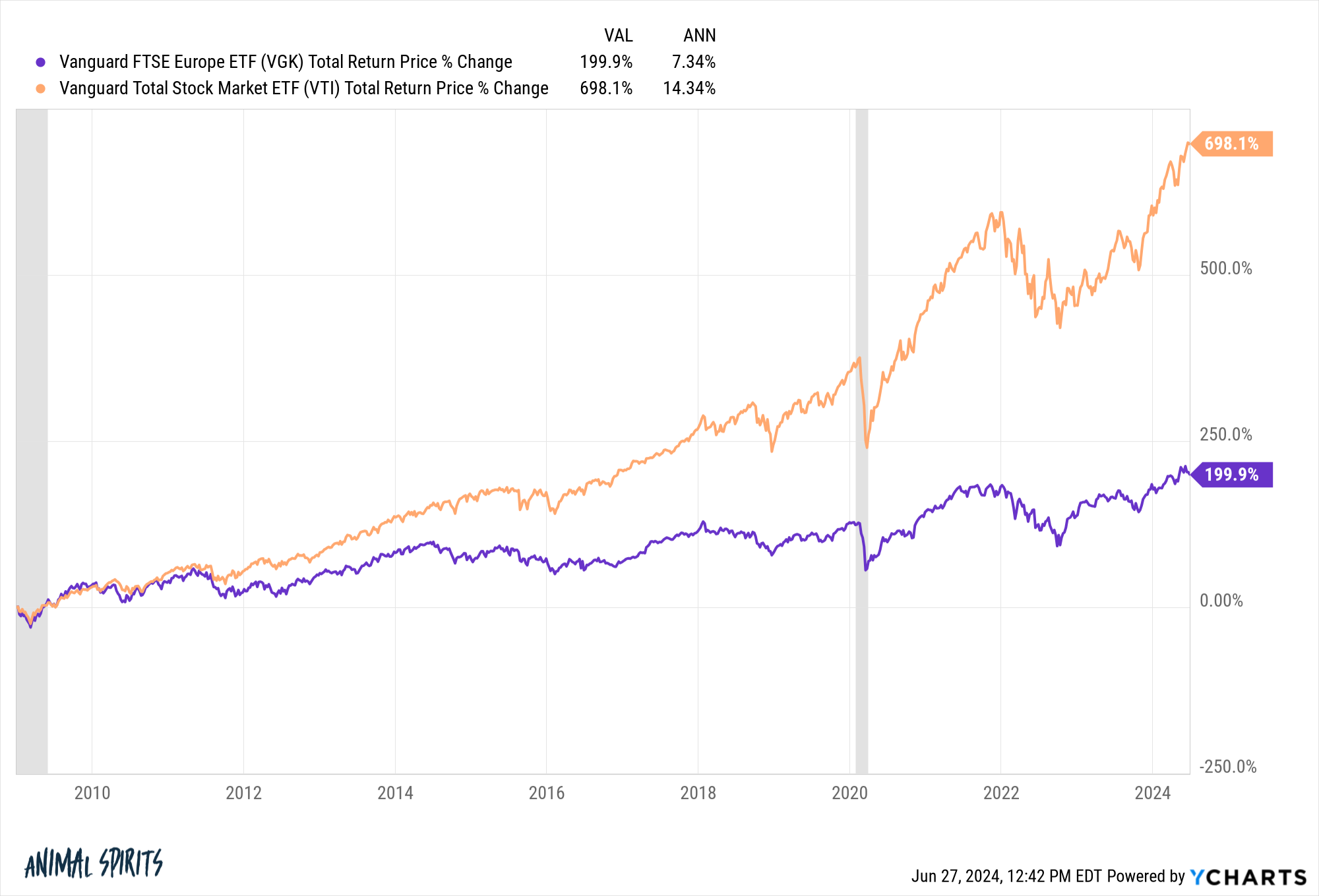

Right here’s a have a look at European shares versus the U.S. inventory market since 2009:

To be truthful, these numbers are from the angle of a U.S.-based investor. A powerful greenback has been a headwind for worldwide shares. The returns would look higher for residents of European nations.

I’m not sensible sufficient to provide you all the explanations for this disparity or provide any broad-based options.1

The realist in me thinks the U.S. dominance will doubtless proceed. We’ve got the most important and greatest tech corporations on the earth. We worship the inventory market and financial development on this nation. People are additionally inclined to obsess over their jobs moderately than take month-long holidays.

America has lots of built-in benefits over the remainder of the world.

However the contrarian in me thinks everybody might be too pessimistic about Europe proper now.

There’s a legendary story about how John Templeton began his funding profession throughout World Conflict II. The 26-year-old investor borrowed $10,000 in 1939, when the conflict started, and invested in additional than 100 corporations buying and selling for lower than $1 per share. A handful of these shares turned out to be nugatory, whereas the remainder had been wildly worthwhile.

Is that this story a non-sequitur? Eh, possibly.

I do know lots of clever individuals in Europe. It’s exhausting for me to see development persevering with to break down within the space whereas the USA swallows the world fairness market. I suppose something is feasible. Being contrarian for contrarian’s sake isn’t an funding technique.

There are two primary choices:

Choice 1. Europe is lifeless cash. The principles and laws there are too onerous for worthwhile firms to flourish.

Choice 2. Everybody is way too pessimistic about Europe’s prospects and it received’t take a lot excellent news to show issues round.

It’s not less than a query price contemplating.

Michael and I talked about European financial struggles and rather more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

Lengthy-Time period Recency Bias

Now right here’s what I’ve been studying these days:

Books:

1That will require a for much longer submit.

This content material, which incorporates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will likely be relevant for any specific details or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.