A reader asks:

I used to be listening to WAYT and Josh talked about and Michael appeared to agree that the small cap premium not exists (for the reason that Nineteen Eighties). I hoped that this query could be mentioned and dissected: What is that this premium? Why doesn’t it exist anymore? How have you learnt? Is it nonetheless price being proudly owning small caps? My uneducated opinion was that small caps traditionally carried out on par, if not higher, than the remainder of the market. Additionally, with the S&P 500 considerably outperforming small caps, it looks like being obese on new contributions going into small caps doesn’t seem to be a farfetched or irrational thought.

The Jeremys (Siegel and Schwartz) lined the small cap premium within the newest version of Shares for the Lengthy Run.

They take a look at returns from 1926-2021. Small cap shares outperformed giant cap shares 11.99% to 10.35%. However mainly all of that premium got here in a single 9 12 months window between 1975 and 1983 when small cap shares have been up greater than 1,400% in whole. Small caps outperformed giant caps 35.3% to fifteen.7% per 12 months in that point. Take away that outlier and the long-run returns are a lot nearer.1

They clarify why this occurred:

One clarification for the sturdy outperformance throughout that interval was the enactment of the Worker Retirement Earnings Safety Act (ERISA) by Congress in 1974, making it far simpler to pension funds to diversify into small shares. One other was the flip of traders to purchase small shares following the collapse of the big-cap Nifty Fifty shares earlier within the decade.

Truthful sufficient. Though I’m certain if we exclude the 2016-2024 interval of huge cap outperformance, small shares would look significantly better traditionally.

Let’s take a look at knowledge over different time horizons to see how small caps have held up traditionally.

The Russell 2000 Index goes again to 1979. Listed below are the annual returns by Could of this 12 months:

- Russell 2000 +10.9%

- S&P 500 +12.0%

The S&P 600 Index, which excludes the various unprofitable shares included within the Russell 2000 goes again to 1995. Listed below are the annual returns by Could of this 12 months:

- S&P 600 +10.7%

- S&P 500 +10.7%

Vanguard has a small cap index fund that goes all the way in which again to 1962.2 Listed below are the annual returns by Could of this 12 months:

- NAESX +10.7%

- S&P 500 +10.2%

DFA has a small cap worth fund that goes again to 1993. Listed below are the annual returns by Could of this 12 months:

- DFSVX +11.3%

- S&P 500 +10.3%

I’m certain you would choose another begin dates that show your level for or in opposition to small cap shares however this can be a comparatively big selection of outcomes over varied time horizons. Over the lengthy haul small caps have roughly stored up with giant caps (or vice versa).

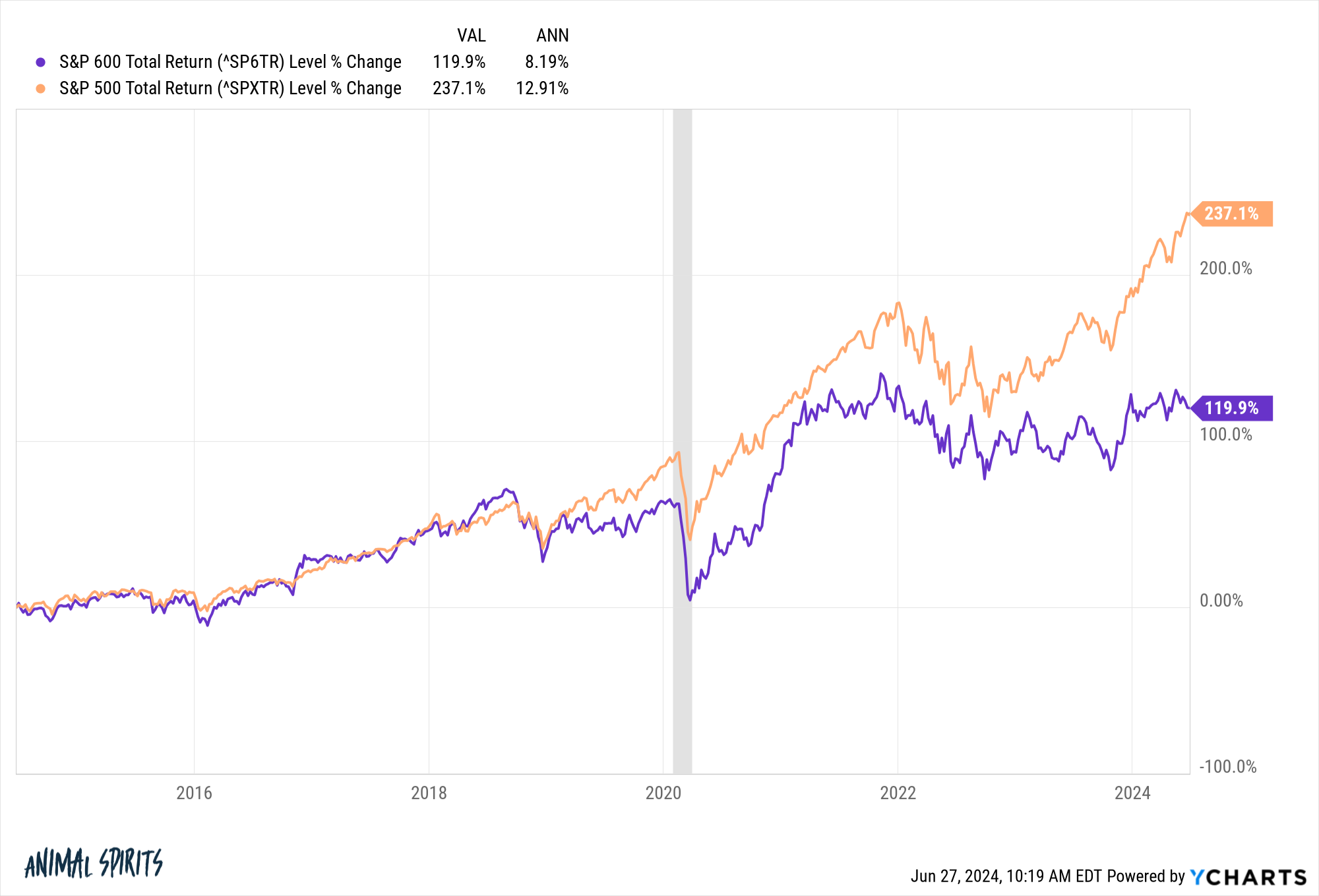

Small caps haven’t stored up this cycle. Listed below are the returns over the previous 10 years:

I’m not within the camp that it’s best to personal small caps for some type of alpha or issue premium. The inventory market is just too sensible to permit that sort of factor to persist.

I take a look at small caps as offering a diversification premium.

Simply take a look at the cycles of relative efficiency for the S&P 600 and S&P 500 for the reason that mid-Nineteen Nineties:

You could possibly discover comparable cycles going even additional again.

The Vanguard Small Cap Index Fund outperformed the S&P 500 by greater than 200% in whole from 1975-1983. Over the following 9 12 months interval, the S&P 500 outperformed by greater than 200%.

Curiously sufficient, the final time small caps lagged in an enormous means was the late-Nineteen Nineties when the dot-com bubble went into hyperdrive. Giant cap shares crushed small cap shares. Then giant cap shares turned overvalued and when the cycle turned the undervalued small firm shares outperformed in an enormous means throughout the subsequent cycle.

I can’t be optimistic this identical situation will play out once more when this cycle lastly turns. Perhaps markets have modified endlessly with regards to giant caps vs. small caps.

Corporations are staying personal longer. Extra personal cash is accessible at this time for enterprise, M&A, and leveraged buyouts. Plus, many giant firms merely purchase out the competitors earlier than they’ll go public, so there are far fewer IPOs at this time than prior to now.

Plus, increased charges have disproportionately harm smaller firms with regards to borrowing. Bigger firms have been in a position to lock in decrease charges and at the moment are incomes cash on their money holdings due to the upper yields, a luxurious extra small firms don’t have.

Perhaps these elements make small caps much less engaging than they have been prior to now. You may’t rule it out however we can also’t make certain small caps are lifeless cash now both.

Inventory market returns have been concentrated in large-cap development shares for a while, however this development won’t final endlessly.

I’m nonetheless a believer in diversification even when it makes you’re feeling like an fool.

Markets are cyclical as a result of human feelings are cyclical.

And I don’t assume human nature has modified.

We lined this query on the newest version of Ask the Compound:

Everybody’s favourite tax professional, Invoice Candy, joined me once more on the present this week to debate questions on what occurs to a Roth IRA once you go away, how a backdoor Roth works in apply, investing your money on the sidelines and learn how to cut back funding taxes as a instructor in a low tax bracket.

Additional Studying:

It is a Great Atmosphere for Greenback Price Averaging

1Nonetheless a slight edge to small caps: 10.03% to 9.80%.

2I’m not precisely certain what number of totally different index iterations this fund has gone by in its historical past however I used to be extra within the prolonged observe file.