Housing prices skyrocket

The Property Council of Australia has launched a report highlighting the alarming hole between the price of new housing and what Queenslanders can afford.

Because the state’s inhabitants grows and the housing disaster deepens, pressing coverage modifications are crucial to make sure secure and reasonably priced housing for all Queenslanders.

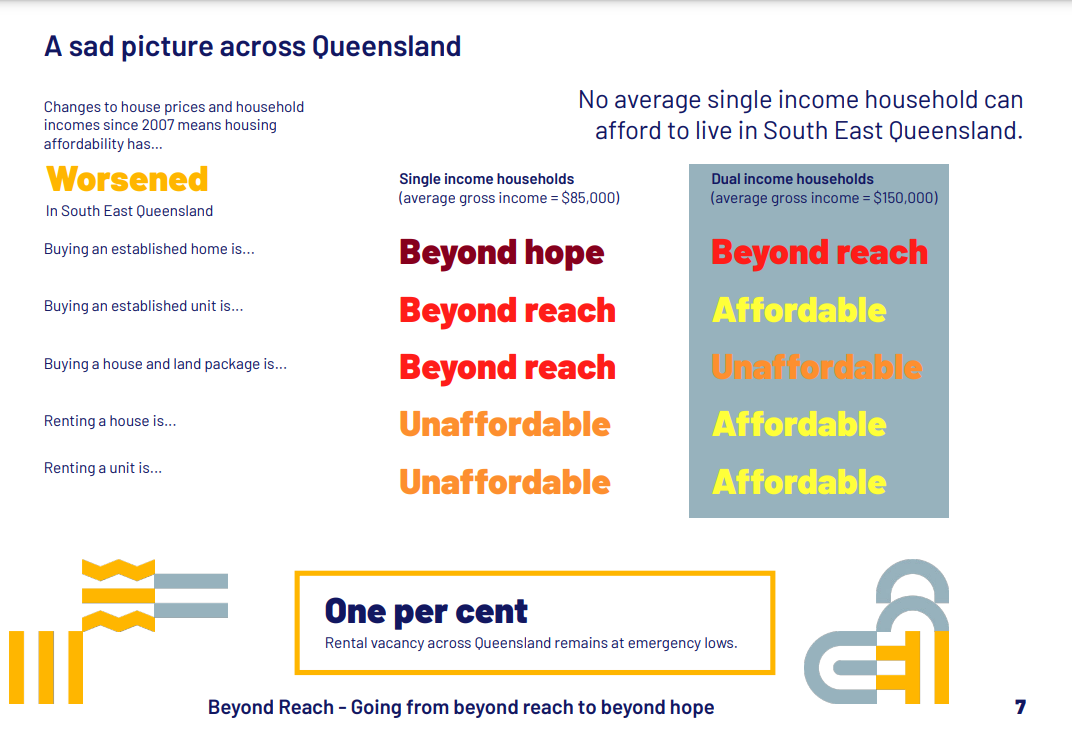

The up to date analysis, initially printed in 2007, predicted a dire housing disaster with out long-term options. Now, 17 years later, the disaster has intensified, particularly in South East Queensland.

Queensland housing affordability disaster

The Property Council report indicated that indifferent housing is unaffordable for a lot of important employees in South East Queensland, with dwelling models solely marginally reasonably priced even on a double earnings. Renting is commonly the one choice, if an acceptable property could be discovered.

Home costs have outpaced family incomes in South East Queensland since 2007, pushed by speedy inhabitants development and inadequate provide.

Reasonably priced housing, outlined as housing prices being 30% or much less of family earnings, is almost non-existent in South East Queensland, significantly for youthful households.

Property Council’s key coverage levers

The unique report highlighted three key coverage levers, and a fourth has now been added:

- Enhance improvement evaluation: Streamline and fast-track functions to ship extra properties quicker.

- Guarantee enough land provide: Enhance competitors and transfer away from restrictive land use planning insurance policies.

- Coordinated supply and funding of infrastructure: Plan and fund important infrastructure transparently.

- Overview taxation settings: Deal with the prohibitive tax settings that drive up prices and deter funding.

Taxation modifications

The Property Council report referred to as for a elementary shift in regulatory and taxation approaches to deal with systemic points.

For the reason that October 2022 housing summit, a number of initiatives have been launched, however taxation settings stay unchanged regardless of their important impression on homeownership and funding.

The reliance on property-related charges and fees, which make up greater than 38% of the state’s taxation income, highlights the dependency on property to fund the state’s price range.

The report concluded with a name for the newly fashioned authorities, post-October state election, to decide to an intensive, evidence-based evaluation of taxes and fees impacting dwelling supply and funding.

The report emphasised the vital position of each trade and authorities in shaping coverage settings that surpass political cycles. With out studying from previous errors and implementing daring modifications, the housing disaster will worsen.

“Rising homelessness, acute mortgage stress, rental shortages, and a focus of housing wealth within the palms of a shrinking proportion of the inhabitants are the inevitable penalties of additional failures to behave,” mentioned Jess Claire, Queensland government director on the Property Council.

Get the most popular and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE each day e-newsletter.

Associated Tales

Sustain with the newest information and occasions

Be part of our mailing record, it’s free!