Retirement calculators may help you intend for the longer term. And over the previous couple of years, there have been plenty of them developed that each one provide slight variations and instruments.

Saving and investing for retirement is a long-term undertaking finest tackled over many years. If you’d like the tailwinds of compounding development, you must make investments for retirement early and sometimes.

Nonetheless, generic recommendation doesn’t reply most individuals’s greatest retirement questions. You wish to know the way a lot you must save every month, what age you’ll be able to retire at, whether or not your funding portfolio is more likely to run out, and what you’ll be able to afford to do alongside the way in which.

That’s the place retirement planning calculators are available. Whether or not you’re simply beginning to make investments for retirement, or are planning to exit the workforce inside a yr or two, you’ll be able to profit from a retirement calculator.

Finest Retirement Calculators For 2024

We’ve examined shut to twenty retirement calculators and chosen our favorites for 2024. You’ll be able to see the complete listing (in ranked order) later within the article, however listed below are our prime picks, beginning with the T.Rowe Value Retirement Earnings Calculator (it is free).

Finest General Retirement Calculator: T.Rowe Value

With a near-perfect rating on usability, a complicated method to evaluation, a deep stage of customization, and a free price ticket (which was the tie-breaker), the T. Rowe Value Retirement Earnings Calculator was our prime choose for the very best total retirement planning calculator. The questions it asks are detailed sufficient to provide you a transparent concept of whether or not you’re on monitor to retire, however high-level sufficient to get your reply in beneath 5 minutes.

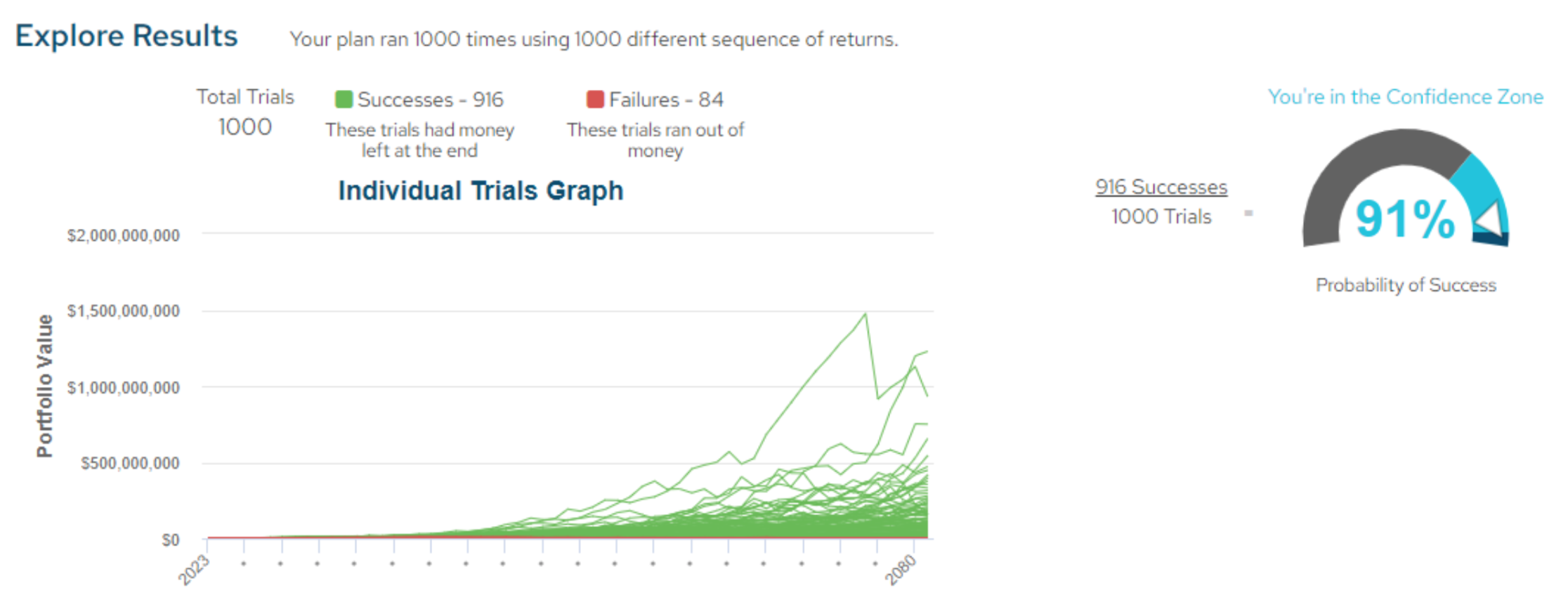

The T. Rowe Value calculator makes use of Monte Carlo simulations that will help you perceive in the event you’re more likely to meet your retirement targets or not. It additionally means that you can “play” along with your assumptions (rising financial savings charges, retiring earlier or later, including money infusions, and many others.). This supplies a dynamic retirement calculator that isn’t overly burdensome.

The calculator focuses completely on retirement, so that you shouldn’t use it for all of your monetary planning wants. However in the event you’re questioning whether or not you’re on monitor to retire, it would assist you to discover the reply.

Finest Free Retirement Planning Device: Empower

Whereas the T. Rowe Value retirement planning calculator solutions whether or not you’ll be able to retire, Empower helps you dig into your retirement planning questions. Empower means that you can do detailed state of affairs planning primarily based in your precise monetary state of affairs. By utilizing real-time information out of your monetary accounts (together with your spending accounts), you’ll be able to dig into actual particulars as an alternative of hypotheticals. Even higher, the instruments are free to make use of, and Empower lives in your cellphone or laptop, so you’ll be able to overview the outcomes at your leisure.

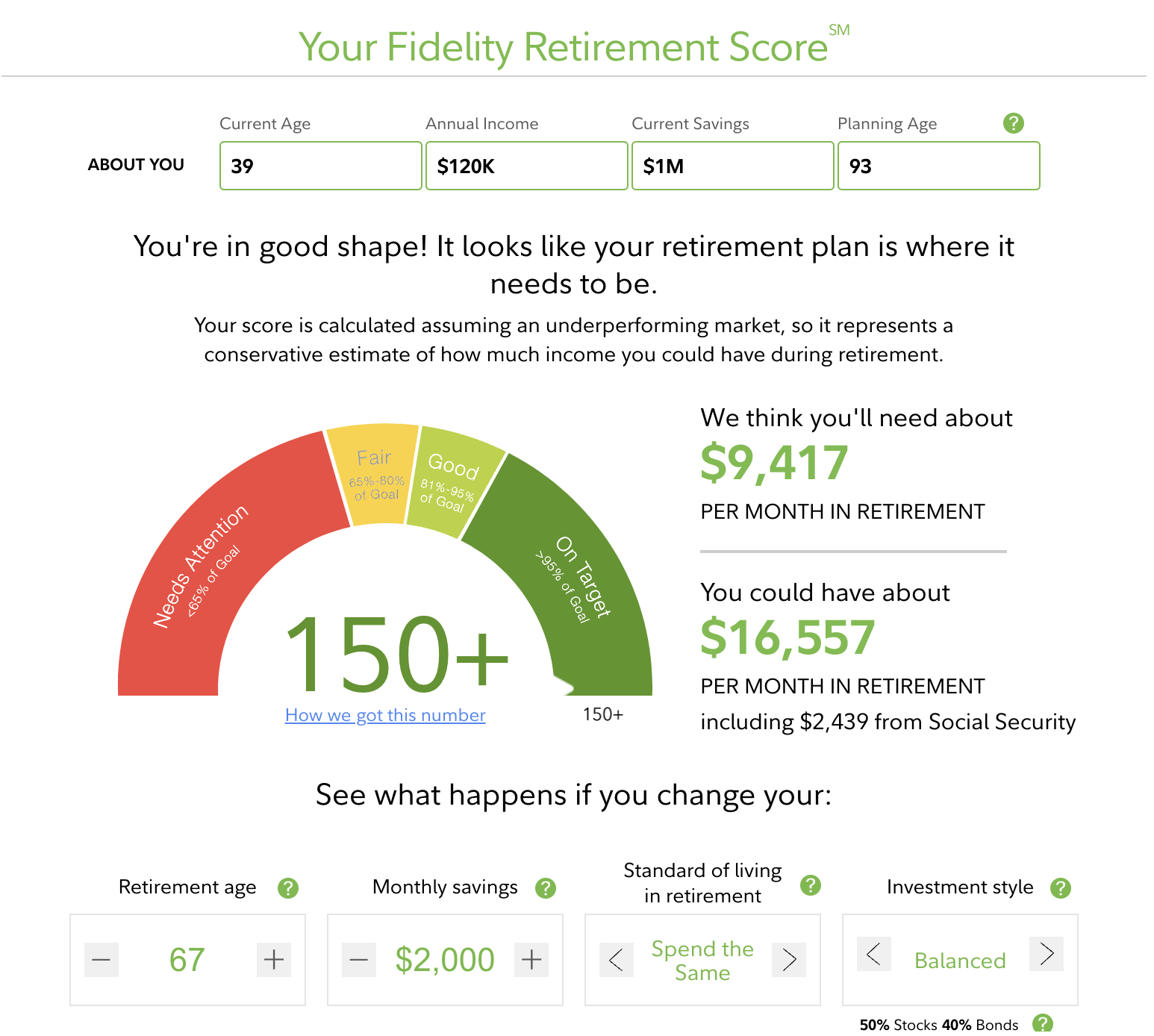

Finest For Fast Evaluation: Constancy’s Retirement Rating

By answering six fast questions, you’ll be able to obtain Constancy’s Retirement Rating. The rating exhibits the chance that your cash will outlive you (primarily based in your responses to the questions). Should you’re not planning to retire within the subsequent few many years, Constancy’s calculator lets you understand whether or not you’re on monitor for retirement. It’s not designed for detailed retirement planning, however it would present you if you must save extra aggressively, or in the event you can take your foot off the gasoline.

Finest For Whole Life Planning: Maxifi

Maxifi takes the prize for finest whole life planning device. It integrates tax planning, life occasions, and adjustments to revenue and bills right into a complete monetary and retirement plan. It takes your present monetary targets as significantly as your future retirement targets.

Maxifi prices $109 per yr, nevertheless it’s cash effectively spent in the event you use the software program to make higher monetary choices. If not, don’t waste your time and cash digging into the device.

A couple of years in the past, only a few corporations supplied complete monetary planning for on a regular basis folks. On this evaluation, we reviewed 4 easy-to-use instruments that provide the flexibility to contemplate all types of life occasions in your evaluation. All 5 acquired scores that allowed them to tie for second place total. Along with Maxifi, ProjectionLab, New Retirement, and OnTrajectory all provide sound monetary planning instruments that let you contemplate retirement together with the remainder of your life. We fortunately advocate any of those instruments for private finance aficionados who wish to reply life’s greatest monetary questions.

Retirement Planning Calculators Particulars

Beneath is a full listing of the retirement planning calculators that we examined — their usability scores, costs, and the ultimate rating assigned to them. Some scores point out a multi-way tie, however the descriptions above present extra element on why sure instruments had been ranked above others.

|

Device |

Description |

Usability |

Value |

Rating |

|---|---|---|---|---|

|

|

Strong calculator estimates whether or not your portfolio can help your retirement wants, and means that you can play along with your assumptions. It makes use of Monte Carlo simulations to supply an estimate of the frequency that your portfolio will final to your total life. |

19/20 |

Free |

25/30 |

|

A premium monetary planning software program designed that will help you make higher choices at this time with out jeopardizing your future targets. Maxifi supplies deep insights into the dangers and rewards of dipping into your financial savings to fulfill a short-term objective vs. holding off. |

15/20 |

$109/yr |

25/30 |

|

|

Monetary planning software program that not solely supplies detailed retirement projections, it additionally helps you monitor progress towards necessary life targets alongside the way in which. If you wish to perceive how huge life-style choices will have an effect on your retirement, OnTrajectory may help. |

15/20 |

$80/yr |

25/30 |

|

Totally customizable monetary planning software program for people who find themselves pursuing Monetary Independence and early retirement. Permits you to account for big bills (youngsters’s school, dwelling upgrades, and many others), adjustments in revenue, spending, and extra. Click on right here to learn our ProjectionLab Evaluate. |

15/20 |

$108/yr |

25/30 |

|

|

Complete monetary planning software program providing detailed monetary plans even with the free model. The upgraded model means that you can plug in tons of of monetary particulars to personalize your plan. Click on right here to learn our NewRetirement Evaluate. |

15/20 |

$120/yr |

25/30 |

|

|

Retirement planning, budgeting, and internet price monitoring app. Join your monetary accounts to the app, and construct a monetary plan primarily based in your precise account balances. Click on right here to learn our Empower Evaluate. |

16/20 |

Free |

23/30 |

|

|

|

A easy calculator that forecasts your anticipated retirement wants, and your probability of assembly them. Restricted skill to play with the numbers and there are many assumptions associated to returns and inflation. Nonetheless, an incredible device for individuals who simply wish to know whether or not they’re on monitor. |

20/20 |

Free |

23/30 |

|

|

A retirement calculator primarily based in your present spending and your anticipated spending in retirement. For individuals who wish to do monetary planning on their very own. If you do not have an in depth understanding of your present spending, that is in all probability not the correct device for you. |

14/20 |

$95/yr |

23/30 |

|

|

A Monte Carlo simulator designed to assist early retirees resolve when their portfolio is giant sufficient to help their retirement wants. You’ll be able to mannequin dozens of situations that will help you resolve whether or not you’ll be able to go away your job to retire. |

13/20 |

Free |

22/30 |

|

|

The Monetary Mentor’s Final Retirement Calculator solutions the large retirement questions. Should you’re beginning to get a deal with in your monetary particulars, this calculator can present you whether or not you are on the trail towards a financially sound retirement. You might must dig round to search out particulars like your tax fee, however as soon as you understand these particulars you’ll be able to construct a easy however sound retirement plan. |

14/20 |

Free |

21/30 |

|

A easy calculator designed that will help you work out the stability between spending and saving for retirement. The device is straightforward to make use of, however does not provide a lot in the way in which of customization (until you wish to change your inputs). |

16/20 |

Free |

20/30 |

|

Tremendous easy retirement calculator that exhibits your anticipated nest egg at retirement, and the way a lot you are anticipated to wish. The calculator is simplistic, however in the event you’re new to investing or eager about retirement, it can provide you a directional tackle whether or not you are on monitor to retire. Click on right here to learn our Stash Evaluate. |

17/20 |

Free |

19/30 |

|

|

|

WalletBurst presents a easy have a look at the connection between your spending, your belongings, and your skill to retire. In case your predominant query is when you’ll be able to give up your job, WalletBurst is the device for you. |

12/20 |

Free |

18/30 |

|

|

The Full Retirement Planner helps you create a customized retirement plan primarily based in your present monetary state of affairs and your retirement aspirations. It permits for detailed planning, however it’s best fitted to individuals who have already got an excellent understanding of their funds. |

7/20 |

$89.99/yr |

16/30 |

|

|

Utilizing easy assumptions, the AARP Retirement Nest Egg Calculator calculates a month-to-month financial savings fee required to retire at a selected age. Sadly, the built-in assumptions appear to be biased in the direction of very low returns (particularly in the course of the retirement years). In contrast with different calculators, the device could recommend too giant of a required nest egg. |

12/20 |

Free |

15/30 |

|

|

One of many unique instruments designed to assist early retirees resolve whether or not they can retire. The calculator makes use of tons of information and means that you can mannequin many alternative situations. Nonetheless, the person interface is caught in 2002, and the jargon makes the calculator laborious to make use of. |

4/20 |

Free |

12/30 |

A Few Caveats About Our Judgment Standards

Every calculator introduced on this article needed to meet sure “desk stakes” standards to be included. These standards embody having clear and truthful assumptions (particularly associated to funding development and inflation).

Calculators utilizing easy assumptions (equivalent to not accounting for volatility) had been allowed so long as assumptions surrounding development and inflation had been displayed. Such calculators are finest for folks with twenty years or extra till retirement.

It additionally wanted to supply particulars about an investor’s anticipated internet price at retirement and their portfolio’s anticipated longevity following retirement. Calculators that didn’t present each of these particulars had been excluded. We additionally excluded instruments that require you to have a retirement account with the brokerage to be able to use the device.

If the calculator met these standards, it was allowed into the listing of thought of instruments. At that time, a very powerful criterion for judging these calculators was usability for the common particular person. This accounted for two-thirds of the general rating. A typical particular person ought to be capable of soar into the calculator and get comprehensible outcomes utilizing moderately correct estimates of their monetary state of affairs. Any calculator that required customers to wade via jargon or text-heavy pages was discounted on the usability entrance.

The opposite criterion for judging the calculator was robustness. Calculators that accounted for extra funding situations, higher refinement of assumptions, or higher simulations of threat had been deemed higher than these with fewer choices. Most calculators let you “play along with your assumptions” to see what you may get on monitor for retirement. However that’s solely the primary a part of robustness. You might also wish to see how your present choice (to improve a home, have a baby, take time without work of labor, and many others.) is more likely to have an effect on your retirement plan. Some calculators allowed you to do that, however others didn’t.

Whereas robustness is necessary, it solely accounted for a 3rd of the general rating for a number of causes. First, most individuals don’t want extremely detailed monetary retirement calculations till the last decade earlier than they retire. Except you’re pursuing extraordinarily early retirement, you in all probability don’t want an in depth monetary calculator till you’re 50-60 years previous. Moreover, most individuals gained’t use the refinement options. A couple of curious folks could use the refinement options primarily based on their present life targets, however most individuals gained’t. Should you’re somebody who rigorously tracks your internet price or religiously makes use of your budgeting app, you might discover it laborious to consider that individuals don’t love spending time on monetary instruments. Nonetheless, most individuals who desire a strong evaluation pays a monetary planner for an evaluation fairly than analysis instruments themselves.

Retirement Calculator Wrap-Up

Irrespective of which retirement calculator you select, it is best to at all times spend someday every year in your retirement plan that will help you keep on monitor. You might not must construct a complete plan, however a high-level retirement goal may help you reside effectively at this time and tomorrow. Should you’re extra targeted in your day-to-day private funds think about using one in every of these budgeting apps and these investing apps that will help you take every day steps to construct your monetary well being.

The put up Finest Retirement Calculators For Projecting Financial savings appeared first on The Faculty Investor.