Shopping for a home when you will have pupil mortgage debt can really feel daunting. It may possibly really feel out of attain for a lot of pupil mortgage debtors.

How will the scholar loans have an effect on your expertise? Do you will have Federal pupil loans on an income-driven compensation plan? Have you learnt how your lender goes to deal with your debt to earnings ratio?

We’ve received some solutions to your questions and a few suggestions. This might make shopping for a home with pupil loans much less intimidating.

Plus, it’s possible you’ll wish to try our House Shopping for 101 Information right here >>

Know What’s Going On With Your Scholar Loans

Sounds easy, however you’d be shocked how many individuals don’t know exactly how a lot they owe and to whom. They don’t know what their fee plan choices are. You is likely to be a type of folks. On the point of purchase a house is an ideal excuse to get your mortgage scenario collectively. This is likely to be a deciding think about your capacity to purchase a property.

Save For A Down Fee

Relying on the mortgage kind you get, it’s possible you’ll want a down fee. Even when you’re getting a 0% down house mortgage, you continue to want one thing for charges – and lenders sometimes wish to see you may nonetheless have an emergency fund even after you shut escrow.

Just a few tricks to save for a down fee along with your pupil loans:

- Earn more cash – go facet hustle and make some additional money

- Get on an income-driven compensation plan

- Solely pay the minimal in your loans

- Leverage a windfall

- Save mechanically out of your paycheck

Speak To A Mortgage Lender

We assume you’re right here since you want a mortgage. For those who pays all money to your new house, congratulations in your luck! Your private home shopping for course of is far more easy. However for most individuals shopping for a house, a mortgage is important, so that you want a lender. This may be anybody from an area mortgage officer on the town to an on-line mortgage firm situated wherever on this planet. It’s a good suggestion to vet a number of potential lenders and discover the one which works nicely with you.

When do you have to discuss to your lender? Instantly. You’ll be able to contact a lender earlier than you even discuss to an actual property agent. In actual fact, we advocate it. That approach you will get an correct image of your value vary and never waste time taking a look at — or getting hooked up to — houses you couldn’t probably afford.

Your lender can let you understand what steps you’ll want to take to have the ability to efficiently safe a mortgage with their firm. They need to on the very minimal discuss to you about how excessive your credit score rating needs to be, viable down fee quantities, and your debt-to-income (DTI) ratio.

Your debt-to-income ratio is the share of your gross month-to-month earnings that goes to repaying money owed. You can not have debt fee take up greater than 43% of your earnings for many lenders to give you a mortgage. Even when you’ll be able to make your pupil mortgage funds every month, in case your DTI ratio is deemed too excessive, you’re out of the operating. Be sincere along with your lender about what it is possible for you to to afford and ask inquiries to be sure you’re not entering into one thing you possibly can’t deal with.

The mortgage lender would possibly even pre-qualify or pre-approve you, by which they check out your funds and allow you to know a lot they may seemingly lend to you. Whereas these are not ensures of efficiently getting a mortgage for a particular home — or ensures you possibly can really afford the quantity they approve you for — a pre-qual or pre-approval is a useful device to have when placing a proposal on a home. Sellers will know you’re a critical purchaser who has already been screened a bit.

Your lender also can introduce you to federal or state applications that present specialised mortgages with decrease down funds, grants for down funds, or different methods it can save you cash. For instance, FHA and VA loans require a smaller or no down fee.

We advocate procuring round for a mortgage lender utilizing a service like LendingTree. It takes a couple of minutes and you’ll see provides from a number of lenders in seconds. Take a look at LendingTree right here.

FHA Mortgage Necessities and Scholar Mortgage DTI Calculations

DTI continues to be critically essential for FHA mortgage approval. As soon as pupil loans are factored in, DTI necessities turn into extra strict. Utilizing the above instance, the scholar mortgage month-to-month fee is $350. Let’s say the overall excellent mortgage quantity is $50,000.

In 2021, President Biden made it simpler for pupil mortgage debtors to get an FHA Mortgage – by easing the necessities of tips on how to calculate DTI for debtors on income-driven compensation plans.

On the third web page of the June 17, 2021 Scholar Loans doc produced by the U.S. Division of Housing and City Growth, it states the next (Editor’s Observe: Formatting has been modified from authentic doc):

“(4) Calculation of Month-to-month Obligation

For excellent pupil loans, whatever the fee standing, the Mortgagee should use both:

- the fee quantity reported on the credit score report or the precise documented fee, when the quantity is above zero; or

- 0.5 p.c of the excellent steadiness on the mortgage; when the month-to-month fee reported on the Borrower’s credit score report is zero.

0.50% of $50,000 is $250. On this case, $250 will likely be used as a substitute of $350. That brings whole debt together with the $1,500 mortgage fee to $2,800 and DTI to 51%. 3% extra doesn’t look like a lot however relying on the distinction between the month-to-month pupil mortgage fee and the 1% calculation, it could possibly be sufficient to push DTI above what lenders are keen to just accept.

“This will push the debt-to-income ratio to a stage the place buying a house with an FHA mortgage is out of attain till that steadiness is lowered,” Justin Derisley, vice chairman of mortgage lending with the Troy, Michigan, workplace of Assured Charge, advised MortgageLoan.com.

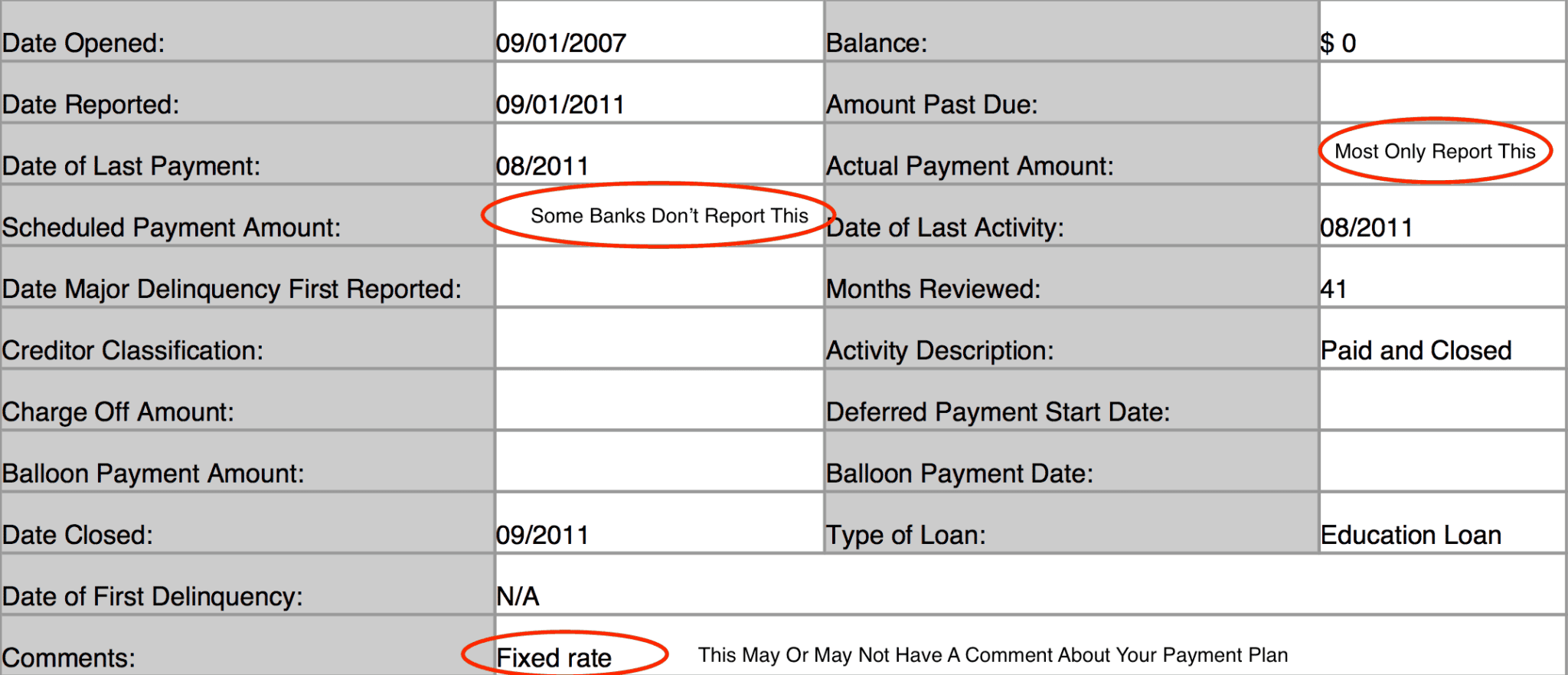

Here is what you are searching for in your credit score report:

Just a few issues:

- Many lenders solely report the precise fee quantity and if it was delinquent. As such, your “scheduled” fee quantity could also be clean

- I’ve additionally seen some banks put the Normal 10-year plan quantity because the “scheduled” fee quantity, after which the precise fee quantity reveals as much less

- Some lenders put the fee plan within the feedback, however most don’t

Observe: Simply because that is the rule, every lender can have their very own inside tips. Some lenders will not settle for this. They may require a fee or use the 1% rule, or different variation.

Discover Help Applications

As a pupil mortgage borrower or first time house purchaser, you might be able to discover help applications that will help you purchase your first house, and even provide help to along with your pupil loans!

For instance, Maryland has a very distinctive program known as SmartBuyer, the place they may put 15% of the acquisition value of the house in direction of paying off any excellent pupil mortgage steadiness. This will considerably enhance your credit score and debt-to-income ratio to have the ability to purchase your first house!

Think about An Revenue-Pushed Reimbursement Plan

Getting on an income-driven compensation plan to your federal pupil loans might assist cut back your debt-to-income ratio. Emphasis on “might.” The reason being that lenders who observe Fannie Mae underwriting tips (i.e., most lenders) should use the fee quantity that reveals up in your credit score report. The catch is that your IDR fee might not present up in your credit score report. (See our publish on credit score experiences, IBRs, and mortgages for a visible instance.)

To know higher, say your month-to-month fee on the Normal compensation plan is $500 a month, however you possibly can’t afford that so that you enroll in an IDR that brings your funds all the way down to $100 a month. If that $100 fee reveals up in your credit score report, the lender will use that to calculate your DTI ratio. You’re good to go! But when that $500 reveals up in your credit score report, they may use that — even when this quantity isn’t what you really pay.

If no quantity seems in your credit score report, they have to calculate the quantity as 1% of your remaining mortgage steadiness. Or they will calculate a fee quantity that, if paid over a 20 to 25 12 months interval, would lead to full compensation. This could possibly be lots larger than your IDR fee.

In case your IDR fee is zero, nevertheless, the lender can not use it to formulate your debt-to-income ratio and the opposite choices will likely be utilized.

So, if you’re on an IDR plan and it does present up in your credit score report, that’s in all probability good for you. This may occasionally dramatically cut back the debt finish of the debt-to-income equation, upping your probabilities of securing a mortgage. In actual fact, this can be the issue that makes or breaks your capacity to purchase a house.

Do not Change Your Reimbursement Plan

Your provide on a spot received accepted? Thrilling, sure, however your journey in shopping for a house is way from over. Your lender nonetheless has to truly provide the mortgage. Even when you’re pre-approved, the lender should now undergo their full underwriting course of to confirm you as a really certified borrower.

This course of might unearth components that weren’t beforehand obvious. With luck and your individual truthful reporting, you’ll not run into any dangerous surprises. However typically folks mess up their very own possibilities, maybe unknowingly. How? By making monetary adjustments earlier than their mortgage is secured.

A very good lender and an excellent actual property agent will inform you repeatedly: no massive purchases whereas in escrow. Don’t purchase a brand new automobile or a brand new boat. Don’t finance that new set of furnishings you’ve been eyeing to your new home. Don’t even purchase a brand new TV.

As to your pupil loans, don’t change them up both. Maintain paying as you have been earlier than on the identical pupil mortgage compensation plan.

Don’t refinance in case you have personal loans. Don’t consolidate any of your loans, change up your fee plan in your federal loans, or take away any co-signers on any mortgage.

Why not? These would possibly set off your lender to recalculate your debt-to-income ratio and never fund your mortgage. Relying on the place you might be within the escrow course of, you is likely to be compelled to cancel your contract and lose your deposit — a destiny we’d all prefer to keep away from.

You have Efficiently Bought Your House – Now What?

You made it! Mortgage paperwork are signed, the contract is closed, and you’ve got the keys to your new house. It’s an ideal feeling, however now you might be embarking on a life as each a house owner and a pupil mortgage debtor. So now what?

Whether or not you’re on an income-driven compensation plan, a Normal fee plan, or another type of compensation, if you’re comfortable and steady with that plan, you possibly can simply hold paying your mortgage like regular.

If you’re on an IDR fee and proceed to want it, be sure you submit your yearly recertification of your earnings. For those who don’t re-submit your earnings, you’ll revert to the Normal fee plan, which is able to drive up your month-to-month prices and will compromise your capacity to pay your mortgage.

After six months of proudly owning your house, Fannie Mae additionally supplies tips for lenders to assist you to use your mortgage to pay pupil loans. The choice is a pupil mortgage cash-out refinance. Much like an everyday cash-out refi, if your house has elevated in worth and also you meet their necessities, you possibly can refinance your mortgage for a bigger mortgage. You’ll be able to select a brand new lender or the identical one, if attainable. The lender takes the distinction between this new mortgage and your present mortgage, transforms it into money, and instantly applies it to your pupil loans.

You need to solely refinance your house if you’re assured it’s a financially sound choice.

Closing Ideas

Shopping for a house with pupil loans will not be all the time straightforward. In actual fact, your capacity to acquire a mortgage for a property might rely in your loans, leading to some disappointment in case your loans aren’t in fine condition. However you don’t have any likelihood to get that mortgage when you don’t assess your pupil mortgage image and be sure you are taking all the required steps to achieve success. Generally it gained’t work, however having the information to get there may be the essential first step of your journey to house possession.

For those who’re not fairly positive the place to begin or what to do, contemplate hiring a CFA that will help you along with your pupil loans. We advocate The Scholar Mortgage Planner that will help you put collectively a stable monetary plan to your pupil mortgage debt. Take a look at The Scholar Mortgage Planner right here.

To reiterate, listed here are some issues which may assist with the home-buying course of in case you have pupil loans:

1. Enrolling in an IDR plan would possibly soar begin your house shopping for course of by lowering your month-to-month bills.

2. Look into federal or state applications that assist house patrons get monetary savings.

3. Speak to your pupil mortgage lender or servicer. See when you can request that your servicer report your true IDR fee to the credit score businesses. It by no means hurts to ask, and when you don’t, the reply will all the time be no.

4. Get a second or third opinion. Speak to extra lenders to see if they may work with you. Every mortgage firm does issues a bit in a different way. All of them have sure legal guidelines and rules they must observe, however they’re versatile in different areas. Once more, when you don’t ask, the reply will all the time be no.

If nothing works, delay your house aim a pair years as you get your pupil loans and different debt so as. This time is likely to be used to financial institution away cash to your down fee, search the next paying job, or cut back different kinds of debt that could be holding you again.

Are you trying to purchase a house regardless of having pupil mortgage debt?