This text was initially printed in Livemint. Click on right here to learn it

These days, there are new mutual fund launches nearly each day!

Due to the bull market and growing fairness market participation, within the final yr, there was a major improve in new fund gives (NFOs) and this pattern is anticipated to proceed for someday.

Now you could be questioning:

Is it a good suggestion to put money into these new mutual funds (NFOs) or not?

With so many choices obtainable it’s typically very troublesome to select. Don’t fear, we’re right here to make this resolution easy for you with the assistance of a framework.

Let’s start…

What are NFOs and the way do they work?

NFO stands for New Fund Provide and refers back to the launch of a brand new mutual fund scheme by an Asset Administration Firm (AMC) or fund home. Throughout an NFO, the fund home invitations traders to subscribe to the items of the brand new scheme. That is the preliminary part when the fund is open for funding, and it usually has a set subscription interval, after which the NFO closes, and common buying and selling begins.

Under are a couple of myths about NFO we wish to bust earlier than we go into the small print.

Fantasy 1: NFOs aren’t just like IPOs

An NFO just isn’t like an IPO. In an IPO, an organization is elevating funds from the general public that it’ll use for a particular objective. You’ve detailed info concerning the firm financials, its enterprise, its prospects, and so forth within the prospectus. You subsequently know the corporate’s enterprise, its income, its progress over time and whether or not the present supply worth is justified. The corporate’s worth could even soar on itemizing if extra traders (greater demand for the inventory) see worth in it.

However, in an NFO the asset administration firm swimming pools in cash from traders and invests that in a set of securities (shares or bonds or authorities securities and so forth), primarily based on a said technique. On the time of NFO, the fund doesn’t maintain any shares and also you, subsequently, have no idea whether or not the underlying shares are low-cost or costly. The Rs 10 is only a worth it begins with to allot items and has no underlying devices so that you can worth it.

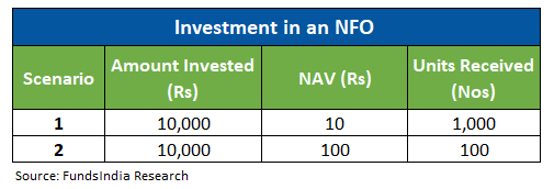

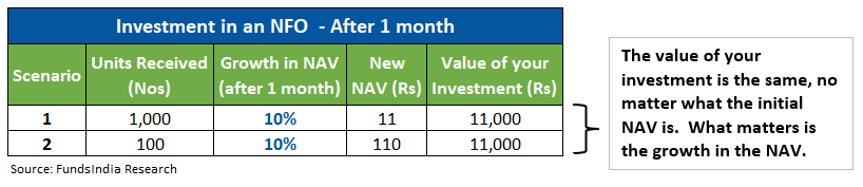

Fantasy 2: NFOs aren’t low-cost

NFO just isn’t low-cost – Whereas the NAV may very well be smaller (for instance Rs. 10) normally that’s the situation worth however that doesn’t imply that you’re shopping for it cheaper. The expansion of a fund’s NAV is essential which relies on the efficiency of the underlying devices it invests in. Let’s perceive this with an instance.

Fantasy 3: NEW doesn’t imply higher

Don’t assume that every one NFOs are completely different and supply higher returns – The NFO is probably not including something new to your portfolio and you’ll have established options in the identical class which might be higher performers. This makes it uncommon to search out funds which might be actually differentiated and higher from others within the class.

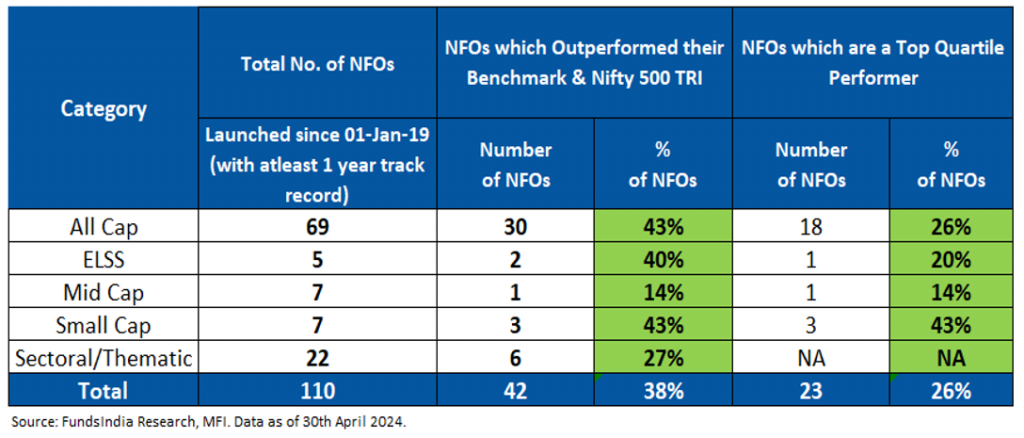

To know this higher, now we have checked the efficiency of the NFOs launched since 1st Jan 2019 (with a minimum of a 1 yr monitor report) until date (thirtieth April 2024).

Out of the 110 NFOs,

- 6 out of 10 NFOs Underperformed

62% of the NFOs have underperformed both their Benchmark or Nifty 500 TRI i.e. 68 funds out of 110 NFOs underperformed.

- Only one out of 4 NFOs have been within the High Quartile

Solely 26% of the NFOs (excluding sector/thematic funds) ended up within the high efficiency quartile i.e. 23 funds out of 88 NFOs.

The myths about NFOs have been busted, however how can we resolve if investing in them is a good suggestion?

Must you put money into an NFO?

We now have made this resolution easy for you with the assistance of a framework.

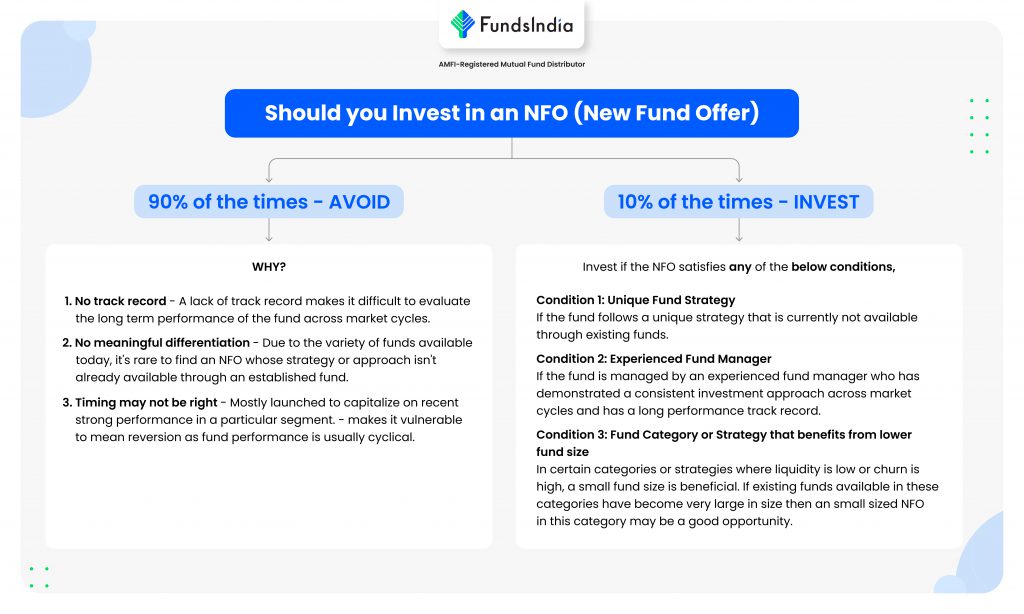

90% of the instances – Keep away from an NFO

NFOs may look thrilling within the first go but it surely additionally has dangers and uncertainties. Majority of the time it’s best to WAIT and WATCH, right here’s why

- No monitor report – A scarcity of monitor report makes it troublesome to guage the efficiency of the fund throughout market cycles. The chance you soak up an NFO is far greater than whenever you go for a fund that has already been round for a couple of years and constructed up a historical past.

- No significant differentiation – Because of the number of funds obtainable immediately, it’s uncommon to search out an NFO whose technique or strategy isn’t already obtainable by a longtime fund. If a longtime fund with a confirmed monitor report is on the market then there’s little or no worth added by investing within the NFO.

- Timing is probably not proper – Largely launched to capitalize on latest robust efficiency in a specific section, which makes it weak to imply reversion as fund efficiency is normally cyclical. Traders have typically piled into these funds at exactly the improper time, solely to be dissatisfied.

What about 10% of the time? What are the uncommon situations in which you’ll be able to put money into an NFO?

10% of the instances – Put money into the NFO

Whereas more often than not it’s higher to attend and observe the fund efficiency earlier than investing, there are uncommon cases the place you may put money into an NFO if it satisfies any of the beneath situations.

Situation 1: Distinctive Fund Technique

If the fund goes to observe a novel technique that’s at present not obtainable within the present funds then this can be a chance to take a position Within the NFO.

For instance, an Worldwide Fairness Technique which might present portfolio diversification and is at present not obtainable in any present funds.

Situation 2: Skilled Fund Supervisor

As a result of this can be a new fund supply with no underlying portfolio to analyse the efficiency, you’ll rely totally on the selections of the fund supervisor. If the fund is managed by an skilled fund supervisor who has demonstrated a constant funding strategy throughout market cycles and has a protracted efficiency monitor report then this may occasionally present an excellent alternative to put money into the NFO.

For instance, It could be an excellent alternative to put money into an NFO managed by Kenneth Andrade (business veteran, Ex CIO of IDFC Mutual Fund and CIO of Oldbridge Capital Mutual Fund).

Situation 3: Fund Class or Technique that advantages from decrease fund dimension

In sure classes or methods the place liquidity is low or churn is excessive, a small fund dimension is useful. If present funds obtainable in these classes have grow to be very massive in dimension then a small sized NFO on this class could also be an excellent alternative.

For instance,

- A brand new fund within the Small Cap class which has a low AUM may have a dimension benefit in comparison with an present small cap fund which has a really massive AUM (the small cap area is comparatively illiquid in nature, a really massive AUM may make it troublesome so as to add worth or outperform the broader market)

- A brand new fund which follows momentum technique + has a low AUM – this fund may have dimension benefits which a bigger fund could not have (momentum primarily based methods may grow to be onerous to duplicate because the fund dimension turns into too massive and the efficiency may not be sustainable).

Summing it up

- NFO is a new fund supply. It’s particularly issued by asset administration corporations or mutual fund homes at any time when they wish to increase cash for a particular scheme.

- NFOs aren’t just like IPOs.

- NFOs aren’t low-cost – Whereas the NAV may very well be smaller (for instance Rs. 10) normally that’s the situation worth however that doesn’t imply that you’re shopping for it cheaper.

- New doesn’t imply higher – Don’t assume that every one NFOs are completely different and higher

- 90% of the instances – Keep away from an NFO due to no monitor report, no which means differentiation and the timing of the brand new fund is probably not proper.

- 10% of the time – Put money into an NFO if any of the situations are happy specifically – distinctive fund technique or skilled fund supervisor or fund class or technique that advantages from decrease fund dimension.

Different articles you might like

Submit Views:

20