Lengthy hours, excessive stakes, and the facility to vary lives

Think about waking up at 4.30am on a Saturday morning. You tip-toe round the home, cautious to not wake your sleeping household, and log into your laptop.

Your shopper, a FIFO truck driver who works the other of regular enterprise hours, asks if he can transfer the assembly ahead.

“Positive,” you say, understanding he’s in all probability anxious about his first dwelling buy, and also you had already written out the state of affairs the day earlier than. “No drawback.”

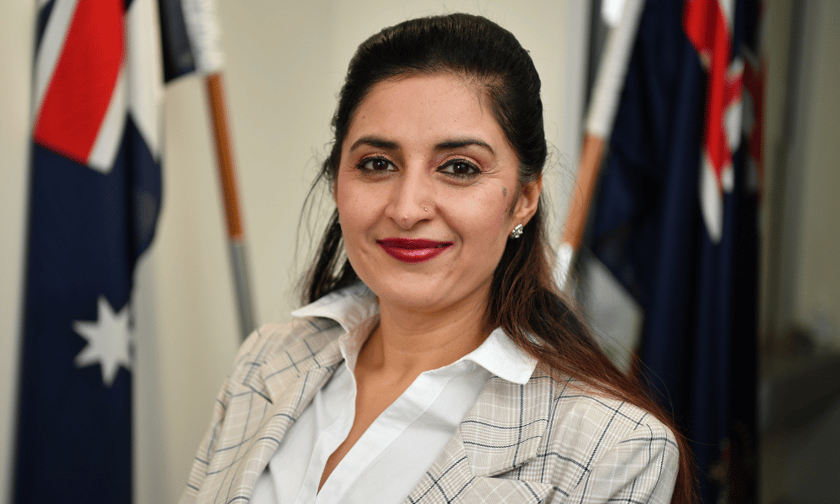

“That is however one of many numerous examples of the dedication and adaptability required to be a mortgage dealer,” mentioned Niti Bhargava (pictured above), director of Resolve Finance Derrimut.

“Whereas it’s actually a hustle at instances, I wouldn’t change it for the world.”

Are brokers laughing all the best way to – and at – the financial institution?

These “millionaire mortgage brokers” are ticking off containers and getting wealthy, laughing their solution to the banks and doubling over in tears, pointing on the poor outdated bankers as soon as contained in the department – or so they are saying.

However the actuality, as many brokers like Bhargava will inform you, is a far cry from that image. It is a world of lengthy hours, fixed hustle, and the ever-present danger of unexpected challenges.

“Many individuals assume brokers are rolling in dough,” mentioned Bhargava, “however the actuality is, most of us are driving Camrys like me, not Mercedes.”

It’s straightforward to see how a cursory look may lead to brokers seeming like wealthy, finance bros.

The common gross annual earnings, previous to prices, was $181,199 within the interval between Oct. 1, 2022, and March 31, 2023, in line with the newest MFAA knowledge.

This was down 7.33% from the six-month interval earlier than the place brokers earned – previous to prices – an eye-watering $195,356.

Nevertheless, the essential distinction with these figures is that it’s gross earnings – previous to prices.

“Overhead prices like advertising and marketing, software program, insurance coverage, hire, enterprise insurance coverage and salaries eat into income and the earnings is not all the time regular,” Bhargava mentioned.

“We’re all the time sitting on the sting of one other expense and it’s worrying.”

Clawback chaos: A singular monetary setback for brokers

“These days, we’re very fortunate if the shopper is staying for twenty-four months. There have been so many cashbacks, rebates, and this and that,” Bhargava mentioned.

“Shoppers are way more charge delicate and it’s a spotlight of ours to retain our purchasers and supply fixed worth.”

“It’s not solely a success to my cashflow, but when I had settled one thing final 12 months, I had already paid taxes on that earnings. When that’s taken away, I can’t declare it as a enterprise loss – it’s simply misplaced earnings,” Bhargava mentioned.

“So, it’s all about producing new purchasers whereas sustaining your relationships along with your current ones. And even for those who do make it as a dealer and also you’re financially nicely off and secure, the following step is staying there.

“We nonetheless should hold working arduous. Laws change. Occasions just like the pandemic can occur. We are able to by no means relaxation on our laurels and congratulate ourselves. It’s a relentless hustle.”

Are brokers Gordon Gecko varieties or small enterprise house owners?

One other false impression about brokers is that they run massive operations.

Absolutely, brokers are of their pinstriped fits commanding high-stake conferences of their expansive workplaces?

The fact, once more, is sort of completely different.

Solely 12% of brokerages have 11 or extra brokers.

Many additionally function in regional areas, serving the homebuying wants of their native communities.

And whereas the stakes are nonetheless excessive – brokers are sometimes tasked with financing their shopper’s largest buy of their life – the conferences occur in enterprise informal garments over Zoom or in a native espresso store.

Whereas Bhargava operates on the outskirts of Melbourne, she is now making her manner as one of many mortgage business’s many sole operators.

“I’m going by way of structural modifications in the mean time. I’m constructing my model and constructing my workforce. After 4 years within the business and I really feel like a beginner once more,” Bhargava mentioned.

“I do know a really skilled dealer who has been within the business for 25 years. Her enterprise companion is leaving and he or she’s experiencing such nervousness in the mean time as she goes by way of the motions of money flows and buying new leads,” Bhargava mentioned.

“It’s a relentless problem, filled with highs and lows, identical to any small enterprise.”

Whereas there are a small proportion of the business that do make it large, writing $100 million-plus and even $1 billion value of loans, Bhargava mentioned scaling a enterprise includes elevated overhead and strain.

“Despite the fact that brokers which can be writing $100 million per 12 months, you might want to think about what number of hours they’ve been working,” she mentioned.

“What changes have they been making with their well being and household time? As a result of they’re pushed, they dedicate time, cash, and sources to look after that shopper. It’s not that straightforward.”

The profound rewards of being a mortgage dealer

Regardless of the challenges, the rewards are profound. The power to assist individuals obtain homeownership, a lifelong dream for a lot of, is a robust motivator. “We’re not simply creating wealth,” mentioned Bhargava, “we’re making a distinction in individuals’s lives.”

That sense of function, the satisfaction of guiding purchasers by way of a fancy monetary course of, retains many brokers going by way of the lengthy hours and fierce competitors.

Being a mortgage dealer is a demanding profession path, however for these with the grit, dedication, and a real want to assist others, it may be a deeply rewarding one.

It is a career constructed on hustle, resilience, and finally, the power to make a optimistic affect on an individual’s future.

Associated Tales

Sustain with the most recent information and occasions

Be a part of our mailing record, it’s free!