I went on a Bucket Checklist Journey to Yellowstone Nationwide Park final month and stayed on the historic Previous Devoted Inn in-built 1904. We noticed the geysers, the Grand Canyon of Yellowstone with its lovely falls, majestic bison with their calves, highly effective grizzly bears with their cubs, and a coyote crossing by a congested intersection with out concern for the site visitors.

I went on a Bucket Checklist Journey to Yellowstone Nationwide Park final month and stayed on the historic Previous Devoted Inn in-built 1904. We noticed the geysers, the Grand Canyon of Yellowstone with its lovely falls, majestic bison with their calves, highly effective grizzly bears with their cubs, and a coyote crossing by a congested intersection with out concern for the site visitors.

The opposite journey that I went on final month was to take a deeper dive into “Fund Household” efficiency for exchange-traded funds that put money into home equities, world and worldwide equities, and rising market equities. The idea is to take a position with an asset supervisor that you just belief within the areas the place they excel with a confirmed monitor document. On this article, I give attention to large- and multi-cap U.S. Fairness and Worldwide fairness funds that one may embody as core funds in a portfolio.

This text is split into the next sections:

Introduction to Trade Traded Funds

In accordance with Susan Dziubinski in “What Is an ETF? Morningstar’s ETF Information“ at Morningstar, “The primary exchange-traded fund, SPDR S&P 500 SPY, made its debut in 1993. By the tip of 2021, greater than $7 trillion in belongings rested in ETFs… ETFs, or exchange-traded funds, are funds that commerce on exchanges. Like conventional mutual funds, ETFs put money into a basket of shares, bonds, or some mixture of the 2. However not like conventional mutual funds, shares of ETFs commerce on a inventory alternate, such because the New York Inventory Trade.”

Ms. Dziubinski describes some great benefits of ETFs over mutual funds:

- ETFs are simple to purchase and promote—and given the charge wars within the business, ETFs have develop into just about free to purchase and promote.

- ETFs have a status for being tax-efficient (considerably true).

- ETFs are additionally recognized for being low value (not at all times true).

- As a result of lots of the hottest ETFs monitor broadly adopted and clear indexes, there’s no thriller behind their efficiency: It’s often the efficiency of the index minus charges.

- Passive ETFs haven’t any key-person danger: If the supervisor leaves, one other can step in with out a lot ado.

She provides that “ETFs distribute fewer and smaller capital features distributions as a result of so many pursue lower-turnover, passive methods”, and that “the ETF construction is extra tax-efficient.”

The overwhelming majority of my belongings are invested in mutual funds, however I preserve an eye fixed out for alternatives amongst exchange-traded funds. Combining decrease expense ratios and tax advantages is an incentive for Fund Households to remain aggressive for traders by switching from mutual funds to ETFs. On this article, I have a look at fund efficiency which is after Fund Household bills.

I gleaned from the Mutual Fund Observer MultiSearch Instrument that there are roughly 2,687 exchange-traded funds with no less than one 12 months because the inception date. These are managed by roughly 227 Fund Households. Seventy-five % of the ETFs are managed by simply twenty-nine Fund Households, the biggest of that are BlackRock, Invesco, First Belief, State Road, Innovator, World X, Vanguard, WisdomTree, and Constancy in descending order. The most important Fund Managers together with mutual funds have eighty % of the Property Beneath Administration (AUM): Vanguard, Constancy, BlackRock, American Funds, State Road, JPMorgan, Schwab, Invesco, T Rowe Value.

For instance, by my estimates, Vanguard affords 124 mutual funds and 84 exchange-traded funds. Whole Vanguard belongings underneath administration (AUM) are roughly $8.9 trillion {dollars}. There are twenty-one Vanguard funds which have each a mutual fund and exchange-traded fund (share lessons) with a complete AUM of $4.6 trillion {dollars}. The typical expense ratio for the ETF share class of those pairs is 0.055% whereas the typical expense ratio of the mutual fund share class is 0.18%.

Greatest Households for U.S. Fairness ETFs

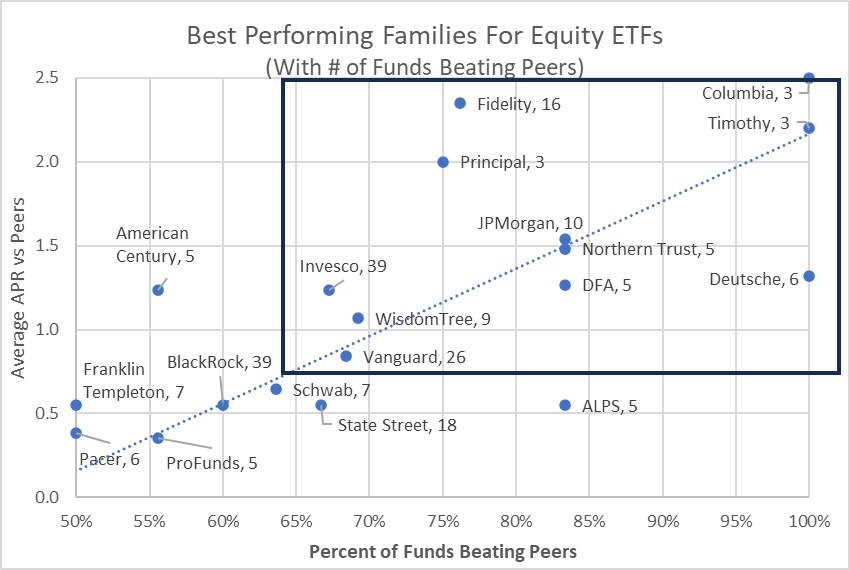

I extracted all (514) U.S. Fairness ETFs excluding these utilizing possibility methods. I calculated the proportion of funds beating their friends and the typical APR for every of the Fund Households over the previous three-year interval. Determine #1 accommodates the entire Households with no less than half of the funds beating their friends and with no less than three ETFs beating their friends, together with a median APR vs Friends better than zero. I think about the 19 Fund Households (20%) to be the extra established, best-performing Fund Households for U.S. Fairness ETFs. These at midnight rectangle are the Fund Households that I’ll dig slightly deeper on their efficiency. I think about the variety of funds beating friends to be a unfastened measure of degree of confidence. The stand out supervisor for U.S. Fairness ETF efficiency is Constancy.

Determine #1: Greatest Performing Fund Households for U.S. Fairness ETFs

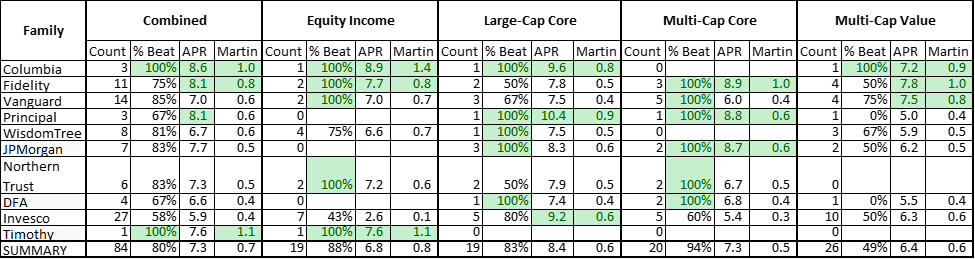

Desk #1 accommodates US Fairness ETFs in Lipper Classes with numerous funds for comparability functions with metrics protecting the previous three years. Whereas the entire Fund Households have carried out above common for the Lipper Classes, these on the high have increased common “P.c Beating Friends”, common annualized returns, and risk-adjusted returns (Martin Ratio). When narrowed to large- and Multi-Cap U.S. Fairness ETFs, Constancy and Vanguard are the dominant Fund Households whereas Columbia, Principal, Knowledge Tree, JP Morgan, and Northern Belief additionally stand out.

Desk #1: Greatest Performing Fund Households for U.S. Fairness Massive- and Multi-Cap ETFs

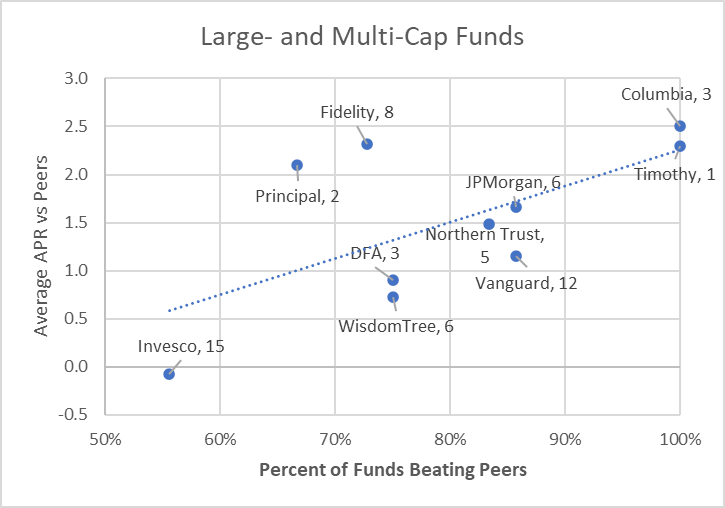

Determine #2 represents these ETFs in Massive- and Multi-Cap Lipper Classes from the desk above in graphical type.

Determine #2: Greatest Performing Fund Households for U.S. Fairness Massive- & Multi-Cap ETFs

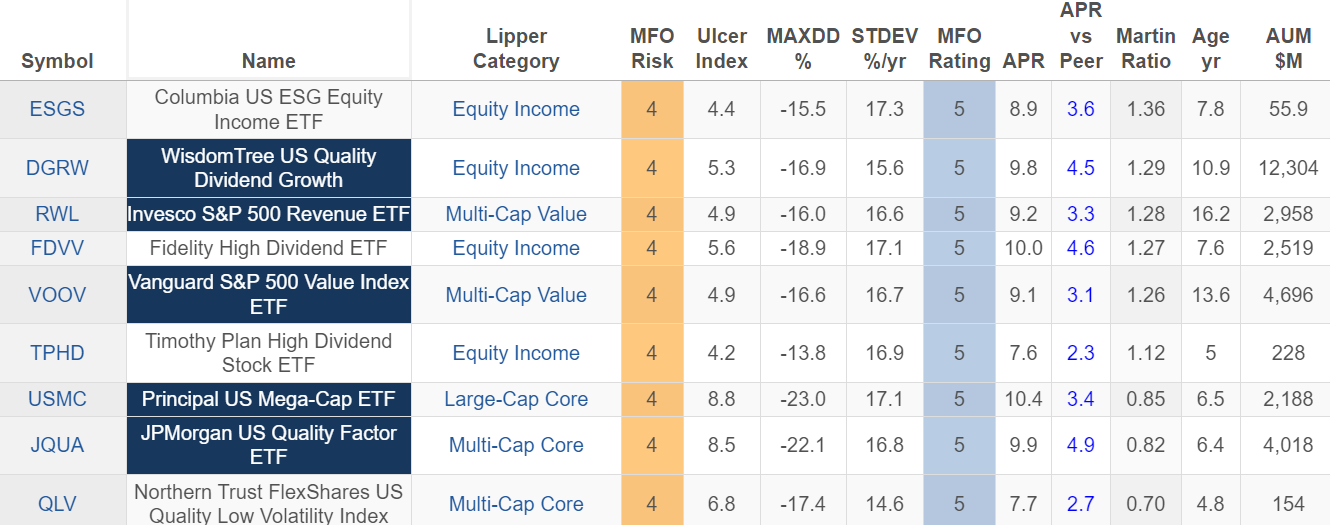

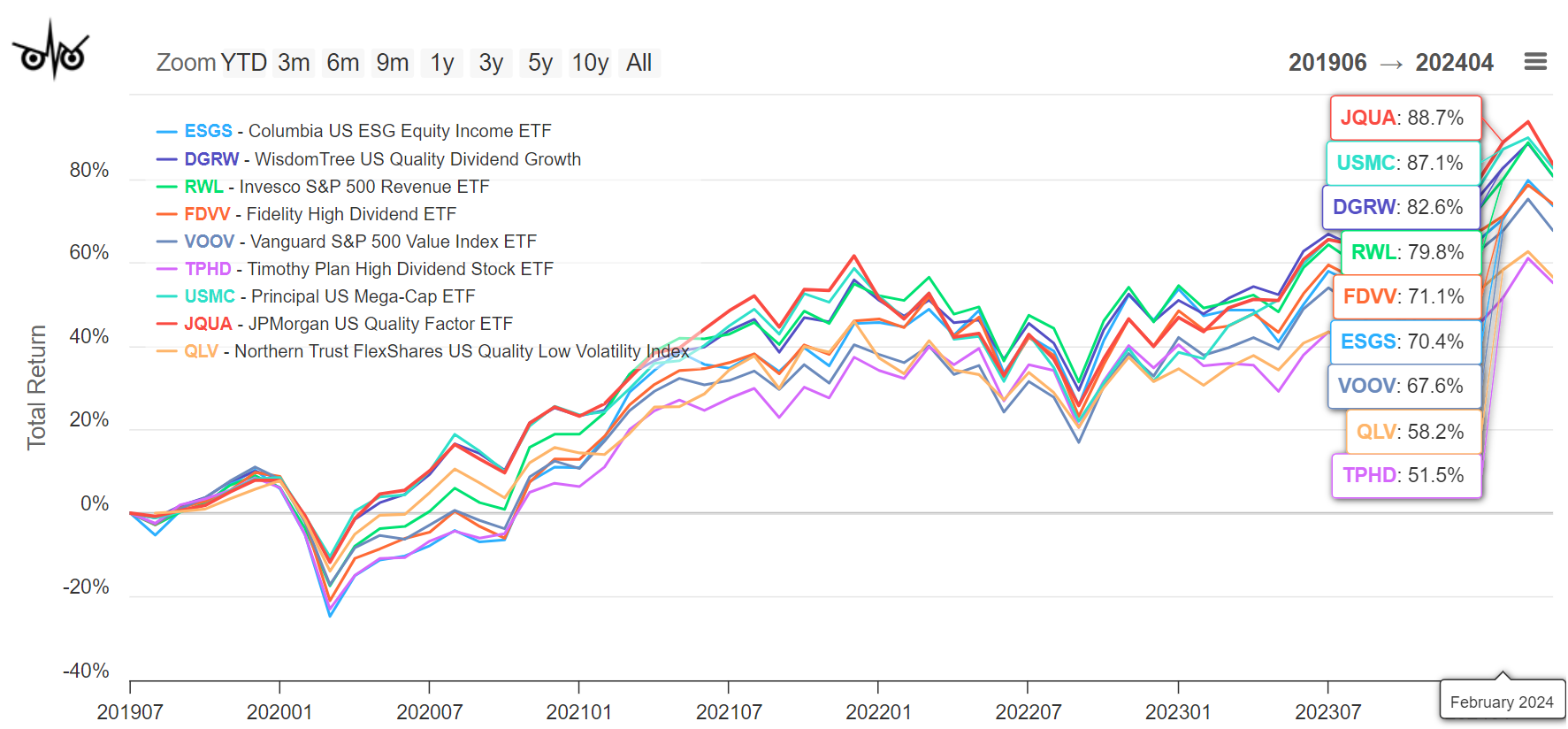

Desk #2 lists a number of the outperforming funds whereas Determine #3 is a graphical illustration.

Desk #2: Chosen Prime Performing Massive- and Multi-Cap U.S. Fairness ETFs

Determine #3: Chosen Prime Performing Massive- and Multi-Cap U.S. Fairness ETFs

Greatest Households for Worldwide Fairness ETFs

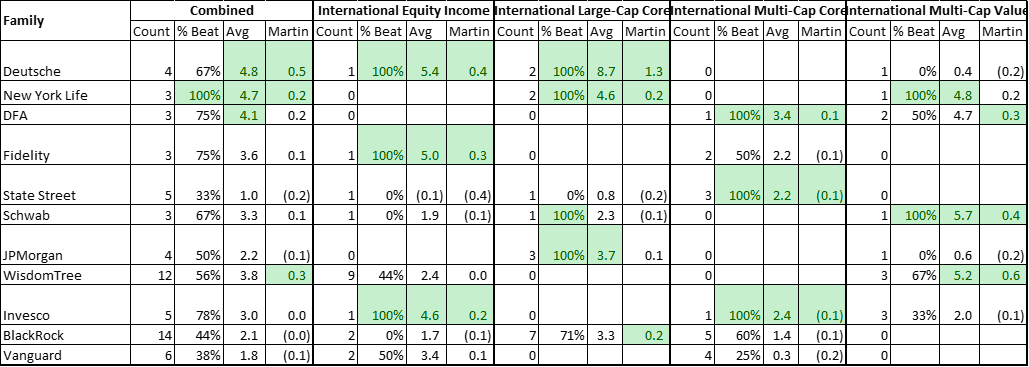

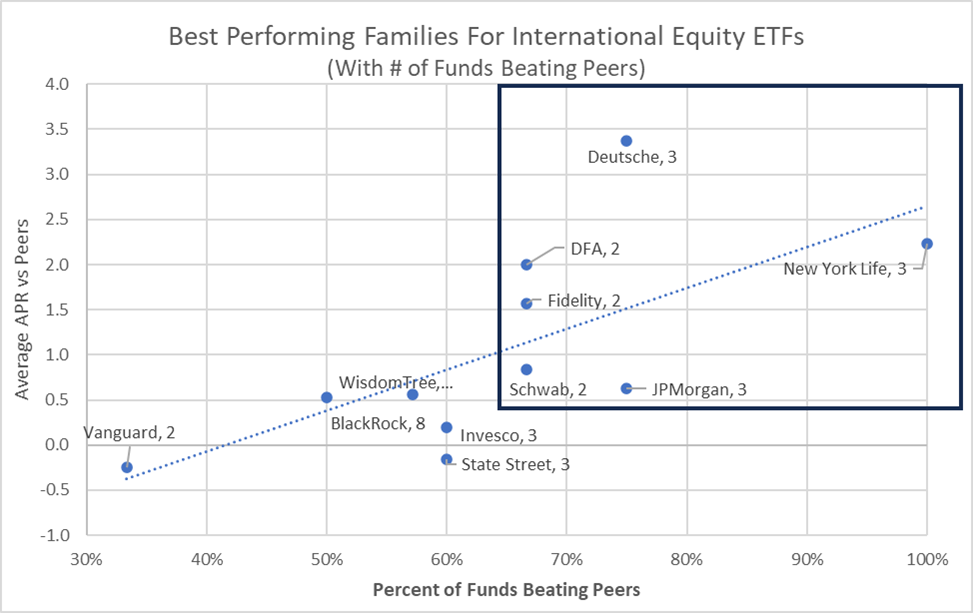

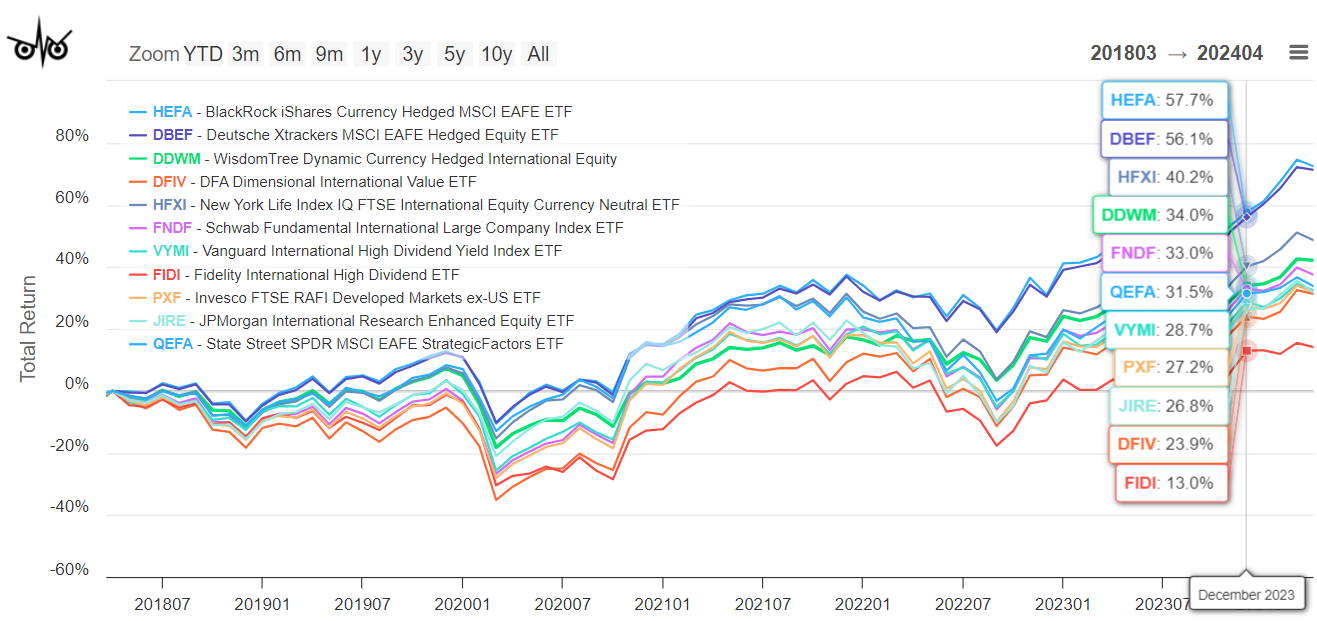

I extracted 144 World and Worldwide Fairness Funds and narrowed the checklist all the way down to eleven Fund Households with Worldwide Massive- and Multi-Cap that outperform their friends as proven in Desk #3 and Determine #4. Of the Worldwide Fairness Massive- and Multi-Cap ETFs, Deutsche, New York Life, DFA, Constancy, and Schwab have the best efficiency.

Desk #3: Greatest Performing Fund Households for Worldwide Massive- and Multi-Cap ETFs

Determine #4: Greatest Performing Fund Households for Worldwide Massive- and Multi-Cap ETFs

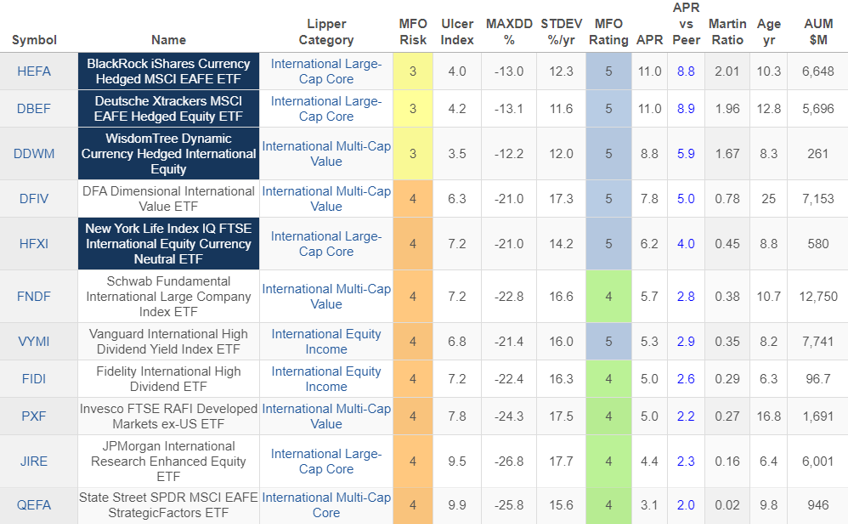

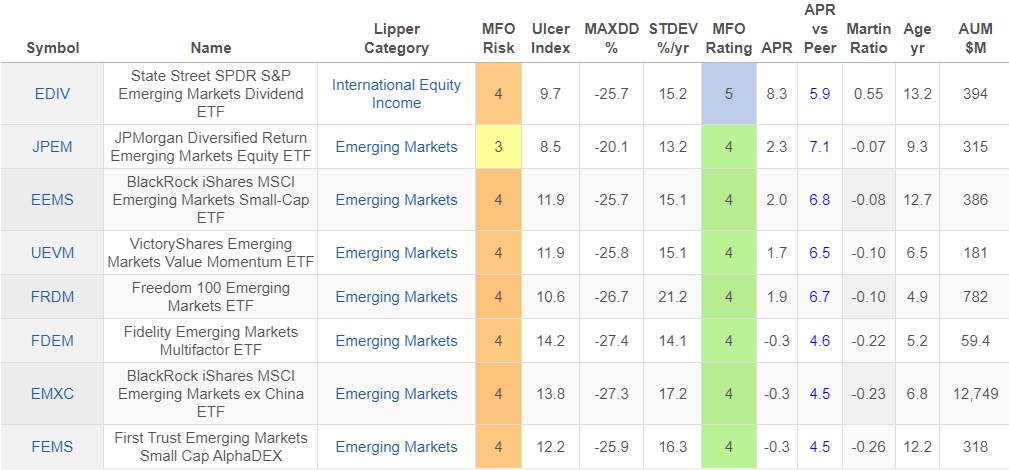

Desk #4 accommodates instance ETFs that outperform from these Fund Households with excessive efficiency within the Massive- and Multi-Cap Worldwide ETF enviornment. Determine #5 represents the identical funds in graphically.

Desk #4: Chosen Prime Performing Massive- and Multi-Cap Worldwide Fairness ETFs

Determine #5: Chosen Prime Performing Massive- and Multi-Cap Worldwide Fairness ETFs

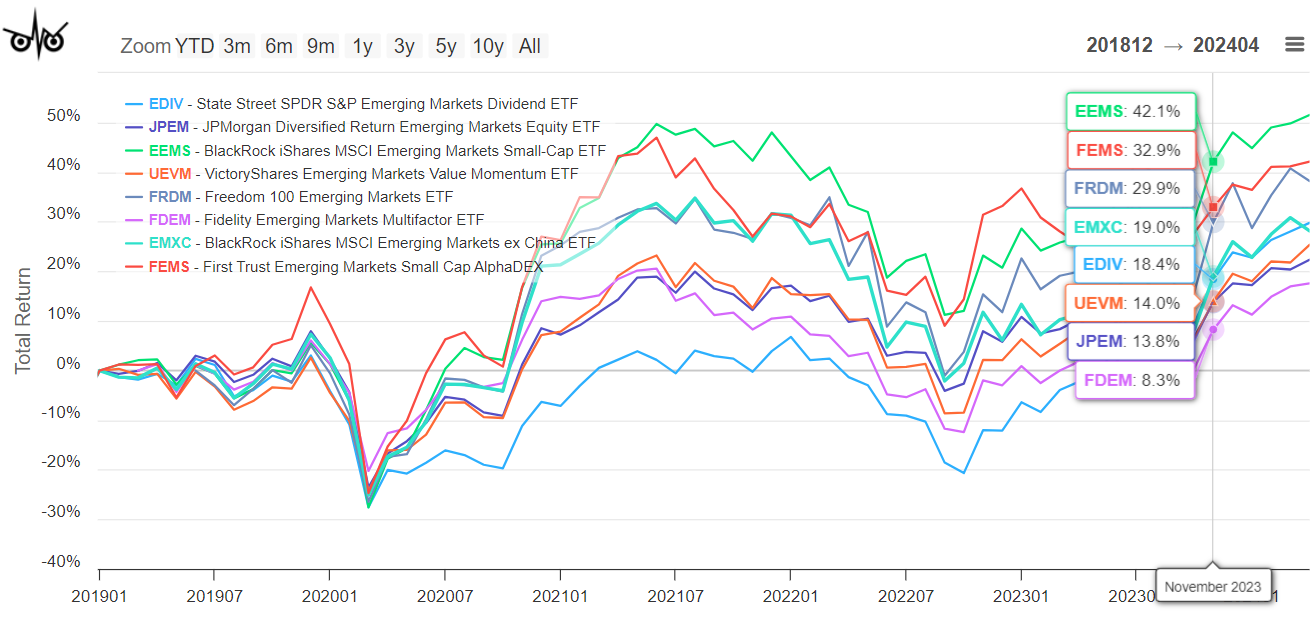

Greatest Households for Rising Market Fairness ETFs

Rising Markets have the potential to offer increased progress, however with extra volatility. I like to take a position a small share in diversified rising markets excluding country-specific funds and people with beneath common allocations to China. I extracted a complete of 40 ETFs which might be invested in diversified Rising Markets. The thirty-four finest performers are unfold amongst sixteen Fund Households. Examples of ETFs from the Fund Households are proven in Desk #5 and Determine #6.

Desk #5: Chosen Prime Performing Rising Market Fairness ETFs

Determine #6: Chosen Prime Performing Rising Market Fairness ETFs

Constructing a Diversified Fairness Portion of a Portfolio

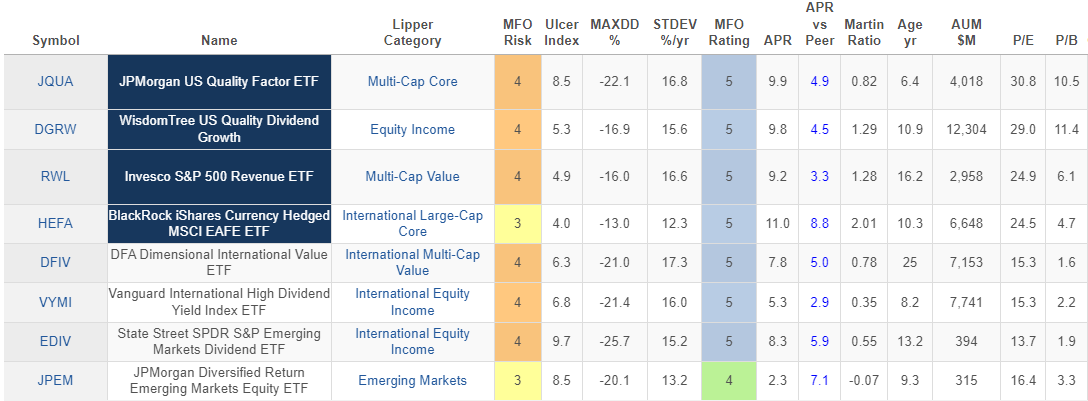

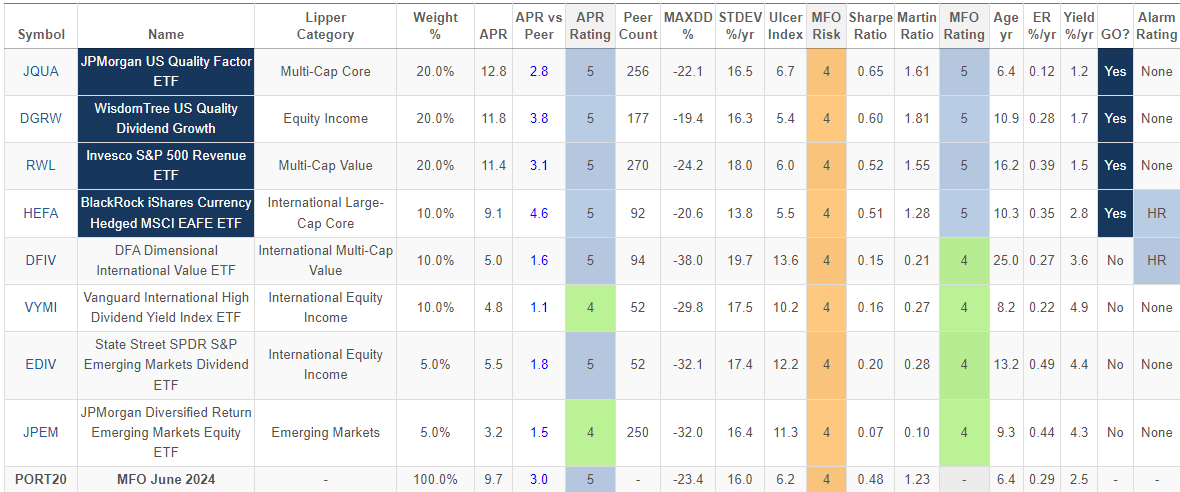

Desk #6 exhibits a number of the best-performing ETFs from the Fund Households and Lipper Classes mentioned on this article. Basically, U.S. Fairness funds have carried out higher than Worldwide Equities, so why make investments internationally? Valuations for U.S. Fairness funds are a lot increased than Worldwide and Rising Market Fairness funds. Roughly twenty-five % of my fairness allocation is exterior of North America because of this in addition to diversification.

Desk #6: Creator’s Picks for the Fairness Portion of a Portfolio – Three-Yr Metrics

I created a portfolio of the above ETFs representing a hypothetical fairness portion of a portfolio for the previous 6.4 years utilizing the Mutual Fund Observer Portfolio Instrument. The funds are rated extremely for each APR and MFO for risk-adjusted return. 4 of the funds are MFO Nice Owls. The portfolio would have returned practically 10% over the previous six years.

Desk #7: Creator’s Instance Fairness Portion of a Portfolio – 6.4 Yr Metrics

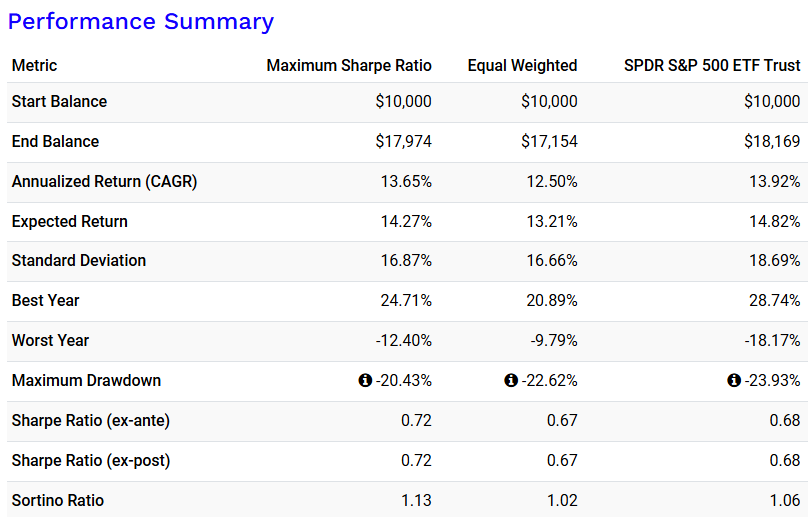

Subsequent, I used Portfolio Visualizer Portfolio Optimization to pick out the funds to create an instance of the fairness portion of a portfolio that maximize the Sharpe Ratio (volatility-adjusted returns). The hyperlink to Portfolio Visualizer is right here.

Desk #8: Instance Fairness Portion of a Portfolio Utilizing Portfolio Visualizer

Determine #7 compares the outcomes of the above portfolio to a portfolio with equal weights for the 9 ETFs.

Determine #7: Instance Fairness Portion of a Portfolio Utilizing Portfolio Visualizer

Desk #9: Instance Fairness Portion of a Portfolio Utilizing Portfolio Visualizer

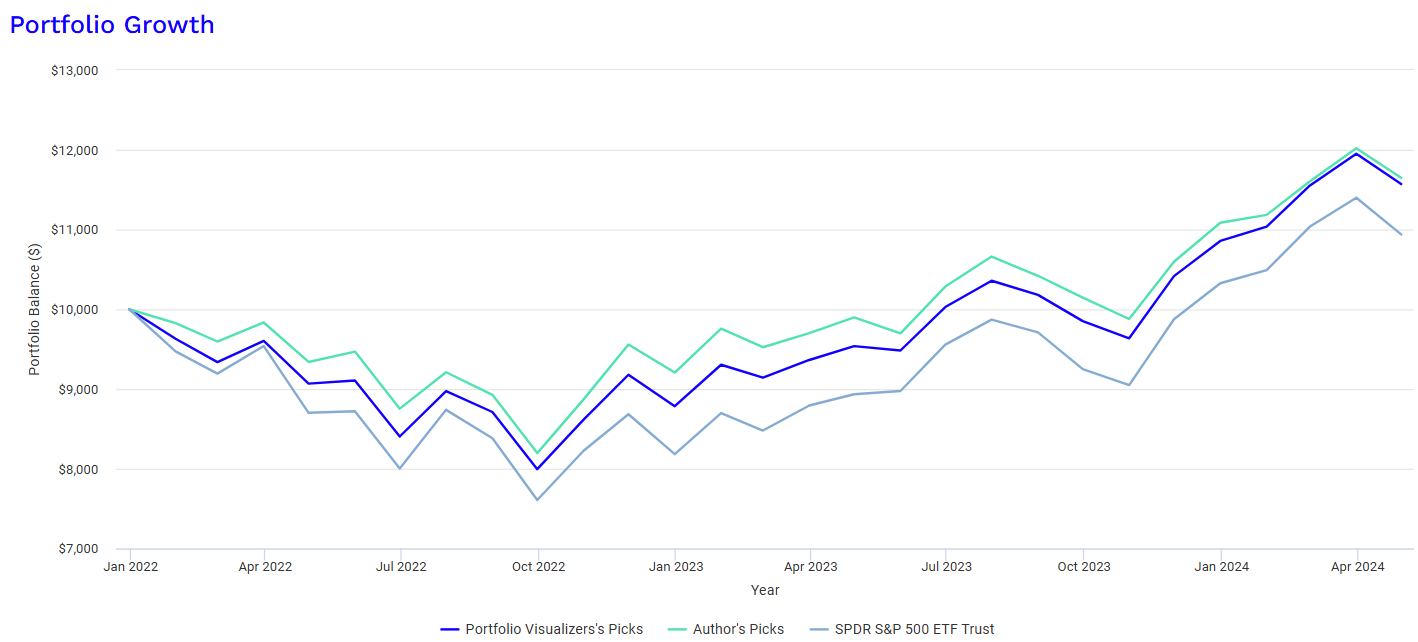

I subsequent in contrast the portfolio of funds that I chosen to that I created with the help of Portfolio Visualizer. The hyperlink to Portfolio Visualizer’s Portfolio Backtest is right here. Determine #8 is constrained by the lifetime of Dimensional Worldwide Worth ETF (DFIV). These two portfolios carried out effectively and similarly.

Determine #8: Creator’s Fairness Portfolio In comparison with the Portfolio Visualizer Assisted Portfolio

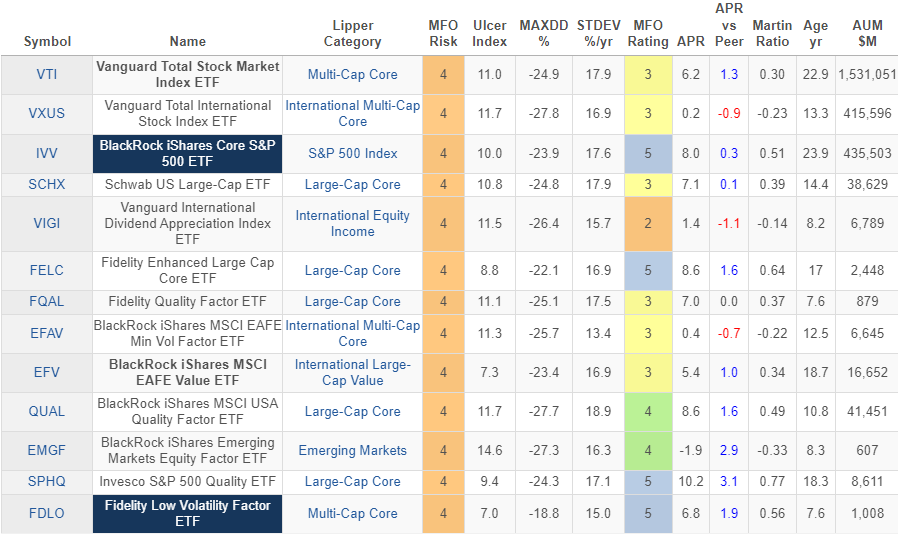

Evaluation Of Creator’s ETFs

The longer term is assured to be completely different than the previous, no less than to some extent. I like to recommend that folks think about using a Monetary Advisor. I exploit each Constancy and Vanguard advisory providers to handle the longer-term accounts which include extra of the fairness funds. Writing this text helps consider their methods and to construct the positions that I handle. Particularly, utilizing the Bucket Method to incorporate the impression of taxes lumps longer-term purchase and maintain fairness funds collectively.

The ETFs beneath are those that both the Advisors or myself have chosen for the Lipper Classes coated on this article. As well as, some serve the aim of long-term purchase and maintain funds whereas others are meant for tax loss harvesting. I prefer to commonly evaluation the funds that I personal for goal and efficiency. The Vanguard Worldwide Dividend Appreciation Index ETF (VIGI) is on my watch checklist to presumably exchange if alternatives exist with out creating increased taxes.

Desk #10: Metrics of ETFs Owned by the Creator – Three Years

Closing

I personal AVGE which I wrote about in “One in every of a Type: American Century Avantis All Fairness Markets ETF (AVGE)”, however didn’t talk about it on this article due to its brief life and the comparatively low variety of ETFs on this World Multi-Cap Core Lipper Class. Of the World Multi-Cap Core ETFs, AVGE sits in the course of the pack throughout its brief 1.5-year life, outperforming its friends by 0.4 factors. State Road SPDR MSCI World StrategicFactors ETF (QWLD), State Road SPDR Portfolio MSCI World Inventory Market ETF (SPGM), and Vanguard Whole World Inventory Index ETF (VT) have outperformed AVGE. I’ll proceed to observe AVGE, however haven’t any intention of buying and selling it primarily based on a brief analysis interval.

I retired two years in the past and have been simplifying. I now spend extra time volunteering for Habitat For Humanity than I spend on investments. I get pleasure from staying on high of business developments and writing monetary articles. I’m leaving on my subsequent journey tomorrow to the Royal Gorge in Colorado and the historic mining district of Cripple Creek.