Goal and technique

The fund seeks capital appreciation by investing within the shares or most popular shares of U.S. small-cap corporations. The supervisor pursues a form of “high quality worth” technique: he seeks high-quality companies (robust stability sheets and powerful administration groups) whose shares are undervalued (based mostly, initially, on value/earnings and price-to-cash movement metrics). As a result of it’s prepared to carry corporations as their market cap rises, the portfolio has about 9% invested in mid-cap shares that it purchased after they had been small caps.

Usually the portfolio holds 45-60 names (at the moment 50) and stays totally invested. That stated, the supervisor notes that whereas “we prefer to hold the cash invested, we don’t wish to make dangerous funding choices. If there aren’t names that meet our standards, we’ll let money construct.” The fund’s present (3/31/2024) money allocation is 10%.

Adviser

FPA (aka First Pacific Advisors) is the fund’s advisor, offering administration, advertising, and distribution providers for the fund. As of March 31, 2024, FPA manages roughly $26 billion throughout a number of methods. Independently owned FPA has 78 staff, with 21 funding professionals. They’re an distinctive agency with unwavering commitments to high quality, worth, and their traders. In 2020, they entered right into a strategic partnership with Bragg Monetary Advisors. Bragg Monetary Advisors is the subadvisor, accountable for the day-to-day administration of the portfolio. The agency is headquartered in Charlotte, NC. Bragg has been round because the early Nineteen Seventies, offers funding providers to establishments, charities, and people, and has about $3.4 billion in property beneath administration. They advise the 2 Queens Street funds and 1500 or so individually managed accounts. The agency is now run by the second era of the Bragg household.

Supervisor

Steven Scruggs, CFA. Mr. Scruggs has labored for BFA since 2000 and manages this fund and Queens Street Worth (QRSVX). That’s about it. No separate accounts, hedge funds, or different distractions. He’s supported by Matt Devries, who has been with Bragg Monetary since about 2016, and Benjamin Mellman, who joined the agency in 2023 after a stint with Worldwide Worth Advisors.

Technique capability and closure

Mr. Scruggs’ rule of thumb is that the technique may accommodate 2.5 occasions the market cap of the most important inventory within the Russell 2000. He interprets that to a comfortable shut at about $2 billion.

Lively share

95.24%. “Lively share” measures the diploma to which a fund’s portfolio differs from the holdings of its benchmark portfolio. Excessive lively share signifies administration which is offering a portfolio that’s considerably completely different from, and unbiased of, the index. An lively share of zero signifies excellent overlap with the index, 100 signifies excellent independence. The “lively share” analysis performed by Martijn Cremers and Antti Petajisto finds that solely 30% of U.S. fund property are in funds which are fairly unbiased of their benchmarks (80 or above) and solely a tenth of property go to extremely lively managers (90 or above).

QRSVX has an lively share of 96.8, which displays a very excessive diploma of independence from the benchmark assigned by Morningstar, the Russell 2000 Worth ETF.

Administration’s stake within the fund

As of the newest Assertion of Extra Data, Mr. Scruggs has invested over $1 million in every of the FPA Queens Street funds.

Opening date

June 13, 2002.

Minimal funding

$1,500 for investor class accounts, and $100,000 for the institutional share class. At Schwab, which holds about 50% of investor-class property, the minimal funding is $100.

Expense ratio

0.96% for investor shares and 0.79% for institutional shares, on property of $712 million.

Feedback

In “The High quality Anomaly” (Could 2024), we explored what’s been referred to as “the weirdest market inefficiency on the earth.” The proof is compelling that high-quality shares bought at cheap costs (Mr. Buffett’s “fantastic corporations at honest costs” excellent) are concerning the closest factor to a free lunch within the investing world. Usually, generally, the worth of abnormally excessive returns is abnormally excessive volatility … besides within the case of high quality shares bought at an inexpensive value (name it QARP). QARP shares supply each increased long-term returns and decrease volatility than run-of-the-mill equities. The final sample for such portfolios is constant: strong in regular markets, nice in declining ones however laggards in quickly rising frothy markets.

Queens Street Small Cap Worth is the very mannequin of such a portfolio, probably the most constantly profitable small-cap funds of the 21st century. As a easy abstract of that declare, listed below are the fund’s Morningstar rankings (as of three/24/2024):

Present: 5-star score, Gold analyst score

Three years: Three stars, common return, low threat

5 years: 5 stars, above common return, low threat

Ten years: 5 stars, above common return, low threat

General: 5 stars, above common return, low threat

The Queens Street – FPA Partnership

Regardless of its success, the fund remained fairly small. In November 2020, Bragg Monetary entered right into a strategic partnership with FPA with a view to present high-quality administrative assist and extra subtle advertising. That association allowed the supervisor to focus extra solely on portfolio administration.

This has turned out to be a contented marriage. The fund has grown dramatically in measurement over the previous 4 years from about $140 million to about $710 million. Investor bills have fallen. Turnover stays exceptionally low. Efficiency has remained exceptionally robust. The portfolio’s lively share, a measure of independence from the index, has remained very excessive, which means that the brand new fund inflows haven’t impaired the supervisor’s capacity to execute.

The 4 Pillars

Queens Street Small Cap Worth shares an funding self-discipline with its larger-cap sibling, Queens Street Worth. The methods for each funds are simply defined, wise, and repeatable: purchase an inexpensive variety of well-run corporations (signaled by their robust stability sheets and administration groups) when their shares are considerably discounted (signaled by their price-to-earnings and price-to-free-cash-flow ratios). Then maintain them till one thing considerably modifications, which ends up in a comparatively lengthy, comparatively tax-efficient holding interval. They summarize it this manner:

- Search for corporations with robust stability sheets, manageable debt, and powerful free money movement.

- Try and normalize financial earnings over full market cycles.

- Consider administration’s monitor report of defining efficient methods and executing their acknowledged targets.

- Try to personal corporations in rising industries with favorable economics.

As a result of Mr. Scruggs’ view of “worth” is much less mechanical than lots of his friends’, he tends to personal some shares which are considerably “growthier” than common. In consequence, the 2 main rankings providers – Morningstar and Lipper – classify the fund considerably in a different way. Morningstar locations it within the “small worth” peer group, whereas Lipper assigns it to “small core.”

The Efficiency Check

Since Mr. Scruggs targets outperformance over the total market cycle quite than attempting to “win” each quarter or yearly, we used the screener at MFO Premium to measure the fund’s long-term efficiency towards each small-value and small-core friends. The fund is simply over 20 years previous, so we examined its 20-year report.

By each measure, throughout time and towards each peer teams, Queens Street Small Cap Worth produced aggressive returns with just about unparalleled draw back safety.

QRSVX efficiency over 20 years, 05/2005 – 04/2024

| Small-cap worth friends | Small-cap core friends | |

| Annual returns | 8.0%, equivalent | 8.0%, trails by 0.1% |

| # peer funds / ETFs | 37 | 162 |

| Sharpe ratio | #4 | #10 |

| Most drawdown | #4 | #8 |

| Ulcer Index | #3 | #1 |

| Normal deviation | #3 | #2 |

| Draw back dev | #2 | #2 |

| Down market dev | #3 | #2 |

| Bear market dev | #3 | #2 |

| S&P 500 draw back seize | 90%, #3 | 90%, #2 |

Information from Lipper International Information Feed, calculations from MFO Premium, as of 4/30/2024

How do you learn that desk?

Annual returns merely measure the fund’s beneficial properties which is a bit above the common small-value fund’s and a bit beneath the common small-core fund’s.

Sharpe ratio weighs the beneficial properties towards the dangers traders had been uncovered to. They rank within the small-value elite and within the high tier (high 18%) of the growthier small-core group.

All the different metrics are other ways of measuring the dangers that traders had been uncovered to: largest decline, day-to-day volatility, draw back or “dangerous” volatility, volatility in months when the market fell even somewhat, volatility in months when the market fell greater than 3% and quantity of the S&P 500’s losses that the fund “captured.” In every case, towards each teams, QRSVX is among the many elite performers.

What explains the regular outperformance?

First, Mr. Scruggs retains his eye on the long-term drivers of returns and actively screens out the short-term noise. Whereas he acknowledges and worries about, the “extreme and unsure disaster” created by the Covid-19 pandemic and the “unprecedented” involvement in markets by central banks, he additionally acknowledges that we don’t know the near- or long-term financial results of both, so neither can drive the portfolio. He stays targeted on discovering particular person shares that “present an inexpensive anticipated return and an sufficient margin of security.”

Second, he has a much less mechanical view of “worth” than most. He argues that the suitable measures of a agency or business’s valuations evolve with time. That evolution requires some rethinking of the significance of each bodily capital (mirrored in price-to-book ratios) and mental capital in assessing a agency’s worth. That’s led him, he experiences, to purchase some worth shares that purely mechanical metrics may describe as development shares.

Third, he maintains a portfolio of higher-quality corporations. Usually, the small-cap universe is plagued by junky corporations: corporations with restricted market attain, untested enterprise fashions and administration, and a historical past of … hmm, “unfavorable earnings.” Mr. Scruggs assiduously avoids corporations that haven’t met each his high quality and valuation standards.

… we’ve a choice for long-term compounders that we hope to personal perpetually. These are high-quality franchises with robust stability sheets, confirmed administration groups, and enticing business dynamics. Compounders don’t normally come low-cost, and whereas we’re all the time valuation-conscious, we’re usually prepared to pay somewhat extra for higher-quality corporations.

So, what can we imply by high quality? On the most simple stage, high quality means we will have faith that an organization’s earnings and money flows might be higher in three to 5 years than they’re in the present day … on the finish of the day, we take a holistic take a look at our corporations, determine their dangers, attempt to stay conservative and considered, and evaluate their present costs to our confidence of their futures.

High quality corporations are good long-term investments, however they have a tendency to lag throughout frothy markets – intervals when traders are sometimes checking their portfolios every day and gleefully – whereas excelling in down markets. The “make cash by not dropping cash” mantra is a bit tame for some however works fantastically for long-term traders. Mr. Scruggs notes,

Traditionally, high quality has been a big contributor to our outperformance throughout market downturns. Low leverage permits corporations to outlive and reinvest when the enterprise cycle turns. Sturdy administration groups will be trusted to shepherd their corporations by means of headwinds and hunt down new development alternatives. Entrenched aggressive positions and industries with favorable outlooks imply that the passage of time is our pal. In observe, it’s by no means this simple.

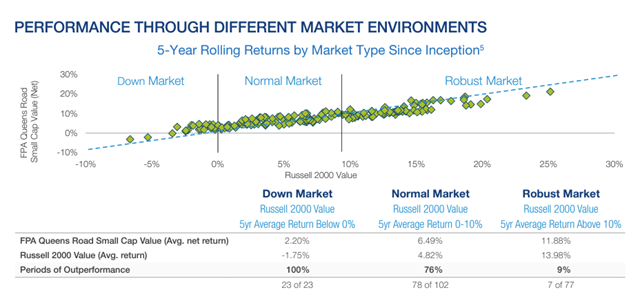

The oldsters at Queens Street have rigorously tracked the long-term (that’s, five-year rolling) efficiency of their fund in three several types of markets: down, regular, and sturdy. Under they supply each a visible illustration (being above the blue line signifies above-average efficiency) and their batting common.

Backside Line

Fairness traders, cautious about excessive valuations, untested enterprise fashions, and unstable markets have trigger to be extra vigilant than ever about their portfolios. Queens Street Small Cap Worth has a report that makes it a compelling addition to their due diligence checklist.

Morningstar acknowledges Queens Street as a five-star fund, an evaluation of their previous efficiency, and a Gold-rated fund, a recognition provided to “methods that they’ve essentially the most conviction will outperform a related index, or most friends, over a market cycle.” We concur.