It may be complicated to know whether or not you are a dependent or impartial pupil for FAFSA and monetary help functions.

Given the present value of upper training, faculty college students want all the assistance they’ll get when paying for school. There are a selection of various methods to pay for school, together with paying your personal method, scholarships, grants, and pupil loans.

Almost all types of monetary help begin with filling out the Free Software for Federal Pupil Support (FAFSA) kind that’s made obtainable by the U.S. authorities. And one of many key sections of the FAFSA kind is figuring out whether or not you’re a dependent or impartial pupil.

This is what you must know.

Filling Out The FAFSA Type

The FAFSA kind is the first kind for monetary help in america, administered by the U.S. Division of Schooling. A typical false impression is that the FAFSA kind is just for pupil loans—it is really utilized by many schools as one a part of their course of for awarding scholarships. Filling out the FAFSA kind every year and sending it to the universities that you’re contemplating will help you work out one of the best educational and monetary match for you.

That is why it is necessary to fill out the FAFSA kind yearly, even when you aren’t planning on taking out any pupil loans. The Division of Schooling estimates that it’ll take about one hour to fill out the FAFSA kind, as there are a number of steps. The primary a number of steps have you ever create a Federal Pupil Support (FSA) ID and enter in your demographic and fundamental monetary data. Then you’ll reply a sequence of inquiries to see if you’ll be labeled as an impartial or a dependent pupil.

Understanding Dependent and Unbiased Pupil Standing: Key Variations

As you search for completely different choices to pay for school, it is necessary to know the distinction between being a dependent pupil and an impartial pupil. A dependent pupil is required to even have their mother or father or guardian fill out the mother or father’s data on the FAFSA kind. That parental monetary data may even be used within the calculations to find out the coed’s Pupil Support Index (SAI).

An impartial pupil will solely have their very own data utilized in monetary help calculations.

Figuring out Whether or not You Are An Unbiased Pupil

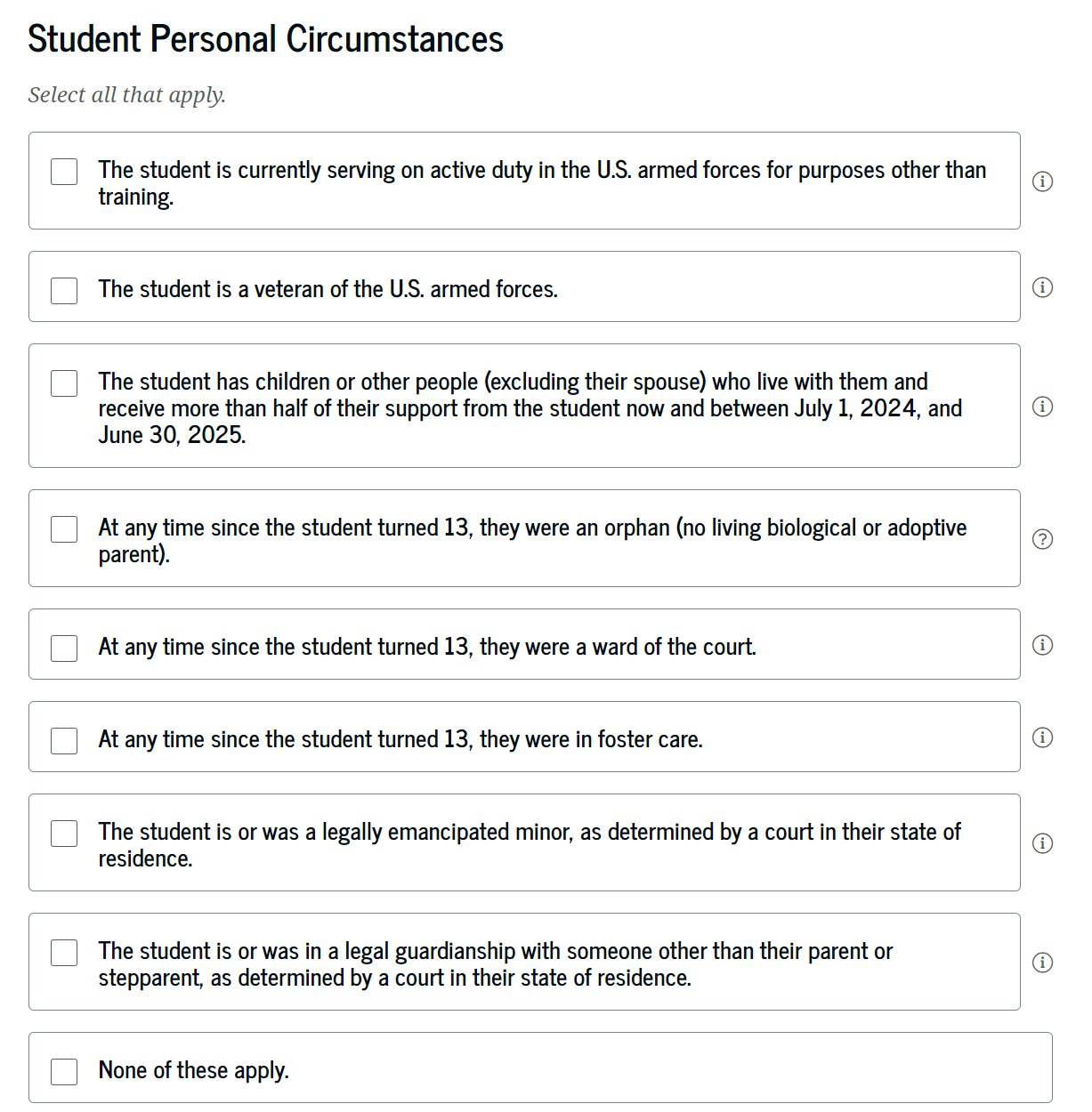

The FAFSA kind first will ask you if any of the next are true of the coed:

- Age 24 or older as of December 31 of the award 12 months

- A graduate or skilled pupil

- Married

If any of these are true, the coed might be labeled as an impartial pupil. If none of these are true, the coed might be requested a sequence of eight questions that you’ll reply (sure or no) to determine the coed’s private circumstances.

- The coed is presently serving on energetic obligation within the U.S. armed forces for functions apart from coaching

- The coed is a veteran of the U.S. armed forces

- The coed has kids or different folks (excluding their partner) who stay with them and obtain greater than half of their help now and between July 1, 2024, and June 30, 2025

- At any time because the pupil turned 13, they have been an orphan (no dwelling organic or adoptive mother or father)

- At any time because the pupil turned 13, they have been a ward of the courtroom

- At any time because the pupil turned 13, they have been in foster care

- The coed is or was a legally emancipated minor, as decided by a courtroom of their state of residence

- The coed is or was in a authorized guardianship with somebody apart from their mother or father or stepparent, as decided by a courtroom of their state of residence

Should you reply sure to any of those, you’ll be labeled as an impartial pupil.

If none of them apply, you might be thought of a dependent pupil.

Dependent College students: Monetary Support Fundamentals

Dependent college students are required to have their mother or father or guardian additionally enter of their monetary data as a part of the FAFSA course of. There are additionally guidelines for how divorced dad and mom ought to fill out the FAFSA. Typically, a dependent pupil will qualify for decrease quantities of economic help than an impartial pupil, because of their dad and mom’ earnings. Filling out the FAFSA as a dependent pupil can be required to find out eligibility for Father or mother PLUS loans.

Unbiased College students: Monetary Support Challenges and Alternatives

If you’re an impartial pupil or paying for school as an grownup, you will typically qualify for extra grants and loans than a dependent pupil with the same scenario. That is as a result of impartial college students do not need to enter their dad and mom’ monetary data on the FAFSA. Normally, that implies that these college students have a decrease Anticipated Household Contribution and due to this fact a better probability of qualifying for needs-based scholarships, loans, and grants.

Due to this, you is perhaps tempted to stretch the reality on a number of the qualifying questions to aim to be labeled as an impartial pupil. That is most unlikely to work, and should put you susceptible to fines or different authorized bother. Your faculty’s monetary help division will probably ask for proof of any particular circumstances, and can simply see by any scenario that isn’t on the up and up.

The Backside Line

One of many key sections of the FAFSA kind is the one which determines whether or not you might be an impartial or a dependent pupil. Dependent college students are required to have their dad and mom or guardians additionally enter in their very own monetary data, whereas impartial college students do not need this requirement.

Due to this, it’s typical that impartial college students will obtain extra funding from the FAFSA than dependent college students. It doesn’t matter what kind of pupil you might be labeled as, be certain that to take a look at one of the best pupil mortgage charges to search out the mortgage that works finest for you.